Home » Bitcoin » US Bitcoin ETFs hit 8-day winning scurry as BlackRock logs $224M gain inflows

Aug. 27, 2024

BlackRock these days increased its holdings of the iShares Bitcoin Have faith in its Strategic Global Bond Fund.

Key Takeaways

- BlackRock’s iShares Bitcoin Have faith led US Bitcoin ETF inflows with $224 million on August 26.

- The iShares Bitcoin Have faith now controls over 350,000 BTC.

Portion this text

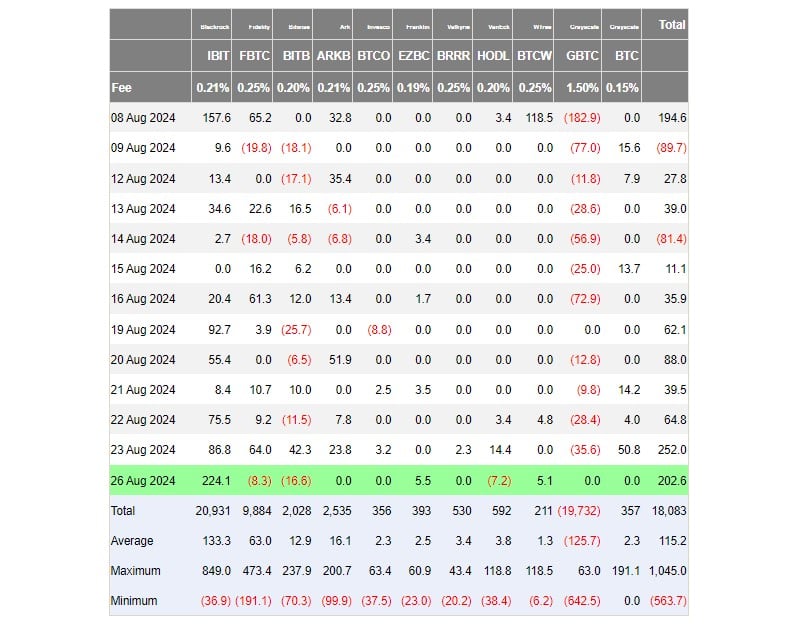

US change-traded funds (ETFs) investing without extend in Bitcoin (BTC) posted eight straight days of gain subscriptions, drawing in about $202 million on Monday, recordsdata from Farside Investors shows. BlackRock’s iShares Bitcoin Have faith (IBIT) outperformed its chums with around $224 million.

Franklin Templeton’s Bitcoin ETF (EZBC) and WisdomTree’s Bitcoin fund (BTCW) additionally posted gain inflows at Monday’s shut, every taking pictures around $5 million.

In distinction, competing funds managed by Constancy, Bitwise, and VanEck reported negative flows. The remaining saw zero investments.

Seven months after their landmark debut, the first establish Bitcoin ETFs within the US bask in seen a stabilization in every inflows and outflows when put next with the preliminary trading duration.

The Grayscale Bitcoin Have faith (GBTC), which had historically been linked to giant outflows, has seen a decrease in redemptions over the last two weeks, basically basically based on Farside’s recordsdata.

IBIT has solidified its dominance within the Bitcoin ETF market with its constantly solid efficiency. The fund’s Bitcoin stash has exceeded 350,000 BTC, basically basically based on basically the most contemporary update.

BlackRock’s self assurance in Bitcoin ETFs is rising with investor flee for meals. The leading asset supervisor these days reported that its Strategic Global Bond Fund added 4,000 shares of IBIT, bringing its entire holdings to 16,000 shares as of June 30.

Portion this text