Matt Odell, Bitcoin entrepreneur, podcaster and endeavor capitalist, sat down with Bitcoin Journal for an outlandish interview to debate the way forward for the trade and the insights unhurried his success.

Neatly-known for having deleted his Twitter legend with over 250,000 followers to circulate stout-time to Nostr, the commence supply Bitcoin-powered social media protocol, Odell has had a prolonged-lasting affect in Bitcoin culture and the trade. Having started a favored Bitcoin podcast known as Fortress Dispatch, the build he has interviewed trade leaders weekly since late 2020, Odell is credited with iconic Bitcoin memes love “Pause humble, stack sats” and even branding the arena “Zaps” to characterize systems made with little portions of bitcoin over social networks love Nostr.

“After spending over a decade the usage of Twitter as my handiest social media it used to be time to circulate my energy over to a protocol that enables more particular person freedom,” Odell told Bitcoin Journal.

Odell is a board member of OpenSats, a nonprofit interested by funding Bitcoin-focused commence supply projects that would in another case strive against to search out a footing within the extremely aggressive, closed system trade. He’s additionally a managing associate at Ten31, a for-income endeavor fund that approaches Bitcoin VC work with a twin mandate: “Our first mandate is to originate our investors cash and originate correct investments and return capital. And our second mandate is to support Bitcoin flourish as freedom cash, reduction originate Bitcoin the next tool to be frail by the individual, to empower the individual.”

Before the total lot a critic of Silicon Valley and the endeavor capital world, he has rapidly became one of most renown VCs within the Bitcoin trade, leading a imaginative and prescient for endeavor capital which posits that constructing free and commence supply system with particular person privateness in thoughts will also be more a success within the prolonged time duration than records mining users and locking them into “moats.” “All of our investments are built on top of commence protocols. There’s no walled gardens. There’s no longer this complete knowing of constructing a moat, love fencing your users in, extracting as a lot records out of them as in all probability, getting them hooked on the app, monetizing their time and their consideration,” Odell passionately explained.

“When I used to be youthful, sooner than we launched Ten31, I used to be of the mindset that all endeavor capital used to be sinister. And that used to be largely a made of my recount of the massive endeavor companies, the a16zs of the arena… You scrutinize them throw a complete bunch of millions of greenbacks at shitcoin projects to dump shitcoins on retail. After which a conducting that’s making an are trying to ethically make within the Bitcoin home struggles to obtain funding,” Odell talked about of the endeavor capital strategy considered in crypto.

The strategy sought to search out exit liquidity for seed investors through ICOs or token launches, shortening the amount of time it on the total took endeavor investment to obtain returns, from almost a decade to as limited as a couple of months.

Beside investments by ICOs, the outdated skool investment strategy pioneered by Silicon Valley — which Odell is additionally serious of — VC supposed investing big portions of cash in startups to make high-enhance companies that obtain big portions of users as early as in all probability; then, are trying to raise beautiful products for gratis, even though the companies had been unprofitable for many years.

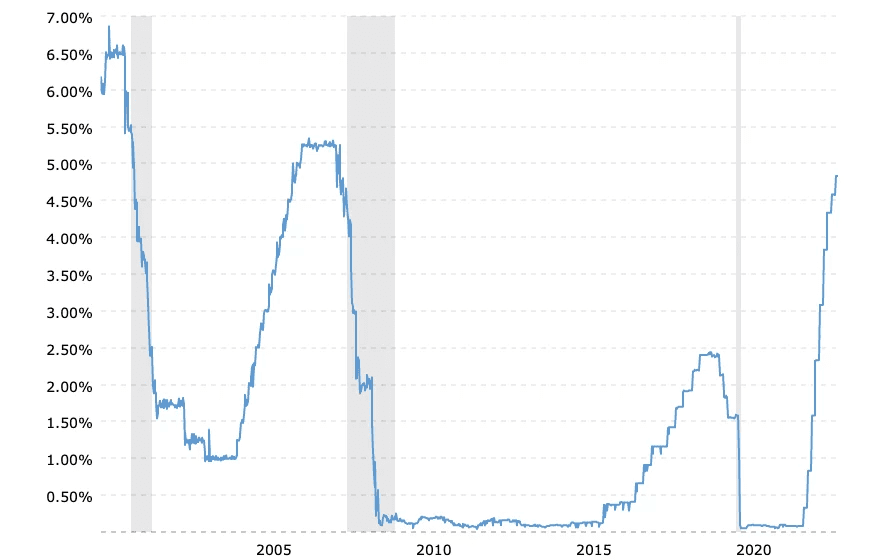

The mark of the equity in these outdated skool VC system companies relied on keeping these users, their records, IP, and controlling obtain admission to to the network effects, whereas additionally raise the infrastructure major to operate and scale. This strategy used to be the norm at some stage in low U.S. curiosity rates within the early 2000s and alternatively from 2008 to 2015, pushed by the U.S. Federal Reserve’s financial coverage. The cease consequence used to be that a complete bunch low price capital chanced on its formula to VC companies which may also then keep cashflowing these inaugurate united states of americafor many years until they either became a success or may perhaps maybe neatly be sold out by a competitor.

But these times own changed and the US’s economic dominance has been challenged by rising powers within the East. Low curiosity rates can no longer be sustained with out very considered inflation. As a consequence, many Silicon Valley startups own needed to originate arduous pivots from high enhance at a loss for many years, toward early income, favoring Odell’s investment strategy: startups that can generate earnings rapidly and commence constructing a bitcoin treasury.

Earnings and commence supply don’t mix neatly; in actuality, they almost seem love contradictory recommendations. When requested systems on how to produce sustainable commence supply funding and endeavor capital in commence supply he talked about, “I judge there’s a heart ground that’s more challenging” referring to the route taken by OpenSats and Ten31. He endured that, “because of the you’re constructing on commence protocols, you perhaps can hit a scale that closed proprietary system in all probability can’t hit.”

Odell additionally explained that, “When we’re in actuality making an are trying to search out investments, the scheme in all equity bit completely different than outdated skool endeavor capital, in that we’re making an are trying to search out founders which may be, initially, constructing on Bitcoin and making Bitcoin more sturdy, but which may be additionally willing and in a position to operate very lean with as reduced costs as in all probability and take a look at to generate earnings as rapidly as in all probability.”

The VC economic calculus is terribly completely different while you happen to evaluate bitcoin is the ideal cash ever invented and has a prolonged life before it. “In outdated skool investor land,” Odell basic,

“what you scrutinize is that this enhance-at-all-charges mindset. They’ll burn $100 million, they’ll burn $200 million, after which perchance in 10 years, they’ll inaugurate changing into a success. But you perhaps can’t attain that in a Bitcoin world because of the what’s the mark of bitcoin going to be in 10 years? And it’s good to peaceable be measuring all of your income in sats, in bitcoin.”

Profitable Bitcoin startups may perhaps maybe make their very possess bitcoin treasury reserves and over time became very a success.

The Ten31 Portfolio And Investment Thesis

The Ten31 portfolio involves over thirty companies that make on top of commence protocols whereas being Bitcoin-centric and rapidly to profitability.

Start9, for instance, builds Bitcoin-native system that is commence supply from top to bottom; it’s functional on most hardware with out traditional Silicon Valley hardware restrictions love these pioneered by Apple. “Start9 is a ideal instance that will most certainly in no way obtain a16z funding… Their complete stack is commence supply. Which you can in no way pay them a cent, and you perhaps can employ all of their products… But at the identical time, their scheme for monetization is twofold. Which you can optionally aquire a pre-built system from them, and so they have to add increasing mark-added companies and products on top — stuff love top class beef up, proxy companies and products, stuff love that,” Odell basic.

Mempool.Plot, most definitely the most popular block explorer in Bitcoin, is one other instance of a a success firm built around commence supply. “Mempool.home is something that’s built-in in almost every Bitcoin wallet. It’s an fully integral commence supply system… They monetize because of the they own got the transaction accelerator, which you perhaps can pay for with bitcoin… They additionally own B2B endeavor agreements,” Odell told Bitcoin Journal.

AnchorWatch, a rather recent Bitcoin firm that has tackled the very sophisticated disaster of insuring bitcoin holdings from theft, is one other huge instance. The firm builds on top of Bitcoin, getting to leverage its network stop but additionally bridging it to the insurance coverage market. “I judge the insurance coverage element is in actuality piquant, particularly self-custody with insurance coverage… It in actuality provides a mark proposition to users that is better than paper Bitcoin,” Odell added.

Of the cohort, Strike, the Bitcoin-focused payment app founded in 2019 by Jack Mallers, is Ten31’s most piquant and most a success investment. It’s on hand in international locations at some stage within the arena and delivers Bitcoin’s cutting-edge expertise to the general public whereas additionally navigating the complexities of regulatory compliance and a seamless particular person expertise. “In phrases of a pure investment point of gape, Strike is by a ways the firm I’m most hooked in to. We’re the main investor. We’re the ideal exterior board seat… That firm is world. It has vital product-market fit. It’s incredibly a success. They’re stacking bitcoin to their treasury: They own over 1,500 bitcoin in their treasury… They most incessantly’re a success. So, every month, they’re correct procuring more bitcoin.”

OpenSats Funds Open Source Trend

Based in 2021, OpenSats is the nonprofit organization that preceded Ten31. It funds commence supply builders and entrepreneurs growing Bitcoin infrastructure that would in another case be very sophisticated to search out funding for. “OpenSats had this dream that, okay, perchance we may perhaps maybe also resolve this disaster by plebs giving $50 a month, pledging to give $50 a month to commence supply developer grants… That became out to be formula more sophisticated than I expected,” talked about Odell. About the early imaginative and prescient of the organization, which sadly failed to plot in as many loyal donations as major to fund commence supply Bitcoin builders, he recalled: “Particularly, OpenSats is 100% gallop-by because of the quite so a lot of charities own questionable practices the build they rob an limitless slit again of donations.”

Odell added that, “Bitcoin is the ideal cash that has ever existed. But there’s this unfamiliar dichotomy that exists. It’s the ideal cash that ever existed, but cash for builders within the Bitcoin home is amazingly sophisticated to come encourage by because of the, initially, you own this overarching crypto ecosystem that drains a ton of capital. After which amongst the those who designate the energy of Bitcoin, quite so a lot of them are unwilling to phase with their sats and have a tendency to support on to their bitcoin as an different of the usage of it to beef up builders.”

Nonetheless, OpenSats got a beneficiant donation from Jack Dorsey — co-founder and ex-CEO of Twitter — of 31 million greenbacks. “All of our huge donations are public, of that 35 million on the OpenSats side, 31 million used to be Jack Dorsey’s non-public charity, Originate Minute Foundation, which is our major supporter,” Odell talked about. A mesmerizing truth is that even right now, after years of offering grants to Bitcoin commence supply projects at some stage within the arena, their treasury is bigger than what they ever raised, because of the they saved all that capital in bitcoin. “We even own more in our multi-sig treasury than we’ve ever raised within the lifetime of the organization. Which is shimmering awesome. Our treasury strategy is principally the most piquant, efficient treasury strategy, which is: Every buck that is available within the market in robotically gets transformed to bitcoin. We correct keep 100% bitcoin reserves.”

The Bitcoin Policy Institute

Odell is additionally a founding member of the Bitcoin Policy Institute, a prime participant in educating politicians in Washington about Bitcoin, how it in actuality works and why it is miles priceless to the general public. The newest pivot of the Bitcoin trade toward partaking Washington differs from the pure libertarian mindset of Bitcoin’s early history. To Odell, then again, that is a natural extension of the 2 elementary pillars that own made Bitcoin huge — education and tooling. These pillars had been pioneered by the Cypherpunks of the 90s within the first “crypto warfare,” and succeeded in making nation-disclose grade cryptography on hand to the arena.

“Piece of the inspiration, too, is, , I used to be shimmering disenfranchised with politics. And Adam Wait on for my part used to be a astronomical inspiration for me by formula of his expertise with the normal Cypherpunk circulate and the normal crypto wars. When it came to encryption, they fought it on two fronts. They fought it with tools. So that they made it in actuality efficient and low price and accessible for folk to encrypt issues, but they additionally fought it within the courts and in politics and in thoughts part,” Odell recalled.

These two pillars had been additionally considered from day one of Bitcoin within the plan of the Bitcoin Talk forum and the Bitcoin system, both founded by Satoshi Nakamoto. The pillars had been later on extended to Bitcoin meetups at some stage within the arena and the big proliferation of Bitcoin wallets and hardware safety devices, as neatly as developer tooling. This day, BPI extends this education pillar to policymakers who commonly know limited or no about Bitcoin, how it in actuality works or why it is miles within the handiest curiosity of the general public, which they, as public servants, are within the damage subservient to.

Bitcoin Park and the Social Layer

Odell is additionally a co-founding father of Bitcoin Park, a neighborhood hub out of Nashville, Tennessee, which has gathered a considerable amount of Bitcoin talent within the U.S. and hosts events on an everyday foundation. Earlier this year, they expanded to Austin, Texas, procuring the Bitcoin Commons, setting up their presence and reach in most definitely the 2 top cities for Bitcoin within the US.

“Bitcoin Park started at a brewery in Nashville,” Odell recalled. “It used to be a meetup at a brewery, and we rapidly hit, love, 200 folk a month for meetups. The brewery used to be principally love, ‘you perhaps can’t come right here anymore’. And we’re love, okay, let’s obtain our possess home. And that’s how Bitcoin Park Nashville used to be born.”

When requested what his imaginative and prescient for Bitcoin Park is, he talked about, “I would ideally find it irresistible to… correct be an inspiration for a total lot of communities to pop up around the arena which may be no longer controlled by Bitcoin Park… I judge it’s straightforward to take into consideration Bitcoin as a tech circulate, but it’s in actuality a circulate of folk, correct? And the tech correct empowers the folk.”

Odell’s Warning About Bitcoin-Backed Loans

Odell had a cautionary warning about bitcoin-backed loans, which he has a deep perception into by advantage of Ten31’s investment in Strike. Explaining the quiz for this recent plan of Bitcoin firm, Odell talked about that “the main quiz driver in actuality is folk are sitting on vital capital gains, taxable while you happen to make employ of/promote — which is in actuality a tax on savings… In the event you’ve been sitting on bitcoin since $100, $200, and you’re selling for $120,000, you’re paying the executive love $30,000 — which is plan of insane.”

He additionally warned of the plot back possibility within the bitcoin mark, a theme that is commonly talked about; he advises users of these loans to be “very conservative.” He additionally warned in regards to the have to compete in this market with self custody — or no longer less than auditable structures — that segregate the Bitcoin collateral from re-hypothecation. Stressing the need for competition in this market, “I judge it’s a extremely important product because of the they’re going to give it for the ETFs, and it creates a extremely perverse incentive the build you’re better off no longer holding valid bitcoin… It’s in actuality important for Strike and the completely different companies within the home to give a extremely solid, correct product by formula of loans so that there’s a extremely solid incentive to stick with valid bitcoin.”