Key Takeaways

- Dogecoin continues to consolidate in a correct fluctuate that is getting narrower over time.

- A daily candlestick shut initiate air of the $0.26 to $0.17 trace fluctuate also can desire its direction.

- DOGE’s trace history reveals that bulls also can indulge in the higher hand.

Dogecoin appears to be repeating the value action it has experienced for the rationale that origin of the year. Even though the procuring stress is no longer high sufficient for DOGE to derive away, plenty of on-chain metrics can abet are waiting for the asse3t’s subsequent significant trace motion.

Dogecoin Remains Stagnant

Dogecoin’s fate is resting on two key metrics.

The distinctive meme cryptocurrency has had a memorable year. It reached a brand modern all-time high of $0.74 in early May perchance perchance within the direction of a duration of frenzy across the market. The asset has a year-to-date return of 4,500% despite the low volatility it has seen within the closing few months.

DOGE’s daily chart reveals that it most frequently consolidates for extended classes forward of breaking out. These stagnation classes are characterised by the formation of descending triangles that result in exponential trace movements.

As an illustration, Dogecoin developed this procedure of technical sample for 26 days forward of surging by 936% in leisurely January. An identical trace action took living in early April after the asset had consolidated for 2 months.

Now, the tenth-most attention-grabbing cryptocurrency by market cap appears to be rising the same bullish continuation sample. Dogecoin’s trace has made a series of lower highs since early May perchance perchance, whereas the $0.17 wait on level is struggling with it from a steep correction.

Chopping thru the descending triangle’s hypotenuse at $0.26 also can kickstart an exponential trace motion in direction of modern all-time highs.

Bullish Signs to Video display

Just some of the principle trace movements Dogecoin has loved all year prolonged indulge in been boosted by critical person endorsements. Such habits means that retail hobby must make bigger for DOGE to realize extra. Nonetheless, some key on-chain metrics can abet desire whether procuring stress is accelerating.

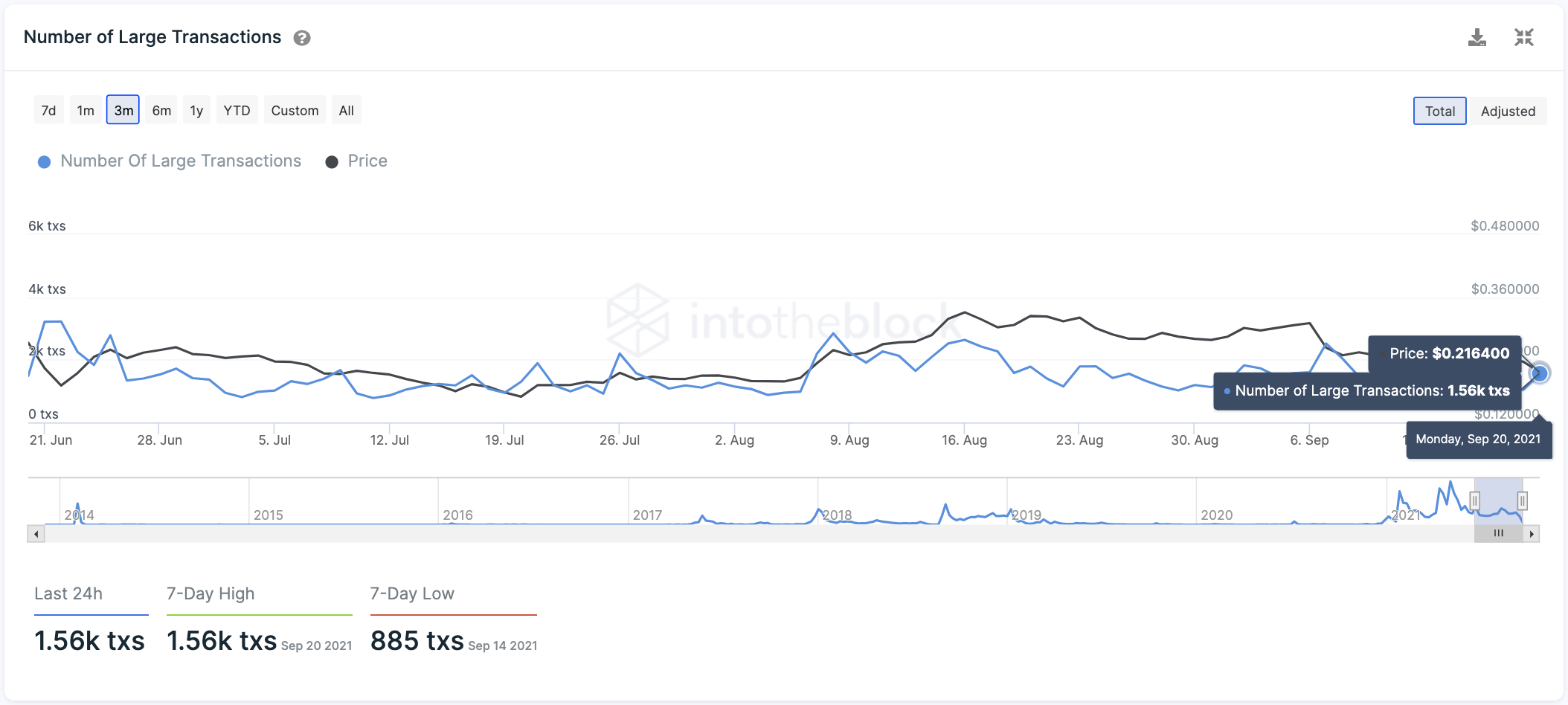

The assortment of sizable transactions on the network with a increased value than $100,000 can act as a proxy to institutional avid gamers’ and whales’ exercise. A serious make bigger in sizable transactions also can display that prosperous investors are origin to position themselves for a brand modern bull slip.

Currently, 1,560 sizable transactions are being done on the Dogecoin network. The assortment of sizable transactions hit a high of two,520 on Sep. 7; a 38% make bigger also can counsel that whales are starting up to desire control of the value action.

If this metric starts to document a series of increased highs, the chances would resolve on the bulls.

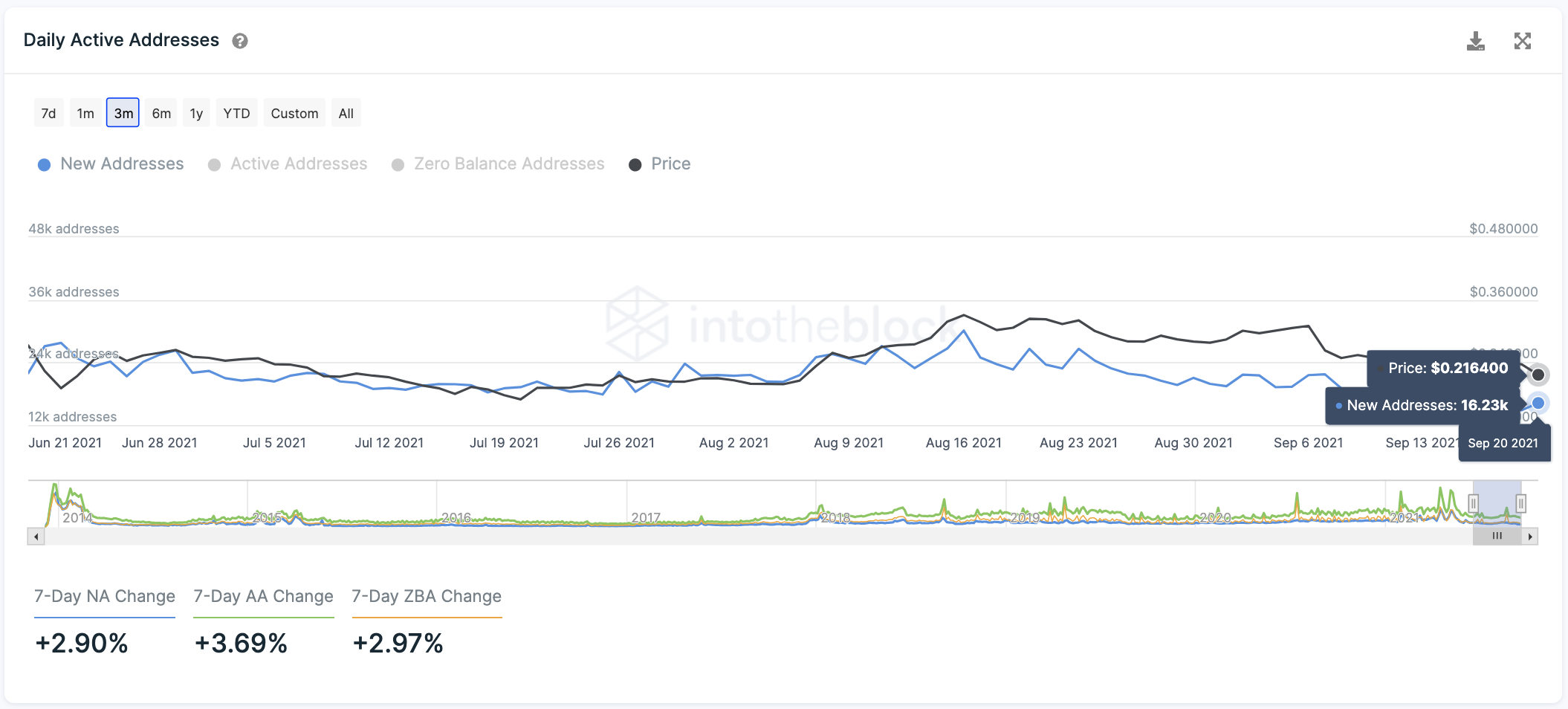

It is in general significant to eavesdrop on the assortment of modern daily addresses created to desire if retail investors are joining the network.

Community advise is mostly regarded as as one in every of doubtlessly the most correct trace predictors. In general, an everyday make bigger within the assortment of modern addresses created on a given blockchain leads to rising costs over time.

A brand modern high of 22,000 modern addresses joining the Dogecoin network per day also can stamp the origin of a brand modern uptrend. Beneath such distinctive situations, merchants must look forward to a increased high on this on-chain metric forward of entering any positions to substantiate that procuring stress is accelerating.

While a spike within the assortment of sizable transactions and modern daily addresses on the network would verify the bullish outlook, a stylish candlestick shut below the symmetrical triangle’s x-axis at $0.17 would invalidate it. The transaction history reveals that after dropping such a predominant wait on level, DOGE would face minute opposition on its formula down to $0.08.