Hear To This Episode:

In this episode of Bitcoin Magazine’s “Fed Look” podcast, we spoke back to Federal Reserve Chairman Powell’s feedback at Jackson Gap on August 27, 2021. We listened to some principal sound bites and talked about it along the manner. Powell became as soon as expected to announce a Fed taper, where it begins to shrink its monthly purchase of securities in quantitative easing.

We procure frequently talked about that Powell is a bit a straight shooter relative to other central bank leaders of the previous and demonstrate. We also are hesitant to ever have confidence a Federal Reserve chairman, nonetheless in this case, we discover many capabilities to agree on.

Bitcoin is beginning to naturally fit into every discussion on central banks and the global economic system. We touch on bitcoin all over this episode.

Chairman Powell At Jackson Gap

We went very in depth with this analysis. Within the most main couple of sound bites, Powell launched the anomalous nature of this recession. Particularly, that life like incomes rose attributable to fiscal stimulus. He made it certain that the irregular interaction between rising incomes and unavailable products and companies from the pandemic shifted quiz from the carrier sector to the manufactured items sector. This spike in quiz and spending on manufactured items as provide chains had been successfully frozen precipitated giant distortions out there and a few costs to rise.

The unstable nature of these imprint moves are now not captured entirely in a 12-month window all over which client imprint index (CPI) is measured. Powell launched an 18-month chart that corrects for a few of the shortcomings of the 12-month version, by including the recession and restoration in total.

We stepped thru some charts exhibiting how transitory imprint will enhance don’t basically imply a declining price of commerce, nonetheless valid imprint declines. Prices plod up and costs plod down. As former autos, commodities, oil, gasoline, and copper, all plod up and down.

The final two clips we listened to had been about valid Fed protection. Powell described what’s, in my notion, the supreme Fed protection instrument, anchoring inflation expectations:

“Our financial protection framework emphasizes that anchoring long trot expectations at 2% is required, for both most employment and rate stability,” he talked about.

Powell by some means danced across the problem of taper, by no manner announcing the be conscious. He reiterated what he has talked about sooner than, that if main and sustained enchancment toward the Fed’s targets are made it could in all probability well moreover very properly be acceptable to delivery tapering this year. Co-host Christian Keroles and I went over this commentary in depth. We interrogate it as likely that Powell became as soon as looking for a manner to retain taper very exceptional on the table nonetheless also give the Fed an out if the global economic system takes a dive within the next couple of months. That dive is calling extra and extra likely, by the manner.

Powell’s Reappointment As Chairman Gets Political

For our 2nd most main topic, we stayed with the Fed. Chairman Powell is up for reappointment in February and it’s miles getting a bit political. The Fed is speculated to be apolitical, nonetheless Powell is coming under increased criticism from progressives within the federal government. They need a extra politically-motivated central bank, to attend them drive in local weather laws and other modern desires.

Powell is caught here between growing strain from politicians to be extra of an activist and members from all over the Federal Delivery Market Committee (FOMC) itself calling for tapering. He have to derive a manner to run a vivid line if he desires reappointment.

China’s Credit Impulse And Shopping Managers’ Index (PMI)

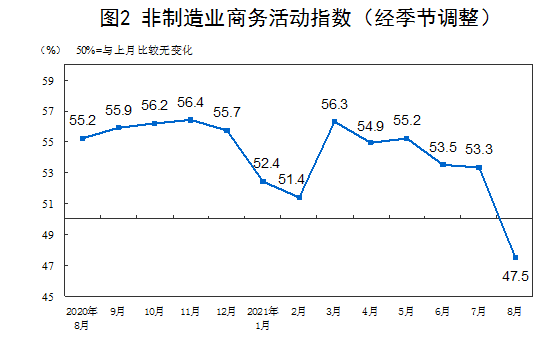

China’s economic system is wavering. It became as soon as infamous submit-Grand Financial Crisis (GFC) as the source of declare that pulled the global economic system out of recession. Within the occasion you had any illusion that that could happen as soon as more, this week’s PMI data has smashed your hopes.

These numbers veil the contraction in China is serious and gathering tempo. Be conscious, in a highly indebted economic system, low declare is now not enough to lead certain of a disaster. You will need growth to quilt repayment of main plus hobby. If the Chinese life like hobby price is 5%, it will deserve to procure 5% declare or else defaults and contagion unfold. As rapidly as the defaults become too a enormous selection of to tackle, bankruptcies could moreover unfold all over its bubble economic system.

Manufacturing PMI

Non-Manufacturing PMI

We hope you to find pleasure from this episode. It is jam packed with Federal Reserve updates. Within the occasion you want it please section and give us thumbs up on YouTube and a correct review on iTunes.

Articles talked about:

Politico: AOC, Tlaib, Pressley name on Biden to dump Powell as Fed chair

IMF: Native weather Swap and Financial Threat