Final Week In Bitcoin is a chain discussing the events of the outdated week that occurred in the Bitcoin enterprise, overlaying all the predominant info and prognosis.

Summary of the Week

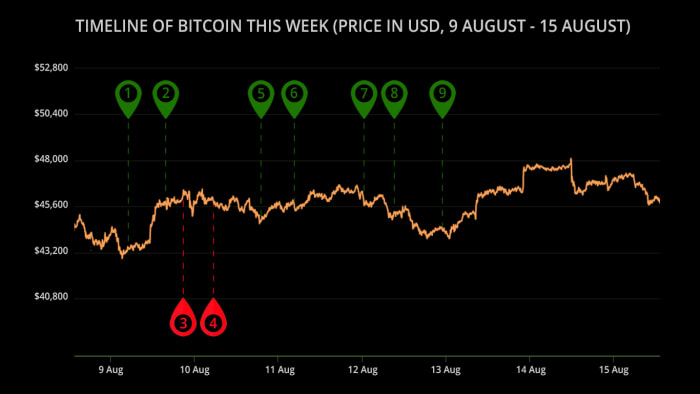

After temporarily dipping below $43,000 on Monday, bitcoin has remained quite in vogue round $46,000 throughout the week, temporarily surpassing $48,000 over the weekend. It’ll be too early to name, nonetheless it absolutely appears to be like as if it is time to get dangle of overly bullish for the short time duration. All the design by means of the last week, the U.S. Senate handed their controversial U.S. infrastructure bill, Bloomberg and Kraken’s CEOs appear to agree bitcoin is heading to $100,000 this year, and the president of Argentina says the country is launch to adopting bitcoin as correct tender. Right here’s closing week in bitcoin:

Timeline Of Bitcoin This Week

Bullish Data That Proves Bitcoin Is Heading Upwards

❶ On Monday, bitcoin mining firm Argo announced memoir earnings for the 2d quarter of 2021. They went on to reveal they beget 1,100 BTC and beget no arrangement of selling their holdings. This bullish sentiment appears to be like to be shared all over the market as miners continue to utilize many of the bitcoin they mine.

❷ On Tuesday, Reddit darling AMC Theatres announced they’d soon launch accepting bitcoin payments for movie tickets and concessions. Whether moviegoers are seeking to pay with bitcoin remains to be viewed; then once more the corporate for the time being sits on a money reserves pile price $2 billion, which can perhaps perhaps perhaps be in a disclose to take dangle of nearly 44,000 BTC, the next stockpile than Tesla’s.

❺ On Wednesday, a Bloomberg Intelligence file stated that bitcoin is still heading in the correct direction to surpass $100,000 later on this year. If that’s no longer bullish ample, Kraken’s CEO, Jesse Powell, shared a identical view, suggesting bitcoin might possibly well perhaps unbiased far exceed $100,000 in the months forward. As talked about sooner than, I part this identical outlook and bitcoin’s performance over the closing two weeks appears to be like to show that we’re ready for liftoff.

❻ Also on Wednesday, digital automobile insurance firm, Metromile, announced that they purchased $1 million in bitcoin with plans to take dangle of an extra $10 million. Besides they stated that they’d enable bitcoin payments on the platform soon.

❼ On Thursday, Need, an $18 billion investment firm, launched a brand new investment option by means of their app that can enable customers to make investments in bitcoin tax-free. Customers will be in a disclose to utilize custody of their bitcoin or beget Constancy act as its custodian. The platform, launched closing year, already manages over 125,000 retirement accounts.

❽ Also on Thursday, one in every of Mexico’s richest males, Riccardo Salinas Pliego added laser eyes to his Twitter profile. The enterprise magnate, price over $15 billion, later tweeted “I deem #bitcoin has a broad future and this might possibly increasingly change the world…. we can gaze.”

❾ At closing, on Friday, Alberto Fernandez, the president of Argentina, was once asked if the country would be conscious in El Salvador’s footsteps in an interview with local broadcaster, Filo Data. He answered by announcing “I form no longer are seeking to switch too far out on a limb […] nonetheless there might possibly be no reason to impart no.” This might possibly perhaps perhaps perhaps unbiased stop up being very bullish. The country has prolonged struggled economically and embracing bitcoin as correct tender might possibly well perhaps perhaps pronounce relief to its hundreds and hundreds of voters.

Bearish Data, Although Bitcoin’s Imprint Doesn’t Care

❸ On Tuesday, Shaded Rock Petroleum announced plans to install up to 1 million bitcoin miners in Canada’s Alberta province. Although that can seem bullish, here’s an organization that also utilizes fossil fuels and it might possibly perhaps possibly perhaps perhaps well also unbiased result in a actually prolonged time duration opposed sentiment referring to bitcoin’s vitality exercise, a sizzling topic as of gradual. A million mining rigs is bullish; extra carbon emissions linked with bitcoin, no longer so mighty.

❹ Also on Tuesday, the U.S. Senate voted and pushed by means of the controversial $1 trillion US infrastructure bill, selecting no longer to enable any of the proposed amendments to the “crypto clause.” All hope is no longer lost then once more as it still has to struggle by means of Congress and even though it does hasten without amendments there, it’s only doubtless to be implemented someday in 2023.

The Verdict: Bullish Notify Ahead

Bitcoin has shown in vogue growth over the closing three weeks. It’s already up over 50% since dipping below $30,000 on July 21st and there seem like no indicators of combating anytime soon. In unbiased just a few short weeks El Salvador will launch its nationwide rollout of bitcoin as correct tender in the country — the first segment of which can doubtless push extra worldwide locations to adopt bitcoin as correct tender and a hedge against deflation.

Furthermore, extra and extra miners are opting to HODL their newly minted money moderately than selling them, indicating that they agree with the bullish sentiment that many investors and analysts are pushing out. Increasingly people and establishments agree that bitcoin might possibly well perhaps unbiased totally surpass $100,000 in the coming months, something I’ve blabbered on about steadily as correctly.

The quantity of firms investing in bitcoin is rising by the week. The quantity of firms accepting bitcoin payments is rising by the week. I don’t give it some idea’d be too far-fetched to impart that soon the quantity of worldwide locations accepting bitcoin will develop by the week. As inflation rises, fiat currencies adore the greenback continue to lose their designate, nonetheless bitcoin doesn’t.

Bitcoin adoption is rising by the week and might possibly well perhaps beget to you’re no longer stacking while it’s a five-resolve asset, you’re going to remorse it when it’s a six, and even seven-resolve asset. So, stack up, strap up and put together for a wild go in the months forward…