As Coti ramps up efforts to bring a decentralized dismay index to crypto, it has enlisted the lend a hand of Professor Dan Galai, one in every of the pioneering brains behind the Cboe Market Volatility Index (VIX), to lend a hand the organization maintain a crypto-oriented version.

VIX Co-Creator to Be half of Coti-Backed Volatility Mission

Since exchanges for cryptocurrencies first arose, the market and accompanying mark hasten catch confirmed to be amongst the most volatile round. Intraday swings of double-digit share rates are ordinary occurrences.

While it would seem fancy outsized volatility given the market’s dramatic actions and momentum, volatility in and of itself is now not ordinary to crypto. Volatility has furthermore been a key metric for realizing distinct markets, especially the alternate choices market.

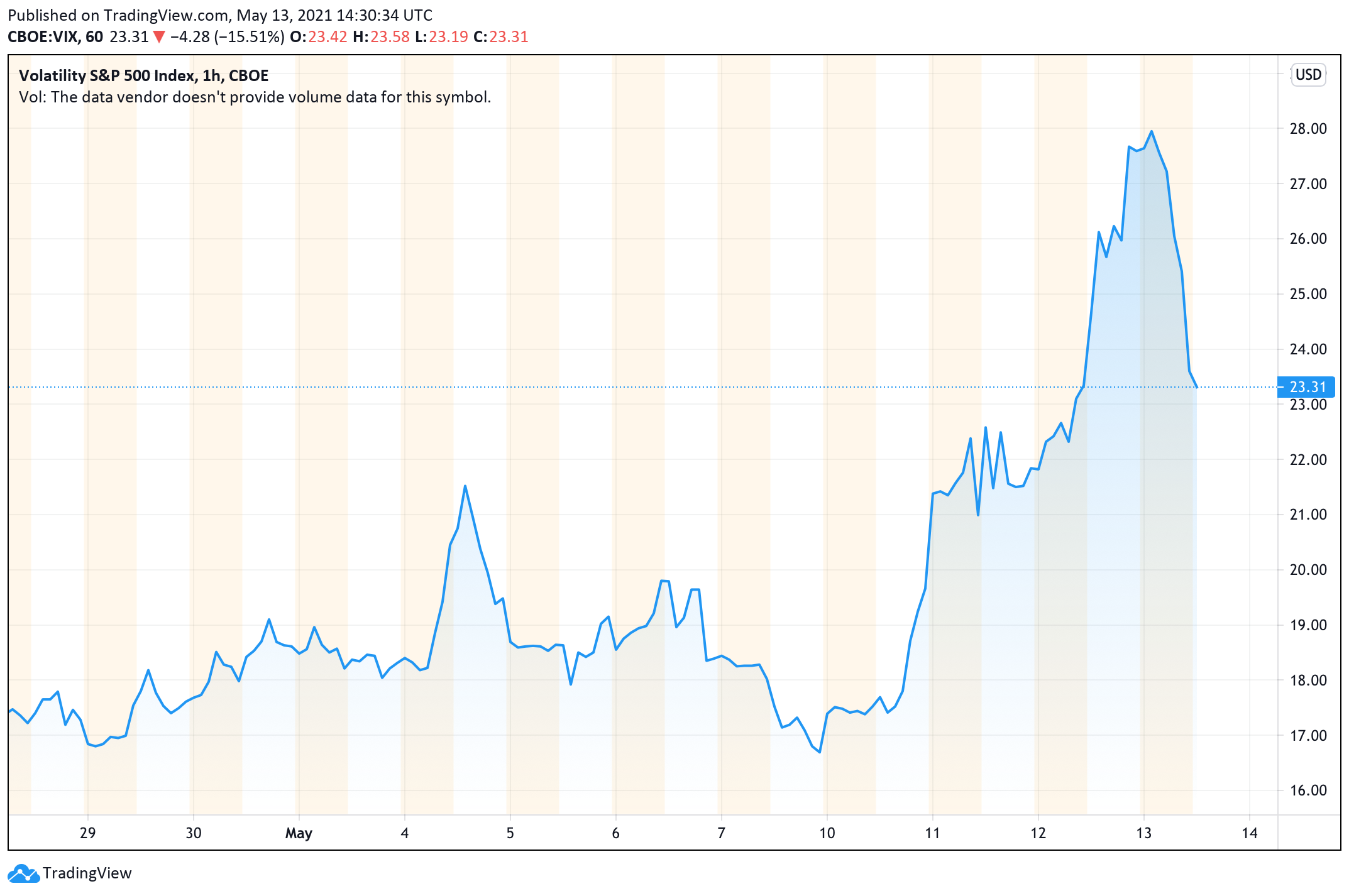

One among the significant barometers for volatility in inventory markets is the Chicago Board Choices Alternate (Cboe) Market Volatility Index, or VIX as it’s more most ceaselessly known. The VIX tracks 30-day implied volatility in S&P 500 alternate choices.

The premise for the VIX was once initially developed by Professor Dan Galai and Menachem Brenner in the insensible 1980s before it was once introduced to the alternate choices exchange in 1993. Since then, it has change into a ubiquitous barometer for trader sentiment and those searching out for security during calamitous situations.

Time and again surging during classes of intense pickups in shopping and selling volumes and downward momentum in underlying inventory prices, the VIX, which is furthermore colloquially is named the “dismay index,” represents how traders assess possibility, dismay, and stress in a market at any given closing date over the next 30 days.

Now Coti, instant for “currency of the web,” is pioneering its private version for the crypto markets, filling the significant need as cryptocurrency continues to historical.

A Unique Ability to Song Expectations and Hedge Cryptos

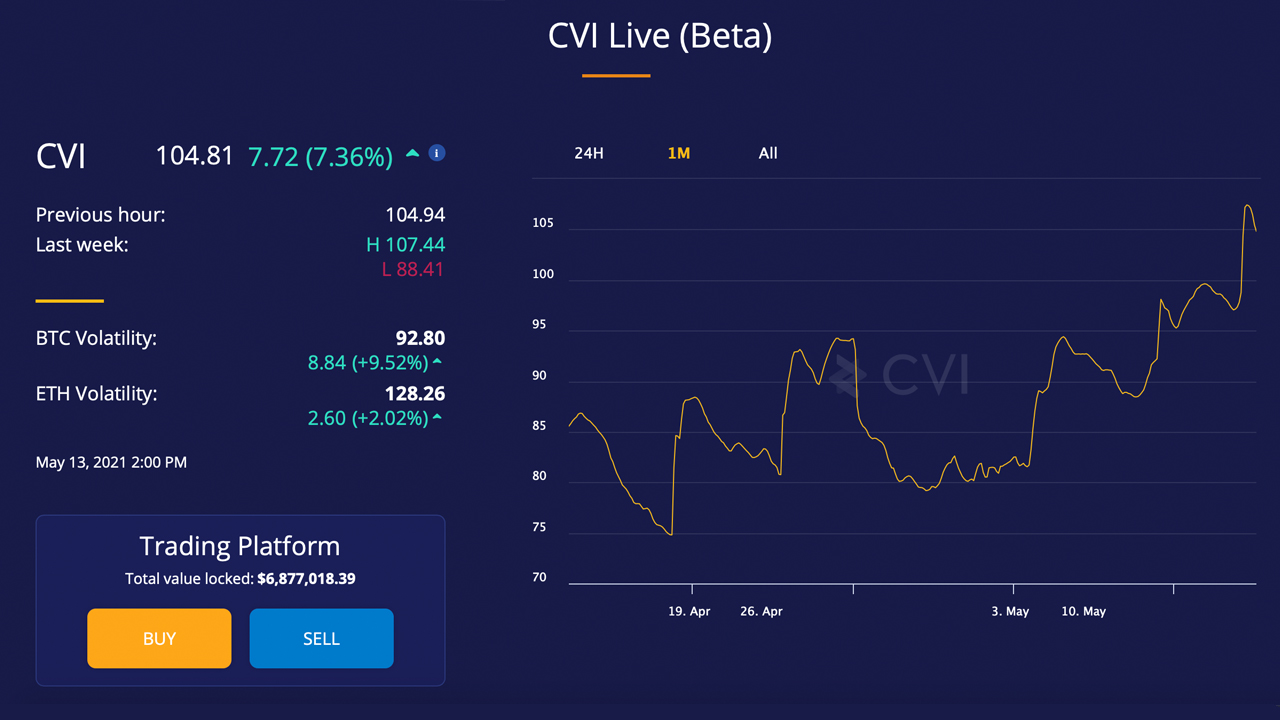

Cryptos’ inherent volatility has equipped Coti with a diversified opportunity to acquire a identical area of interest the VIX already controls in alternate choices markets. The organization, which targets to empower both centralized and decentralized finance through posthaste, scalable, setting friendly, inclusive digital infrastructure, is constructing a crypto dismay index of its private, titled the “Crypto Volatility Index” or CVI for instant.

Crypto Volatility Index (CVI) on Might well 13, 2021.

Crypto Volatility Index (CVI) on Might well 13, 2021.The volatility index, which represents 30-day implied volatility in bitcoin (BTC) and ethereum (ETH), will grant traders the ability to hedge in opposition to rising volatility or leverage it in their programs. It’s designed to echo the efficiency of the VIX but in an completely decentralized layout. Excessive volatility is in general a value that a market downturn shall be all around the corner, but correlation would now not consistently equate to causation as evidenced by the VIX and its corresponding historical past.

To bring its diagram to fruition, Coti is adding Professor Dan Galai to its board of advisors. Galai, who instructions deep skills in possibility management and financial derivatives, can lend a hand oversee the CVI mission as it gradually rolls out the decentralized protocol.

Professor Galai had this to direct:

As advisor to the Crypto Volatility Index mission, I’m taking a watch forward to serving to maintain developed possibility management instruments for traders on this new, and in general wild asset class. I’m confident the CVI group has the recordsdata and ability to position diagram into practice and originate a if truth be told significant product in the cryptocurrency express.