The beneath is an excerpt from the Bitcoin Magazine Real file on the upward thrust and fall of FTX. To learn and download the final 30-page file, educate this link.

The Beginnings

The build did it all start for Sam Bankman-Fried? As the chronicle goes, Bankman-Fried, a aged global ETF dealer at Jane Aspect road Capital, stumbled upon the nascent bitcoin/cryptocurrency markets in 2017 and used to be apprehensive on the quantity of “chance-free” arbitrage different that existed.

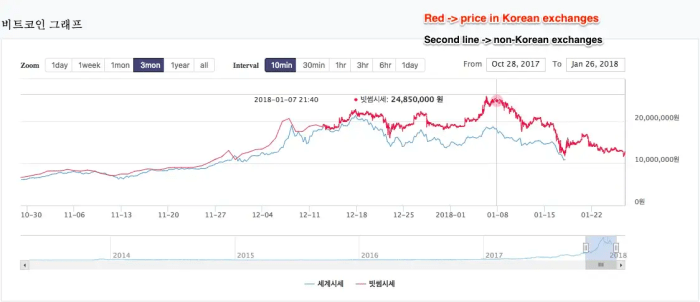

In particular, Bankman-Fried acknowledged the nasty Kimchi Premium, which is the enormous disagreement between the price of bitcoin in South Korea versus other global markets (as a result of capital controls), used to be a particular different that he took advantage of to first start making his hundreds and hundreds, and lastly billions …

No no longer as a lot as that’s how the chronicle goes.

The Kimchi Premium – Source: Santiment Recount material

The accurate chronicle, whereas maybe the same to what SBF favored to dispute to label the meteoric upward push of Alameda and as a result of this truth FTX, appears to be like to be like to own been one riddled with deception and fraud, as the “smartest guy in the room” narrative, one who saw Bankman-Fried on the quilt of Forbes and touted as the “contemporary day JP Morgan,” fleet modified to one in every of large scandal in what appears to be like to be like to be the largest financial fraud in contemporary historical previous.

The Delivery up Of The Alameda Ponzi

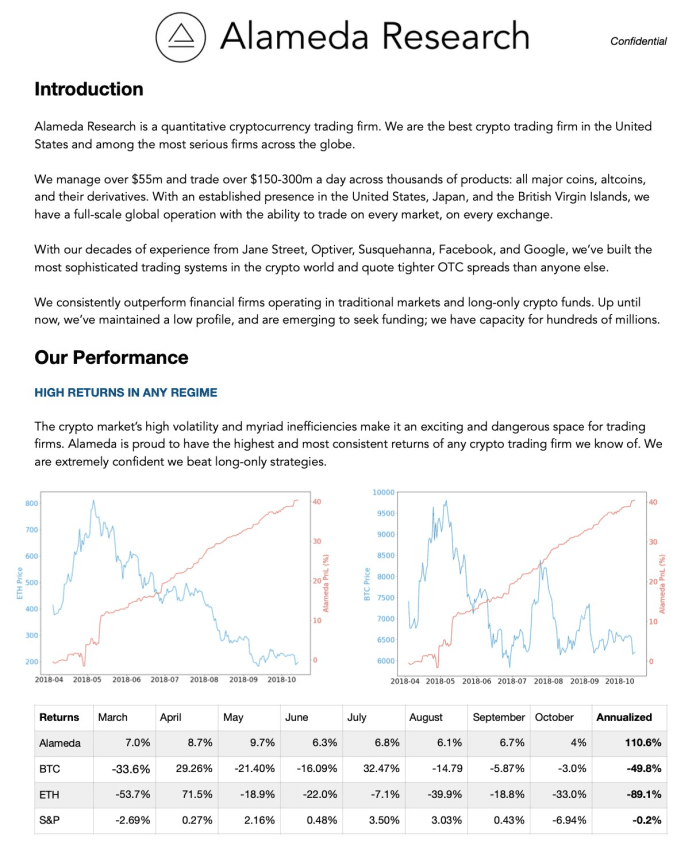

As the chronicle goes, Alameda Study used to be a excessive-flying proprietary trading fund that outdated quantitative systems to attain outsized returns in the cryptocurrency market. While the chronicle used to be plausible on the floor, as a result of the reputedly inefficient nature of the cryptocurrency market/industry, the red flags for Alameda were glaring from the starting up.

As the fallout of FTX unfolded, old Alameda Study pitch decks from 2019 began to dash into, and for many the declare used to be pretty honest. We are in a position to consist of the fats deck beneath sooner than diving into our prognosis.

The deck comprises many glaring red flags, together with a pair of grammatical errors, together with the providing of simplest one investment manufactured from “15% annualized fastened price loans” that promise to own “no downside.”

All glaring red flags.

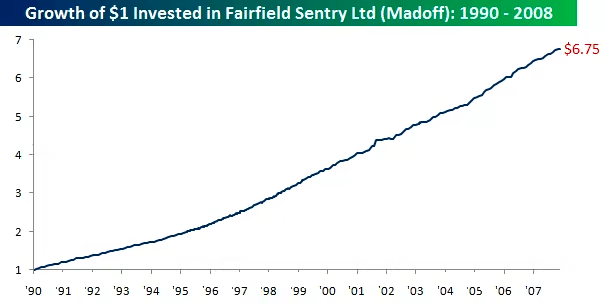

Equally, the form of the advertised Alameda equity curve (visualized in red), which reputedly used to be up and to the honest with minimal volatility, whereas the broader cryptocurrency markets were in the center of a violent endure market with vicious endure market rallies. While it’s 100% imaginable for an organization to carry out effectively in a endure market on the brief aspect, the ability to generate constant returns with near infinitesimal portfolio drawdowns is no longer a naturally taking place actuality in financial markets. Indubitably, it’s a dispute-memoir signal of a Ponzi arrangement, of which we own viewed sooner than, all thru historical previous.

The performance of Bernie Madoff’s Fairfield Sentry Ltd for almost 20 years operated pretty equally to what Alameda used to be selling through their pitch deck in 2019:

- Up-simplest returns no subject broader market regime

- Minimal volatility/drawdowns

- Guaranteeing the payout of returns whereas fraudulently paying out early traders with the capital of contemporary traders

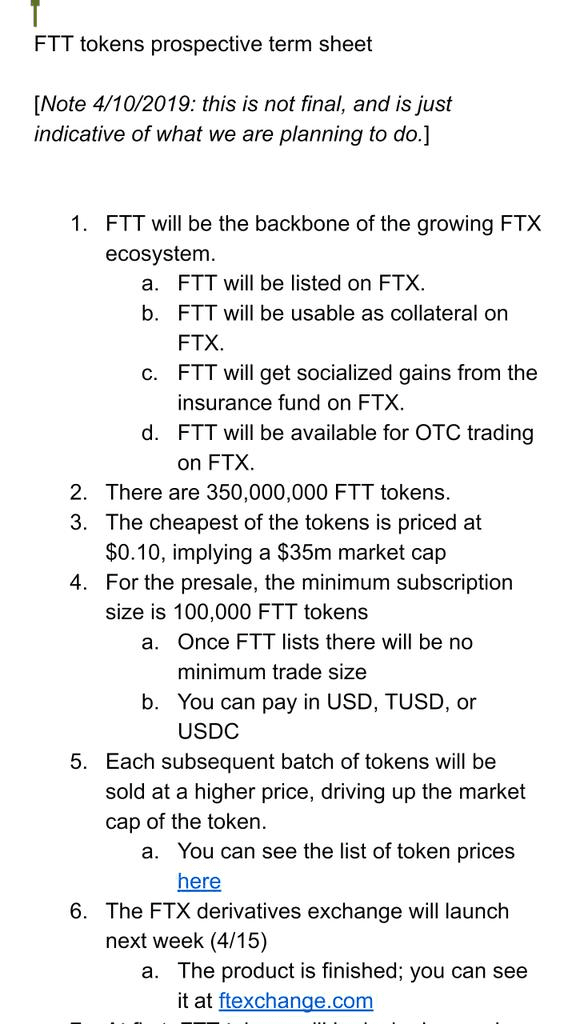

It appears to be like that Alameda’s arrangement began to bustle out of steam in 2019, which is when the company pivoted to growing an commerce with an ICO (initial coin providing) in the uncover of FTT to continue to offer capital. Zhu Su, the co-founder of now-defunct hedge fund Three Arrows Capital, gave the impression skeptical.

Approximately three months later, Zhu took to Twitter again to accurate his skepticism about Alameda’s next endeavor, the starting up of an ICO and a up to date crypto derivatives commerce.

“These connected guys are in actual fact attempting to start a “bitmex competitor” and attain an ICO for it. 🤔” – Tweet, 4/13/19

Under this tweet, Zhu acknowledged the following whereas posting a screenshot of the FTT white paper:

“Closing time they forced my biz accomplice to uncover me to delete the tweet. They started doing this ICO after they couldn’t procure to any extent further larger fools to borrow from even at 20%+. I uncover why nobody calls out scams early ample. Risk of exclusion greater than return from exposing.” – Tweet, 4/13/19

Furthermore, FTT will be outdated as collateral in the FTX destructive-collateralized liquidation engine. FTT bought a collateral weighting of 0.95, whereas USDT & BTC bought 0.975 and USD & USDC bought a weighting of 1.00. This used to be honest until the collapse of the commerce.

FTT Token

The FTT token used to be described as the “backbone” of the FTX commerce and used to be issued on Ethereum as a ERC20 token. Genuinely, it used to be mostly a rewards basically based mostly marketing arrangement to entice extra customers to the FTX platform and to prop up balance sheets. Most of the FTT present used to be held by FTX and Alameda Study and Alameda used to be even in the initial seed spherical to fund the token. Out of the 350 million total present of FTT, 280 million (80%) of it used to be controlled by FTX and 27.5 million made their arrangement to an Alameda pockets.

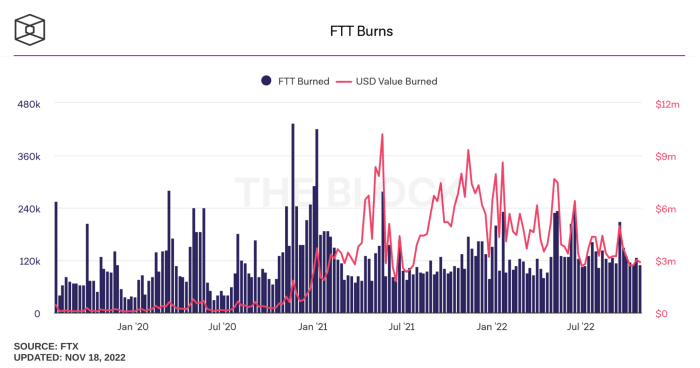

FTT holders benefited from extra FTX perks equivalent to lower trading charges, reductions, rebates and the ability to use FTT as collateral to interchange derivatives. To enhance FTT’s price, FTX mechanically bought FTT tokens the use of a percentage of trading price revenue generated on the platform. Tokens were bought after which burned weekly to continue using up the price of FTT.

FTX repurchased burned FTT tokens per 33% of charges generated on FTX markets, 10% of get additions to a backstop liquidity fund and 5% of charges earned from other uses of the FTX platform. The FTT token does no longer entitle its holders to FTX revenue, shares in FTX nor governance choices over FTX’s treasury.

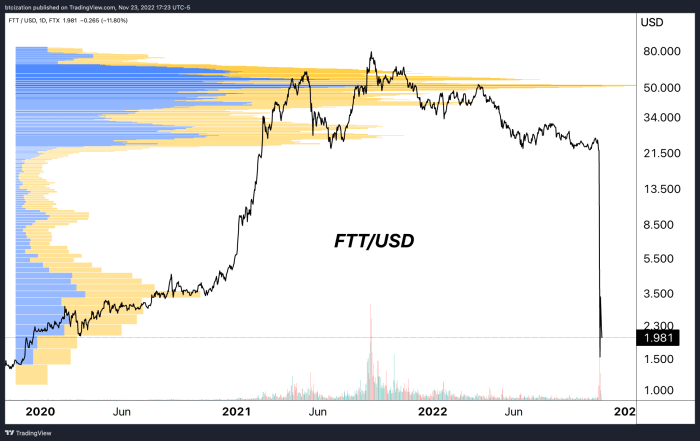

Alameda’s balance sheet used to be first talked about in this Coindesk article exhibiting that the fund held $3.66 billion in FTT tokens whereas $2.16 billion of that used to be outdated as collateral. The sport used to be to power up the perceived market price of FTT then use the token as collateral to borrow in opposition to it. The upward push of Alameda’s balance sheet rose with the price of FTT. As prolonged as the market didn’t disappear to sell and collapse the price of FTT then the sport may perchance maybe perchance continue on.

FTT rode on the backs of the FTX marketing push, rising to a height market cap of $9.6 billion help in September 2021 (no longer together with locked allocations, the final whereas Alameda leveraged in opposition to it unhurried the scenes. The Alameda sources of $3.66b FTT & $2.16b “FTT collateral” in June of this year, along with its OXY, MAPs, and SRM allocations, were blended price tens of billions of bucks on the head of the market in 2021.

FTT Market Cap (logarithmic scale) – Source:CoinMarketCap

CZ Chooses Blood

In one decision and tweet, CEO of Binance, CZ, kicked off the toppling of a home of cards that in hindsight, appears to be like inevitable. Concerned that Binance may perchance maybe perchance be left keeping a nugatory FTT token, the company aimed to sell $580 million of FTT on the time. That used to be bombshell records since Binance’s FTT holdings accounted for over 17% of the market cap price. Right here’s the double edged sword of getting the massive majority of FTT present in the hands of some and an illiquid FTT market that used to be outdated to power and manipulate the price greater. When anyone goes to sell one thing enormous, price collapses.

As a response to CZ’s announcement, Caroline of Alameda Study, made a excessive mistake to whisper their plans to have interaction all of Binance’s FTT on the most up-to-date market attach of $22. Doing that publicly sparked a wave of market start curiosity to impart their bets on the build FTT would race next. Rapid sellers piled in to power the token attach to zero with the thesis that one thing used to be off and the danger of insolvency used to be in play.

In the slay, this field has been brewing since the Three Arrows Capital and Luna collapsed this previous summer season. It’s likely that Alameda had important losses and publicity but were in a discipline to continue to exist per FTT token loans and leveraging FTX customer funds. It’s some distance also lustrous now why FTX had an curiosity in bailing out companies worship Voyager and BlockFi in the initial fallout. Those companies may perchance maybe perchance honest own had enormous FTT holdings and it used to be needed to withhold them afloat to retain the FTT market price. In the latest bankruptcy documents, it used to be published that $250 million in FTT used to be loaned to BlockFi.

With hindsight, now we know why Sam used to be shopping up all of the FTT tokens he may perchance maybe perchance uncover his hands on per week. No marginal buyers, lack of use cases and excessive chance loans with the FTT token were a ticking time bomb ready to blow up.

How It All Ends

After pulling help the curtain, we now know that all and sundry in every of this led FTX and Alameda straight into bankruptcy with the companies disclosing that their top 50 creditors are owed $3.1 billion with simplest a $1.24 money balance to pay it. The company likely has over 1,000,000 creditors which may perchance maybe perchance well be due money.

The licensed bankruptcy doc is riddled with glaring gaps, balance sheet holes and a lack of business controls and constructions that were worse than Enron. All it took used to be one tweet about selling a enormous quantity of FTT tokens and a disappear for purchasers to start withdrawing their funds in a single day to insist the asset and liability mismatch FTX used to be dealing with. Customer deposits weren’t even listed as liabilities in the balance sheet documents equipped in the bankruptcy court docket filing despite what we know to be around $8.9 billion now. Now we can hit upon that FTX by no means had in actual fact backed or neatly accounted for the bitcoin and other crypto sources that possibilities were keeping on their platform.

It used to be all a net of misallocated capital, leverage and the shifting of shopper funds around to resolve a see at and retain the confidence sport going and the 2 entities afloat.

.

.

.

This concludes an excerpt from “The FTX Ponzi: Uncovering The Largest Fraud In Crypto History.” To learn and download the fats 30-page file, educate this link.