TLDR

- The ETH Coinbase top price has surged, signaling elevated whale exercise from US-based mostly investors.

- Whale accumulation has driven the upward thrust in the ETH Coinbase top price, with principal procuring exercise on Coinbase.

- ETH’s rally coincided with elevated procuring stress, pushing the Coinbase top price to levels no longer seen since January.

- The low reserves on Coinbase contemplate a noteworthy rely on of for ETH, with around 4.8 million ETH final on the platform.

- Ethereum’s evolving exercise case in DeFi and stablecoins continues to entice critical whale ardour and deliver procuring.

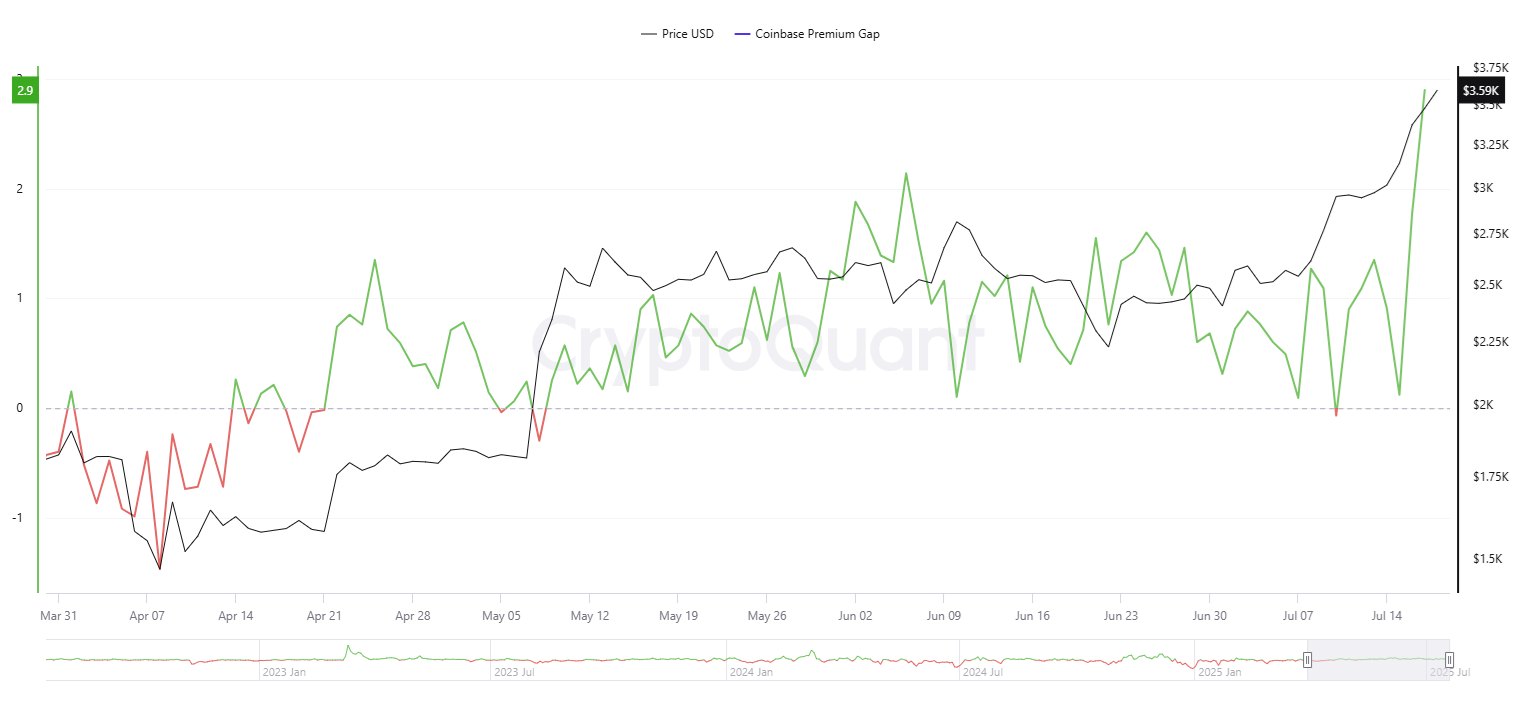

Ethereum (ETH) has seen a principal upward thrust in the ETH Coinbase top price, signaling elevated whale exercise from US-based mostly investors. The highest price, which remained critical at some level of Q2, has spiked to levels no longer seen since January. This surge in exercise aligns with a broader pattern of whale accumulation, extra reinforcing the increasing rely on of for ETH.

US-Based totally Whales Riding ETH Coinbase Top price Surge

The present upward thrust in the ETH Coinbase top price has drawn attention to US-based mostly whale investors. Based totally on recordsdata from CryptoQuant, ETH’s rally has been fueled by critical procuring exercise on Coinbase, ensuing in an uptick in the highest price. This vogue has persevered despite Ethereum no longer but reaching the highest price levels seen at some level of the latter section of 2024.

- Source: Cryptoquant

Historically, the Coinbase top price has been quick-lived, in most cases returning to baseline within weeks. On the replacement hand, this time, the highest price has persisted for a total lot of months, indicating that whale accumulation is ongoing. While exterior factors cherish elections had beforehand driven US-based mostly trading, the present surge is driven by tough procuring stress from whales.

As ETH moves to elevated build ranges, the Coinbase top price has maintained its upward trajectory. Whale accumulation has been particularly pronounced, with some whales procuring more than 13,000 ETH inside the past 24 hours alone. These moves are in conserving with a higher pattern of company and institutional investors increasing their publicity to ETH.

Low ETH Reserves Signal Elevated Demand

The ETH Coinbase top price surge comes amidst vastly low reserves on the platform. Spherical 4.8 million ETH stay readily on the market on Coinbase, contributing to the availability tightness. Wintermute’s present commentary confirmed that the market maker has depleted its OTC desk, extra underscoring the elevated rely on of for ETH.

The low reserves assert a shift in the broader market dynamics, with deliver rely on of for ETH rising. The asset has more and more been viewed as a retailer of price, a characteristic once held by diverse digital assets. Additionally, rely on of for ETH collateral in lending protocols has elevated, extra fueling the highest price’s upward thrust.

Despite ETH no longer being scarce, noteworthy of the readily on the market present is locked in staking or DeFi protocols. This limits the amount of ETH that whales can freely trade or take hang of in. The true ETH procuring exercise has kept Coinbase’s reserves shut to their all-time lows, signaling sustained ardour from US-based mostly investors.

Ethereum’s Changing Use Case Attracts Whale Hobby

Ethereum’s evolving exercise case has also contributed to whales’ increasing rely on of. While meme coins and NFTs own shifted to diverse networks, ETH remains central to DeFi and stablecoin activities. It continues to make stronger liquidity for well-known stablecoins equivalent to USDT and USDC, making it an very crucial asset for institutional investors.

Within the past 24 hours, ETH transactions saw a principal shift, with whales sending tokens to exchanges cherish OKX and Coinbase Institutional. These transactions were section of upper moves, with one whale transferring over 20,000 ETH. Such exercise extra highlights the ongoing whale-driven vogue, as higher gamers proceed to deliver themselves on the market.

Whale sentiment in direction of ETH has remained bullish for months, particularly in comparability to retail merchants, who own shown much less ardour. This vogue has been evident at some level of Would possibly well merely and June, with whales constantly procuring ETH at decrease reasonable costs.