In the Bitcoin community, we usually hear the U.S. buck called an “exorbitant privilege.” Namely, that the U.S. advantages disproportionately from the buck’s reserve forex put of dwelling. This article will detail why the recent monetary system has, the truth is, been a burden on the United States, why the fiat buck system is ending and what that suggests for the manner forward for Bitcoin.

Background

First, what is a world reserve forex? Briefly, it is the forex that governments and natty world entities fancy central banks rob to facilitate world commerce, credit, accounting and usually to wait on their very occupy currencies. The U.S. buck holds this location on the present time.

The buck’s reserve put of dwelling became officially established in the Bretton Woods Settlement of 1944. Since the U.S. became the fully valuable economy left standing after World War II, it became fully pure that the U.S. buck would possibly well maybe be agreed upon to anchor a unique system. In accordance with Bretton Woods, valuable currencies were pegged to the U.S. buck, which in flip became pegged at $35 per ounce of gold.

This methodology first and critical served the sector smartly, enabling rapid rebuilding after WWII, especially in Europe, Japan and several emerging markets. It became also an integral segment of the fight in opposition to communism. Worldwide locations were welcomed into this manner of world finance and commerce so long as they were fascinating to facet in opposition to the Soviets. Nonetheless, the Bretton Woods originate quickly ran up in opposition to barriers. The gold backing restrained the buck’s present, despite the predict for forex all the plan in which thru the sector rising exponentially. Enter the Triffin quandary.

Triffin Plight

The Triffin quandary became first articulated in 1959 by Robert Triffin. The valuable thought is, when a forex is used as a world reserve, home constraints conflict with world predict. The high predict for greenbacks and the limits of gold on the offer create an incentive for the U.S. to go natty commerce deficits and debase the forex. If that were the cease, it could probably maybe be that uncomplicated, but a unique incentive breeds a market response as smartly.

Despite what many bitcoiners and macro pundits judge, 1971 became no longer an especially pivotal year. The smartly-known occasions of that year, particularly the Nixon Shock, were a pure progression, a recognition of the actual fact in the monetary system established years ahead of. By the time the Triffin quandary grew to change into usually known in the 1960s, it became already being solved. The market constantly finds a capacity.

In preference to wanting the Federal Reserve or U.S. government to meet world predict by printing and exporting greenbacks to the sector, banks in each location would possibly well maybe additionally create it for themselves by making buck-denominated loans. Right here is how all credit-based fully mostly fiat is printed, in the strategy of a mortgage. The Eurodollar system shaped as a world interbank system and had unofficially changed Bretton Woods ahead of 1971.

The Eurodollar Machine

The Eurodollar is the recent monetary system consisting of off-shore U.S. greenbacks and buck liabilities which would possibly well maybe be no longer beholden to the Fed or U.S. government protection. Enterprising bankers solved Triffin’s quandary by printing greenbacks out of doors the U.S.

These off-shore (or shadow) greenbacks commerce one-to-one with real U.S. greenbacks, because, smartly, they are U.S. greenbacks. In a quirk of credit-based fully mostly fiat money, it is printed in loans denominated in that forex. A commodity-backed money is both fully backed or no longer. There is a measure of the commodity in a vault someplace, and an purpose ratio of forex to backing that reveals debasement. Nonetheless credit-based fully mostly fiat has nothing to distinguish a buck created by a bank in the U.S. from one created by a bank in, pronounce, Singapore.

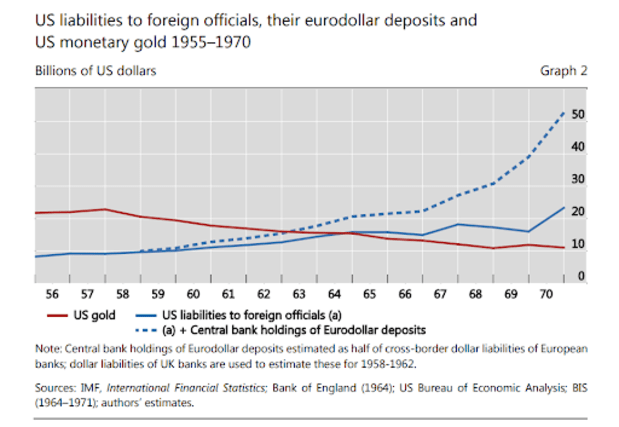

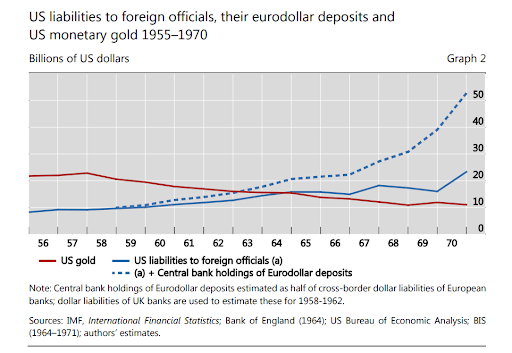

The Eurodollar system had its roots in the leisurely 1950s, and grew with the insatiable predict for greenbacks that commerce deficits couldn’t meet. By 1970, the off-shore Eurodollar present held by central banks became greater than the reliable foreign buck present (ogle chart above).

This emerging monetary system became fully ignored in the early days because it didn’t fit into economists’ units. The Eurodollar system remained unstudied for years with fully about a dauntless economists risking their careers to behold into things that didn’t fit into the reigning units. By 2020, the Financial institution for Worldwide Settlements’ (BIS) estimated there to be $12.7 trillion in measurable USD-denominated debt originated and held out of doors the U.S. Nonetheless, this is fully a little part, because it would not judge derivatives, chains of custody, forex swaps, or other shadow merchandise, making the efficient sum repeatedly elevated. That’s why it’s called “shadow banking,” we don’t know the licensed extent of their balance sheets.

So long as the loans would possibly well maybe additionally simply also be serviced, the system will take care of ticking along. That implies these loans must be productive and yield cash scuttle along with the circulation elevated than most valuable and past-time of the loans. Since money in this credit-based fully mostly Eurodollar system is constantly revolving debt, the smallest interruption in the glean of belief and credit ratings can reason a monetary crisis.

Eurodollar And Free Replace Subsidy

If the Eurodollar’s elasticity became the actual hand of the buck, originate procure admission to to most of the sector’s markets became the left. Worldwide locations being procure from regional wars and their goods having procure admission to to simply about all markets is a historic anomaly. Old to the heart of the 19th century, constructed-in markets as we know them on the present time did not exist, and till WWII, world commerce became concentrated to a pair goods and shopping and selling companions within networks of colonial possessions. The post-WWII technology, which provided world establishments fancy the UN, WTO and NATO, became paid for by the U.S. This U.S. subsidy in the procure of a security and commerce umbrella enabled the world economy to develop fancy never ahead of.

Many participants procure this dynamic heart-broken. They ogle U.S. involvement for the duration of the a long time in Korea and Vietnam, then Central The united states, then Iraq, Libya, and Afghanistan as U.S. imperialism, in its put of it essentially benefiting others in the security umbrella. The U.S. navy became expanding affect and take care of an eye fixed on over these pronounce areas of operation, no longer for the sake of a U.S. empire, but to retain a world system which appreciated others. The Pax Americana became about warding off incidents fancy Sarajevo 1914 or Poland 1939.

This does no longer excuse U.S. atrocities and substandard behavior, but it is a ways most valuable to obtain the U.S. became no longer essentially the most most valuable beneficiary. Who became harm most by the world wars in the 20th century? No longer the U.S. In level of fact, the period since WWII, supposedly the technology of the U.S. empire, became marked by the hollowing out of the U.S. economy and mammoth U.S. commerce deficits, as the rest of the sector flourished the spend of Eurodollars.

Reserve Currency As A Burden

The united states is a quite unique creation. It didn’t reach its continental boundaries till after the Mexican-American War of 1848. What adopted became two a long time of inner political restructuring and intercontinental infrastructure constructing, culminating in 1869 with the completion of the intercontinental railroad. From that level, it took two more a long time for the U.S. to change into the final note economy on the planet, long ahead of the sector wars of the 20th century.

Certainly, by 1914, U.S. GDP became twice the scale of the 2d greatest economy, and roughly 20% of world GDP. I give these numbers to reward the U.S.’s location ahead of the Federal Reserve and ahead of getting the world reserve forex. It became already dominant and expanding its lead.

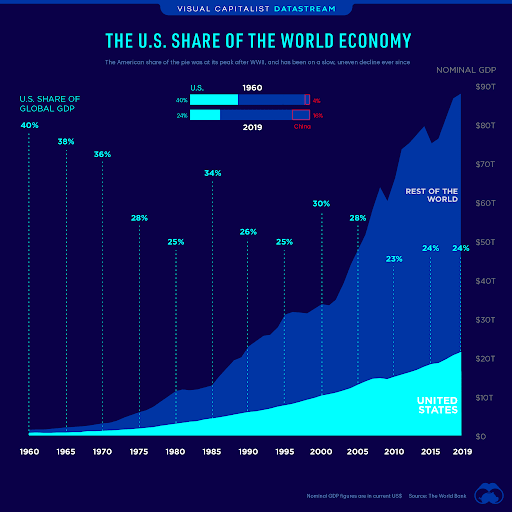

The clarification for this dominance just shouldn’t be any longer as a result of U.S. buck as a reserve forex. When leaders from all the plan in which thru the sector were meeting at Bretton Woods, the U.S. became guilty for 50% of the world GDP, a total half of the sector’s economy and presumably a elevated share of the sector’s accrued capital. Bretton Woods did not boost the U.S.’s allotment, it prompted it to fall.

A in vogue rebuttal is, “WWII destroyed noteworthy of the European economy, so as that’s why the U.S. became so dominant on the time.” That is licensed, but it’s segment of the geopolitical actuality. Europe is prone to wars, and creating and accumulating capital long-time period is more no longer easy than in contrast to the U.S.

By 1960, in the early days of the Eurodollar, the reserve forex put of dwelling of the buck became already disproportionately benefiting the rest of the sector. The U.S. allotment of GDP had dropped from 50% to 40%. By 1980, fully 35 years after Bretton Woods, the buck as reserve forex had lower the United States’ allotment of world GDP in half, down to 25%. It has never recovered.

Geographic Economics

There are two valuable reasons for the relative wealth and energy of the United States, and so that they’re geographic and political, no longer as a result of buck. Geographically, the U.S. has pure sources in abundance, a chain of essentially the most uncomplicated pure harbors on the planet on the 2 most valuable oceans, the final note contiguous and perfect-quality farmland, more navigable rivers than the rest of the sector mixed and borders which would possibly well maybe be extremely low-designate to protect. It would take the worst government on earth to clutter that up. Nonetheless in its put of communism, politically, the U.S. has the strongest constitutional custom on the planet, a invoice of rights and a level of tell and person autonomy that has, for essentially the most segment, restrained government overreach and abuse.

When having a behold impartially on the geographic and political setting of the U.S. relative to other nations of the sector, it is no longer stunning that it is the dominant economy. It’s a ways rather destined to be so.

In distinction, there are many nations and areas of the sector that remained undeveloped till the closing 50 years, despite them having a for so a lot longer historic past of civilization and publicity to world commerce than the U.S. The Eurodollar expansion made these beforehand uneconomic corners of the sector economic to construct. New technology performed a job for sure, however the game changers were artificially low-designate credit, a liberal commerce expose whereby they’d maybe additionally securely and quite sell their exports, and free security in opposition to their neighbors.

The realm reserve put of dwelling of the buck is a well-known segment of the globalized expose described above. Some have talked about that the U.S. navy is the final backing of the buck, and there would possibly well be about a fact to that. The buck and the navy are synergistic in sustaining world peace and commerce. In a long time past, the different to selecting the buck had nothing to create with throwing off the imperialistic shackles of U.S. oppression. The different became existence out of doors the globalization umbrella, that suggests noteworthy lower economic boost, more regional battle and oppression by neighbors. In the event you withdraw the U.S. subsidy of globalization and the Eurodollar, many areas will as soon as more change into uneconomic and the price of regional conflicts will likely be correct now borne by the nations themselves.

Marginal Earnings Product Of Debt

In economics, there would possibly well be the concept of diminishing marginal returns. Applied to credit, we usually ogle this as the “marginal income made of debt,” in other phrases, how noteworthy boost create we procure from every unique buck in debt? Early debt is extremely productive, used to finance tasks with the final note bang for his or her buck, while later debt is comparatively unproductive.

For a third-world nation that hasn’t had procure admission to to low-designate credit and security in its total historic past, joining the globalized economy intended there became a couple of low-placing fruit fancy infrastructure of roads, rail, electrical energy and communication that yielded huge preliminary productiveness positive aspects. Developed economies had a identical route, but all nations are the truth is working out of productive uses of latest debt.

As nations change into saturated with debt, boost slows and even reverses. Financial tools fancy quantitative easing, have been tried and failed to revitalize old boost rates. That it is doubtless you’ll maybe’t save a debt-ridden system by in conjunction with more debt. The worldwide credit binge is coming to an cease. Primarily the most smartly-known example is Japan, however the sample would possibly well maybe additionally simply also be viewed in the everslowing European boost payment and most no longer too long ago in China. China is the closing huge economy to hit the boost wall.

The cease of the Eurodollar system just shouldn’t be any longer a voluntary task. It would no longer add productive debt and toughen its occupy weight. No longer fully does every buck in unique debt fully create $0.25 or so of industrial boost, but all people knows it. That knowledge creates a hesitant atmosphere which depresses credit boost and endangers the flexibility for the economy to repay most valuable and past-time. Even with a 0 hobby payment protection the system is amazingly fragile.

Turning Inward And The Route To Bitcoin

It’s a ways reach heresy to tell globalization just shouldn’t be any longer a pure anxiety. In spite of every part, it’ll be self-evident that free markets will have a tendency to toughen commerce and the division of labor. That’s licensed, but up-to-the-minute globalization is the cease result of the final note subsidy in world historic past, and has taken the interconnectedness of manufacturing and monetary processes to absurd stages. Right here is changing into plainly evident as present chains correct now failed at some stage in 2020 and complications continue into 2021. Like any backed activities, it is an inefficient spend of capital, inflicting malinvestment and misallocation of sources.

With out the burden of the world reserve forex and of shielding globalization, the U.S. will have the selection to retain more of its wealth at dwelling, investing time and energy into getting its occupy dwelling wait on in expose. The shift a ways from globalization will have profound consequences, felt most acutely in marginal economies and in battle-prone areas. The U.S. is neither of these.

Signs of the cease of globalization are all the plan in which thru us. The upward push of populism, commerce wars, and US withdrawal from technology-long navy efforts, all talk to a breakdown in this world political expose.

The Afghanistan exit is correct essentially the most reasonable value that the U.S.-led expose is ending. It doesn’t topic that it became botched in every doubtless manner, that correct makes it all the more extremely efficient as a nail in the coffin of globalization. Sure, the vogue it became out became a blow to the U.S. reputation, but that doesn’t topic. Taking flight from Afghanistan improves the U.S. monetary anxiety, especially relative to nations bordering Afghanistan that now must address a smartly-armed Taliban on their borders.

Returning to a location which the U.S. loved ahead of this mountainous experiment in globalization is a mammoth sure for the U.S. It’s a ways self-adequate, or would possibly well maybe additionally simply also be self-adequate, and safe. In the event you add in the rest of North The united states, as an economic bloc, it’ll additionally with out anxiety put 40% of world output and consumption, with out involving itself in the messy politics of Eurasia.

Because the U.S. dispenses with American-led globalization, this would possibly well maybe additionally additionally dispense with the needless burden of the world reserve forex. Why would the U.S. take care of a Eurodollar system plagued by a debt trap, which cedes take care of an eye fixed on over the U.S. economy to world monetary markets? The Eurodollar has reached its pure cease and must be changed, it is a nationwide security sigh.

Because the cease of the Eurodollar becomes more definite to all people, politicians and bankers will no longer protect the reserve forex put of dwelling all that vigorously. It’s no longer of their simplest hobby to create so, there’s nothing to avoid losing. The recent buck system is a gigantic burden, and the U.S. will voluntarily ditch for a unique version of the buck.

It’s no longer uncommon in U.S. historic past to change the buck’s originate both. On moderate, it has took location every couple of a long time. The Coinage Act of 1834, silver coin adjustments in 1853, the National Banking Act 1863, the Crime of 1873, the Bland-Allison Act of 1878, the Federal Reserve Act in 1913, gold confiscation in 1933, Bretton Woods in 1944 and the Nixon Shock in 1971. It’s a ways long gone due for a revamping of the buck as soon as more. Most likely most severely, the U.S. has a historic past of removing a central bank.

How Bitcoin Backing Will Be Accomplished

How would a transfer to a bitcoin backing be executed? That is the million bitcoin predict. I’ve given this some conception over the closing couple of years, as the final adoption of bitcoin becomes more and more likely. Clearly, predicting the particular task is extremely speculative, and bitcoin can even be utilized by itself or in the Lightning Network, but this is my recent prediction:

It’s a ways extremely no longer going, at this level, that the U.S. government will soar straight into retaining bitcoin. The more pure route is thru the banks, and we’ve already viewed the first steps in this route. On July 29, 2021, Impart Avenue, the 2d-oldest bank in the U.S., grew to change into the latest valuable bank to offer bitcoin-associated services to clients. Others embody BNY Mellon, JPMorgan, Citigroup and Goldman Sachs, which would possibly well maybe be the truth is offering bitcoin-associated services to clients.

As banks rob more bitcoin and the bitcoin designate continues to upward push dramatically — in segment aided by the banks retaining more of it — bitcoin will change correct into a natty allotment of their balance sheets. This will both force the U.S. government to take bitcoin, or simply regulate it and defer to banks retaining bitcoin.

Alongside with the banks retaining a couple of bitcoin, the U.S. would must create bitcoin licensed tender and toughen the formation of some type of bank-centered Layer 2, fancy a federated sidechain. This sidechain would possibly well maybe additionally resemble Blockstream’s Liquid.

The buck would possibly well maybe be the denomination of possibly 100 satoshis within that sidechain. This is able to give banks the flexibility to extend credit to a minimum level in step with the federation policies while enabling maximum transparency, thereby addressing the in vogue criticism in opposition to the mounted present of bitcoin. (No longer fixing for the mounted present, that doesn’t need fixing. Nonetheless enabling some procure of elasticity.)

This task would entail a drastic weakening of the Federal Reserve, and a return to a rather forgotten technology in the U.S. where banks, no longer central banks, were ascendant. Because the U.S. rediscovers its populist and non-interventionist past, this would possibly well maybe additionally additionally redefine its monetary system per the past as smartly, this time round bitcoin.