“Endure markets are the staunch time to be alive and in the sector. It’s shadowy for these that don’t know what they’re doing, it’s superior for these which maintain an extended-duration of time judge.” – Simon Dixon

The variation between Bitcoin and everything else is that the price of bitcoin doesn’t matter. Over the long duration of time the price of bitcoin has long gone up, yes, however the price proposition of bitcoin as laborious, non-confiscatable and really decentralized money is usually what issues. Now not the price hype and not the pump. This is the reason traders and speculators maintain lost hobby in Bitcoin, and proceed to flock to the latest pumping decentralized finance (DeFi) or non-fungible token (NFT) venture at the drop of a hat. This lack of hobby from the speculators is viewed by many as a unsafe pattern for Bitcoin, however it’s really a really definite one. What we are seeing now represented in the decrease bitcoin label is the price of its valid helpful utility and the absence of retail hypothesis capital that used to be there earlier than. This article will characterize why that’s a right part.

Since its inception, inaccurate analysts maintain described Bitcoin as a Ponzi plot dependent on persisted artificial hypothesis pumping into the space. As any one with expertise can uncover you, speculators are knowing-object chasers by nature and pull out of any space the minute one thing shinier comes along. Smartly, the bitcoin “endure market” has arrived and your total speculators are long gone. They got bored and took their toys dwelling with them. Even with them long gone, bitcoin is quiet valued at some distance bigger than its 2020 and 2021 lows and is increasing adoption on an institutional (and sovereign) level. This adoption represents right label.

The stock market sugar plod caused by Federal Reserve Board money printing and harmful right hobby charges is ending, and the roller coaster is now going down from the tip. This has had an impact not wonderful on bitcoin, however on the stock market and the quite various altcoins as wisely. Put simply, everything goes down and after the chaos subsides we are able to ogle what resources, stocks and projects really offer tangible, unbiased label. That’s what funding used to be persistently supposed to be about. Despite the perplexed dichotomy between “boost stocks” and “label stocks,” investing is by definition supposed to be about your long-duration of time perception in the label of one thing, not in its brief-duration of time boost projections. Retail investors maintain struggled to realize this as a result of salvage-wisely off-snappy, everyone’s-a-genius market tradition of the previous few years. Indeed, if an asset like bitcoin isn’t persistently appreciating on a double- or triple-digit basis, then it’s a “failing” asset to those of us. The market is on its head. Which means, the meme-stock crowd is out of bitcoin now, associated to they’re out of the stock market as a total. Appears the memers had paper fingers all along.

This article by Bloomberg, titled “Day Trader Military Loses All The Money It Made In Meme-Stock Generation,” particulars what number of of the new traders that entered the space maintain “never viewed a market that wasn’t supported by the Fed.” Retail traders lost your total beneficial properties they made in the Dogecoin, AMC and GameStop rallies, and are precisely attend at square one.

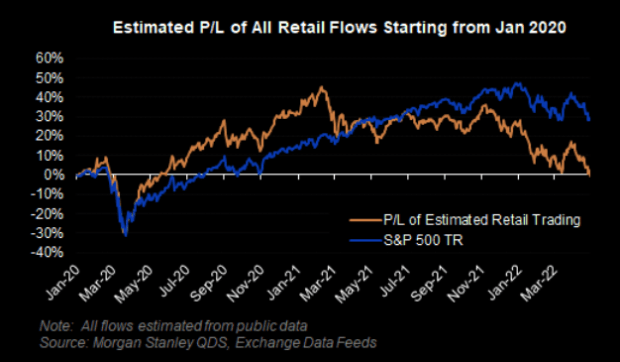

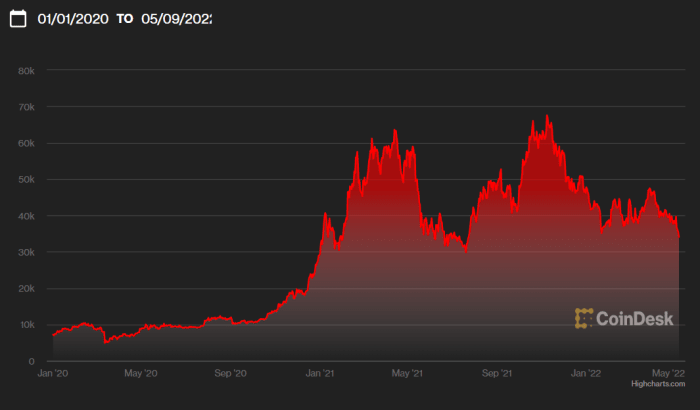

The general market is falling most piquant now and now we maintain to rethink what a “right funding” is. Treasure the above chart from Morgan Stanley shows, the final movements of retail trading maintain canceled out to zero since January 2020 in spite of their temporarily outsized beneficial properties in 2021. If we study at the novel time’s bitcoin label to the January 2020 label, we quiet ogle a originate of 331% for bitcoin, outdoing the S&P 500’s return by a broad margin and beating the final retail trading profit of fully nothing by a margin of infinity. Enact we would prefer from now on proof that HODLing is a superior strategy?

Source: Coindesk. January 1, 2020, BTC label: $7,175.50. Would maybe well well 9, 2022, BTC label: $30,943

Positive, bitcoin is down from its all-time high by half, however factoring in the unbelievable market distortions caused by unparalleled money printing, memestock manipulations and put up-COVID-19 hobby charges since early 2020, bitcoin quiet blows one thing else else out of the water. We neutral must zoom out to a extra “appropriate” market window in show to explore this. Everybody is appearing like the sky is falling, however again, that is wonderful on sage of most retail investors wonderful entered the market in 2020 or 2021 and maintain never viewed a market that wasn’t supported by the Fed.

There might be a tradition in the Bitcoin neighborhood in the in the period in-between of “low (i.e., long-duration of time) time desire,” which fundamentally counters the Ponzi plot-minded speculators that need snappy beneficial properties all of the time. Excessive (brief-duration of time) time desire fuels the perpetual “passive income” lie that beginners persistently drop for. In distinction, the “modest” two-three hundred and sixty five days originate of 331% in bitcoin is extra than ample for HODLers which maintain been looking out for since earlier than the feeding frenzy of the previous two years. Long-duration of time time desire works for bitcoin on sage of its main label proposition has held neutral since its inception, and this is able to maybe proceed to preserve neutral sometime for these that wait. Those that can not wait are washed out by the market over a protracted ample duration of time in any market, associated to now we maintain viewed with the 0% win originate for novice retail traders that pull inner and outside too grand. The beneficial properties caused by hype, stimulus and cultural madness were fleeting, however the beneficial properties in Bitcoin utility and adoption maintain been right all along.

Detractors maintain been criticizing Bitcoin for desiring meme-stock speculators to salvage it work, however now that the meme-stock speculators are long gone, the detractors are criticizing Bitcoin for the speculators not being there. This is completely illogical, and proof that Bitcoin just will not be really a Ponzi plot. The the same can not be acknowledged for quite various cryptocurrencies. Ponzi schemes by definition can not exist for decades and the honesty in recent bitcoin label attests to the honesty of its main label proposition. Positive, it goes down in most cases. It is some distance a trademark of health and transparency. One thing that neutral goes up and up and up eternally? That’s a Ponzi plot and the bottom will persistently drop out lastly.

Nobody’s singing “Pump It Up” anymore, and in spite of how fun and euphoric the 2021 rally used to be for a whereas, the space is usually better off with out the memers around. It’s time for a extra grown-up tradition of pattern and adoption around Bitcoin, and time for a extra grown-up label conversation as wisely.

It is some distance a guest put up by Nico Cooper. Opinions expressed are fully their very have and impact not necessarily replicate these of BTC Inc. or Bitcoin Magazine.