Bitcoin mining companies continue struggling to live to converse the tale the continuing endure market. Dreams of outperforming bitcoin as a public mining company are lengthy long gone. Bankruptcies and court docket cases have routine headlines. And even Wall Boulevard analysts that were once bullish on bitcoin mining investment alternatives now remark they’re “pulling the shuffle” except the market improves. But exactly how tainted is the sleek endure market?

It’s continuously darkest before morning time, as the adage says. And when put next to outdated endure markets, the mining alternate appears to be a lot closer to the live of a turbulent market phase than the starting of it. This article explores a bunch of data sets from the sleek and outdated endure markets to contextualize the speak of the alternate and the contrivance the mining sector is faring. From hardware lifecycles and miner balances, to hash price enhance and hash mark declines, all of these facts expose a explicit yarn about no doubt one of Bitcoin’s most indispensable financial sectors.

Mining Earnings Is Evaporating

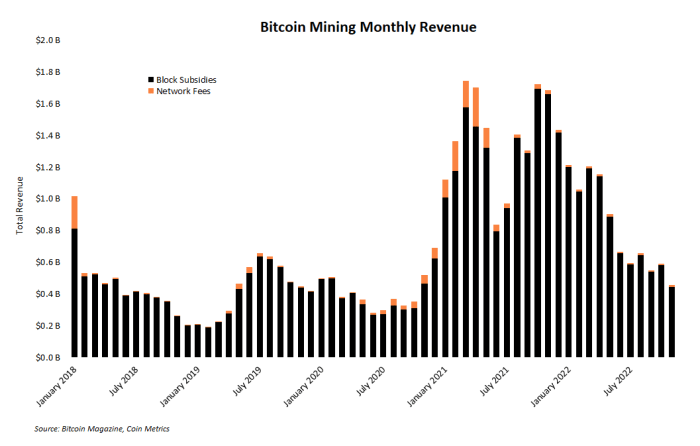

When bitcoin’s mark drops, it’s now not surprising that dollar-denominated mining revenue also drops. But it has – loads. Roughly 900 BTC are mild mined on each day foundation and can fair be except the next halving in 2024. However the fiat mark for these bitcoin has plummeted this three hundred and sixty five days, that approach miners possess far fewer greenbacks for charges cherish electrical energy, repairs and the servicing of loans.

Because the chart below demonstrates, in November, your total bitcoin mining alternate earned now not up to $500 million from processing transactions and issuing new coins. The bar chart below reveals this monthly revenue when put next to the past five years. November mining revenue marks a two-three hundred and sixty five days low for monthly earnings.

This past month marked a two-three hundred and sixty five days low for Bitcoin mining company revenue.

Doubtless Hash Price Uptrend Reversal

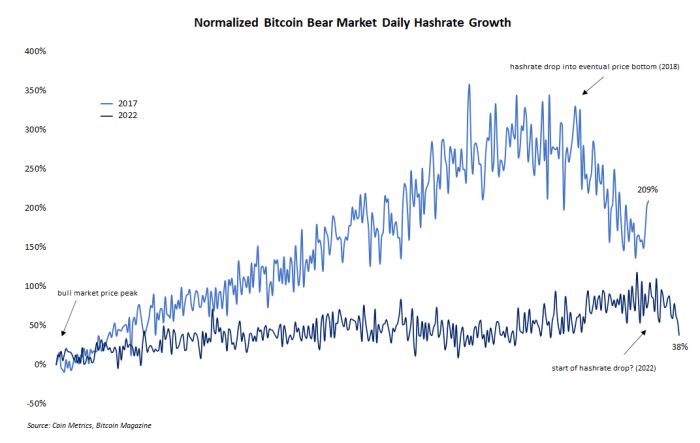

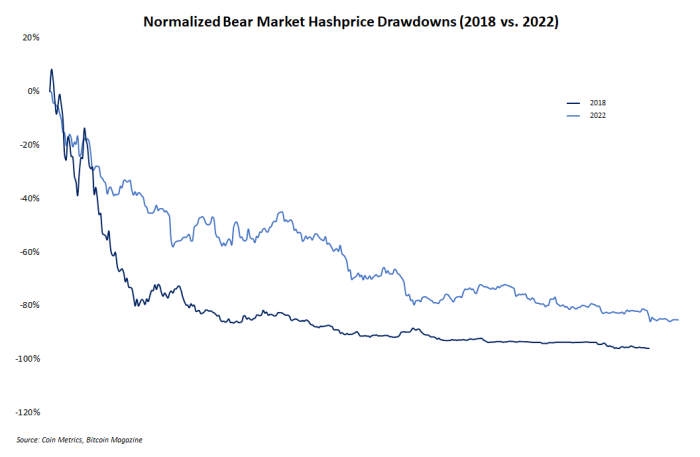

Comparing the sleek endure market to the outdated one in 2018 provides some appealing insights into how the mining alternate has changed and the contrivance it has remained the the same. One such comparison is hash price enhance all the contrivance by downward mark trends. It’s now not sleek to glimpse hash price develop all the contrivance by endure markets. The annotated line chart below reveals normalized hash price enhance all the contrivance by the 2018 and 2022 endure markets from bitcoin’s mark peak to the drawdowns’ historic past (or sleek) lows.

But one thing that is clearly lacking from the above chart is a correction in hash price enhance all the contrivance by the later period of the bearish phase. In 2018, let’s remark, the enhance pattern clearly changed route and dropped as the market within the finish stumbled on a low for bitcoin’s mark. But within the sleek market, hash price has entirely grown. Perchance a limited tumble in hash price by behind November indicators a pattern replace, nonetheless the quiz is mild originate.

Collapse Of Public Mining Corporations

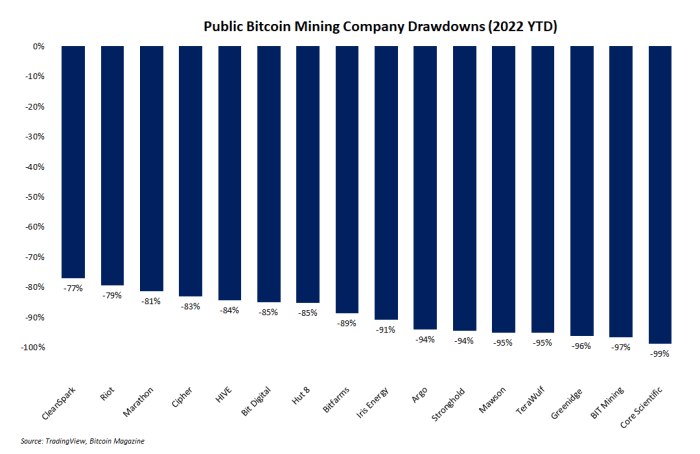

Perchance the most brutal bitcoin mining chart of all reveals the drawdowns of publicly-traded mining companies this three hundred and sixty five days. It’s no secret that the past three hundred and sixty five days has been brutal for bitcoin, various cryptocurrencies, and the global economy in traditional. But mining companies critically were clobbered. Over half of of these companies possess considered their portion costs drop over 90% since January. Easiest two — CleanSpark and Revolt Blockchain — possess now not dropped bigger than 80%.

Mining companies in traditional are regularly regarded as to be a excessive-beta investment in bitcoin, that approach when bitcoin goes up, mining stock costs dawdle up extra. But this market dynamic cuts every ways, and when bitcoin falls, the contrivance back for mining shares is a lot extra brutal. The bar chart below reveals the bloodbath these shares possess persevered.

The Rise And Fall Of Bitcoin Mining’s ‘AK-47’

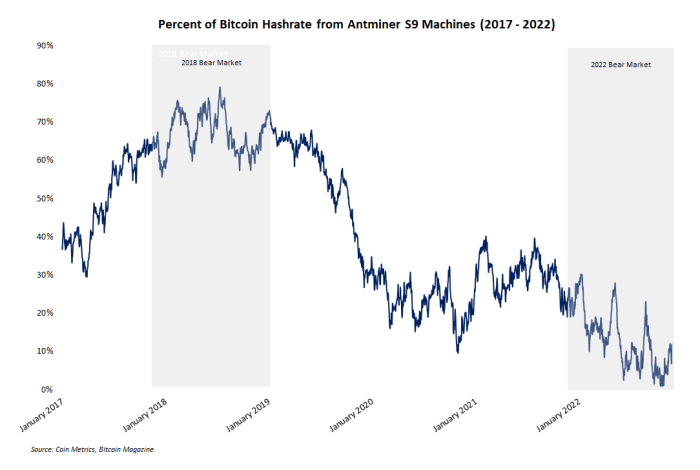

An underappreciated hallmark of the sleek bitcoin endure market is the precipitous decline in hash price contributed by Bitmain’s Antminer S9 machines. This model of mining machine is from time to time referred to as the “AK-47” of mining for that reason of its sturdiness and legit efficiency. And at one point within the 2018 endure market, the S9 became once king. Nearly 80% of Bitcoin’s whole hash price got right here from this Bitmain model all the contrivance by the depths of the outdated endure market.

However the sleek endure market tells an fully various yarn. On account of new, extra efficient hardware and a vice-grip squeeze on mining profit margins, the percentage of hash price from S9s dropped below 2% in early November. The annotated line chart below reveals the rise and drop of this machine.

Miner Stability Retraces Its Sell Off

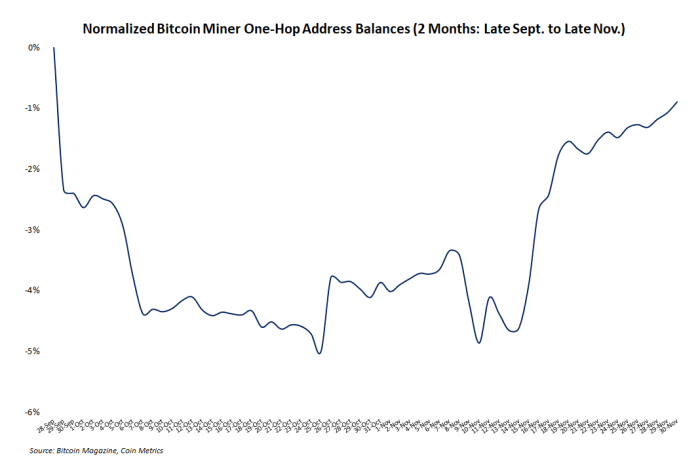

The past few months were disastrous for the “crypto” alternate as replace wars, bancrupt custodians and various kinds of industrial contagion swept the market. Many bitcoin traders cherish to earn their phase of the alternate is mostly insulated from the chaos of the the relaxation of “crypto,” nonetheless right here is in total spurious. In the case of miners, who’re notoriously tainted at timing the market, some dread became once evident as address balances and miner outflows regarded as if it could perchance most likely maybe tumble and spike, respectively.

But this exercise became once short lived. The road chart below reveals that miner address balances possess nearly fully retraced their tumble from behind September by October. Briefly, miners seem like support in HODL mode, impervious to exogenous market events. Whether or now not the endure market is over or now not is unknown. But miners seem like amassing bigger than selling.

Hash Tag Fall At the sleek time Vs. 2018

Hash mark is no doubt one of many most traditional financial metrics for miners to note, even when few folks originate air of the mining sector perceive it. Briefly, this metric represents the dollar-denominated revenue expected to be earned per marginal unit of hash price. And cherish every little thing else within the endure market, hash mark has fallen considerably. But its decline is now not sleek, especially when or now not it is when put next to the hash mark decline in 2018.

Proven within the chart below are normalized hash mark drawdowns from 2018 and 2022. Readers will imprint the barely same slope and measurement of the drawdowns. 2018 became once pretty steeper. 2022 up to now has been shallower nonetheless longer. But every were and are brutal for fledgling mining operations.

The Next Portion Of Mining

Relate and bust cycles are a pure sequence of events for any effectively functioning market. The bitcoin mining sector is just not any exception. For the past three hundred and sixty five days, mining has considered its weaker, unprepared operators weeded out as the excesses from the bull market are delivered to yarn. Now, within the depths of a bearish period, the explicit builders can continue to expand their operations and manufacture a solid foundation for the next phase of euphoric bullishness.

This is a guest post by Zack Voell. Opinions expressed are fully their own and accomplish now not primarily reflect these of BTC Inc or Bitcoin Journal.