Home » Bitcoin » US Bitcoin ETFs hit 7-day losing streak, outflows surpass $1 billion

Sep. 6, 2024

Bitcoin ETFs fight as most critical funds esteem Constancy’s FBTC file massive capital withdrawals.

Key Takeaways

- Constancy’s Wise Foundation Bitcoin Fund noticed the largest outflow with $374 million leaving in the seven trading days.

- BlackRock’s iShares Bitcoin Belief skilled its second-ever outflow since its inception in January.

Part this text

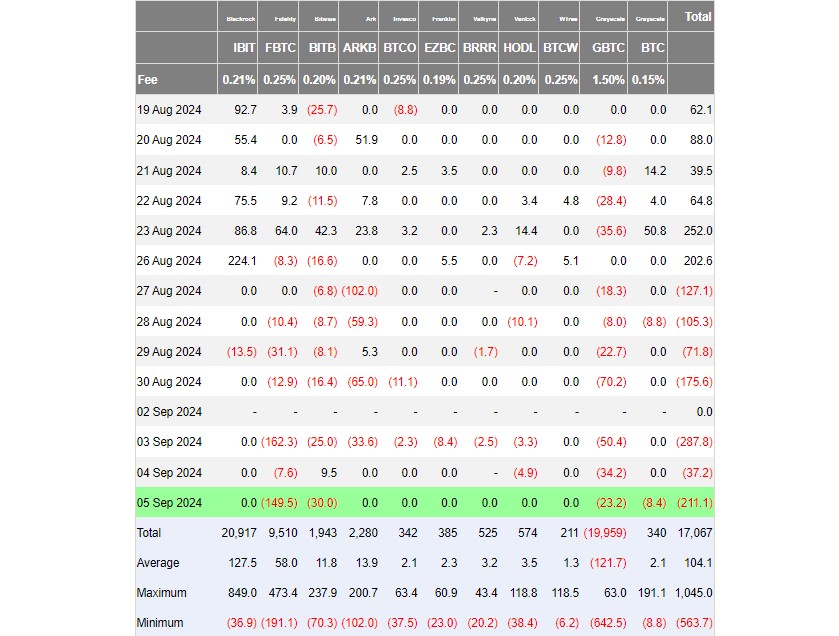

US feature Bitcoin trade-traded funds (ETFs) continued earn outflows for straight seven trading days, collectively shedding over $1 billion from August 27 to September 5, in step with data from Farside Merchants.

Severely, Constancy’s Wise Foundation Bitcoin Fund (FBTC) used to be the one which led the capital exit, no longer Grayscale’s Bitcoin ETF (GBTC). Roughly $374 million left FBTC over these seven days while GBTC posted $227 million in outflows.

The field’s largest Bitcoin ETF, BlackRock’s iShares Bitcoin Belief (IBIT), noticed its second-ever outflow since its January originate, with merchants withdrawing $13.5 million on August 29. IBIT has reported zero flows on other days throughout the stretch.

This marked a minor downturn from the fund’s outdated performance, because it had seen fixed inflows in the weeks leading up to the stagnation.

Completely different US Bitcoin ETFs, as opposed to for WisdomTree’s Bitcoin Fund (BTCW), equally reported losses, and not using a most critical capital inflows throughout the length.

Bitcoin’s reversal is challenged amid ETF outflows and market fears

Bitcoin’s (BTC) present mark decline has been exacerbated by power ETF outflows and rising international market uncertainty. Thursday noticed a serious earn outflow of $211 million from US Bitcoin funds, marking the fourth-top likely each day outflow since Would possibly well 1.

Bitcoin’s mark has been unable to atomize above the $65,000 resistance stage, leading to continued promoting stress. While long-time-frame Bitcoin merchants remain successful, non eternal holders are going thru challenges in the present market conditions.

The priority and greed index stays firmly in the terror territory, reflecting broader market concerns a few ability recession.

Bitcoin’s mark has dropped by over 4% in the previous week, currently trading around $56,500, per TradingView’s data.

Part this text