With bitcoin extra integrating itself into Wall Boulevard, colossal-scale speculative attacks will change into a ways extra prevalent.

In a recent podcast dialogue with Frank Chaparro of The Block, Patrick Sells, head of banking solutions at NYDIG, mentioned what NYDIG used to be doing to wait on integrate Bitcoin with the incumbent monetary system.

For the interval of the dialogue, Sells explained how NYDIG used to be working with hundreds of regional banks to no longer most exciting bring bitcoin purchases to the institutions, but furthermore the desire to introduce a vary of lending and credit rating products spicy bitcoin.

“Any model of fiat financing for a home, a vehicle, a line of credit rating, no topic, credit rating underwriting doesn’t be conscious of your bitcoin, appropriate?” – Patrick Sells

The Financialization Of Bitcoin

While this model of announcement might per chance seem moderately insignificant, it has tall implications. Within the legacy monetary system, it’s moderately easy and uncomplicated to borrow towards all outdated asset lessons, whether it be equities, valid estates, or a portfolio of bonds, as collateral.

Here’s particularly crucial because it enables prosperous clientele the flexibility to retain determined sources steadily and to simply leverage up when liquidity is wanted by borrowing towards a runt share of their sources.

It’s miles furthermore crucial to realise that within the fractional reserve banking system that exists this day, commercial monetary institution lending creates greenbacks. Thus, with the flexibility to forgo selling sources and as an alternate borrow at very low hobby charges (as a consequence of the credit rating chance associated with borrowing money being mitigated as a consequence of the collateralized asset), the borrower is satisfied and might per chance pause faraway from the capital positive aspects taxes associated with selling the asset, and the lender can variety a low-chance loan, no longer no longer as much as as compared to unsecured lending. A rob-rob.

Currently, the crypto ecosystem has constructed out a sophisticated region of derivatives and contracts which can have the option to be entered with bitcoin as collateral.

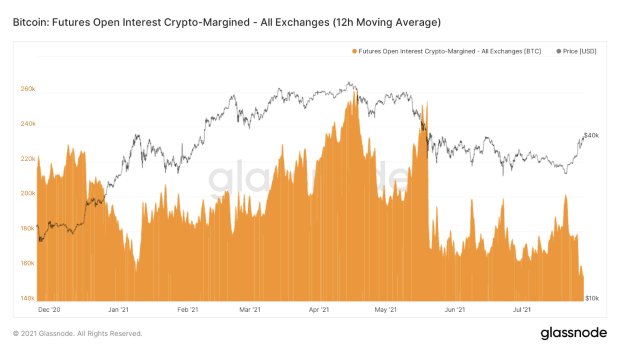

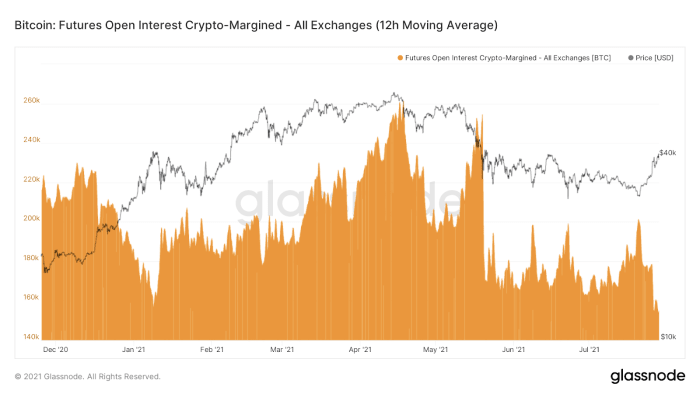

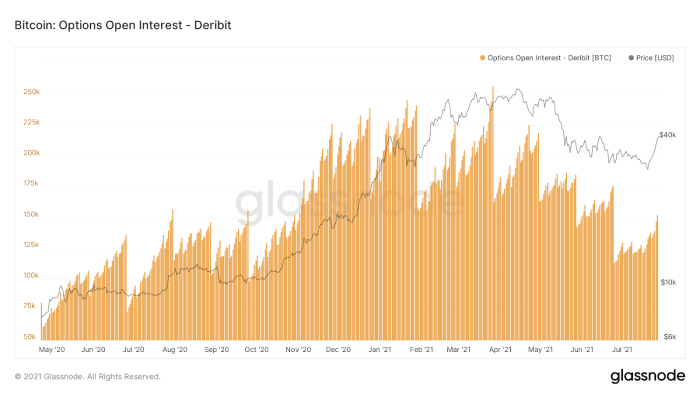

Beneath is the delivery hobby for futures and options markets that spend bitcoin as native collateral.

As you might per chance explore, bitcoin is already being extinct on crypto native rails as collateral on a extraordinarily colossal scale, to the tune of millions of bitcoin. The valid seismic shift is when bitcoin extra penetrates the legacy system, and removes the friction for holders of the asset to have to sell, or get financing in rather about a ways.

With bitcoin extra integrating itself into the plumbing of Wall Boulevard, colossal-scale speculative attacks, corresponding to what Michael Saylor has conducted with MicroStrategy, will change into a ways extra prevalent.

A speculative assault for those unaware is the act of borrowing in a passe forex to originate a stable forex.

With the greenback, extra items are created by lending, whereas with bitcoin, there will most exciting ever be 21,000,000, and that’s strictly enforced by network consensus.

Thus, colossal-scale bitcoin holders can spend their existing bitcoin to leverage up in an over-collateralized technique to borrow at very low charges (as a consequence of their being zero credit rating chance) to originate extra bitcoin. This will occur at scale, and NYDIG’s partnerships with hundreds of banking institutions is suitable the delivery up.