UNI, the native token of Uniswap, one of the essential head decentralized exchanges (DEXes), is below extensive promoting stress. From the day-to-day chart of the UNIUSDT, the token is down 62% from March highs, though costs trust stabilized within the previous few trading weeks.

To position within the numbers, chart records exhibits that it is miles up almost about 35% from August lows, intriguing promoting stress.

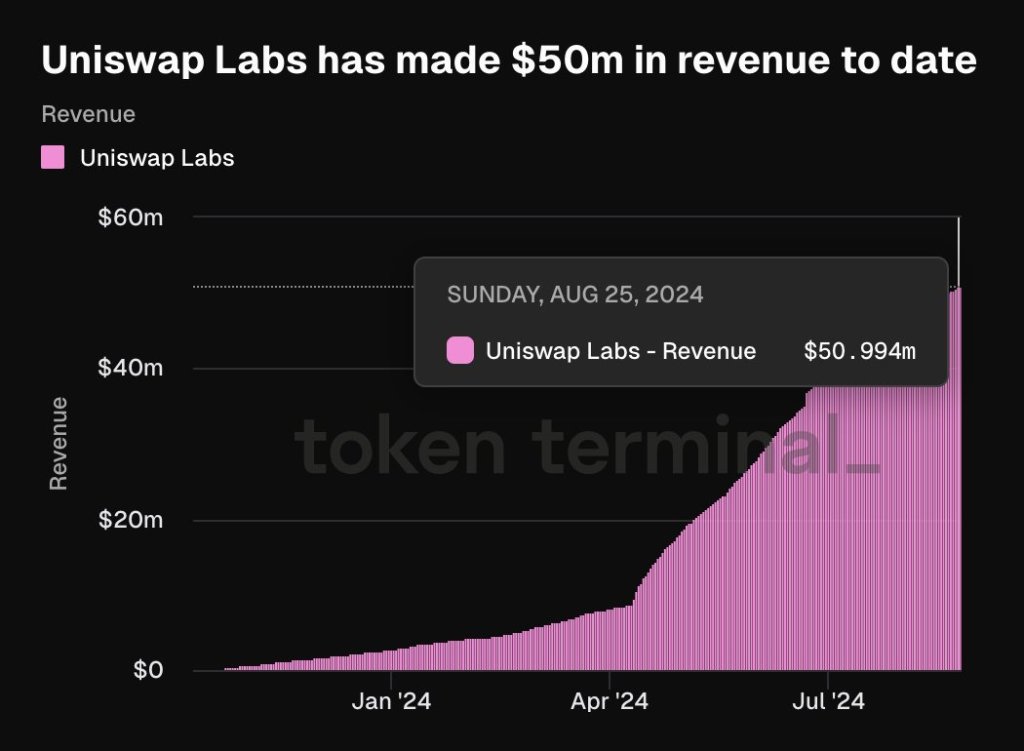

UNI Is Down Nonetheless Uniswap Generates $50 Million In Earnings So A long way

Though UNI is worthy off from all-time highs, shaving almost about 85% from 2021 peaks, other thrilling inclinations may well well abet costs within the long tear. Token Terminal records on August 25 exhibits that the DEX has generated $50 million in earnings to this level.

Uniswap enables traders to trustless swap tokens on more than one platforms and blockchains. Before all the things, it launched on Ethereum in November 2018 earlier than being deployed on the BNB Chain and varied layer-2 platforms for Ethereum, including Arbitrum and Optimism.

In contrast to Binance, which is custodial, Uniswap customers handiest need a non-custodial wallet to connect and swap. All trades are tidy contracts-led and without an middleman. On the identical time, there is a broader pool of tokens, some of that are unavailable on prime centralized exchanges cherish Binance.

The advantages offered by Uniswap trust seen the protocol extinguish greater the property below management to over $4.73 billion, constant with DeFiLlama. As of August 26, Uniswap is offered on over ten platforms, however the protocol manages over $3.8 billion on Ethereum.

Cumulatively, DeFiLlama records has generated over $2.3 billion in costs. All these costs are from swaps on Ethereum and all other platforms. In the final 24 hours, Uniswap has generated over $854,000 in costs.

Is The Future Radiant, Builders Prepare For V4

As crypto costs extinguish greater, it is miles always extremely possible that DeFi process will upward thrust. For the reason that restoration from mid-October 2023 to the March 2024 high, DeFi total price locked (TVL) more than doubled. This growth shows rising interest and self belief from the neighborhood. In step with DeFiLlama, DeFi TVL across all networks stood at around $40 billion in October but rose to over $106 billion by March 2024.

As DeFi TVL rises, Uniswap will enable more swaps, increasing its costs. Furthermore, the DEX will possible be a trek-to platform because it enhances its protocol.

Earlier this month, Uniswap Labs, which is constructing the protocol, announced a $2.35 million prize pool for developers. The fund aims to reward developers who opt out flaws on Uniswap v4 earlier than rollout. As soon as are residing, the original version of the DEX will provide original parts, including customized oracles and Hooks for method more flexibility.

Feature image from Adobe Stock, chart from TradingView

Disclaimer: The notion stumbled on on NewsBTC is for academic functions

handiest. It doesn’t list the opinions of NewsBTC on whether or to no longer aquire, promote or withhold any

investments and naturally investing carries dangers. You are told to habits your occupy

evaluate earlier than making any funding choices. Use records offered on this online page

entirely at your occupy risk.