Inquire for the absolutely scarce, inelastic financial asset that is bitcoin continues to elongate and the associated price will finally react.

The below is from a fresh edition of the Deep Dive, Bitcoin Journal‘s top rate markets publication. To be amongst the first to receive these insights and other on-chain bitcoin market diagnosis straight to your inbox, subscribe now.

Offer squeeze: that has been the topic of many of the past Day after day Dives and this would per chance perchance well be the topic this day, for the reason that underlying chronicle remains the very same.

Inquire for a fully scarce, inelastic financial asset continues to elongate, provide is getting pulled off the market at feverish tempo, and worth is not at all times reacting.

The market is at last beginning to receive up.

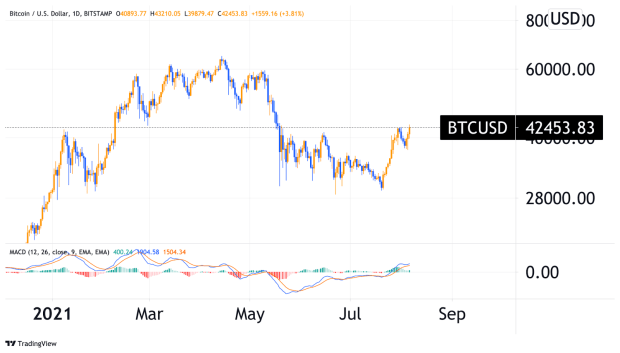

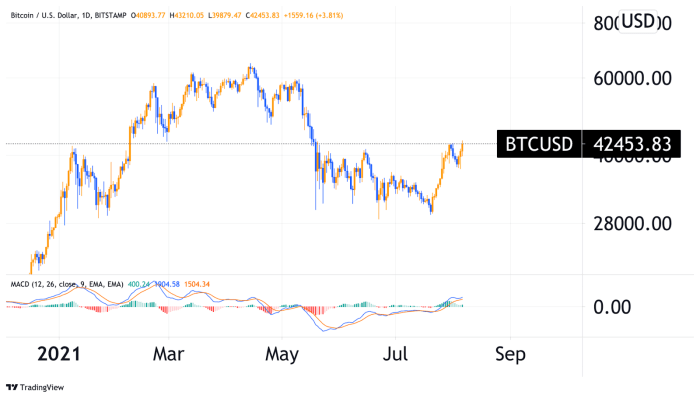

The BTC everyday chart seems ripe for a monster breakout, with a good deal of sizzling air above the $43,000 level.

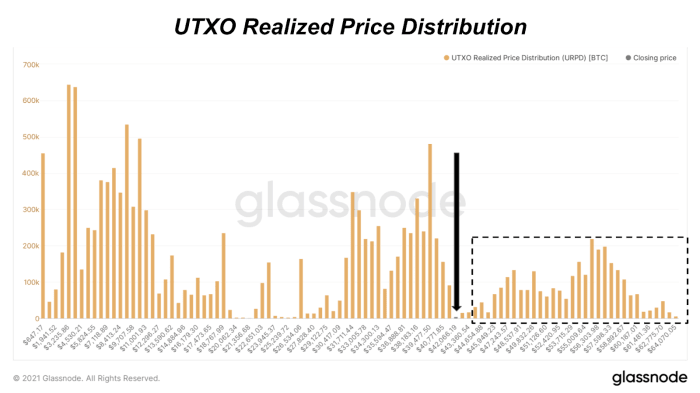

On-chain volume tells an identical chronicle, with limited resistance above the $43,000 level, with a huge wall of UTXO distribution below. Following the months of accumulation in the vary of $30,000 to $40,000, bitcoin has very exact give a rob to and it would seemingly rep a clear meltdown in worldwide equity markets for bitcoin to smash the vary low and fall below $29,000.

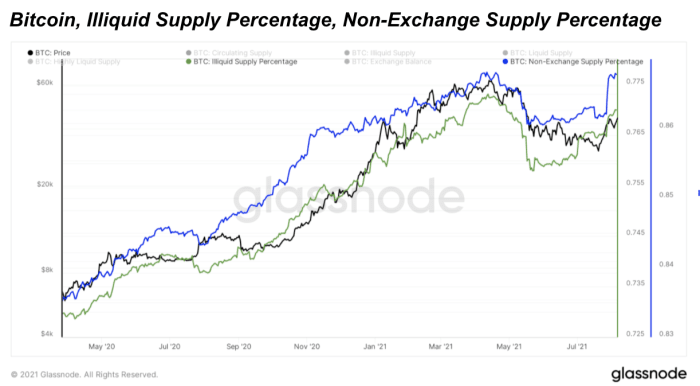

As now we had been highlighting the provision scarcity and dichotomy between derivative market bearishness and narrate market accumulation, we current an energetic chart below.

Plotted below is the associated price of bitcoin, the share of circulating provide now not on exchanges and the volume that is illiquid. Derivative market bearishness is love looking out to combat gravity when the provision aspect is squeezed as onerous as it currently is.

With the technique that bitcoin trades, it is fully ability for all-time highs to be made briefly present, as in over the next month or two. Bitcoin attach stream is reflexive in bull markets, as elevated attach increases quiz, using attach even extra.