In accordance with a latest Bloomberg article, John Roque of 22V study believes that Ethereum might possibly well fall to $420, a loss of 80% from its fee model, and here’s why.

Ethereum Would possibly perhaps perhaps well also Drop 80%

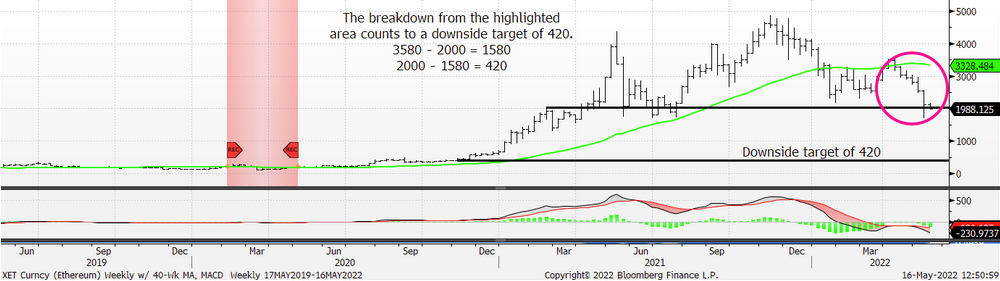

The trader believes Ethereum, which is within the intervening time procuring and selling at $2,000, is set to ruin by the toughen zone and will most likely fall below $420. Roque drew consideration to a model vary whereby $3,580 is the give up and $2,000 is the backside.

With Ether falling below $2,000, it is now not any longer within the beforehand specified vary and will begin to fall to the next important chart toughen at around $420.

Source: 22v Study

As a result of the 2nd-most appealing cryptocurrency is shedding model, it has fallen below all spirited averages, in conjunction with the 50-, 100-, and 200-day traces. The above-mentioned indicators’ downward movement is a important bearish factor for any asset.

Ethereum is moreover oversold on both the weekly and daily charts, in accordance to Roque, which is why it might well’t rally within the foreseeable future.

ETH/USD trades aroun $2k. Source: TradingView

While the analyst claims that Ethereum is de facto “over” key toughen ranges for the 2nd most appealing cryptocurrency on the market might possibly peaceable be considered. On the weekly chart, as an example, traders have but to take a look at 200-week moderate toughen.

Linked Reading | Bitcoin Indicator Hits Historical Low Not Considered Since 2015

ETH Alternate Provide Rising

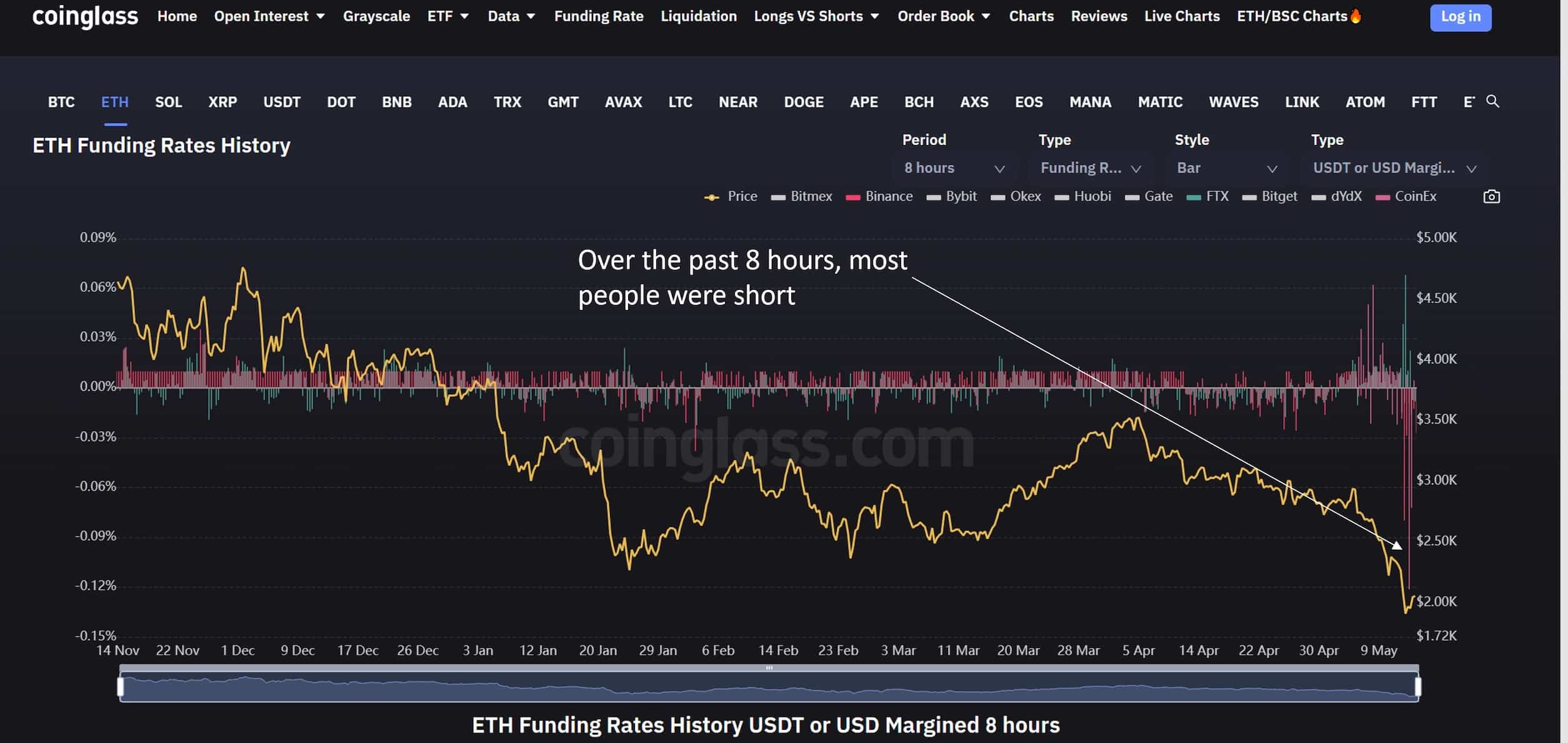

Santiment, an on-chain data provider, affords us an perception into what Ethereum’s subsequent model movement might possibly very nicely be (ETH). On an 8-hour chart, natty shorts for Ethereum at $2,000 have constructed up, in accordance to the information provider.

Nonetheless, in accordance to Santiment, this customarily doesn’t determine with the shorter, and a brief squeeze is liable to ensue. In consequence, the associated fee of Ethereum might possibly upward thrust again.

Recordsdata shows funding charges historical previous. Source: Santiment

The ETH substitute provide is one other merchandise to have in ideas. Santiment observes:

“While we saw a nice fall in provide on exchanges for the previous three hundred and sixty five days or so, Would possibly perhaps perhaps well also 1st 2022 saw an massive achieve bigger in provide on exchanges as people rushed to exit their positions, which is clearly reflected on the associated fee itself.”

In consequence, any future achieve bigger within the unreal provide will situation off one other decline. Which capacity that investors are jumpy and have given up entirely. Though the worry seems dire, this would perhaps very nicely be an nice time to possess unusual roles.

Linked reading | Ethereum Hashrate Breaks All-Time High, Will Label Practice?

Featured image from iStockPhoto, Charts from TradingView.com