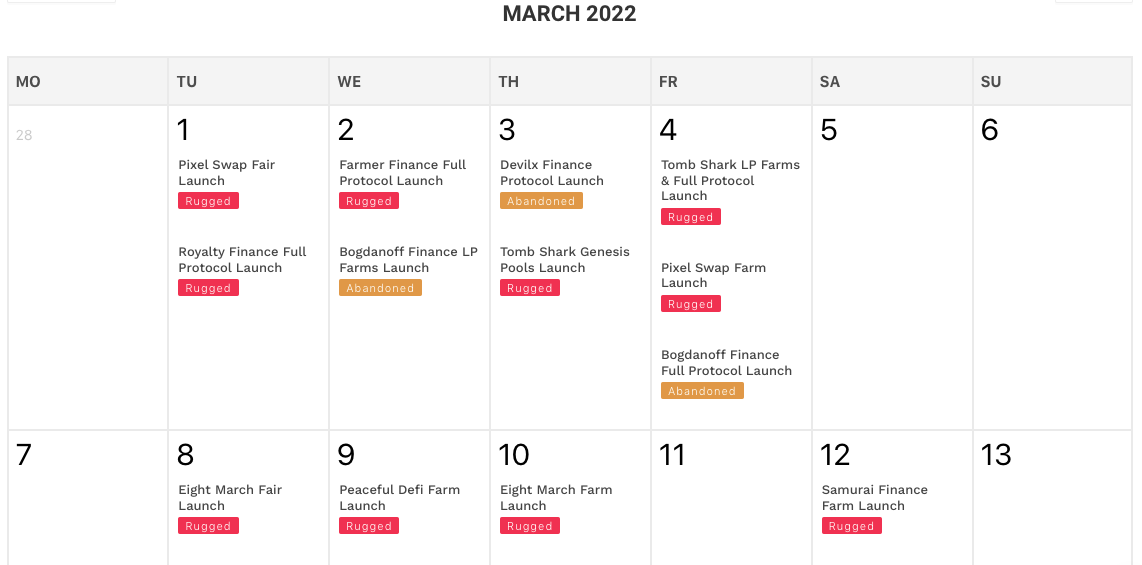

The security of the DeFi and especially the FTM ecosystem is shaking as “Tomb Fork” tasks appear to be the finest save for scams to thrive. Even after some investigation, what might maybe maybe seek take care of a safer venture can easy prove to be a fraud.

Recently, PulseDAO got rugged. Allegedly, their earn dev turned against the and KYC might maybe maybe now not be enough to abet this particular person responsible.

Tomb Forks And Rug Pulls

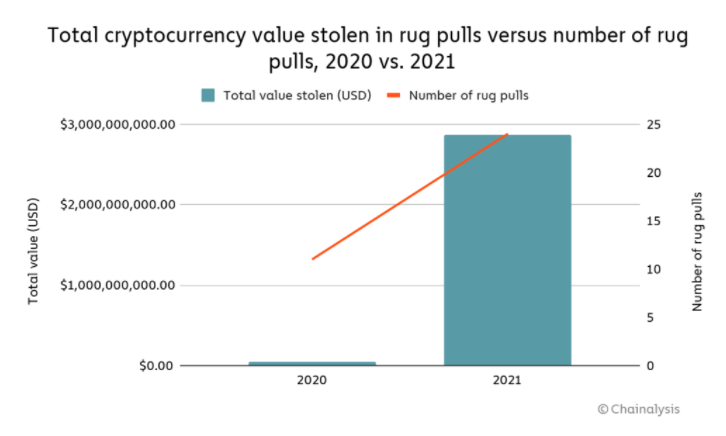

As per Chainalysis records, in 2021 DeFi rug pulls took over $2.8 billion price of crypto and accounted for 37% of all cryptocurrency rip-off income in the three hundred and sixty five days, versus appropriate 1% in 2020.

A unstable model known as Tomb Fork, in general FTM-basically based totally, has change into ultimate for rug pulls and various investors abet falling in.

A unstable model known as Tomb Fork, in general FTM-basically based totally, has change into ultimate for rug pulls and various investors abet falling in.

Pulse became a venture that allowed users to “acquire their earn prediction markets about anything.” They launched a token model with the promise of rewarding “all members pretty, whereas additionally making the network resilient.”

PulseDAO became a Tomb Fork. In accordance with Tomb Finance, Tomb forks are algorithmic stablecoin tasks that peg their token to 1 other coin, first and indispensable FTM.

Within the case of Tomb Finance, they intend to “acquire a mirrored, liquid asset that would be moved around and traded with out restrictions.”

The PulseDAO Rug

The rug became confirmed by Rugdoc.io, who had beforehand warned that the venture had a threat of governance mishandling and they wanted their contracts to be subjected to a chubby audit with a excellent auditor. They highlighted the next threat vectors:

-

No longer KYC’d with RugDoc

-

No decent audits as of date

-

Liquidity is now not locked with RugDoc

-

No longer in a multisig. We extremely counsel the venture to make exhaust of 1 with community members or decent 3rd events as an approver as a result of the talked about governance threat.

Then, they spotted that 4243 FTM became eradicated from the venture by the contract owner here. It appears to be take care of they pulled out practically all of the venture’s liquidity.

“It appears to be Tomb forks personal inherent governance dangers, which is why it is a long way extreme to personal renounced contracts and KYC in save prior to coming into.”

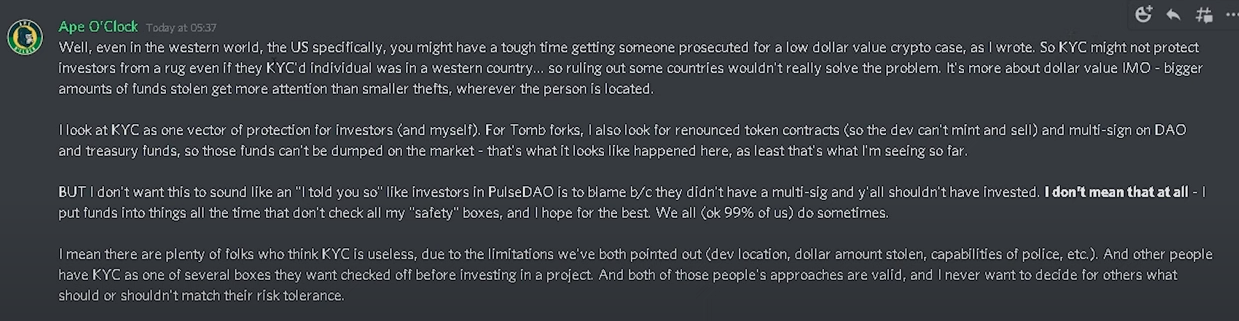

Nonetheless, RugDoc missed that PulseDAO did KYC with ApeOClock, nonetheless it became now not enough for security, and here’s a extraordinarily critical advise for investors to personal in mind. Is KYC enough? More on that below.

About 5 days prior to now, PulseDAO talked about through Discord they were having components with their spoiled-chain bridge, nonetheless nothing more. After March 13, all accounts and net sites were down or deleted.

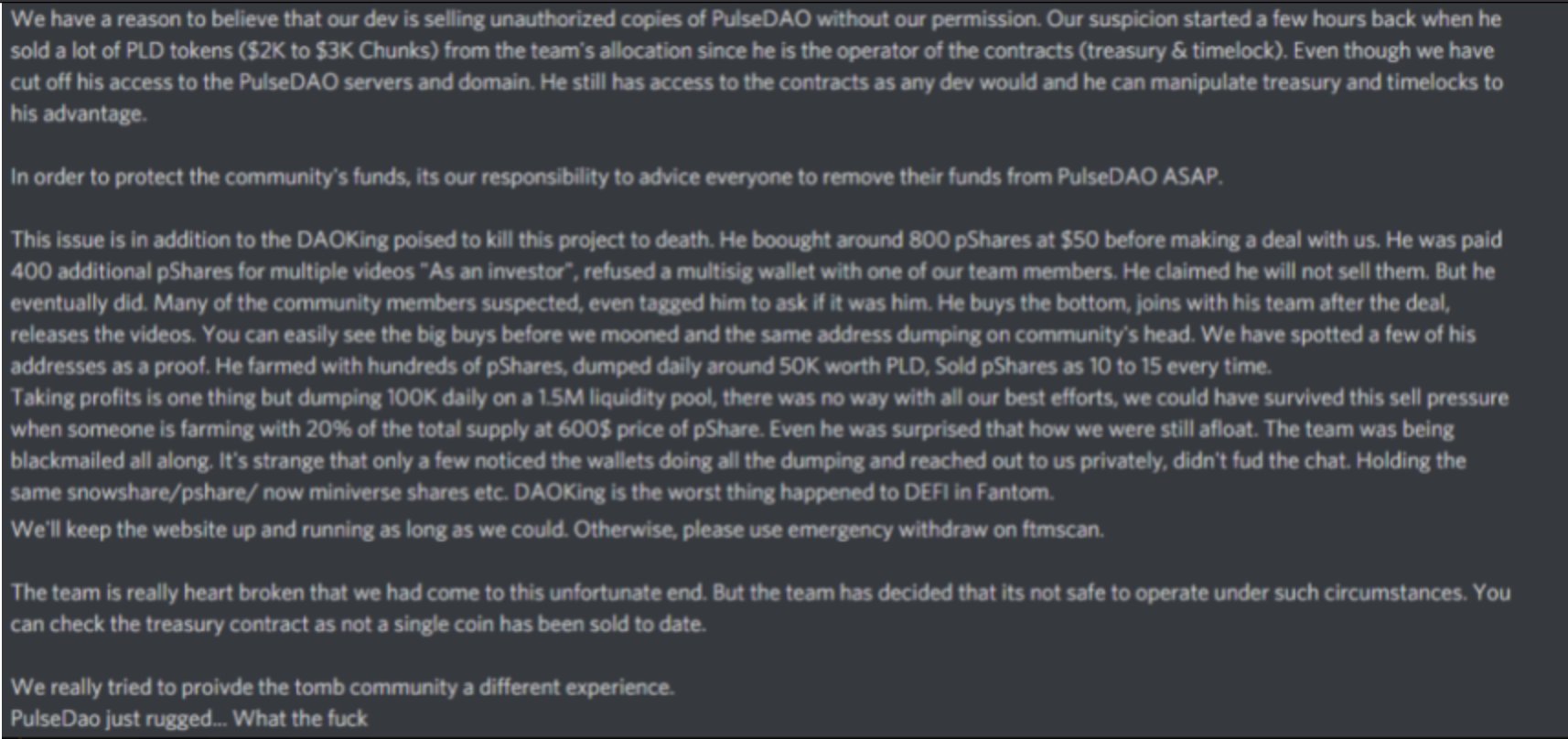

There might maybe be now not mighty recordsdata running around, nonetheless scraping screenshots of messages from the crew, here’s one amongst the excuses they gave:

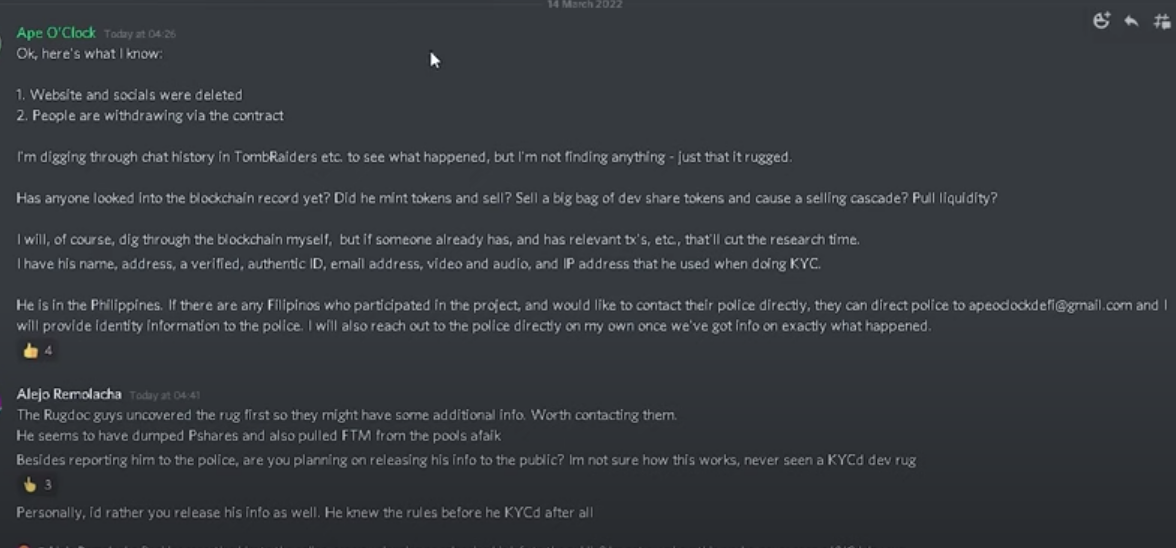

But even Ape O’Clock, the platform they primitive for their KYC, became puzzled:

The crew’s cited an particular person that became “poised to abolish the venture”, “DAOKing”. He’s a YouTuber who apparently had made a take care of PulseDAO to compare them in a video. This YouTuber claims they primitive him as a scapegoat and that he is totally one amongst their largest holders and got rugged as effectively.

He listed his pockets in a most fresh video and actions might maybe maybe very effectively be checked through FTMScan. Even supposing he claims otherwise, some users divulge it is a long way unclear if he owns diversified wallets. Nonetheless, he appears to be to be actively taking part with Ape O’Clock to analyze the pull and purchase action.

To this level, it does seem take care of a dev rugged your complete venture.

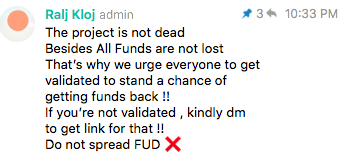

PulseDAO Telegram channel claims the next:

The crew additionally talked about they are investigating the “assault” and fixing their website and will purchase responsibility.

They additionally claimed the motive they took their Discord channel and Twitter down became that they need “encouragement, make stronger and optimism now not FUD and disheartening comments” whereas they take care of to revive companies and products.

Deciding to purchase down all most important sources of recordsdata is a extraordinarily authentic change ought to you wish to purchase responsibility.

Moreover, the sample of rug pulls components out an unsustainable model: Tomb Forks.

Some are rapid spotted as onerous pulls, meaning that the devs coded the token with a malicious backdoor; some are gentle pulls, meaning that the venture will get dumped.

Linked Reading | A Run For The Truth: Fantom Vs. Rekt, What Went Down

Why KYC Didn’t Topic

Many investors compare a security field when a venture has KYC, nonetheless the PulseDAO example reveals its primitive face.

One of the critical critical causes it might maybe maybe most likely well now not gather any distinction are:

- Getting higher crypto thefts from some international locations might maybe maybe very effectively be difficult or even very unlikely.

- Authorities might maybe maybe now not seek into smaller crypto tasks.

- Scammers might maybe maybe now not even be held responsible in different international locations since the rug pull falls into gray areas.

A particular person pondered: “How will we query DeFi as a complete to assemble and grow if the is rarely any safeguard in save?”

FTM Achieve

Fantom (FTM) has been shopping and selling around $1.08 in the on each day basis chart, down 5.50% in the last 24 hours. The coin has skilled pains from investors thanks to the departure of most important builders. The root has claimed this might maybe maybe now not affect their plans.

Linked Reading | Why Fantom Fell 22% Following Key Personnel Exit