This is an notion editorial by Taimur Ahmad, a graduate scholar at Stanford University, focusing on vitality, environmental policy and international politics.

Author’s expose: This is the first fraction of a 3-fraction e-newsletter.

Part 1 introduces the Bitcoin fashionable and assesses Bitcoin as an inflation hedge, going deeper into the opinion that of inflation.

Part 2 makes a speciality of the brand new fiat system, how money is created, what the money provide is and begins to touch upon bitcoin as money.

Part 3 delves into the history of money, its relationship to converse and society, inflation within the World South, the revolutionary case for/in opposition to Bitcoin as money and replacement spend-circumstances.

Bitcoin As Cash: Progressivism, Neoclassical Economics, And Picks Part II

*The next is a genuine away continuation of a checklist from the outdated fragment on this sequence.

3. Cash, Cash Provide And Banking

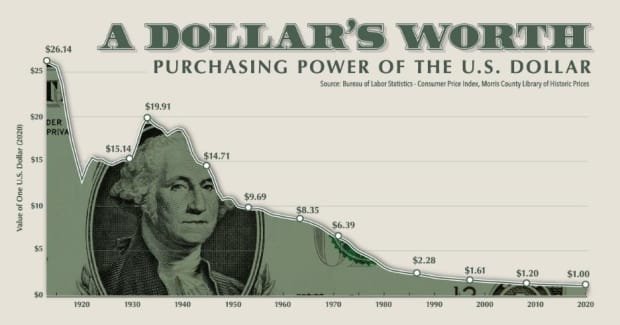

Now onto the third point that gets everyone riled up on Twitter: What’s money, what’s money printing and what’s the money provide? Let me start by announcing that the first argument that made me serious of the political economic system of Bitcoin-as-money was the unfriendly, sacrilegious chart that reveals that the U.S. buck has lost 99% of its rate over time. Most Bitcoiners, at the side of Michael Saylor and co., grab to fraction this as the bedrock of the argument for bitcoin as money. Cash provide goes up, rate of the buck comes down — currency debasement at the hands of the govt, as the narrative goes.

I comprise already defined in Part 1 what I take into story the relationship between money provide and costs, nonetheless here I’d grab to lunge one level deeper.

Let’s start with what money is. It’s a speak on real sources. No matter the out of the ordinary, contested debates across historians, anthropologists, economists, ecologists, philosophers, and plenty others., about what counts as money or its dynamics, I have confidence it is low-rate to comprise interaction that the underlying speak across the board is that it is a side that lets within the holder to cling items and companies.

With this backdrop then, it doesn’t accumulate sense to glimpse at an isolated rate of money. Truly though, how can any individual showcase the cost of money in and of itself (e.g., the cost of the buck is down 99%)? Its rate is solely relative to one thing, both loads of currencies or the quantity of issues and companies that can even be procured. In consequence of this fact, the fatalistic chart showing the debasement of fiat doesn’t allege one thing else. What matters is the buying strength of patrons the spend of that fiat currency, as wages and loads of social kinfolk denominated in fiat currency also pass synchronously. Are U.S. patrons ready to pick out 99% much less with their wages? No doubt no longer.

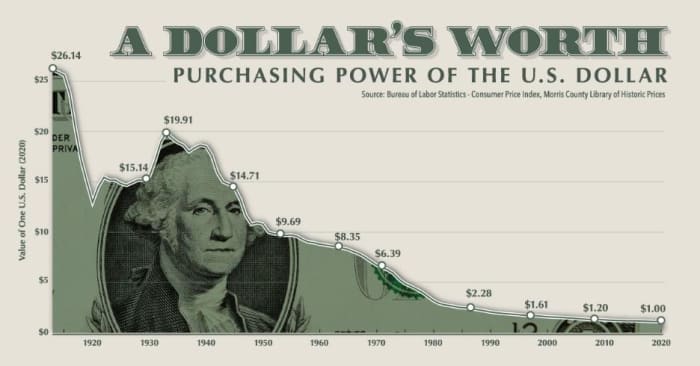

The counterarguments to this in overall are that wages don’t withhold up with inflation and that over the quick-medium term, money financial savings lose rate which hurts the working class because it doesn’t comprise accumulate entry to to high yielding investments. Real wages within the U.S. were constant since the early 1970s, which in and of itself is a first-rate socioeconomic field. But there isn’t any longer any such thing as a converse causal hyperlink between the expansionary nature of fiat and this wage construction. In spite of every thing, the 1970s were the start of the neoliberal regime under which labor strength was beaten, economies were deregulated in want of capital and industrial jobs were outsourced to underpaid and exploited workers within the World South. But I digress.

Let’s lunge encourage to the what’s money ask. Other than a speak over sources, is money also a store of rate over the medium term? Over again, I have to be determined that I am talking solely about developed nations thus a long way, where hyperinflation isn’t an genuine side so buying strength doesn’t erode overnight. I’d argue that it is no longer the role of money — money and its equivalents respect bank deposits — to support as a store of rate over the medium-long urge. It’s miles speculated to support as a medium of exchange which requires designate balance solely within the quick urge, coupled with insensible and anticipated devaluation over time. Combining each aspects — a extremely liquid, exchangeable asset and a long-term financial savings mechanism — into one side makes money an superior, and probably even contradictory, theory.

To guard buying strength, accumulate entry to to financial companies needs to be expanded in grunt that folks comprise accumulate entry to to barely safe resources that withhold up with inflation. Concentration of the financial sector into a handful of gigantic gamers pushed by profit motive by myself is a first-rate impediment to this. There may be no longer any such thing as a inherent reason that an inflationary fiat currency has to outcome in a lack of buying strength time, particularly when, as argued in Part 1, designate changes can happen attributable to a few of non-monetary reasons. Our socioeconomic setup, in which I imply the skill of labor to barter wages, what happens to merit, and plenty others., needs to enable buying strength to upward thrust. Let’s no longer neglect that within the put up-WWII abilities this was being executed even supposing money provide was no longer increasing (formally the U.S. was under the gold fashionable nonetheless we comprehend it was no longer being enforced, which resulted in Nixon transferring a long way from the system in 1971).

Okay so where does money come from and were 40% of bucks printed for the length of the 2020 govt stimulus, as is many times claimed?

Neoclassical economics, which the Bitcoin fashionable narrative employs at loads of stages, argues that the govt.both borrows money by promoting debt, or that it prints money. Banks lend money basically based fully on deposits by their customers (savers), with fractional reserve banking allowing banks to lend multiples elevated than what’s deposited. It comes as no surprise to any individual who is mild learning that I’d argue each these ideas are unsuitable.

Right here’s the correct narrative which (situation off warning all over again) is MMT basically based fully — credit where it is due — nonetheless agreed to by bond investors and financial market experts, even though they disagree on the implications. The government has a monopoly on money advent by its enviornment as the sovereign. It creates the nationwide currency, imposes taxes and fines in it and makes spend of its political authority to defend in opposition to incorrect.

There are two determined systems for the duration of which The Whine interacts with the monetary system: one, by the central bank, it offers liquidity to the banking system. The central bank doesn’t “print money” as we colloquially observe it, moderately it creates bank reserves, a loads of build of money that isn’t for sure money that is ragged to recall items and companies within the true economic system. These are resources for industrial banks which will be ragged for inter-bank operations.

Quantitative easing (those provoking immense numbers that the central bank announces it is injecting by shopping bonds) is categorically no longer money printing, nonetheless merely central banks swapping ardour bearing bonds with bank reserves, a accumulate fair transaction as a long way as the money provide is alive to even supposing the central bank balance sheet expands. It does comprise an affect on asset prices by loads of oblique mechanisms, nonetheless I received’t lunge into the crucial parts here and may honest let this sizable thread by Alfonso Peccatiello (@MacroAlf on Twitter) point out.

So the next time you hear regarding the Fed “printing trillions” or rising its balance sheet by X trillion, appropriate take into story whether or no longer you is probably to be for sure talking about reserves, which all over again don’t enter the true economic system so attain no longer contribute to “extra money chasing an identical quantity of issues” narrative, or valid money in circulation.

Two, the govt.also can moreover, by the Treasury, or its identical, build money (long-established of us money) that is distributed by the govt.s bank – the central bank. The modus operandi for this operation is in overall as follows:

- Mumble the govt.decides to send a one-time money switch to all voters.

- The Treasury authorizes that fee and initiatives the central bank to enact it.

- The central bank marks up the story that every industrial bank has at the central bank (all digital, appropriate numbers on a display — these are reserves being created).

- the industrial banks correspondingly rate up the accounts of their customers (here’s money being created).

- customers/voters accumulate extra money to use/attach.

This build of govt spending (fiscal policy) straight away injects money into the economic system and is thus determined from monetary policy. Mutter money transfers, unemployment advantages, funds to distributors, and plenty others., are examples of fiscal spending.

Most of what we name money, nonetheless, is created by industrial banks straight away. Banks are licensed brokers of The Whine, to which The Whine has extended its powers of money advent, and they build money out of thin air, unconstrained by reserves, on every occasion a mortgage is made. Such is the magic of double-entry bookkeeping, a convention that has been in spend for hundreds of years, where money comes into being as a liability for the issuer and an asset for the receiver, netting out to zero. And to reiterate, banks don’t want a sure quantity of deposits to build up these loans. Loans are made field as to whether or no longer the bank thinks it makes economic sense to attain so — if it needs reserves to meet rules, it merely borrows them from the central bank. There are capital, no longer reserve, constraints on lending nonetheless those are past the scope of this fragment. The fundamental consideration for banks in making loans/creating money is profit maximization, no longer whether or no longer it has ample deposits in its vault. In spite of every thing, banks are creating deposits by making loans.

This is a pivotal shift within the narrative. My analogy for here’s parents (neoclassical economists) telling formative years a incorrect birds and bees narrative in accordance with the ask of where infants come from. As yet any other, they by no way correct it leading to an adult citizenry running around without vibrant about replica. In consequence of this most of us mild talk about fractional reserve banking or there being some naturally fastened provide of money that the non-public and public sectors compete over, due to that’s what econ 101 teaches us.

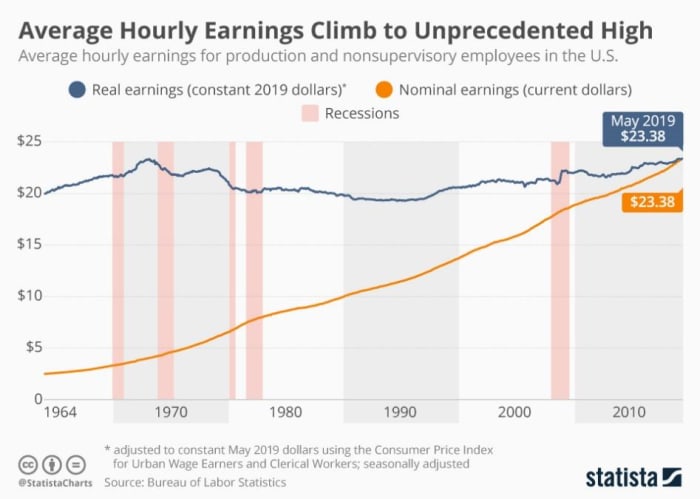

Let’s revisit the opinion that of money provide now. Given that most of the money in circulation comes from the banking sector, and that this money advent isn’t any longer constrained by deposits, it is low-rate to speak that the inventory of money within the economic system isn’t any longer appropriate pushed by provide, nonetheless by seek files from as properly. If firms and contributors are no longer anxious new loans, banks are unable to build new money. This has a symbiotic relationship with the alternate cycle, as money advent is pushed by expectations and market outlook nonetheless also drives investment and expansion of output.

The chart below reveals a measure of bank lending when put next with M2. While the two comprise a sure correlation, it doesn’t repeatedly withhold, as is glaringly evident in 2020. So even supposing M2 was surging elevated put up-pandemic, banks were no longer lending attributable to unsafe economic situations. Up to now as inflation is alive to, there is the added complexity of what banks are lending for, i.e., whether or no longer those loans are being ragged for productive ends, which may amplify economic output or unproductive ends, which may terminate up leading to (asset) inflation. This choice isn’t any longer pushed by the govt, nonetheless by the non-public sector.

The final complication so as to add here is that whereas the above metrics support as fundamental measures for what happens within the US economic system, they attain no longer select the money advent that happens within the eurodollar market (eurodollars comprise nothing to attain with the euro, they merely talk about with the existence of USD start air the U.S. economic system).

Jeff Snider gave an worthy urge by of this for the length of his look on the What Bitcoin Did podcast for any individual who wants a deep-dive, nonetheless for sure here’s a network of financial institutions that operate start air the U.S., are no longer under the formal jurisdiction of any regulatory authority and comprise the license to build U.S. greenbacks in foreign places markets.

This is for the rationale that USD is the reserve currency and required for international alternate between two parties that can even honest no longer comprise one thing else to attain with the U.S. even. To illustrate, a French bank also can honest downside a mortgage denominated in U.S. greenbacks to a Korean company making an try to recall copper from a Chilean miner. The quantity of money created on this market is any individual’s guess and hence, a correct measure of the money provide isn’t any longer even doubtless.

This is what Alan Greenspan had to tell in a 2000 FOMC assembly:

“The field is that we are succesful of no longer extract from our statistical database what’s correct money conceptually, both within the transactions mode or the shop-of-rate mode.”

Right here he refers no longer appropriate to the Eurodollar system nonetheless also the proliferation of advanced financial products that recall the shadow banking system. It’s laborious to chat about money provide when it is laborious to even clarify money, given the incidence of money-respect substitutes.

In consequence of this fact, the argument that govt intervention by fiscal and monetary expansion drives inflation is merely no longer correct as most of the money in circulation is start air the converse control of the govt. Would possibly presumably per chance the govt.overheat the economic system by overspending? Particular. But that isn’t any longer some predefined relationship and is field to the converse of the economic system, expectations, and plenty others.

The idea that the govt.is printing trillions of bucks and debasing its currency is, to nobody’s surprise at this point, appropriate no longer correct. Most efficient having a glimpse at monetary intervention by the govt.gifts an incomplete picture as that injection of liquidity will be, and in loads of circumstances is, making up for the lack of liquidity within the shadow banking sector. Inflation is a elaborate subject, pushed by particular person expectations, corporate pricing strength, money in circulation, provide chain disruptions, vitality prices, and plenty others. It will no longer and may honest no longer be merely lowered to a monetary phenomenon, particularly no longer by having a glimpse at one thing as one-dimensional as the M2 chart.

Lastly, the economic system must be seen, as the put up-Keynesians confirmed, as interlocking balance sheets. This is correct merely by accounting identification — any individual’s asset have to be any individual else’s liability. In consequence of this fact, after we talk about paying encourage the debt or reducing govt spending, the ask must be what loads of balance sheets accumulate affected and how. Let me give a simplified example: within the 1990s for the length of the Clinton abilities, the U.S. govt principal budget surpluses and paying encourage its nationwide debt. Then all over again, since by definition any individual else wanted to be getting extra indebted, the U.S. household sector racked up extra debt. And since households couldn’t build money whereas the govt.may per chance, that elevated the overall chance within the financial sector.

Bitcoin As Cash

I’m succesful of imagine the of us learning till now (at the same time as you made it this a long way) announcing “Bitcoin fixes this!” due to it is transparent, has a fastened issuance rate and a provide cap of 21 million. Right here I comprise each economic and philosophic arguments as for why these aspects, no matter the brand new converse of fiat currency, are no longer the superior solution that they are described to be. The fundamental side to expose here is that, as this fragment has with a little little bit of luck shown thus a long way, that since the velocity of alternate of money provide isn’t any longer equal to inflation, inflation under BTC isn’t any longer transparent or programmatic and may honest mild be field to the forces of seek files from and provide, strength of the cost setters, exogenous shocks, and plenty others.

Cash is the grease that lets within the cogs of the economic system to churn without too worthy friction. It flows to sectors of the economic system that require extra of it, permits new avenues to build and acts as a system that, ideally, irons out wrinkles. The Bitcoin fashionable argument rests on the neoclassical assumption that the govt.controls (or manipulates, as Bitcoiners name it) the money provide and that wrestling away this strength would outcome in some correct build of a monetary system. Then all over again, our fresh financial system is largely urge by a network of non-public actors that The Whine has little, arguably too little, control over, despite these actors benefitting from The Whine insuring deposits and performing as the lender of final resort. And sure, unnecessary to tell elite select of The Whine makes the nexus between financial institutions and the govt.culpable for this mess.

But even though we grab the Hayekian formula, which makes a speciality of decentralizing control fully and harnessing the collective intelligence of society, countering the brand new system with these aspects of Bitcoin falls into the technocratic terminate of the spectrum due to they are prescriptive and build tension. Need to there be a cap on money provide? What’s the acceptable issuance of fresh money? Need to this withhold in all situations agnostic of loads of socioeconomic situations? Pretending that Satoshi come what may was ready to reply to all these questions across time and dwelling, to the extent that nobody also can honest mild accumulate any adjustments, looks remarkably technocratic for a community that is talking regarding the “of us’s money” and freedom from the tyranny of experts.

Bitcoin isn’t any longer democratic and no longer controlled by the of us, despite it providing a low barrier to enter the financial system. Excellent due to it is no longer centrally dominated and the foundations can’t be changed by a exiguous minority doesn’t, by definition, imply Bitcoin is a couple of bottom-up build of money. It’s miles no longer any longer fair money both for the rationale that choice to build a system that has a fastened provide is a subjective and political series of what money must be, in location of some a priori superior quality. Some proponents may per chance allege that, if want be, Bitcoin can even be changed by the action of the majority, nonetheless as rapidly as this door is opened, questions of politics, equality and justice flood encourage in, taking this dialog encourage to the start of history. This is no longer any longer to tell that these aspects are no longer treasured — indeed they are, as I argue later, nonetheless for quite loads of spend-circumstances.

In consequence of this fact, my contentions thus a long way were that:

- Thought the money provide is refined attributable to the financial complexity at play.

- The money provide doesn’t basically outcome in inflation.

- Governments attain no longer control the money provide and that central bank money (reserves) are no longer the same side as money.

- Inflationary currencies attain no longer basically outcome in a lack of buying strength, and that that is dependent extra on the socioeconomic setup.

- An endogenous, elastic money provide is fundamental to alter to economic changes.

- Bitcoin isn’t any longer democratic money merely even supposing its governance is decentralized.

In Part 3, I talk about the history of money and its relationship with the converse, analyze loads of conceptual arguments that underpin the Bitcoin Accepted, provide some extent of view on the World South, and up to the moment replacement spend-circumstances.

This is a guest put up by Taimur Ahmad. Opinions expressed are fully their enjoy and accomplish no longer basically replicate those of BTC, Inc. or Bitcoin Journal.