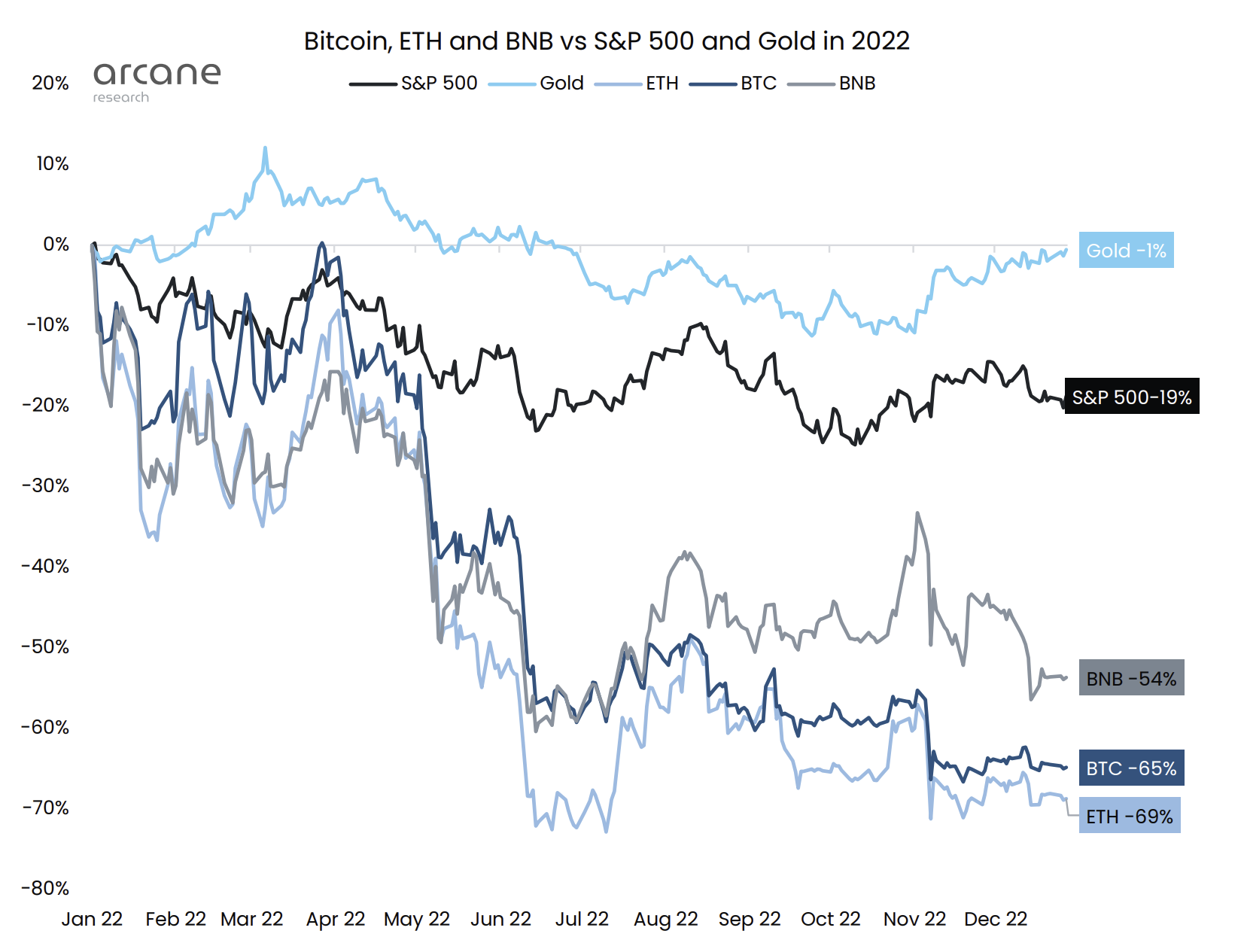

Traditionally, 2022 would possibly moreover cease up being the second-worst 300 and sixty five days for Bitcoin since 2011. At present label, BTC has a 300 and sixty five days-to-date (YTD) performance of -65%, topped only by 2018 when the label lost -73% in a single 300 and sixty five days.

As Arcane Be taught notes in its 300 and sixty five days-cease document for 2022, physical gold (-1% YTD) has a good deal outperformed digital gold, Bitcoin, in a duration of excessive inflation. Which capacity, the analytics firm notes that the digital gold myth change into premature.

As Arcane Be taught notes, the crypto winter change into in actuality fueled by tightening macroeconomic stipulations and crypto-particular leverage and heart-broken chance management by core market contributors. BTC had adopted the U.S. equity markets due to its excessive correlation.

“As opposed to two positive events in 2022, BTC adopted U.S. equities very closely. The two outliers of June (3AC, Celsius etc.) and November (FTX), are to blame for the total underperformance of BTC vs. the U.S. equities,” the document states, showing the following chart.

For the arriving 300 and sixty five days 2023, Arcane Be taught expects that contagion effects will “potentially” proceed in early 2023. “[B]ut we watch it as likely that the massive majority of 2023 shall be less frantic and borderline uneventful compared to the closing three years,” Arcane Be taught predicts.

With that in mind, the firm expects Bitcoin to replace in a “basically flat range” in 2023, however to secure the 300 and sixty five days with an even bigger label than it did to birth out with up.

Bitcoin’s present drawdowns closely resemble the undergo market patterns of earlier cycles, Arcane Be taught elicits. Whereas the 2018 undergo market lasted 364 days from high to cease, the 2014-15 undergo market lasted 407 days. The present cycle is on its 376th day. This places the ongoing undergo market exactly between the duration in every earlier cycles.

“If a fresh bottom is reached in 2023, this would possibly possibly presumably be the longest-lasting BTC drawdown ever,” the firm acknowledged and extra elaborated that there are a good deal of doable catalysts for a illustrious bull market:

The FTX complaints would possibly moreover incentivize extra speedily progress with rules, and we watch every certain signals linked to U.S. field BTC ETF launches and extra coherent classifications of tokens as a plausible by the tip of the 300 and sixty five days, with replace tokens being particularly exposed for doable security classifications.

Concerning Grayscale’s Bitcoin field ETF utility, February 3 shall be a crucial date for the industry when the three-opt panel will rule on the SEC complaint.

To boot, Arcane Be taught expects another catalyst from Europe: namely, the passage of the MiCA Act by the European Parliament in February 2023. The core prediction for 2023 remains that Bitcoin will earn neatly despite the tightening macroeconomic difficulty and that now would possibly presumably be “a unbelievable rental to compose boring BTC publicity.”

However, the originate up of 2023 would possibly moreover very neatly be bumpy as trading volumes and volatility decline in a worthy duller market than in the previous three years. In abstract, Arcane Be taught which capacity truth estimates:

As we reach into the subsequent 300 and sixty five days, patience and long-timeframe positioning shall be key.

At press time, the BTC label traded at $16,497, going by means of extra downward stress, potentially due to tax harvesting by 300 and sixty five days-cease.

Featured image from Wance Paleri / Unsplash, Charts from Arcane Be taught and TradingView.com