The under is a fleshy free article from a present version of Bitcoin Magazine Pro, Bitcoin Magazine’s top rate markets newsletter. To be among the many first to receive these insights and other on-chain bitcoin market diagnosis straight to your inbox, subscribe now.

The Merge

On September 15, Ethereum is planning to admire its long-promised “Merge,” the put the protocol will shift from a PoW (proof-of-work) consensus mechanism to a PoS (proof-of-stake) consensus mechanism.

In this document, we can present significant parts on how the proof-of-stake mechanism works for Ethereum, the use of technical definitions supplied from Ethereum documents. Second, we can overview the switch to proof-of-stake from first principles, which will encompass a proof as to why mighty of the reasoning for the switch is perhaps flawed. Remaining, we can quilt the distress factors of the Ethereum PoS mechanism evaluating and contrasting the governance to Bitcoin and a PoW consensus mechanism to disclose the basic differences between the systems.

This portion modified into partly impressed by Glassnode’s Lead Analyst, Checkmate’s most contemporary work on Why The Ethereum Merge is a Broad Blunder.

The Basics

With the shift in consensus mechanisms, Ethereum shifts its block production far from GPU (graphics processing unit) miners over to staking validators.

Validators: “To participate as a validator, a particular person need to deposit 32 ETH into the deposit contract and bolt three separate items of tool: an execution client, a consensus client, and a validator. On depositing their ether, the actual person joins an activation queue that limits the rate of contemporary validators becoming a member of the community. As soon as activated, validators receive contemporary blocks from chums on the Ethereum community. The transactions delivered within the block are re-executed, and the block signature is checked to be particular that the block is official. The validator then sends a vote (known as an attestation) in desire of that block all over the community.” – Ethereum.org

Validators remove the role of block production far from miners, and importantly, switch the vitality construction far from precise world vitality enter (within the fabricate of hashes) in direction of capital, within the fabricate of staked ether.

Security: “The threat of a 51% attack quiet exists on proof-of-stake because it does on proof-of-work, but it be even riskier for the attackers. An attacker would want 51% of the staked ETH (about $15,000,000,000 USD). They would possibly be able to also then use their admire attestations to create particular their most unusual fork modified into the one with basically the most accumulated attestations. The ‘weight’ of accumulated attestations is what consensus consumers use to search out out the true chain, so this attacker would possibly maybe well perhaps be ready to create their fork the canonical one. However, a energy of proof-of-stake over proof-of-work is that the crew has flexibility in mounting a counter-attack. Let’s assume, the lawful validators can also judge to withhold constructing on the minority chain and ignore the attacker’s fork whereas encouraging apps, exchanges, and pools to carry out the identical. They would possibly be able to also furthermore judge to forcibly remove the attacker from the community and ruin their staked ether. These are stable economic defenses against a 51% attack.” – Ethereum.org

The Ethereum internet space claims that the security will doubtless be stronger in a PoS consensus system in plan of a PoW consensus system, but we admire in mind this to be highly controversial.

Whereas a proof-of-work protocol relies purely on economic incentives and precise world bodily constraints to win the chain against attackers within the fabricate of an attack, PoS relies on “social governance” by slashing to are attempting and withhold stakers lawful. To clarify additional, to 51% attack the Bitcoin community (to complete a double spend), an attacker would want win admission to to an worthy quantity of bodily infrastructure and vitality resources within the fabricate of ASIC miners, electrical infrastructure, and (low-place) vitality, forward of an attack is even tried. To cap it all off, any hypothetical attacker that does put win admission to to this stuff will mercurial comprehend it’s extra economical to easily be an lawful miner.

With proof-of-stake, stakers are saved lawful by slashing, the put adversarial chums peep their ether win destroyed (for actions such as proposing multiple blocks within the identical slot or violating consensus). Within the same model, within the case of ability censorship by a dominant majority of stakers (extra on this later), there is an option for a minority snug fork. To quote Vitalik Buterin,

“For other, extra sturdy-to-detect assaults (significantly, a 51% coalition censoring everyone else), the crew can coordinate on a minority particular person-activated snug fork (UASF) by which the attacker’s funds are as soon as extra largely destroyed (in Ethereum, here’s carried out by process of the “verbalize of being inactive leak mechanism”). No enlighten “sturdy fork to delete cash” is required; as a change of the requirement to coordinate on the U.S. to make a different a minority block, everything else is automatic and simply following the execution of the protocol principles.”

Miner Extractable Payment (MEV)

MEV is an abbreviation of “Miner Extractable Payment” that has today modified to “Maximal Extractable Payment” which refers to the earnings that will also be made by extracting worth from Ethereum users by block production.

Given the worthy monetary application ecosystem built on Ethereum, there is over and over an arbitrage different within the ordering of transactions. The producers of blocks can reorder, sandwich (the act of front-working a worthy verbalize, easiest to use their market verbalize as exit liquidity to earnings from the spread), or censor transactions internal blocks being produced. It in overall affects DeFi users interacting with automatic market makers and other apps.

Treasury Sanctions And The Looming Possibility Of OFAC Rules

Remaining week, the U.S. Treasury announced that Twister Cash modified into added to the U.S. OFAC (Place apart of job of International Resources Withhold watch over) SDN checklist (the checklist of namely designated nationals with whom American citizens and American companies are no longer allowed to transact). The sanctions placed on Twister Cash were in particular necessary resulting from they were placed no longer on a particular person particular person or enlighten digital wallet address, but moderately the use of a neatly-organized contract protocol, which in basically the most overall fabricate is correct records. The precedent establish by these actions are no longer ideal for inaugurate-supply tool constructing.

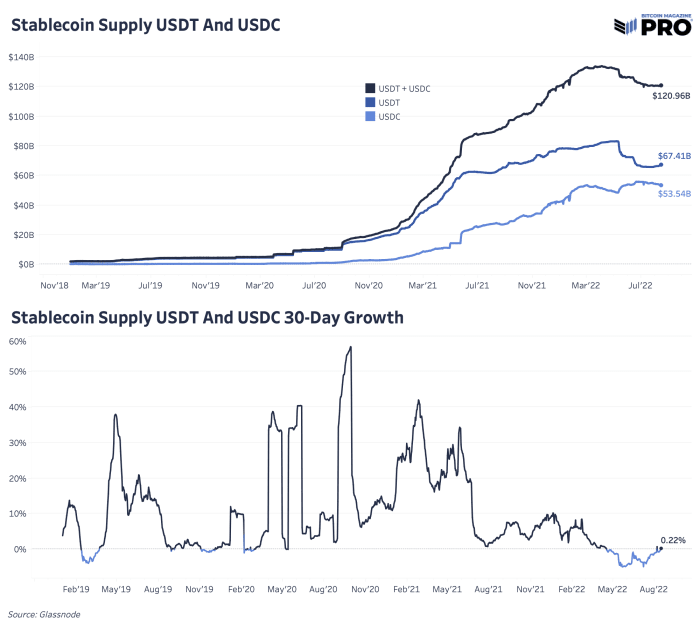

No topic the apt and constitutional precedent of the switch, the response from stakeholders all over the Ethereum and DeFi ecosystems modified into the supreme eyeopener. Merely hours after the Treasury added Twister Cash to the SDN checklist, Circle, issuer of $53.5 billion stablecoin USDC, had up thus far its blacklist to encompass each and every sanctioned address and neatly-organized contract, officially disbanding holders of USDC from interacting with the protocol, and even seizing a tiny quantity of funds.

Circle launched the following commentary following the switch,

“Circle is a regulated firm that created, and now manages and points one amongst the supreme dollar digital currencies on this planet. As such, we conform with sanctions and compliance requirements, and admire carried out so for years, resulting from constructing a faster, safer, and additional ambiance pleasant map to switch worth globally requires have faith, and resulting from it’s the law. That have faith has helped USD Coin (USDC) grow vastly within the final few years and has established USDC all over the digital asset financial system globally.” – Circle blog

This activate a chain reaction within the DeFi ecosystem, the put mighty of the infrastructure that had been built on top of / around USDC, whereas it had now change into an increasing number of glaring that this wasn’t a sustainable long-time-frame answer for supposedly decentralized finance. MakerDAO

In enlighten, there began to be an increasing quantity of agonize about DeFi protocol MakerDAO, which leverages the Ethereum blockchain to create an over-collateralized snug-pegged stablecoin the use of blockchain-essentially based fully collateral.

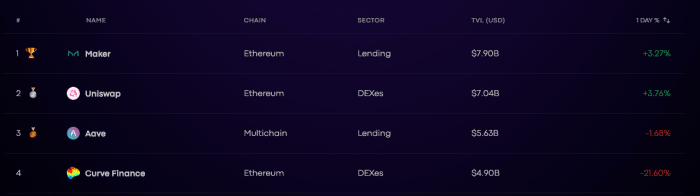

No topic the a large different of flaws of the use of TVL (total worth locked) as a measure, Maker’s plan atop the checklist for DeFi protocols is telling. Within an ecosystem that saw explosive enlighten publish 2020, Maker’s upward thrust modified into among the many most meteoric.

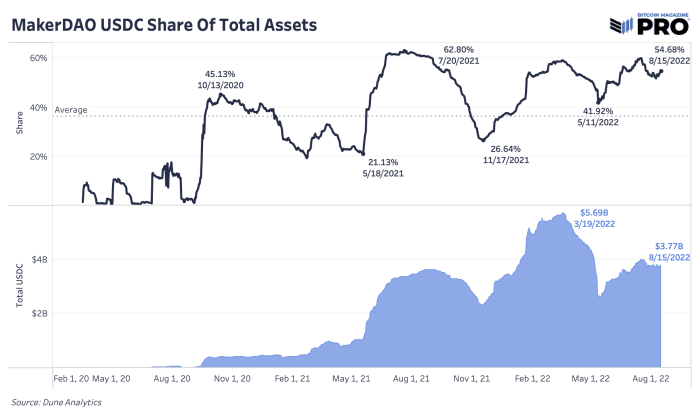

MakerDAO permits users to generate DAI (an algorithmic stablecoin) by depositing collateral resources into Maker Vaults, which has change into an increasing number of reliant on USDC.

At the time of writing, Maker has approximately $10.44 billion in resources locked in its vaults, with $7.23 billion of DAI issued against that collateral.

Shown under is the proportion of MakerDAOs collateral that is USDC alongside with the mix USDC worth within the pane under:

It’s problematic when the inspiration of a so-known as decentralized monetary revolution is so reliant on collateral that’s the liability of a central issuer.

However, you would possibly maybe well’t and not utilizing a doubt blame Maker for its reliance on USDC. They are making an strive to resolve an economic say that has existed for centuries. As a outcomes of making an strive to peg DAI to $1, the architects of MakerDAO confronted the conventional foreign money peg trilemma. Economic historical past has shown that it’s easiest attainable to complete two of three desired coverage outcomes at one time:

- Environment a fastened foreign money change rate

- Allowing capital to circulation freely and not utilizing a fastened foreign money change rate agreement

- Self sufficient monetary coverage

Within the case of DAI, MakerDAO’s algorithmic stablecoin, the alternatives are equivalent, however the present Treasury sanctions and subsequent compliance on behalf of Circle has led MakerDAO to position a matter to its increasing reliance on USDC:

The trilemma in Maker’s case is the following:

- Preserve USD peg

- Abandon stablecoins as collateral

- Scale MakerDAO

Maker can easiest take two of the three alternatives.

With the present trends with USDC, it seems love Maker is serious relating to the latter two, with the final consequence being the abandonment of the USD peg for DAI. With this decision, the inspiration modified into floated to remodel all USDC into ETH, given the bearer asset nature of the cryptocurrency asset relative to the tokenized liability of Circle, a centralized institution regulated by the U.S. govt.

This resulted in a response from Vitalik Buterin, which highlighted the dangers of backing an algorithmic stablecoin with volatility collateral (albeit overcollateralized because it for the time being stands).

Right here’s a worthy say for the DeFi plan in regular. How carry out you create a decentralized ecosystem of borrowing/lending, when the very thing that is in basically the most inquire of to be borrowed is a permissioned “off-chain” asset (the U.S. dollar)? Algorithmic stablecoins are attainable, but require over-collateralization and depart away users vulnerable to the distress of margin calls/liquidation if the worth of the pledged collateral drops.

The an increasing number of realized threat of censorship and guidelines coming by the pipe formulation that DeFi because it’s identified at the present time, with worthy reliance on centralized stablecoins as collateral, is inclined.

To cite Lyn Alden,

“Stablecoins are beneficial, but centralized. And by extension, they centralize any community that is overly reliant on them.”

Extra Infrastructure Censorship

Rapidly after the Treasury announcement and blacklists from Circle, key Ethereum infrastructure project Infura, which permits for users/apps to connect with the Ethereum blockchain, began to dam RPC (remote design call) requests to Twister Cash. Infura is the carrier provider for basically the most-feeble wallet application in Ethereum, MetaMask, among other applications. Infura is the supreme node provider within the Ethereum ecosystem, and despite the indisputable truth that progressed users route around the ban the use of their admire consumers, the marginal particular person is completely no longer at that stage of technical competency.

Following the Twister Cash incident, founder and CEO of Coinbase Brian Armstrong spoke out relating to the sanctions from the U.S. Treasury, citing the immoral precedent that comes with sanctioning a abilities in plan of a say particular particular person or entity. He followed the criticism by citing,

The Centralization Recount With PoS Ethereum

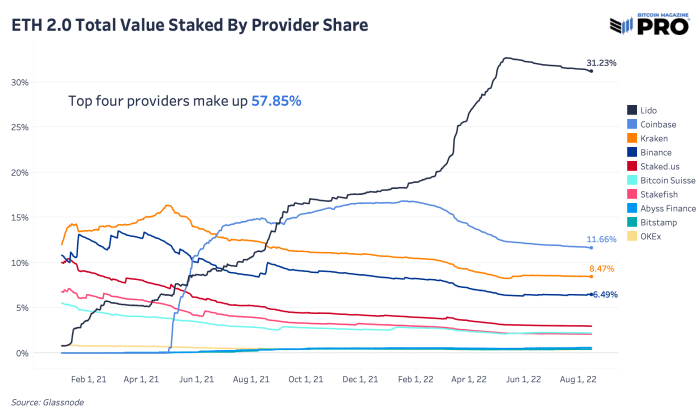

Whereas Ethereum proponents and developers will claim that the swap to PoS makes Ethereum mighty extra decentralized and resistant to adversarial attack, the empirical evidence parts to an increasing quantity of staking centralization, which is ready to consequence in some worthy considerations. At the time of writing, 57.85% of ether is being staked with four services, with Lido keeping by far the supreme market allotment.

Lido is a liquid staking answer which permits users to stake their ether (and forgo the 32 ETH threshold for smaller holders) in change for stETH token, which is a claim that will also be redeemable for ether at some level within the long bolt.

By create, present stakers of ether can no longer unstake their cash, even without delay after the Merge takes plan, with Ethereum roadmap estimates suggesting the attainable enabling of withdrawals from staking validators at some level in 2023.

The fleshy code enabling withdrawals publish-Merge has no longer but been executed.

Provided that the withdrawals to unstake ETH is never any longer but an option for users, a liquid staking answer such as Lido (which is far and away the market chief) is an especially exquisite option for users who remove to admire win admission to to their cash to change/hedge/collateralize their ETH.

In a previous mission of ours, Celsius and stETH – A Lesson on (il)Liquidity, we wrote relating to the one-map dynamic of stETH redeemability:

“stETH is a token issued by Lido which offers users a carrier the put they’re ready to lock any quantity of ETH in change for the stETH token, which is ready to be rehypothecated in DeFi to create yield, encourage as collateral, etc. This contrasts to other kinds of ETH staking the put your resources are no longer liquid.” – Celsius and stETH – A Lesson on (il)Liquidity.

(Liquid) Staking appears to be a winner-remove-all (or most) dynamic, the put users take the carrier that has the smoothest particular person experience, basically the most liquid secondary market (ETH to stETH is for the time being a one-map market until PoS withdrawals are enable, but users can swap within the secondary market), and basically the most exquisite rate earnings (extra on this later). These are valid a pair of of the explanations that Lido’s proof-of-stake market allotment is as worthy because it’s.

The Increasing Dangers Of Lido

In a blog publish written on Ethereum.org by Danny Ryan, a lead researcher for the proof-of-stake rollout for the Ethereum Foundation, Ryan highlighted the increasing risks that centralization of stake in Lido can also consequence in for Ethereum:

“Liquid staking derivatives (LSD) such as Lido and equivalent protocols are a stratum for cartelization and induce significant risks to the Ethereum protocol and to the linked pooled capital when exceeding severe consensus thresholds. Capital allocators must be responsive to the dangers on their capital and allocate to different protocols. LSD protocols must self-limit to steer clear of centralization and protocol distress that can within the extinguish ruin their product.

“Within the unparalleled, if an LSD protocol exceeds severe consensus thresholds such as 1/3, 1/2, and a pair of/3, the staking spinoff can extinguish outsized earnings when compared to non-pooled capital attributable to coordinated MEV extraction, block-timing manipulation, and/or censorship – the cartelization of block plan. And in this scenario, staked capital turns into unfortunate from staking in other locations attributable to outsized cartel rewards, self reinforcing the cartel’s withhold on staking.”

In Ryan’s phrases, risks exist if a staking answer grows to withhold a severe quantity of stake in a PoS system, attributable to the ability to use coordinated MEV (miner extractable worth), and/or the ability to censor particular actors/transactions at a whim.

Ryan’s advice, to admire the liquid staking protocol self-limit to steer clear of centralization and protocol distress, modified into build as much as vote by Lido by process of the governance token LDO.

Votes performed with the LDO governance token is how key Lido selections are made.

A vote for LDO holders modified into taken to self-limit the staking allotment for Lido, with the poll starting on June 24 and concluding on July 1. The vote modified into performed on Snapshot, a favored instrument for DAOs (decentralized self sustaining organizations) on Ethereum to conduct protocol balloting/governance.

The consequences?

A 99% landslide for choosing to no longer self-limit by LDO holders.

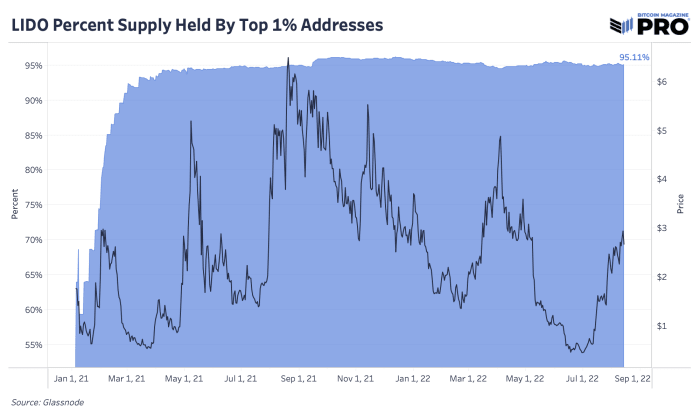

The landslide vote mustn’t map as a surprise, given that 95.11% of LDO tokens are held internal the tip 1% of addresses, most of which can well perhaps be U.S.-regulated finishing up capitalist (VC) companies.

Provided that Lido governance is never any longer without delay controlled by most necessary finishing up capitalist companies, of which most diagram below U.S. jurisdictions, ETH has a rising centralization say.

When summing up the amount of staked ETH all over Lido, Coinbase, Kraken, and Staked alone, 56.57% of staked ETH for the time being resides in carrier services without delay or no longer without delay below the jurisdiction of the U.S. govt.

Circling abet to the Merge as a consensus alternate, carry out you withhold in mind basically the most necessary alternate that Ethereum is finishing as much as head from a proof-of-work to a proof-of-stake community?

Block production is intelligent from a carrier performed by miners to validators.

This implies that validators, those which can also very neatly be staking 32 ETH, are the ones guilty of the block production of the Ethereum community. The distress for Ethereum as neatly as the centralized carrier services, is that stress from U.S. authorities to censor at the protocol stage. Referring abet to Buterin’s publish, the Ethereum crew essentially based fully on censorship from centralized entities would snug fork, to delete the “attacker’s” stake:

“For other, extra sturdy-to-detect assaults (significantly, a 51% coalition censoring everyone else), the crew can coordinate on a minority particular person-activated snug fork (UASF) by which the attacker’s funds are as soon as extra largely destroyed (in Ethereum, here’s carried out by process of the “verbalize of being inactive leak mechanism”). No enlighten “sturdy fork to delete cash” is required; as a change of the requirement to coordinate on the U.S. to make a different a minority block, everything else is automatic and simply following the execution of the protocol principles.”

The say with this map is that attributable to the worthy DeFi/L2 ecosystem built around Ethereum through the years, any dissident fork (rebelling against OFAC compliance) would doubtless lose its ecosystems of stablecoins and trusted oracles.

Fork Ethereum without the backing of USDC, and a daisy chain of DeFi liquidations begins as the non-compliant fork now has USDC-forked tokens which can also very neatly be intrinsically nugatory, sparking a large contagion carry out / margin call scenario.

Bitcoin underwent a equivalent take a look at in 2017 with the fork wars, the put a large push modified into made by representatives from over 50 companies attending a gathering, notoriously called the Unusual York Settlement, to prolong the block size of Bitcoin, which modified into a required alternate in consensus.

Particular particular person users of bitcoin revolted against such adjustments, given the precedent that coordinated sturdy forks and altering consensus principles would admire, and as a change done a cozy fork that enabled the later create-out of scaling alternatives such as the Lighting Network. The key distinction between the fork proposed by the Unusual York Settlement conspirators and the ones activated by a worthy different of moderate bitcoin users modified into that the aged modified into a proposal to sturdy fork, whereas the latter modified into an decide-in snug fork, which formulation that consensus is quiet backwards-like minded for nodes that did not strengthen.

In Ethereum’s case at the present time, the increasing encroachment of attainable future censorship at the block production stage would no longer require one other fork, as a change of the one that is already planned for the Merge at the present time. The fork would possibly maybe well perhaps be on the dissident users, who are pushing for an inaugurate, censorship-resistant future.

The certain distinction between what Bitcoin executed in 2017 versus what Ethereum can also thoroughly face within the long bolt is that a worthy allotment of its ecosystem would doubtless be misplaced alongside the trend given the dependence on centralized stablecoins such as USDC in its DeFi ecosystem.

PoS Slashing Hypothetical

Let’s checklist a uncomplicated hypothetical and peep the map in which it would also play out. The U.S. govt imposes elevated guidelines on Circle, the USDC issuser. They propose to limit transactions from a checklist of linked Ethereum addresses. Centralized U.S. companies which can also very neatly be Ethereum staking validators need to adhere to those guidelines by rejecting blocks with these transactions or blacklisting addresses. Within the event that they carry out no longer, they are going to face elevated scrutiny, fines, sanctions, etc.

The proposed Ethereum answer is slashing by consensus. Slashing would ruin a proportion of the validator’s ETH stake forcing them to rethink their immoral censorship actions. But, consensus desires to map from a majority of nodes whereas the broad majority of staked ETH already sits with these centralized validators (and would possibly maybe well no longer be withdrawn as of now).

By no longer having extra solo validators and nodes, consensus would exist with these better centralized teams and no longer with the broad majority of ETH users. Within the scenario, centralized teams wouldn’t admire the incentive to bravely fight against govt guidelines. Whereas users, who admire staked their ETH with these centralized institutions, don’t admire the incentive to want to slash their admire ETH holdings within the name of censorship resistance.

Totally different ETH users and nodes can push against this to force a attainable minority fork or UASF (particular person-activated snug fork). However this would possibly maybe occasionally doubtless doubtless map at the expense of losing Circle and masses of the developed DeFi infrastructure that has been built on Ethereum over the final few years.

In an adversarial scenario, given the precedent establish by Circle final week, is there a sound case to be made for Circle no longer selecting the OFAC-compliant chain/fork?

We must be obvious that we unequivocally carry out no longer give a boost to the sanctioning of neatly-organized contracts, sinful-stage censorship, or imposed top-down verbalize management over the mediums of verbal change or economic worth.

All we are aiming to carry out is pose what we build a matter to are official questions. Bitcoin, Ethereum, and broadly the cryptocurrency market at worthy are making an strive to remove the issuance and management of money far from the verbalize.

History reveals that there will doubtless be a vested hobby in controlling/co-opting this endeavor.

By no formulation-Ending Forks

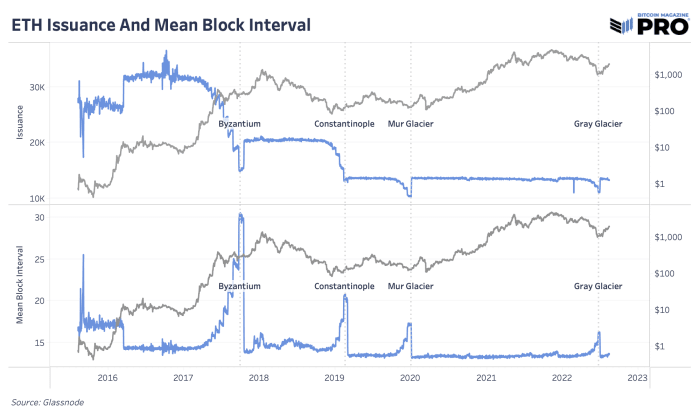

All the map in which by Ethereum’s historical past, there’s been a different of enormous sturdy forks and updates by create to create an ever-evolving protocol. Many of these adjustments admire included adjustments to say bombs to push abet ability Merge dates and altering present issuance over time to be an increasing number of disinflationary. Proponents of Ethereum argue this makes ether “extremely-sound” cash, which is paradoxical given that the soundness of money is derived from the incapacity to be modified/altered/diluted in any map, in particular for political capabilities.

No longer easy forks and most necessary updates at the core of Ethereum’s map is quite the actual opposite of Bitcoin’s. Updates and adjustments to the consensus protocol admire modified as the narratives and imaginative and prescient of what Ethereum must be has modified. Whereas this would possibly maybe occasionally also very neatly be exquisite for its idealist users/proponents, this leaves Ethereum’s governance to be enviornment to later politics.

With the rising uncertainty and risks of lifestyles publish the PoS Merge, all we are succesful of predict is for sturdy forks and most necessary updates to proceed. For many, here’s exquisite as the Ethereum crew will work to create contemporary alternatives and complex protocol designs counting on what most necessary mission they face. But for others, Ethereum as an asset and protocol peep love an engineering experiment that is missing lawful stability.

10/16/2017: Byzantium change, “A sturdy fork is a alternate to the underlying Ethereum protocol, developing contemporary principles to bolster the system. The protocol adjustments are activated at a particular block number. All Ethereum consumers want to bolster, in another case they are going to be caught on an incompatible chain following the feeble principles.”

02/28/2019: Constantinople change, “The everyday block cases are increasing attributable to the difficulty bomb (usually identified as the “ice age”) slowly accelerating. This EIP proposes to delay the difficulty bomb for roughly 12 months and to diminish the block rewards with the Constantinople fork, the second fragment of the Metropolis fork.”

1/2/2020: Muir Glacier change, “The everyday block cases are increasing attributable to the difficulty bomb (usually identified as the “ice age”) and slowly accelerating. This EIP proposes to delay the difficulty bomb for one other 4,000,000 blocks (~611 days)”

8/5/2021: EIP-1559 – London sturdy fork, “A transaction pricing mechanism that involves fastened-per-block community rate that is burned and dynamically expands/contracts block sizes to address transient congestion.”

12/8/21: Arrow Glacier Substitute, “The Arrow Glacier community strengthen, equally to Muir Glacier, adjustments the parameters of the Ice Age/Venture Bomb, pushing it abet several months. This has also been carried out within the Byzantium, Constantinople and London community upgrades. No other adjustments are supplied as fragment of Arrow Glacier.”

6/29/2022: Gray Glacier Substitute, “The Gray Glacier community strengthen adjustments the parameters of the Ice Age/Venture Bomb, pushing it abet by 700,000 blocks, or roughly 100 days. This has also been carried out within the Byzantium, Constantinople, Muir Glacier, London and Arrow Glacier community upgrades. No other adjustments are supplied as fragment of Gray Glacier.”

Advance-Term Market Outlook

Lastly, we previously highlighted valid how leveraged and speculative the Ethereum derivatives market is lovely now. Reaching over 100% from its lows in June, ETH has been riding the Merge hype whereas performing as high beta to bitcoin (which has been high beta to equities). Traders admire piled in going long into the Merge. There’s absolute self perception that the Merge myth has helped to switch place upwards over the final two months. However it fully must be famed that ETH has valid been following the course of broader equities and distress.

Over the final few days, those relationships were breaking down and ETH, alongside with bitcoin, are exhibiting indicators of weakness at key breakout place areas. The market appears to be at one amongst its most pivotal parts of the cycle all over a attainable admire market rally conclusion, the Merge in four weeks and a September FOMC meeting within the identical month.

Remaining Give an explanation for

Our build a matter to is that with the introduction of bitcoin, the Byzantine Generals’ Recount (in another case identified as the double-spend say) chanced on an engineering answer. With the mix of proof-of-work and a dynamic say adjustment, humanity had within the extinguish learned strategies to store and switch worth in a trustless formulation all over the tips superhighway. The system’s consensus mechanism is secured by a community of self sustaining node runners, operating a tool that is as uncomplicated, sturdy and resilient as technically attainable, in verbalize to bootstrap a brand contemporary decentralized monetary system from the bottom up against the interests of the world’s most highly effective institutions.

We think that ether as an asset and Ethereum as a platform are one thing assorted completely, and rather heaps of the create/engineering selections made by the crew admire led it to potentially change into vulnerable to clutch within the long bolt.

From an idealist level of build a matter to, an are attempting and include a brand contemporary permissionless infrastructure of monetary applications the use of Ethereum is unique, however the rationalist in us believes that the narratives of lawful decentralized infrastructure and “extremely-sound” monetary properties are extra of a marketing gimmick than actuality.

“Governments are true at removing the heads of a centrally controlled networks love Napster, but pure P2P networks love Gnutella and Tor appear to be keeping their admire.” — Satoshi Nakamoto, November 7, 2008