With its mentioned mandate targets, the Fed is implicitly telling the market that any taper focus on is total nonsense.

“The financial protection targets of the Federal Reserve are to foster economic prerequisites that raise out both stable prices and maximum sustainable employment.”

Within the Federal Reserve’s mandate, there are two mentioned targets for their financial protection:

- Right prices

- Most employment

With these two mentioned targets, the Fed is implicitly telling the market that any taper focus on is total nonsense, and here is why:

The total economy is built upon credit, and to withhold full employment and stable prices (i.e., “2% inflation focusing on”), credit can’t be allowed to contract.

Let’s dig into some newest dispositions within the loyal property marketplace for context:

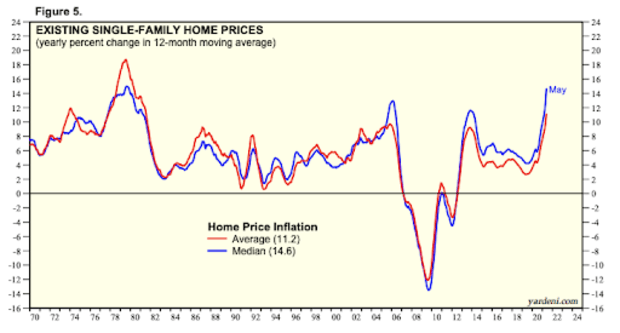

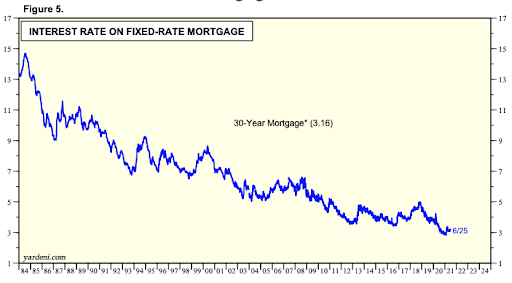

Median prices for single family homes admire increased 14.6% 300 and sixty five days over 300 and sixty five days, fueled by file low mortgage rates over the closing 18 months.

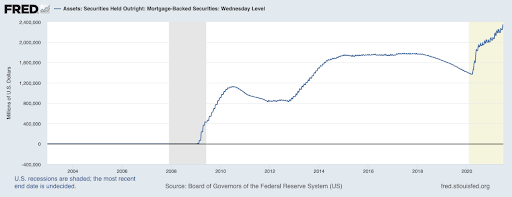

Nonetheless what happens if the Fed tapers? What happens if the Fed stops procuring mortgage backed securities at a clip of $40 billion per month?

The Fed taking the punchbowl a long way from markets would indicate sinful news for likelihood sources, loyal property integrated. It’s miles crucial to take note that loyal property is amongst basically the most leveraged asset classes within the market, as it is favorite to desire with simplest a 20% down rate (or even much less).