This text became before all the issues published in Bitcoin Journal’s “Orange Occasion” print edition with the headline “The Stage Is Now Region.” Click on here to subscribe now.

After a protracted time of vogue and the a hit routing of socialists, nefarious CIA proponents of “Democracy”, cowards and comfortable-skinned, elephantine, virtue-signaling infiltrators, Bitcoin is stronger than ever, rising in loads of attractive and encouraging ways and confounding of us that can’t mediate.

The stage is now purpose for Bitcoin to utterly replace fiat online and offline as the predominant formulation of us employ. The infallible Bitcoin community and particular person-grade Bitcoin instruments are spreading cherish wildfire in each route as of us assemble as much as what this new community can originate for them and how fiat is inflating under their feet, apt as of us wakened to what the web could well originate, and that they didn’t need the submit station of enterprise to any extent further.

The ideal explosion of Bitcoin users shall be on cell cell phone platforms the save Pockets of Satoshi, Samourai Pockets, Breez, Muun, Phoenix, Pine, and BlueWallet are the forefront of a brand new class of capabilities in the rising “Particular person Bitcoin” sector.

Totally about a of us realize the colossal impact Particular person Bitcoin is going to own on the formulation issues are ordered on this planet, and no doubt, the list of egocentric and ignorant sad actors listed above are both incapable of imagining it, and if no longer, are actively against it under orders to prop up the unethical, unsustainable, and nefarious fiat hiss quo.

Fortunately no longer all of us are pushed by fright of the brand new, or seize their marching orders from violent psychopaths. That is glaringly sure in the case of El Salvador, the surprise market chief that is forging forward quickest and most effectively to swap from the cash of mass abolish to the cash of peace, “Bitcoin”. No longer ideal are they embedding Bitcoin deeply into the economic system there, they’re actively educating other international locations to succor them seize away the yoke of fiat and the murderous democracy boosters.

Regarded as some of the international locations attending the ancient summit in San Salvador became the mighty Nigeria, which, need to it trace the advice and studying accrued there, could well seize its rightful station as the industrial heart of the continent of Africa. Rather than deciding on the racist-inspired “Afro” currency, it could perhaps well resolve on bitcoin as the unifying, provably graceful, and economically sound “lingua franca of cash” for all residents in African international locations — bringing unparalleled economic advantages to your filled with us that stay on that continent, as well as the prolonged-leisurely permanent elimination of toxic Western influences.

Democracy created fiat. It is miles that fiat philosophy (created by a pedophile, John Maynard Keynes) that became a key ingredient in the extinguish of the economies of the African continent. By adopting bitcoin, fiat will stop to own vitality over 1,404,827,471 of us, environment them on a route to prosperity and proper expose. Bitcoin has the vitality to defang the unnatural blood-sucking viper that injects poison into the economies of Africa and drains blood from the of us.

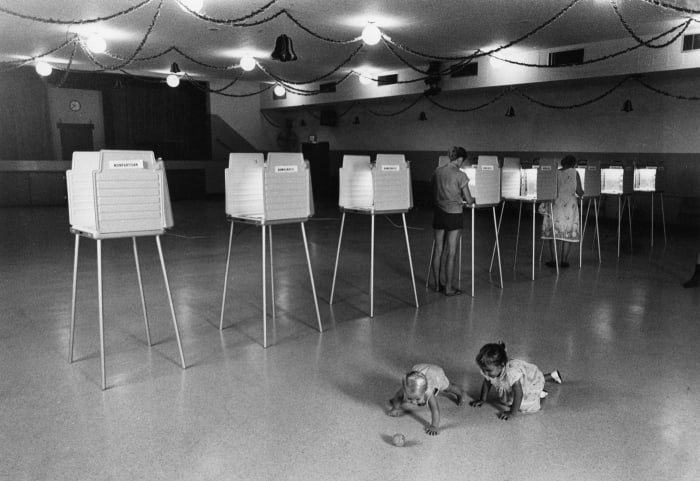

Voting doesn’t comprise fiat ethical. Voting doesn’t trump math. Somebody who’s for balloting as the technique to come to a decision how a monetary device need to work is anti-Bitcoin, and no doubt, no Nigerian need to hear to a Washington wonk who needs all international locations to be Cargo Cult copies of the West and its unethical, nefarious, unbalanced, and unworkable programs of preserve watch over.

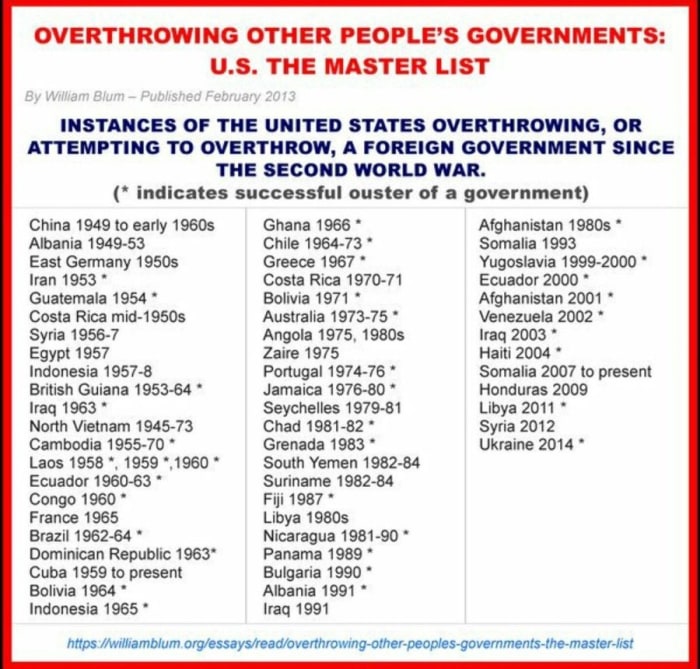

“Democratic” doesn’t equal graceful, correct, or correct. It doesn’t guarantee apt outcomes, or restrain the Express from committing mass abolish. Democratically overproduced fiat is the gasoline that powered the mass abolish “Protection drive Industrial Advanced” that ravaged the 20th century. Now, with bitcoin in station as the arena’s cash, outrages cherish this can no longer happen again attributable to there simply and literally will not be any cash for it.

Everyone who understands Bitcoin and what it became designed to originate doesn’t argue about this. There’ll not be any longer any argument to be made against it. The time of arguing is over. The lying, mass-murdering, racist democracy boosters (about a of whom faux to be “for Bitcoin”) will not be any longer going to be ready to trade the inevitable . The producer of the form and arbiter of the aim of cash has been the muse train for generations. There shall be no extra debate. The die is already cast. Somebody arguing about Keynesianism vs Bitcoin, democracy vs free markets or another distraction is delusional; actuality is going to be asserted and imposed on the market and there is nothing that you just can originate about it.

How and why is that this so, and what is it about Bitcoin in explicit that makes any of this predictable? Doesn’t the value of bitcoin and the arrangement it fluctuates refute these extravagant claims? Are they extravagant claims?

Bitcoin is a truly new abilities, even supposing the utility and math ideas that it brings to life are a protracted time used. The double-spending train has been solved; this means that it is miles seemingly to use a digital “certificate” to stand in the station of cash and guarantee that that as prolonged as you preserve it no person else can employ that “certificate” rather than you. That is an unparalleled paradigm shift, the implications of which are no longer but fully understood, and for which the instruments originate no longer but exist to fully seize just correct thing about this new thought.

This new abilities requires some new thinking with regards to rising companies which are constructed upon it. Within the the same formulation that the pioneer providers of electronic mail did no longer precisely realize the carrier they were promoting for about a years, new and proper all for Bitcoin is required, and need to emerge, so as that it reaches its full doable and turns into ubiquitous.

Hotmail outmoded acquainted technologies (the web browser and electronic mail) to dangle a higher formulation of gaining access to and delivering electronic mail; the root of the usage of an electronic mail shopper cherish Outlook Speak has been completely out of date by web interfaces and electronic mail “in the cloud” that offers many advantages over a dedicated shopper with your mail to your have native storage.

Bitcoin, that will transform the formulation you transfer cash, need to be understood by itself terms, and no longer apt as a web form of cash. Passionate about bitcoin as cash is as absurd as all for electronic mail as but one more form of sending letters by submit; one no longer ideal replaces the opposite but it profoundly changes the formulation of us ship and like messages. It will not be a easy substitution or one-dimensional development of an novel thought or carrier.

As I truly own outlined beforehand, Bitcoin will not be any longer cash. Bitcoin is a protocol. When you happen to address it in this formulation, with the ideal assumptions, that you just can originate the direction of of putting Bitcoin in a correct context, allowing you to comprise rational suggestions relating to the form of services that shall be worthwhile in accordance with it.

Every phase of Bitcoin is text. It is miles continuously text, and never at any point ceases to be text. That is a reality, and as text, it is miles protected under the free speech provisions of the constitutions of civilized international locations with guaranteed, irrevocable rights.

If Bitcoin is a protocol and no longer cash (it is miles), then organising currency exchanges that mimic precise-world cash, inventory and commodity exchanges to alternate in it will not be any longer the sole real arrangement of discovering its put. That you just can no longer purpose up an electronic mail alternate to undercover agent the price of electronic mail services, and the the same thing applies to Bitcoin.

Staying with this divulge of thought, need to you variety in an electronic mail for your Gmail story, it is seemingly you’ll well presumably be inputting your “letter”. You press ship, it goes through your ISP, over the web, into the ISP of your recipient and then it is miles outputted for your recipient’s machine. The same is factual of Bitcoin; you enter cash on one stop through a carrier and then ship the bitcoin to your recipient, with out an middleman to address the transfer. Once Bitcoin does its job of shifting your cost at some stage in the globe to its recipient it need to be “be taught out”, i.e., grew to change into assist into cash, in the the same formulation that your letter is exhibited to its recipient in an electronic mail.

Within the electronic mail hiss, as soon as the transfer occurs and the electronic mail it is seemingly you need to always have bought conveys its data to you, it has no use rather than to be a file of the tips that became despatched (accounting), and also you archive that data. Bitcoin does this accounting on the blockchain for you, and a correct carrier constructed on this can store prolonged transaction miniature print for you in the community, but what it is seemingly you need to always have to own as the recipient of bitcoin is services or items no longer bitcoin itself.

Bitcoin’s factual nature is as an on the spot technique to pay (irrespective of no longer being cash) wherever on this planet. It will not be an investment, and preserving on to it in the hopes that this can change into helpful is cherish preserving on to an electronic mail or a PDF in the hopes this can change into helpful in the prolonged stoop with out simultaneously investing in the companies that supply entry to it for buyers doesn’t comprise any sense. In any case, you can preserve on to bitcoin and seek for its cost stoop up, and its cost will stoop up, but it is seemingly you need to always have to own guts to weather the violent waves of promoting and procuring as the transition to an all-bitcoin economic system gets under formulation.

Despite the reality that that you just can’t double employ them and each is habitual, bitcoin don’t own any inherent cost, unlike a e book or any bodily object. They are able to no longer bask in in cost. Wrong all for Bitcoin has unfold attributable to it behaves cherish cash, as a result of reality it could perhaps perhaps no longer be double spent. Misrepresentation of Bitcoin’s factual nature has masked its twin nature of being digital and no longer double-spendable.

Razzles. They originate as a candy, and then stop as a gum. Earlier than you chew them, which are they? A candy, or a gum?

Bitcoin is digital, with your full qualities of data that comprise data non-scarce. It sits in a brand new station that oscillates between the merchandise of the bodily world and the infinitely plentiful digital world of data, belonging exclusively to the digital world but having the traits of each. For that reason it has been broadly misunderstood and why a brand new formulation is required to originate companies around it.

All of this goes some technique to show veil why the value of procuring bitcoin at the exchanges doesn’t topic for the particular person. If the price of procuring bitcoin goes to 1¢, this doesn’t trade the amount of cash that comes out at the opposite stop of a transfer. As prolonged as you redeem your bitcoin immediately after the transfer into both items or currency, the the same cost comes out at the opposite stop irrespective of what you paid for the bitcoin need to you began the direction of.

Take into story it this formulation. Let us hiss that you just need to ship a prolonged text file to but one more particular person. You are going to both ship it as it is miles, otherwise that you just can compress it with zip. The dimensions of a file file when it is miles zipped shall be as much as 87% smaller than the distinctive. After we transpose this thought to Bitcoin, the compression ratio is the value of bitcoin at but one more. If bitcoin trades for $100, and also you need to utilize something from anyone in India for $100 you need to utilize 1 bitcoin to assemble that $100 to India. If the value of bitcoin is 1¢ then you’ll need 10,000 bitcoin to ship $100 greenbacks to India. These could well be expressed as compression ratios of 1:1 and 10,000:1 respectively.

The same $100 cost is despatched to India, whether you use 10,000 or 1 bitcoin. The put of bitcoin is inappropriate to the price that is being transmitted, in the the same formulation that zip data originate no longer “care” what is inside them; Bitcoin and zip are insensible protocols that originate a job. As prolonged as the price of bitcoin doesn’t stoop to zero, this can own the the same utility as if the price were very “excessive”.

Bearing all of this in options, it’s sure that new services to facilitate the immediate, frictionless conversion into and out of bitcoin are wanted to permit it to purpose in a fashion that is factual to its nature.

The brand new enterprise units of exchanges are no longer addressing Bitcoin’s nature precisely. They’re the usage of a twentieth-century model of inventory, commodity, and currency exchanges and superimposing this onto Bitcoin. Interfacing with these exchanges is non-trivial, and for the normal particular person a daunting prospect. In some circumstances, you need to wait as much as seven days to receive a transfer of your fiat currency after it has been cashed out of your story from bitcoin. While here’s no longer a fault of the exchanges, it represents a truly precise impediment to Bitcoin performing in its nature and providing its full cost.

Imagine this; you receive an electronic mail from at some stage in the arena, and also it is seemingly you’ll well presumably be notified of the reality by being displayed the topic line to your browser. Then you no doubt prepare to your ISP to own this electronic mail delivered to you and also you need to wait seven days for it to near to your bodily mailbox.

The very thought is completely absurd, and but, here’s exactly what is taking place with bitcoin, for no technical reason whatsoever.

It is miles definite that there need to be a rethink of the services which are rising around Bitcoin, along with a rethink of what the factual nature of Bitcoin is. Rethinking services is a standard phase of entrepreneurship and we need to ask enterprise units to fail and early entrants to fall by the wayside as the ceaseless iterations and pivoting growth, apt as it became in the early days of the web.

Bearing all of this in options, specializing in the value of bitcoin at exchanges the usage of a enterprise model that is inappropriate for this new utility simply will not be any longer rational; it’s cherish putting a methane-respiration canary as a detector in a mine stuffed with oxygen-respiration humans. The chook dies even supposing nothing is rotten with the air; the miners stoop to evacuate, leaving the uncovered gold seams in the assist of, thinking that they’re all about to be wiped out when all is fully ravishing.

Day merchants speculating on bitcoin from house reason the value to oscillate. It’s an synthetic signal that has nothing to originate with inquire for bitcoin and its circulation as an economic utility to facilitate commerce.

Bitcoin, and the guidelines in the assist of it are here to forestall. As the decision of of us downloading the shopper and the usage of it will increase, cherish Hotmail, this can at final reach serious mass and then unfold exponentially throughout the web. When that occurs, the ideal enterprise units will spontaneously emerge, as they’ll change into glaring — in the the same formulation that Hotmail, Gmail, Fb, cellular telephones, and on the spot messaging appear cherish 2nd nature.

Within the prolonged stoop. I feel about that ideal about a of us will speculate on the price of bitcoin, attributable to even supposing that shall be imaginable, and even worthwhile, there shall be extra cash to be made in providing easy-to-use Bitcoin services that seize full just correct thing about what Bitcoin is.

One thing is definite; stride shall be of the essence in any future Bitcoin enterprise model. The originate-americathat present on the spot delight on each ends of the transaction are the ones which are going to be triumphant. Even when the volatility of the value of bitcoin is scoot to stabilize, since it has no use in and of itself, getting assist to cash or items immediately shall be a sought-after characteristic of any enterprise constructed on Bitcoin.

The needs of Bitcoin companies present many challenges by formulation of performance, security, and new thinking. Out of these challenges will approach new practices and utility that we are capable of ideal apt take into consideration as they approach over the horizon.

Sooner or later, when there is no extra fiat, and the chaotic transition zone between fiat and Bitcoin has been abolished, then all the issues shall be priced in bitcoin, and there shall be no volatility, attributable to no person makes use of something else rather than bitcoin to use or promote. When you happen to know any chemistry, this would well be cherish a response’s reagents reaching equilibrium; that you just can shake it and gallop all of it you cherish; the response is over and also you’re left with the inert product.

Correct now, compared to the amount of fiat on this planet, bitcoin can comprise bigger and contract very all of sudden over a well-organized fluctuate, attributable to it is miles miniature in quantity. It could well comprise bigger to what for many is an unimaginably excessive put, and then shrink down again. As it gets bigger and accumulates extra mass (its put expressed in fiat), these fluctuations will change into smaller and smaller. By all of this, bitcoin stays precisely the the same; it is miles its users which are publishing numbers as a signal to react upon which are changing.

In its essence, here’s a battle between Bitcoiners and liars. The liars who promote democracy and who take into consideration that morality and even rights can approach out of a vote.

The options of socialism and democracy are diametrically opposed to the core philosophy of a voluntary survey-to-survey device cherish Bitcoin. Detect-to-survey programs disintermediate the transfer of data and put off the need for an arbitrary governing authority or carrier provider. Bitcoin, cherish math, has no philosophy and is fair.

Socialism’s basic premise is that “property is theft”, and that all property, items, and services need to be collectively owned for the wait on of all of us in a coercive Express with no decide-out. Below a socialist device of forced group, folk originate no longer own free use of their inherent rights, which are violently suppressed.

That is an inherently wicked proposition, the save one community of of us inevitably coalesce into an illegitimate ruling class to administration and administer other of us “for his or her have correct” — the ideal of the collective. Even when this aggregation of vitality were no longer the case, no man or community of men has the ideal to drive but one more man to relinquish his property.

Libertarians realize that there is no such thing as “the rights of the collective” and that ideal a residing particular particular person human has rights. Chief amongst these rights, the “root correct”, is the ideal of property. Somebody who contends that Bitcoin is a socialist thought is largely incorrect about how Bitcoin works and its factual nature, or is making an attempt to redefine socialism so as that it could perhaps perhaps slot in with and be the normal-bearer of the inevitable rise of Bitcoin. You are going to detect this need to you be taught the phrase, “my thought of socialism is”, which arrangement that the speaker wants to abandon the sad scent of socialism and rebrand the word to mean something that it will not be any longer, so as that he can remain “a committed socialist” and be a phase the precise world at the the same time.

Bitcoin is the antithesis of socialism. Bitcoin transfers, and the possession of bitcoin and the guidelines governing exchanges are no longer administered by a central Express authority — unlike a tool designed by a socialist, the save who can have what, how remarkable of it, and what is going to be performed with it truly is regulated by a community of violent bureaucrats.

Bitcoin is a strict survey-to-survey protocol, and no longer a centralized device under the preserve watch over of arbitrary options or incorrect economic options cherish Keynesianism. In its essence, Bitcoin acts cherish a legislation of nature (powered by cryptography) and it doesn’t and could well no longer care about your philosophy or ideology. By dint of this on my own, Bitcoin can no longer be known as socialist or own a political philosophy attributed to it any higher than an inanimate object or a basic drive of nature can. It is miles designed to originate one thing, it does that one thing, and that one thing will not be any longer inherently political; ideal Bitcoin’s users own political options that they struggle, and fail, to superimpose upon it. Bitcoin is fair, cherish a hammer or a neutron or a handgun.

Bitcoin is a stateless utility that is solely voluntary. You are going to also or also can no longer use bitcoin at your have discretion. No one forces you to be a phase of the Bitcoin ecosystem or to abide by its options. How remarkable bitcoin you gain in alternate for items and services is completely as much as you and your procuring and selling partners, and what you utilize your bitcoin on is completely as much as you.

The users of Bitcoin originate no longer “own a hiss” in what that you just can or can no longer originate with them. There’ll not be any longer any Express, statist, or socialist that can uncover you that you just furthermore mght can no longer procure as many bitcoin as that you just can, or that your bitcoin belong to the collective, or that it is seemingly you’ll well presumably need to hand over a proportion of them to the Express “for the ideal of the of us”.

Users of Bitcoin, by default, are freely associating of us, deciding on freely to accept the guidelines of the Bitcoin device. That is the total reverse of socialism, which is the negation of particular particular person liberty, the abolition of free decision, and the elimination of property rights.

Somebody who claims to be a socialist while advocating for the in vogue adoption of bitcoin is de facto performing against their socialist principles and desire to dangle a world the save collective property possession and centralized route of capital is enforced by violence.

In a world the save cash transfers are made completely through bitcoin, a socialist hiss will at the very least own a enormous amount of exertion compelling of us to hand over their cash to the Express by drive. As in vogue, the socialist collectivists will resort to threats, violence, imprisonment, confiscation of precise property, and another wicked and disgusting arrangement they would possibly be able to approach up with to preserve conclude cash from of us. This prompts the inquire, “how can an avowed socialist advocate the adoption of bitcoin when it has the functionality to homicide his violent Statist utopia from the inside out?”.

It’s a mesmerizing inquire. I believe that many socialists who advocate the adoption of bitcoin are having a profound inner battle with the emergence of no longer ideal Bitcoin but of the web itself and its unbelievable, easy instance of stateless cooperation between men that has changed the arena and had the originate of benefiting all people.

The net has brought the total physique of human data to all people who makes use of it, at a cost that is come zero. It has also rendered virtually redundant the hiss monopoly over phone programs and postal programs. Somebody who silent believes that “we” need the Express in the face of these revelations is completely insane, or is on the avenue to forsaking socialism, or is sticking his fingers in his ears, unable to face the information of this topic.

Mankind is higher off in each formulation with out the Express. The paradigm shifts brought on by the web in publishing, song distribution, postal mail, telephony, and the brand new, unparalleled services created by the connectivity of the web are proof of this. Each of these industries has been regulated by the Express in the offline world, and now that they’re working in the web world with out Express law they’re extra efficient and valuable by orders of magnitude. The actual of us which are against this are the vested pursuits, the buggy whip makers and the socialists, and on every occasion they struggle and exert their affect they anguish and injure of us and reason them to fritter away cash and time the save they would in another case no longer need to.

The next huge shift on the web is going to be the total disruption of the sclerotic financial institution-mediated cash transfer programs in favor of net-facilitated cash transfers that seize away banks completely from the direction of drift. This match will reason an infinite acceleration in the transaction price of commerce worldwide, will defund the socialist states and be of enormous wait on to all people, in every single save.

Your total attempts the banks are making now to embrace the web and survey-to-survey payments programs will at final fail, as prolonged as of us are free to originate utility, originate it, and freely interface with cash at will. For that reason PayPal had banned transfers that contact bitcoin in any formulation; they knew that Bitcoin is completely superior to PayPal, and that it constituted an existential risk to their enterprise. PayPal allowing its device to be outmoded to comprise payments in alternate for bitcoin is allowing blood vessels to feed a cancerous tumor. Bitcoin is most cancers to PayPal and they need to execute it at any cost.

The PayPal response to the inevitable survey-to-survey price ecosystem in the form of their “Blue Dorito” suffers from the lethal elixir of powdered friction, arbitrary options, suppression, and law by the Express, all made soluble with a profound lack of creativeness — none of which Bitcoin suffers from… but that is previous the scope of this submit. PayPal (and Coinbase) will at final change into the MySpace of shifting cash attributable to they’re each wedded to a pre-net mode of thinking with regards to payments, and they’re in an abusive shotgun marriage ceremony with the Express.

Bitcoin is going to be the automobile for services that comprise this disruption technique to scoot. Once serious mass is reached, Bitcoin shall be completely unstoppable. We would prefer ideal scrutinize at the French restrictions on 128bit SSL and the formulation they dropped them when it change into the normal security for e-commerce transactions. The first signal of this shift could well be the adoption of Bitcoin as an accessory carrier on some of the predominant cash transfer carrier providers, offering bitcoin transfers to the computer illiterate.

Bitcoin will not be any longer socialist. It will not be collectivist. It is miles voluntarist. It is miles a tool of voluntary, completely non-violent, free association.

There are many misconceptions about what Bitcoin is. That’s under no circumstances attractive. Just a few of these misunderstandings are rather natural; Bitcoin is something radically new and a amount of, and so coming to terms with what it is miles shall be a daunting project for the computer illiterate that doesn’t know what cash is. That combination — pc illiteracy and economic lack of information — are the toxic cocktail that makes it very no longer going to comprise Bitcoin.

Just some of the misconceptions on the opposite hand, save no longer own something else to originate with misunderstanding monetary theory. They’re simply rotten, as it is miles rotten to train, “liquid water is dry”.

Bitcoin will not be any longer democratic. There’ll not be any longer any universe the save Bitcoin is democratic.

There. I said it in a technique that is unambiguous. Bitcoin will not be any longer democratic. It has never been democratic. It’ll never be democratic.

It is miles serious to comprise this, so as that that you just can know exactly what it is seemingly you’ll well presumably be facing need to you use and mediate about Bitcoin.

“ASCII Bernanke.” Bitcoin’s creator is aware of what cash is and what need to be performed relating to the inherent issues associated with fiat currency — homicide the Federal Reserve irrevocably and return the preserve watch over of cash manufacturing to folk voluntarily performing in stay performance. That is the correct formulation the train of inflation is going to be solved. That is what Bitcoin does. The portrait on the ideal is embedded in the Bitcoin blockchain as a tribute to Fed Chairman Ben Bernanke, who destroyed the dollar in a Keynesian frenzy of cash printing, defrauding hundreds and hundreds of of us.

Bitcoin, by originate, will not be any longer democratic. No topic how continuously you are making an attempt to train that it is miles, it will not be any longer, and it never shall be. And it is miles always no longer socialist, as I apt clearly outlined.

Eradicating all of the charming, modern technical miniature print, the core of Bitcoin is that it is miles voluntary and the transactions and ledger entries made with it are mediated by a pc program. You seize, as a free human being, to download the specified utility, use Bitcoin and be scoot by the community’s fastened options.

There is no balloting fervent, no coercion, no duty, social or in another case to use it. You are no longer even required to donate your CPU and bandwidth to the Bitcoin community in alternate for the usage of it. When you happen to use Bitcoin, you volunteer to use it on its terms. It is miles as easy as that.

Lest it is seemingly you need to always have any un-readability about this, you decide in and of itself will not be any longer “democratic”. Extra on that under, but to comprise why Bitcoin will not be any longer democratic, we want to comprise what democracy is.

What is “democracy”? Democracy is a coercive political device the save of us in a geographic station are “enfranchised”. This implies that they all own a “vote”, allotted one vote per man, that they would possibly be able to cast in “elections”, the save the accumulator of doubtlessly the most votes wins, and then that particular person takes “station of enterprise”. No topic what the winner thinks or his plans are, he gets unparalleled, unconstrained, additional-judicial, additional-ethical powers over the “residents” and come in total immunity from the legislation.

That’s all that democracy is.

I shall stoop away out that after in vitality, these of us preserve conclude, abolish, lie, unsafe, and poison to their sad heart’s train material, with virtually absolute easy project that they would possibly be able to assemble away with whatever nefarious they originate, irrespective of what the scale. Indubitably, the bigger the scale of their crimes, the less seemingly they’re to face any justice of any variety, and the extra seemingly they’re to be rewarded. And naturally, the sole real monopoly on the allotting of justice belongs to the the same “democracy” which in originate, polices itself. In civil litigation the tenet is that no person shall be a judge in his have reason, but in democracy, here’s the default. It is miles an originate scandal.

Now assist to Bitcoin. At no point in the Bitcoin direction of originate it is seemingly you need to always have a vote over any facet of how Bitcoin works, who owns what bitcoin, how they’re disbursed, transferred, their cost, or something else whatsoever to originate with its operation. When you happen to don’t cherish it, you’re free to claim no to use it.

The reality that that you just can seize one correct over but one more does not imply it is seemingly you’ll well presumably be taking part in democracy or performing “democratic”. You are going to’t hiss that, “Ice cream is democratic”, attributable to that you just can seize whatever flavor you cherish in Baskin Robbins or Carvel. Or seize Baskin Robbins over Carvel. You are going to’t hiss that deciding on a Volkswagen over a Ford Fiesta is, “a democratic decision”. Democracy arrangement ideal the hermetically sealed one-man-one-vote inherently unsafe and unethical political device. That’s it. That’s all.

Because hundreds and hundreds of of us own been brainwashed in authorities colleges to take into consideration that the device of authorities that educated them is the correct, they own been inspired to misuse the word “democracy” as a synonym for all the issues correct or something else that is valuable. I truly own even heard of us announcing, “that’s very democratic of you” when anyone does but one more particular person a correct turn. That is how distorted the which arrangement of the word “democracy” has change into.

Bitcoin is a valuable abilities, so rather naturally, these uneducated and unsafe of us will use the word “democracy” in association with it, irrespective of it having no relation of any variety, formulation, shape, or form to democracy. Passionate about it, it is miles quite correct that these of us mediate Bitcoin is democratic. If they understood its factual nature, they would hysterically rail against its mass adoption, as they own been educated cherish canines to originate against any risk to the violent device that has them in a hypnotic spell.

And these of us are very well educated. And completely hypnotized. It’ll approach as no surprise then, that Bitcoin, the utility that is going to be of wait on to billions of of us on Earth, is being known as “democratic”. Sorry to break your mesmeric delusions, democracy fans; Bitcoin will not be any longer democratic, and the usage of it has nothing to originate with majority rule, drive, balloting, or something else that touches democracy in any formulation. Bitcoin is with out your greasy taint or fetid stink.

The nonsense that a decision available in the market is “democratic” stems from the incorrect theory that customers spending cash is by some ability a “vote”. It will not be. It is miles an economic decision, that doesn’t impose any rule over others, has nothing to originate with achieving a majority, etc. Mark also how some deranged thinkers misuse the word “direct”. That is the correct formulation that the delusional democracy booster can comprise an argument — by distorting English until phrases lose all their which arrangement. People spending cash originate no longer “own a direct” (or as they hiss in the U.Okay., “own their hiss”); they own a decision. Even when they’re the usage of spurious central-financial institution-printed paper cash, their direct, concept, or sentiment is inappropriate for the time being of decision and alternate.

Even when you were to repurpose “the Blockchain” to act as a voter registration and balloting device (mockingly, it would then truly change into a chain; a Chain of Fools that holds of us as slaves to morally evil, violent, and unethical mob rule). This could no longer comprise Bitcoin the cash-transport device democratic, it would simply be but one more “creative” use of the blockchain utility — this time for an antisocial and completely nefarious reason: implementing the preserve, coercion, and violence of democracy.

On this nightmare hiss, the miners would change into de facto gaolers. Stealing bitcoin would mean that the political device shall be bought — literally — for bitcoin. The premise is as nauseating as it is miles rotten.

All of this absurd posturing and conflating of Bitcoin with democracy (or socialism), on the opposite hand, is now nothing higher than faintly fun noise. The of us which are doing it are as inappropriate as needless men.

The of us that cherish democracy are going to in finding out first-hand what democracy in fact arrangement and what it did to them, by virtue of its abrupt absence and the disagreement of life before and after democracy. Bitcoin is going to defund the Express by entertaining and extinguishing your full fiat currency on this planet, so as that at final the the deluded slaves of democracy can vote all day and all evening with out the votes cast having any originate whatsoever. The libertarian society, protected and powered by Bitcoin, will not be any longer going to permit the violent, deluded, and sick devotees of democracy to wage warfare, preserve conclude cash, or intervene with voluntary contracts and alternate.

Bitcoin will not be any longer democratic; it is miles voluntarist. No topic what you hiss or take into consideration, the personality of Bitcoin doesn’t trade. You are going to call it a fruit cake, a leprechaun, cotton candy, a shaggy dog legend, Koosalagoopagoop, or something else that you just cherish. As it is miles with the ocean, when you dive into it, you will assemble wet. What you favor doesn’t approach into it. If it is your desire to forestall dry, don’t soar in, but that you just can no longer ask to forestall dry and stoop swimming at the the same time. Calling Bitcoin democratic when it will not be any longer is fully absurd, and insulting. The field has had rather ample of it and its virus-cherish variants.

Sooner or later, Bitcoin doesn’t care what you hiss. It could well’t care about something else. What you hiss doesn’t topic; that is the final word vitality of Bitcoin. Bitcoin is cherish a drive of nature. It is crucial to adapt to moral requirements of behavior in the Bitcoin-mediated world, or starve, for the reason that option of violence is taken off of the table. The implications of all of this can ideal change into sure as soon as it is miles too leisurely for the democracy fans to forestall it, who shall be left scratching their heads wondering what took station, why democracy died, and crucially, why all the issues has no longer fallen apart…

…but is now infinitely higher.

No authorities on Earth can trade Bitcoin. They are able to both fail or adapt to Bitcoin. By allowing themselves to be remodeled by Bitcoin, in a counter-intuitive and unbelievable consequence, they’ll change into extra extremely efficient than they ever own been. The advantages Bitcoin will ship to each economic system will give unparalleled new instruments to governments, no longer to oppress and homicide, but to originate correct by the explicit permission of the populace.

As of us adopt Bitcoin, they’ll be “balloting with their cash” and shifting to a station the save the skinny-skinned, lying boosters of democracy don’t own any vitality over something else.

Bitcoin will at final soak up all fiat currency on this planet as particular person Bitcoin purchasers cherish Pine are set in globally. The jurisdictions that allow companies that facilitate this transformation to work unencumbered are going to be the brand new financial centers of the Twenty first century. And if they don’t, the absorption is going to happen despite all the issues.

Whether or no longer your purpose is to dominate in Bitcoin services as a nation, there is no other rational technique to formulation this rather than forsaking KYC/AML, and Conway’s “Game of Existence” offers a ravishing illustration of why here’s so.

The Game of Existence, also identified simply as Existence, is a cellular automaton devised by the British mathematician John Horton Conway in 1970.

The field in the Game of Existence is a two-dimensional grid of square cells, each of which is in one of two imaginable states, alive or needless. Every cell interacts with its eight neighbors, which are the cells which are horizontally, vertically, or diagonally adjoining. At each step in time, the next transitions happen:

- Any stay cell with fewer than two stay neighbors dies, as if precipitated by underpopulation.

- Any stay cell with two or three stay neighbors lives on to the next generation.

- Any stay cell with higher than three stay neighbors dies, as if by overpopulation.

- Any needless cell with exactly three stay neighbors turns into a stay cell, as if by reproduction.

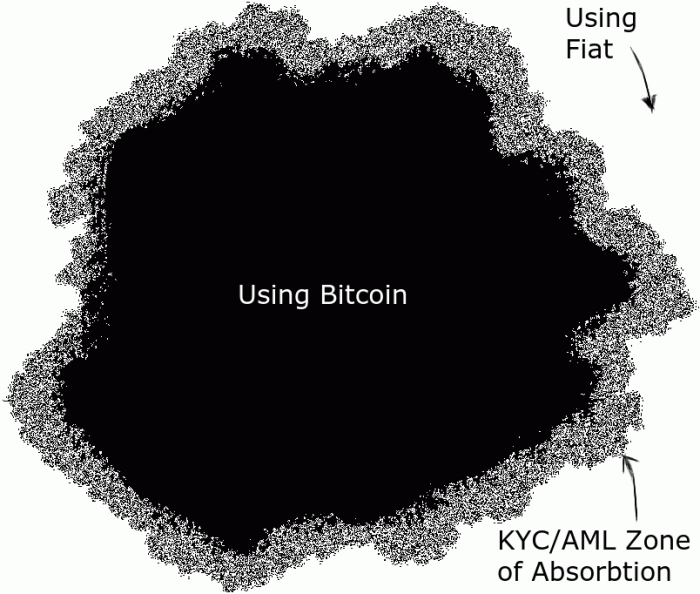

Let us now superimpose this easy thought on Bitcoin adoption. Imagine a world the save there is total KYC/AML, and it has been working for years, with valid instruct in Bitcoin adoption. The illustration under is a characterize of this world; it is miles a grid with one billion cells in it. Each cell is a human being who makes use of cash or bitcoin. If the cell is sad, they use bitcoin as cash. If the cell is white, they use fiat currency as cash.

For a cell to convey from white to sad (a particular person beginning to use bitcoin), fiat must be converted into bitcoin at a KYC/AML entry point. This occurs in a thin line at the edge of the fuzzy grey mass, by approach of compliant companies that supply this conversion carrier.

Everyone outside in the white zone is both unbanked or the usage of ideal fiat currency and banks. Everyone inside the mass in the sad zone makes use of bitcoin. These in the sad zone originate no longer ever seize with KYC/AML, attributable to they already own bitcoin, and progressively ship it wherever, to any particular person, globally with out additional permission of any variety.

The central mass will increase in size as it absorbs fiat currency. It’ll preserve rising until both it absorbs all fiat currency, or a lower-than-total absorption equilibrium point is reached. A lower-than-total absorption equilibrium shall be precipitated by the Bitcoin community reaching a technical higher limit (cherish the transaction price limit, which is now very no longer occurring a handy level thanks to Elizabeth Stark’s Lightning Labs “Layer-2” community) or a psychological or political distortion (banning, taxation, FUD, usability, or another synthetic force).

We are capable of survey from this illustration and thought experiment that at final, there shall be an even selection of users who will never again need to be KYC-/AML-verified, attributable to their cash exists and circulates freely ideal as bitcoin. This implies that at some stage in the Bitcoin ecosystem, KYC/AML is nugatory after the predominant conversion. It also turns into immediately sure that any bitcoin leaving the mass on a survey-to-survey basis when new bitcoin users are brought in, creates extra mass with out KYC/AML, and this amount shall be very well-organized as soon as the central mass is well-organized.

This straightforward illustration shows what is going to happen as bitcoin absorbs fiat currency. KYC/AML can own a short life, after which this would well be nugatory as a utility to trace of us, since a well-organized decision of users are in bitcoin and never contact fiat.

Rather than plow through this completely pointless stage of KYC/AML, a nation with competent leaders will realize the inevitable, and stoop to attract companies into their jurisdictions by eschewing the law of Bitcoin services.

The advantages of the virtuous circle of Bitcoin corporations all incorporating and working in the the same miniature station of the the same city can no longer be overstated. As a prolonged-length of time approach, forsaking KYC/AML is the correct logical route.

Within the absorption zone is the save your full companies touching Bitcoin will purpose. That’s the save Bitcoin “pure play” companies will flourish, and which arrangement utility companies, providing the a need to-own pockets and merchant services, new courses of services constructed on multisig and the opposite instruments in Bitcoin; powered escrow services, time-induced conditional payments, and plenty of other issues.

All of us, institutions, and governments in the prolonged stoop shall be equal peers on the Bitcoin community the save no particular person or entity has to any extent further preserve watch over over Bitcoin than another, and all people has entry on the the same, provably graceful, equal basis.

Bitcoin is the pure, level taking half in discipline the save no person can cheat and all people is guaranteeing the community for the wait on of all people else. This will not be any longer “democratic” as some very slow of us also can want to persuade you; here’s voluntarism in scoot.

All corruption comes from the legislation produced by crony capitalism and democracy and unethical companies the usage of it to distort economics. Below a Bitcoin regime, this will not be any longer going to be imaginable to print cash for any reason whatsoever. That feeble privilege of the Express is completely revoked in Bitcoin. Now cash is allotted by advantage on my own; that you just can no longer gain cash when you don’t assist other of us. That’s factual on a particular person level, the enterprise level, and the governmental level also. Everyone can own the absolute vitality to refuse to pay for something else they would quite no longer pay for. This could occasionally change into a universal legislation under Bitcoin.

In Bitcoin, all people can own a free decision to be a slave or no longer, but no longer with other of us’s cash. You are going to voluntarily seize to subordinate your self to liars, democracy boosters, and warmongers, but you can’t forcibly enlist other of us and their cash. Since most of us are no longer attracted to “Spreading Democracy”, demonizing and murdering brown-skinned strangers and other vile, disgusting issues, it is seemingly you’ll well make sure that that the ills of the 20th century unfold by democracy and its nefarious boosters will technique to a entertaining, abrupt, permanent, and most welcome stop.

Naturally the inquire that follows is, “Which of the brand new nation-states has the correct probability of dominating in this Bitcoin-mediated world?”. Oddly ample, the nation whose authorities behaved the worst in the 20th century has the correct probability of turning itself around and turning into a beacon of gentle again. The US of The United States.

The Founding Fathers of the ideal nation in the history of the arena, the US of The United States, gifted that nation a tool borne of genius, ethics, and subtlety. That unbelievable device, when mixed with and constrained by Bitcoin, will dangle a nation that will final longer than the Roman Empire and be extra prosperous. All that is required is that it follows the legislation as laid down by the Founders.

Hearings on Bitcoin and its derivatives are being held in the USA continuously, and invariably the professional witnesses fail to well checklist the right processes occurring. If they outmoded the ideal language and excluded all analogies, the correct imaginable conclusion could well be that The United States can no longer adjust Bitcoin under its fresh lawful device. The Constitution ensures the inalienable rights of American residents, and due to this reality Bitcoin is a protected act or note by virtue of it being a form of published text. The actual formulation Bitcoin shall be made regulable is that if the Constitution is changed; and that does not imply adding a brand new Amendment — it arrangement eradicating the First Amendment completely.

Inevitably the anti-Bitcoin “protagonists” will face a sturdy and finally a hit lawful train that will seize away the doable for any form of “BitLicense” or interference from the CTFC, FinCEN, or another company. It’ll also seize away any probability of interference at the Express level. The of adhering to the basic legislation of the US will reason The United States to change into the heart of all Bitcoin enterprise for the total world, and need to reason trillions of greenbacks value of e-commerce to drift throughout the USA.

Let me show veil why here’s the case.

Some hiss that Bitcoin is cash. Others hiss that it will not be any longer cash. It doesn’t topic. What does topic are three issues: that Bitcoin is, that the Bitcoin community does what it is miles supposed to originate completely reliably, and what the factual nature of the Bitcoin community and the messages in it are.

Bitcoin is a database, maintained by a community of affiliates that shows and regulates which entries are allotted to what Bitcoin addresses. That is executed completely by transmitting messages which are text, between the pc programs in the community (identified as “nodes”), the save cryptographic procedures are performed on these messages in text to verify their authenticity and the identity of the sender and recipient of the message and their station in the public ledger. The messages despatched between nodes in the Bitcoin community are human readable, and printable. There’ll not be any longer any point in any Bitcoin transaction at which Bitcoin ceases to be text. It is miles all text, your full time.

Bitcoin shall be printed out onto sheets of paper. This output can seize a amount of forms, cherish machine-readable QR codes, or it’ll be printed out in the letters A to Z, a to z, and zero to 9. This implies they’ll be be taught by a human being, apt cherish “Huckleberry Finn”.

At the time of the introduction of the US of The United States, the Founding Fathers of that new nation in their deep data and distaste for tyranny, apprehensive by the memory of the absence of a free press in the international locations from which they escaped, wrote into the basic legislation of that then-young federation of free states, an explicit and unambiguous freedom, the “Freedom of the Press”. This amendment became first attributable to of its central significance to a free society. The First Amendment ensures that all Americans own the vitality to divulge their correct to submit and distribute something else they cherish, with out restriction or prior restraint.

Congress shall comprise no legislation respecting an establishment of faith, or prohibiting the free divulge thereof; or abridging the liberty of speech, or of the clicking; or the ideal of the of us peaceably to assemble, and to petition the Authorities for a redress of grievances.

This single line, eternally precludes any legislation that restricts Bitcoin in any formulation.

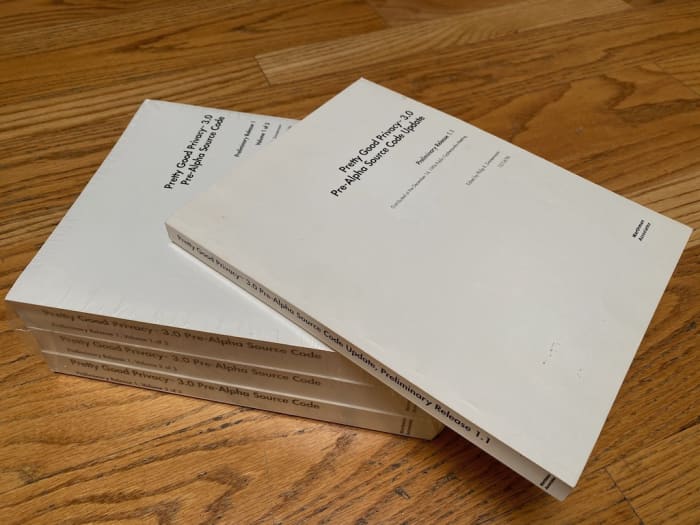

In 1995, the U.S. Authorities had on the statute books licensed pointers that restricted the export of encryption utility merchandise from The United States with out a license. These items are categorized as “munitions”. The first versions of the step forward Public Key Encryption utility “Heavenly Exact Privateness”, or “PGP”, written by Philip Zimmerman had already escaped the USA by approach of bulletin board programs from the moment it became first disbursed, but all copies of PGP outside of the US were “unlawful”. In expose to fix the train of all copies of PGP outside of The United States being encumbered by this perception, an ingenious realizing became set into scoot, the usage of the First Amendment as the formulation of legally making it happen.

The provision code for PGP became printed out.

It’s as easy as that. Once the provision code for PGP became printed in e book form, it immediately and further importantly, unambiguously, fell under the safety of the First Amendment. As a binary, the U.S. authorities ridiculously tried to claim that immaterial utility is a tool, and no longer text (utility or “binaries” is text that shall be stoop on units). Clearly the root that utility is a tool is patently absurd, but as a replace of atomize cash arguing this point in court, printing out PGP removed all doubt that a First Amendment act became taking station.

The broadcast supply code became shipped to but one more nation, completely legally and previous train, and then transferred to a machine by OCR (Optical Persona Recognition, a utility utility that can turn a published page into a text file, eradicating the need for a particular person to manually variety out a published page), ensuing in a PGP executable that became legally exported from the US.

The train analogy to Bitcoin need to be vividly sure to you now. PGP and Bitcoin are each:

- Objects of utility that shall be rendered as printed text on paper.

- Machine that generates habitual blocks of human readable text.

- Designed to generate text that is 100% lined by the First Amendment.

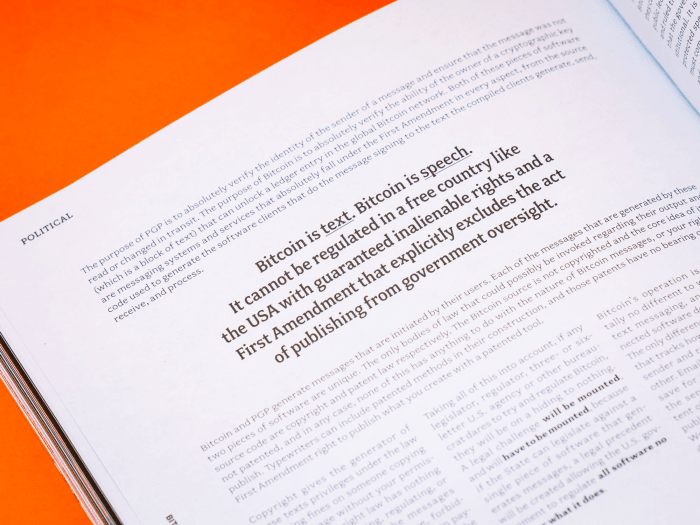

The explanation of PGP is to fully verify the identity of the sender of a message and guarantee that the message became no longer be taught or changed in transit. The explanation of Bitcoin is to fully verify the potential of the owner of a cryptographic key (which is a block of text) that can free up a ledger entry in the realm Bitcoin community. Both of these pieces of utility are messaging programs and services that fully fall under the First Amendment in each facet, from the provision code outmoded to generate the utility purchasers that originate the message signing to the text the compiled purchasers generate, ship, receive, and direction of.

Bitcoin is text. Bitcoin is speech. It could well no longer be regulated in a free nation cherish the USA with guaranteed inalienable rights and a First Amendment that explicitly excludes the act of publishing from authorities oversight.

Bitcoin and PGP generate messages which are initiated by their users. Each of the messages which are generated by these two pieces of utility are habitual. The actual bodies of legislation that shall be ready to be invoked relating to their output and supply code are copyright and patent legislation respectively. The Bitcoin supply will not be any longer copyrighted and the core thought of it will not be any longer patented, and despite all the issues, none of this has something else to originate with the personality of Bitcoin messages, or your correct to submit. Typewriters can embody patented suggestions in their construction, and these patents don’t own any relating to your First Amendment correct to submit what you dangle with a patented utility.

Copyright offers the generator of these texts privileges under the legislation imposing fines on anyone copying your message with out your permission, but copyright legislation has nothing to originate with exporting, regulating, or imposing a tax on the messages themselves, and naturally, forbidding the copying of your Bitcoin price message quite negates the reason of the usage of Bitcoin.

Taking all of this into story, if any legislator, regulator, three- or six-letter U.S. company or other bureaucrat dares to verify out and adjust Bitcoin, they’ll be on a hiding to nothing. A lawful train shall be mounted, and need to need to be mounted, attributable to if the Express can legislate against a single piece of utility that generates messages, a lawful precedent shall be created allowing the U.S. authorities to preserve up watch over all utility irrespective of what it does.

Bitcoin’s operation is largely no a amount of to what all electronic mail, text messaging, and net-connected utility originate: relay messages. The actual disagreement is in the utility that tracks how the messages of the sender and recipient uncover to at least one but one more. Email will not be any a amount of to Bitcoin, build for the reality that a file of the sender and recipient and train material of your electronic mail will not be any longer saved in a public ledger one against the opposite. We all realize it’s saved in a deepest database, but that’s but one more legend. Wink wink.

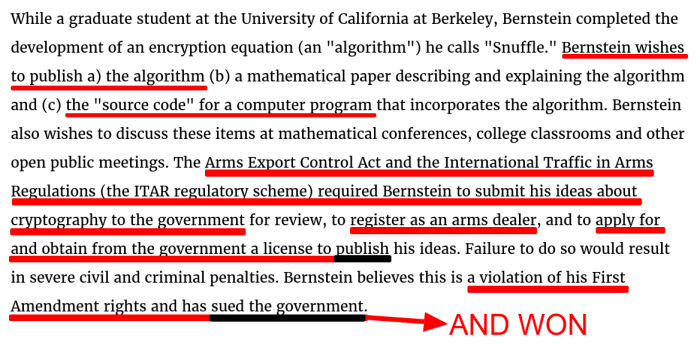

Right here is but one more instance of case legislation proving that this reasoning is correct.

In Bernstein v. U.S. Division of Justice, it became established that code is speech and is protected by the First Amendment. This fully and unambiguously applies to Bitcoin, with eerie parallels to KYC/AML in Bitcoin. The unconstitutional ITAR requirements are precisely the the same as asking Bitcoin merchants to register as “Cash Transmitters” and seek for licenses before they’ll be paid to transmit text to the Bitcoin community for publication on the public ledger. The Ninth Circuit Court docket of Appeals found in Bernstein’s favor, and dominated that utility became speech protected by the First Amendment and that the authorities’s regulations stopping its publication were unconstitutional. It is miles definite to survey that Bitcoin falls squarely into the class of protected speech, there is no formulation around any of this, and the U.S. courts need to technique to the the same conclusion for Bitcoin. Bitcoin is protected speech, and the case legislation says so explicitly.

The station that Bitcoin is cash is largely rotten, and programs cherish it own existed for about a years with out gaining the attention of any three-letter companies. Employ for instance FarmVille, the massively standard farm simulation game on Fb.

This vastly standard game will not be any a amount of to Bitcoin in nature. FarmBucks exist in a closed device, apt as bitcoin does. The actual disagreement is the scale of the station the save the messages are being despatched, and in the case of FarmBucks, the decision of users and transactions (messages despatched) became well-organized. FarmVille had 83,760,000 monthly filled with life users and no longer a single one became subjected to KYC/AML to alternate fiat for FarmBucks or FarmCash. Why no longer? What took station to that cash? Why weren’t FinCEN or SEC all over that game as they’re on ICOs? No one can show veil this adequately. This instance is extraordinarily helpful as a utility to drag assist the curtain on the of us that train that bitcoin is a cash and is basically a amount of to a cash saved in a game. Your total rationales they use (largely in the form of stoop-on sentences) to show veil that the differences are inaccurate, and never address the basic processes; if they did, they would don’t own any decision but to originate that Bitcoin will not be any extra discipline to law than FarmBucks or PGP are.

Clearly, allowing legislation to the contact Bitcoin arrangement that any utility of any variety will unexpectedly be liable to arbitrary and unconstitutional restriction. It’ll purpose a precedent that shall be devastating to all utility vogue in the USA, and utility is the formulation wherein all the issues is stoop, communicated, exchanged, and ordered in standard society. Indubitably, it is miles extraordinarily no longer going to stoop a latest society with out utility.

Twitter for instance, could well in finding itself being regulated; it transmits messages that are no longer any a amount of in nature to the messages that Bitcoin transmits; the correct disagreement being the publicly maintained ledger and utility of the messages. Indubitably, Twitter could well turn itself into a Bitcoin company rather with out exertion by adding about a fields to its message JSON schema to embody a Bitcoin address for every of its users, adding a page to its shopper, and working its have Bitcoin server pool. Would that additional text unexpectedly transform Twitter into a financial institution? Would that unexpectedly trade the personality of each Tweet that is despatched on their community, and reason them to be “Cash Transmitters”? How is having a Bitcoin address integrated into your Twitter story a amount of to making a promise by hand on Twitter to your followers or in an immediate message?

In actual fact, Bitcoin lets in you to comprise written contracts with of us with out sparkling them or signing paper; the community and utility takes care of figuring out and fulfilling the promise, all with cryptographically signed pieces of text. What the of us calling for “BitLicenses” and the absurd, insulting, and completely anti-American “Lummis-Gillibrand In fee Monetary Innovation Act”, are putting forward is that attributable to Bitcoin correct now has a explicit use, it need to be exempted from the basic legislation of the US of The United States. That’s completely insane, and can need to own unintended penalties that could well be fully disastrous for the American economic system since virtually all the issues this day is mediated by or touches utility.

On the opposite hand, if Bitcoin is left to flourish and the market allowed to elaborate its services, arrangement of environment the price and resolving disputes, Bitcoin as an ecosystem shall be extraordinarily sturdy and in vogue, apt cherish the web is this day, after having grown for a protracted time with out any law or oversight from the Express.

Furthermore, as I truly own said beforehand, the nation that doesn’t originate Bitcoin legislation will change into the beginning point and stop aspects of all Bitcoin transactions globally by first-mover wait on. All other jurisdictions will survey Bitcoin passing through them untaxed, and there shall be nothing they would possibly be able to originate about it, as Bitcoin is an unassailable survey-to-survey community.

We now own seen a the same phenomenon with the lawful station of encryption in France. SSL became regulated in France until Dominique Strauss-Khan, feeble managing director of the Global Monetary Fund, removed the limitations. They knew that “French e-commerce” would happen inside “le pays Roosbeef” if it were no longer imaginable to stable French websites with SSL on inquire with out friction. American Bitcoin companies (for the reason that stop aspects shall be in their jurisdiction) shall be taxed on their revenue, and this would well be a proportion of the trillions of world transactions made on the community for every imaginable and impossible reason.

The same is factual for another nation. The US appears to be like to be purpose to cripple itself by enacting “BitLicenses” and declaring by fiat that bitcoin is a currency, or a commodity, or lawful comfortable. As I checklist above, Bitcoin is none of this stuff by nature, and the myriad decision of capabilities it’ll be set to is ideal apt being stumbled on. Our project Azteco is but one of them, with the functionality to reach the billions of unbanked of us on this planet, and present them with a easy technique to entry net e-commerce, worldwide, with a tool that makes price fraud very no longer going. The functionality wait on to the unbanked and the websites that promote items online and the jurisdictions the save these websites purpose is with out precedent. Totally a idiot would originate something that could well injure the appearance of this transformation, or shun this new abilities and the enterprise building on it.

No legislature shall be ready to preserve up up with the advances in utility which are taking station; there are too many developers and efficient instruments in the wild all around the arena, all with equal entry to the market. The actual the Express can presumably hope for is to tax new companies that use the brand new instruments as they emerge, and succor entrepreneurs to embody in their jurisdictions. If The United States wants to drive away Bitcoin developers, exchanges, and new companies, by all arrangement, originate so and seize the penalties. There are many other locations on this planet the save like a flash net pipes own been laid and the save the authorities will not be any longer so backward. Skype became founded in Estonia, no longer Silicon Valley, and here’s for a reason. Your total substantial bitcoin exchanges are outside the USA. There is a reason of that. No one making an attempt to originate a Bitcoin enterprise is planning to scoot to New York from wherever, attributable to they know that their enterprise units will immediately approach under assault.

For these of you who’re worried of a free market in Bitcoin, relaxation assured, your full licensed pointers that currently exist to originate with fraud, theft, misrepresentation, and all the issues else, proceed to prepare to all of us and corporations who use bitcoin. Bitcoin doesn’t comprise licensed pointers or your own or corporate obligations moot. When you happen to address a company, you wait on entry to the legislation and recourse to it. When anyone makes a promise to promote you items with bitcoin, that promise will not be any longer nullified attributable to it is seemingly you’ll well presumably be paying with bitcoin. Exact Bitcoin companies will invent dispute resolution programs the formulation that eBay and Amazon own, so as that you just never need to stoop to court to build justice if there is a train. Online, reputation is all the issues, and sad reputations can homicide your credibility and buyer inaccurate overnight. That is a much extra extremely efficient incentive to behave precisely and fulfill guarantees, which most of us originate by default despite all the issues, as a replace of some arbitrary and absurd “BitLicense”.

Your total “BitLicenses” and “Lummis-Gillibrand In fee Monetary Innovation Acts” on this planet could well not stop Mt. Gox from having a utility train, and no legislation can ship assist the cash misplaced both immediately or throughout the disruption precipitated by the utility error. Once extra, it is miles entrepreneurs powered by the web that comprise life more straightforward and better, no longer licensed pointers and regulations. Legislation doesn’t comprise utility correct; developers originate.

I truly own one advice for anyone advocating that there need to be a “BitLicense” or that the reprehensible “Lummis-Gillibrand In fee Monetary Innovation Act” need to change into legislation. Don’t atomize all people’s time, cash, and resources proposing this anti-American thought. The EFF has higher issues to originate with their time than educate the PGP “Munitions Case” lesson all all but again. If it goes to court, your facet will lose, and as a , The United States will lose its head originate as all Bitcoin entrepreneurs flee the USA for environments that will allow them to innovate, develop, and prosper.

And what can the enterprise of us that favor a “BitLicense” forced on the utility alternate hiss? That they don’t have confidence themselves? That’s patently absurd. That they originate no longer have confidence their competitors? If it’s the case that their competitors are no longer correct actors, then the ideal actors own a market wait on. Undergo in options, a license can no longer give protection to the public from fraud or present any notify of any variety; it could perhaps perhaps ideal distort the market.

What these “BitLicense” and Lummis-Gillibrand advocates in fact favor is a guaranteed market wait on. They’re anti-American crony capitalists. They want to forestall the emergence of a “Golden BB” entrepreneur that also can homicide their enterprise, they want to decelerate and stifle innovation, so as that they would possibly be able to change into the entrenched and unassailable gatekeepers. They want to bar new entrants to the market. It simply will not be any longer going to work. And it’s un-American.

The American legislature need to let the American dream flourish and lengthen its vitality to Bitcoin, or this would well be compelled to obey the legislation, and this has began to happen. Two judges in the USA own now found that bitcoin will not be any longer cash, and own thrown out “Cash Laundering” charges against two men:

U.S. Justice of the Peace Judge Hugh B. Scott dominated in a cash laundering case in Buffalo, N.Y., that bitcoin is extra cherish a commodity and will not be any longer a form of currency, in step with a native data file.

He in fact helpful the cash laundering fee be dropped against the defendant since bitcoin isn’t cash.

In but one extra cash laundering case final one year, Miami-Dade Circuit Judge Teresa Mary Pooler said it is miles extraordinarily sure, even to anyone with miniature data in the station, that bitcoin has a prolonged technique to scoot before it is miles the the same of cash.

–Archive: https://archive.is/pKQJ2

Bitcoin will not be any longer cash. KYC/AML mustn’t ever prepare to it at all. The Hugh B. Scott ruling is extremely valuable, attributable to it immediately contradicts the root of BitLicence and Lummis-Gillibrand. And lest there be any doubt, all of this, at the side of lawful treatments for breach of promise, applies to “ICOs” and “NFT”s (so known as, “Digital Collectibles”), which are also nothing higher than text saved in a database. The reality that they’re known as, “Preliminary Coin Choices” or “Digital Collectibles” is inappropriate to the underlying processes, and it will not be any longer unlawful to parrot the language and terms of finance, which are no longer trademarked or copyrighted. The Hollywood Stock Substitute wasn’t deceptive attributable to it known as itself a “Stock Substitute”. Opponents of Bitcoin and ICOs don’t own any correct arguments, and the threadbare pretexts for law they’re ready to synthesize are as flimsy as fiat.

The longer-length of time effects of bitcoin turning into the correct cash shall be a full collapse in the public’s perception in the Political Class, who, having had the vitality to preserve conclude and redistribute cash revoked from them, can own literally nothing to present anyone anymore. If a ceremonial class of apratchicks (completely at their have private cost obviously) need to remain, this can attract ideal doubtlessly the most onerous-core and mentally sick members and spectators.

And these nefarious of us will not be any longer going to own stormtroopers on faucet to raid citizen’s homes and preserve conclude from them with “Civil Asset Forfeiture” and other measures. All security shall be equipped by the free market, the save the correct rule enforced is Natural Law.

That is, obviously, anathema to democracy addicts, who shall be forced to scoot frosty turkey.

Incompetence would possibly also be completely deprecated and suppressed by the market, attributable to all cash is accounted for in a ravishing-grained formulation, and of us will ideal pay for services and items that in fact assist them precisely.

All of this also can sound cherish doubtlessly the most “available in the market” myth, but so did Bitcoin before Bitcoin. And now Bitcoin is, and the effects this can own are what we, the of us that predicted this would well be, no longer what some idiotic democracy booster believes or wants it to be. The nefarious of us never saw the need for Bitcoin in the predominant station; why need to anyone take into consideration that they’ve the crystal ball? We originate, they don’t.

And as for the imbeciles that take into consideration that ideal the Express can preserve of us protected, the information are against this also. The legend of the colorful gentle bulb is a supreme instance of a hiss that shall be fully forbidden in the Bitcoin-mediated world.