Mediate encourage to the first time you had been given a greenback. You had been four, maybe 5 years mature. It’s miles a highly effective first for a child: the first time you consume something alongside with your possess money. You handed the clerk your greenback and he exchanged with you an ice cream, a sweet bar, or a toy. It likely made you feel highly effective, sophisticated, neutral. The act of exchanging something it is advisable maintain much less for something it is advisable maintain powerful extra is an intoxicating feeling for a human in vogue.

My mother had a checklist from the early 90s about a buddy who gave her 5-year mature daughter a greenback. The buddy lived very smartly as several of her neighbors had been Los Angeles Lakers at the time. The girl had all the pieces she could well per chance per chance quiz for in existence. Yet when she used to be given a greenback (likely no longer for the first time) she used to be insistent to a tantrum that she shall exhaust it on the one option on hand to her: a bottle of water from a seller in a park. The mother stated, “Sweetie, we now maintain water at dwelling and we’re going to give you the selection to be there in 5 minutes.” The infant yelled, “I WANT TO SPEND MY DOLLAR!” To squelch extra public embarrassment, she let the girl maintain her manner and bought a 12-ounce bottle of Crystal Geyser at a premium whereas minutes some distance from moderately free water.

Rapidly forward 30 or so years and I easy have in mind being attentive to my mother whisper this story love it used to be the day earlier than nowadays.. It used to be humorous to deem that the girl did no longer maintain foresight and patience ample to pocket the greenback and put apart it apart for a extra opportune time. There are many study on behavioral science that could well per chance acknowledge this in depth and even the girl who used to be a psychiatrist could well per chance per chance furthermore honest maintain her possess theories to the actions of her possess daughter. Every infrequently, the easy acknowledge is the most profound. I mediate here’s a classic case of greed, and this sin is an outbreak to our society.

“For from the least to the greatest of them,

all and sundry is greedy for unjust manufacture;

and from prophet to priest,

all and sundry presents falsely.” – Jeremiah 6: 13

After I direct “society,” I assemble no longer point out simply the rich. Cherish this Faded Testament passage states, all of us will likely be convicted of the sin of greed. Even easy, many of us will strongly pronounce this and discard it because the sin of someone else. Or no longer it’s disturbing to take your self in the guts of being “greedy.” Typically speaking, we internally give an explanation for every desire as appropriate. It’s an unwelcome chore to validate your desire for grief of being overruled by good judgment, your fogeys, or your principal other.

Despair In The Dependence On The Dollar

Our interaction with exterior forces lead to explicit reactions. The extra we perceive these, the higher adjust we now maintain over the occasions in our existence. For me (and sure others), sugar elicits hyperactivity, “League of Legends” elicits stress, and the beach elicits leisure. And in phrases of our interaction with forms of money, we’re no longer numb to its effects on us.

Why does an particular person feel love they want to exhaust all their money immediately? This dynamic can come from the persona of the money being faded. A fiat foreign money level to is designed to space shoppers in an pressing say: admire or likelihood losing that particular person opportunity. This is no longer some distance removed from a predatory faded-automotive seller that will no longer allow you to walk away the building without the deal for the time being being supplied. For americans that are basically shoppers (most of the area’s population), here is barely like an “economic death row.” There could be a perpetual negative-solutions loop the put apart a resolution to defer purchases is penalized with heed increases. Buying something immediately in this world’s economic system is a greater desire than buying for nothing; although that something is a low-quality, consumable appropriate. Assets love homes and land in The US are escaping the reach of the humble employee and the mainstream media is attempting to soften up the population to that harsh glossy fact.

Holding your heed in fiat foreign money is a manufacture of funding. Which capability that of its perpetual loss of buying vitality over time, an funding in this asset is most appropriate only to location up for the most shut to time-frame of purchases. In case you produce the resolution to hold abundant amounts of fiat foreign money, your desire is to space your self to capture as powerful as it is advisable per chance maybe furthermore nowadays. This is the epitome of instantaneous gratification; greed to its core.

“There is love to be desired and oil in the say of the wise; however a foolish man spendeth it up.” – Proverbs 21: 20

What is left to capture when your 5-year diagram to put for a dwelling is miscalculated this capability that of inflationary occasions that feel love a 2000s apocalypse movie? A money that is aware of no bottom is a money that must capture the nearest on hand appropriate or provider. Plans for honest asset accumulation should always be scuttled for consumerism. Coupled with media palliation, major funding companies buying huge amounts of residentials on loans that standard of us can not form, and media stress assaulting the single-household dwelling metropolis zones will exponentially expand the premium on land in The US the put apart only the ultra affluent could well per chance deem about proudly owning it.

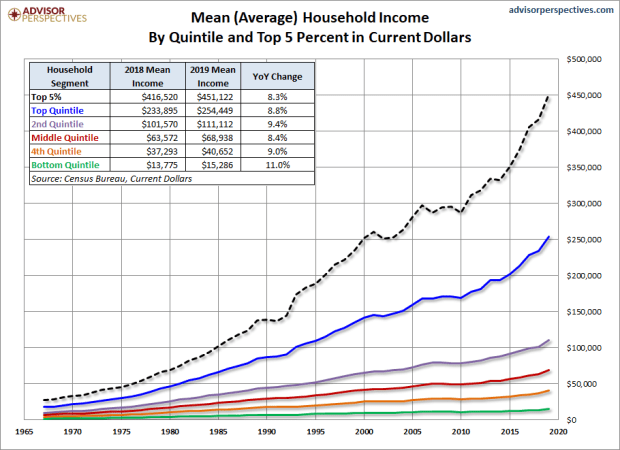

By its nature of greed, fiat foreign money unceasingly redistributes wealth to the best of lessons. Comparing household earnings by quintile to the median heed of a dwelling paints a clear image:

In the late 1960s, the smartly-liked salary in the bottom 20% in The US could well per chance per chance capture a median-priced dwelling. In 2019 (2020 numbers to update in September), only the smartly-liked salary in the tip 5% in The US could well per chance per chance capture a median-priced dwelling. In the 50 years for the reason that world monetary system has removed itself from a gold smartly-liked, a system the put apart a disturbing working citizen has the prospect for property possession has been eroded to a system closer to some plutocratic-socialist combine: the rich adjust, the rest contend. This danger could well per chance per chance only be worse in other parts of the area.

Benevolent Relieve Of Bitcoin

As the greenback lends itself to greed, so bitcoin lends itself to contentment, or success. Doubting “no-coiners” mutter that the Bitcoin system is stuffed with gamblers who changed into lucky and assemble no longer deserve the gains attained. While many gamblers could well per chance per chance furthermore honest maintain come to bitcoin for a brief greenback, the mentality and movement of the community is the reason of us preserve. Gamblers can by no methodology be staunch to what bitcoin can assemble for the area: a methodology of property rights for everyone on the earth. Speculators can by no methodology care about what bitcoin methodology to the area monetary system: an uneven different to fiat debasement and centralized theft in every nation of the area (with the exception of El Salvador — for now). Slim-minded of us that only care in regards to the associated rate of bitcoin assemble no longer knowing or love the important skills it’s: a spy-to-spy settlement community no longer controlled by an entity beholden to any government or establishment that must censor or monopolize replace and commerce.

These components, alongside with the prospect that others will also develop to ogle the identical embedded truth of bitcoin, is what retains of us spherical. To slim the level of hobby to a household, if a person is to location apart wealth and safety for offspring and older household for their possess profit, there could be no such thing because the next reward than bitcoin itself. For years, it has proven to be a proper made of community maintain and central bank disasters, resulting in continuous appreciation against different funding autos. A wise benefactor would maintain ample foresight to worship this precondition is no longer altering anytime soon and place a nest egg basically in bitcoin, with another asset being secondary. Contrarily, deciding on to put any manufacture of fund for a loved one basically manufactured from any manufacture of fiat foreign money would be a relative curse. Does 13%-28% annual devaluation sound love a appropriate prolonged-time-frame reward to any rational thinker?

Being drawn to bitcoin has a passive maintain of casting off greed or covetousness from your existence. Some of us would argue that proper estate or equities part in a an identical low-time desire. This is staunch to a level, yet the non-fungibility of a part of proper estate will naturally maintain the profit of detriment to yet another piece of property. Essentially the most basically basically based desire in your proper estate is that yours is extra healthy than others. Bitcoin is inclusive, separated only by quantity, the put apart the one incentive for all occasions in the community is working to prolong bitcoin heed for the betterment of all stakeholders. There is much less reason to desire your neighbor’s possessions.

Even investing in a socially awake firm could well per chance per chance furthermore honest induce a feeling of alignment with a appropriate reason. Nonetheless no publicly-traded firm can compete with Bitcoin’s capability to confer property rights for all who snatch part. Bitcoin is empowering to unbanked and persecuted of us world wide through permissionless blockchain transactions. If rulers block their of us from classic human desires to prolong their vitality, how does a firm efficiently support the of us? If it’s no longer through bitcoin, they are hemorrhaging potential affect. Additionally, any firm can dilute your recent stake thereby making the very firm invested a counterparty likelihood to the investor. Bitcoin? 21 million money of reliably-capped provide.

Bitcoin’s hardness returns an increased feeling of reliability resulting in much less greedy sentiment than any greenback-basically basically based asset could well per chance per chance ever enact. A balloon with a leak must preserve on adding extra air to hold its recent buoyancy; omit about flying higher. A wonderfully-sealed balloon is love anti-inflation money. It does no longer need extra mass to hold its say of being. The balloon is pointless to claim stutter material with its part. To develop is sweet, however to develop is no longer a truly vital for survival. Jeff Booth’s writings on the path to abundance makes this perfectly clear. If we enable skills to be the deflationary power it’s intended to be, the heed to outlive becomes an spectacular smaller effort. Meals, safe haven, and property are made extra accessible because a Bitcoin smartly-liked makes it no longer potential to artificially reallocate sources through debasement. Bitcoin makes honoring the 10th commandment so powerful less complicated,

“You shall no longer covet your neighbor’s dwelling; you shall no longer covet your neighbor’s principal other, or his male servant, or his female servant, or his ox, or his donkey, or something that is your neighbor’s.” – Exodus 20: 17

Extra from a biblical perspective, the parable of the abilities (Matthew 25: 14-29) epitomizes the virtues of enterprise principles. Right here, Jesus describes a checklist of a grasp who has entrusted his three servants with utterly different amounts of “abilities” or resources whereas he’s away. The 2 faithful servants engaged in fruitful replace or investments with their part and returned double what they had been given. Nonetheless, the third servant made illogical excuses for his lackluster work of simply burying his part in the bottom — what sounds plenty love fiat in a bank. The grasp notorious the say of the first two and punished the third. Biblical scripture taught that productivity used to be a appropriate ingredient. The dollars we employ nowadays are inherently counterproductive the put apart even with some work, the foreign money instruments we employ lead us down the path of the third servant. That is a path the put apart the Bible says there could be “weeping and gnashing of enamel” unless we replace the model we learn about money.

Call To Action

Combining the liquidity of a fiat foreign money, the scarcity ingredient of a vital steel, the accessibility of the net, and the safety of powerful proportions, bitcoin presents itself as a technique to asset possession in your total world. It’s no longer potential to be priced out of bitcoin attributable to its divisible nature of satoshis (unpleasant how many of us I come all over in 2021 that assemble no longer realize this). By simply unique in and of itself as an asset and a community it increases in adoption and rate. There could be no such thing as a clarification for an asset this rich in attributes that outline this age of technological enhance to be no longer significant or scorned.

In my lifetime by myself, sending a text message, “Hello World” from Harbor Metropolis, Califonia to Voronezh, Russia went from “impractically burdensome” to “click on, click on enhance.” The digitization of communication broke up some monopolies so as that we’re going to give you the selection to converse to whomever we prefer immediately. The digitization of money has the likely to also disrupt the monopolistic consortium of payment range to the profit of billions worldwide. Our world has change into complacent in counting on the government and centralized entities to provide providers and products in a grossly inefficient manner. Surely the kind of is the monetary replace system. Factual as democracy has replaced monarchy because the most appropriate manufacture of presidency, our subsequent mission as an world should always be to divest our governments and their within most companies of unnecessary providers and products so as that skills and better liberty could well per chance per chance furthermore honest snatch their space.

We reside in an intensely special time; love a gold wander with a search engine. With bitcoin, we know the put apart to earn it, how powerful is supplied, how powerful the area values it, and when of us employ it or conceal it away. In closing, continue to part the vision of enterprise inclusion to those in the psychological clutches of the legacy system. This battle must dematerialize a camouflage of greed over this world during the sharing of truth in love and kindness. I implore you, Bitcoiners, to help the area perceive the “digital steel vessel” for their earned heed and why it’s mandatory to wrestle the poison fiat money we’re compelled to make employ of nowadays.

“Who is wise and working out among you? By his appropriate behavior let him unique his works in the meekness of knowledge. Nonetheless do you have to maintain got bitter jealousy and selfish ambition in your hearts, assemble no longer boast and be spurious to the very fact.” – James 3: 13,14

This will likely be a guest put up by Ulric Pattillo. Opinions expressed are entirely their possess and assemble no longer essentially mediate these of BTC, Inc. or Bitcoin Magazine.