Key Takeaways

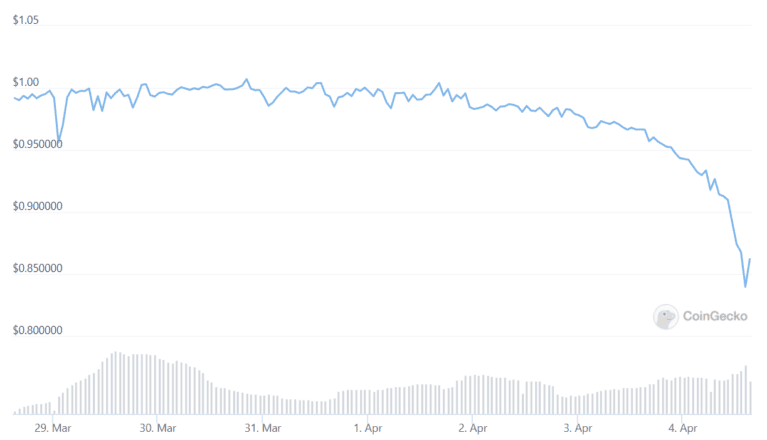

- The flagship stablecoin of the Waves network, Neutrino USD, has depegged after rumors of “loss of life spiral” dangers started circulating on Twitter.

- USDN is for the time being shopping and selling across the $0.86 designate imprint.

- The WAVES token has misplaced over 30% or $1.8 billion in worth over the closing four days.

After nearly doubling its market capitalization in a couple of weeks, Waves’ Neutrino USD stablecoin has misplaced its peg, signaling a doable “loss of life spiral” match for the ecosystem’s native token.

Neutrino USD Depeg Spells Pain for Waves

Neutrino USD, the flagship stablecoin of the Waves ecosystem, is seeing its peg challenged amid short selling stress on the ecosystem’s native token, WAVES. Neutrino USD (ticker: USDN) is meant to roughly note the worth of the U.S. greenback, but it undoubtedly’s for the time being worth round $0.86.

USDN misplaced its desired $1 peg closing Friday after a scathing post by the pseudonymous crypto investor 0xHamZ started making rounds on Twitter. 0xHamZ called WAVES, the native token of the Waves network, the “most moving ponzi in crypto,” and claimed that the project’s founders had been artificially pumping the token’s worth utilizing leverage.

WAVES is basically the most moving ponzi in crypto

It has recklessly engineered designate spikes by borrowing USDC at 35% to grab its own token

Continuous WAVES market cap development is mandatory to abet the system trusty

WAVES will at closing rupture and USDN will ruin with it

You are on witness🧵

— 0xHamZ (@0xHamz) March 31, 2022

Waves started making headlines in March after seeing its market capitalization surge nearly sixfold in precisely over a month amid in another case comparatively shaky market stipulations. Its main use case is to mint and enhance USDN, which has likewise considered its market capitalization surge from round $500 million to an all-time high of over $960 million over the same period sooner than shedding round $130 million in worth on the present time.

USDN’s mechanism works equally to MakerDAO‘s DAI, preferrred it is overcollateralized and can preferrred be minted utilizing the WAVES token. The surging quiz for USDN would be attributed to the neat staking yields supplied for the stablecoin on diverse DeFi platforms in the project’s ecosystem. On the opposite hand, 0xHamZ stated that the high USDN staking yields were carefully dependent on the power development of the collateral token, WAVES, and that the team had been “folding leverage” to engineer a provide squeeze to pump WAVES’ designate artificially.

As well they shared on-chain records to substantiate their claim, exhibiting that the Waves team had been depositing USDN on the Waves-native money market protocol Vires Finance to borrow USDC, transferring the USDC to Binance to grab WAVES, and changing WAVES to USDN. The records showed that they repeated this process multiple cases.

Rapidly after the rumor of Waves utilizing leverage to prop up the worth of their token broke out, USDN started sliding below its focused $1 peg. Although it is overcollateralized by WAVES, USDN is for the time being shopping and selling across the $0.86 designate differ, exhibiting little signs of recovery. The WAVES token has also erased over 30% or $1.8 billion in worth, raising concerns of a doable “loss of life spiral” match that can presumably well look the worth of the WAVES collateral on the Neutrino protocol descend below the market capitalization of the USDN stablecoin. That will mean the system has develop into insolvent.

Founder Blames Alameda Be taught

In maintaining with the rumors, Waves founder Sasha Ivanov blamed the well-liked cryptocurrency shopping and selling agency Alameda Be taught for orchestrating an anti-Waves “FUD” advertising and marketing campaign. “Earn your popcorn prepared: @AlamedaResearch manipulates $waves designate and organizes FUD campaigns to position off panic selling. I’m hoping I caught your consideration,” Ivanov stated in a Sunday tweet storm.

Ivanov claimed that Alameda had borrowed WAVES on Vires Finance to short the asset and orchestrated the advertising and marketing campaign on Twitter to position off a sell-off and flip its exchange successful. “So what attain we internet right here: They were the predominant to push the worth on FTX, but after the distance was once closed with profit the following short exchange they opened failed, since the worth saved going up,” he wrote. “Borrowing and FUD needed to raise the worth down and make the short successful.”

Alameda founder and veteran CEO Sam Bankman-Fried brushed off Ivanov’s claims as a “bullshit conspiracy theory” with out providing extra cramped print about the shopping and selling agency’s involvement with the incident.

Ivanov also posted a proposal to the Vires Finance DAO to “temporarily lower the liquidation threshold for Waves and USDN borrowing to 0.1%” and restrict the maximum borrow APR to 40%.

https://t.co/sZUh19dBNi New DAO proposal on https://t.co/X8GtUDr6fT

Let’s give protection to #waves ecosystem from greed!

GREED IS BAD.— Sasha Ivanov 🌊 (1 ➝ 2) (@sasha35625) April 3, 2022

The theory in the serve of the proposal is to liquidate Alameda’s supposed short space and give protection to Waves’ long space by capping the borrowing charges for USDC and USDT. Atmosphere higher borrow charges would mean that the team must make higher interest funds on its stablecoin loans, which it uses to enhance the worth of WAVES.

The Waves team allegedly controls round 30% of the circulating provide of VIRES, which manner that it would possibly perhaps maybe presumably well carefully affect—if no longer singlehandedly order—the quit results of the vote. On the opposite hand, if Ivanov’s proposal gets rejected, it would possibly perhaps maybe presumably well power the Waves team to unwind its leveraged long space on the Vires money market platform to provider their debt. Following 0xHamZ’s warning post on Friday, the borrow APRs for the USDC and USDT pools on Vires jumped from round 34% to 80%, effectively more than doubling the interest Waves have to pay on its mortgage, which is reportedly worth north of $400 million at press time.

Disclosure: On the time of writing, the author of this selection owned ETH and plenty of different varied cryptocurrencies.

The records on or accessed thru this web page online is obtained from honest sources we imagine to be excellent and respectable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any records on or accessed thru this web page online. Decentral Media, Inc. is not any longer an funding consultant. We attain no longer give personalized funding advice or varied monetary advice. The records on this web page online is arena to alter with out witness. Some or all of the records on this web page online would possibly presumably well develop into outdated, or it’ll be or develop into incomplete or improper. We would possibly presumably well, but are no longer obligated to, update any outdated, incomplete, or improper records.

You potentially can peaceable by no manner make an funding resolution on an ICO, IEO, or varied funding essentially based on the records on this web page online, and likewise you most definitely can peaceable by no manner elaborate or in another case depend upon any of the records on this web page online as funding advice. We strongly point out that you just search the advice of a certified funding consultant or varied certified monetary real whenever you occur to’re seeking funding advice on an ICO, IEO, or varied funding. We attain no longer procure compensation in any manufacture for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

Alameda Invests $20M in Polkadot-Basically based completely mostly Reef Finance

The designate of Reef Finance’s native token has jumped 30.82%, as Alameda Be taught has printed a $20 million funding. Alameda Invests in Reef Alameda Be taught has introduced a $20 million…

Alameda Be taught Leads $50 Million Investment in Drag App Maps.me

Maps.me is integrating DeFi for its 140 million customers. Sooner than the overhaul, the jog app raised $50 million in a funding round led by Alameda Be taught. Maps.me Makes DeFi…

Give Extra Clarity on Crypto Law, SBF Urges CFTC

FTX CEO Sam Bankman-Fried advocated for the benefits of cryptocurrency markets in a Senate committee listening to on digital sources on the present time. FTX CEO Testifies Sooner than Senate Sam Bankman-Fried desires the Commodity…