Key Takeaways

- DAO is an abbreviation for “Decentralized Self sustaining Organization,” a neighborhood which interacts spherical laborious-coded principles encoded in the blockchain.

- DAOs maintain seen exponential progress in 2021, most particularly from DeFi protocols delegating governance to their communities.

- Whereas DAOs need so a long way basically been connected to crypto, veteran organizations will maintain the support of the technological innovation of blockchain-based completely governance.

DAO is an abbreviation for “Decentralized Self sustaining Organization.” These crypto-native organizations are clear communities whose core principles are laborious-coded in the blockchain.

DAOs vs. Broken-down Organizations

DAOs maintain gathered heaps of tempo in crypto no longer too long ago. For many blockchain enthusiasts, the explosion is finest the beginning of an improbable wider style that might peep world organizations exist in decentralized develop in the end.

The put veteran organizations require a immense deal of believe between contributors on assorted hierarchical ranges, the core principles and governance for DAOs are dealt with by dapper contracts. Equivalent to how DeFi protocols automate the needed believe between monetary actors in the veteran world, you don’t want to be anxious about a self- CEO or a dishonest CFO on this planet of DAOs.

DAOs are Recordsdata superhighway-native monetary organizations collectively owned and managed by their very own contributors. As an alternative of veteran high-down agencies, DAOs reward participation from all contributors in a share determined by the DAO’s founding code. That code might perhaps be consulted in any admire instances by somebody on the blockchain.

Within the veteran world, organizations maintain constantly required believe to characteristic, particularly when bigger sums of cash are involved. DAOs don’t need believe to characteristic because the total principles are in the beginning, and any adjustments require a majority vote. Such votes additionally occur on the blockchain, so no third events or intermediaries are needed.

To be taught more about how DAOs characteristic, Crypto Briefing spoke to DAOhaus product supervisor Spencer Graham. DAOhaus is a DAO explorer at the frontier of innovation in this sector. It enables any particular person to be a half of an present DAO or compose a recent one. Explaining the heed of DAOs over veteran organizations, Graham says:

“Structurally, DAOs are superior to veteran organizations attributable to they distribute ownership and vitality plan more evenly, are great more uncomplicated to compose, and maintain considerably lower barriers to contribution.”

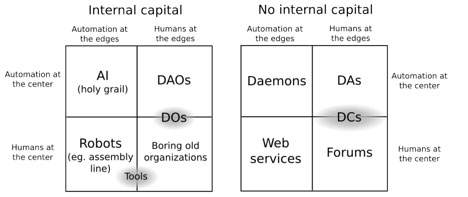

On Would possibly well perhaps well perhaps 6, 2014, Ethereum founder Vitalik Buterin posted an article titled “DAOs, DACs, DAs, and Extra: An Incomplete Terminology Manual” detailing the aptitude for blockchain-based completely organization governance. Buterin wrote:

“The postulate of a decentralized self sustaining organization is inconspicuous to list: it is an entity that lives on the Recordsdata superhighway and exists autonomously, however additionally carefully relies on hiring individuals to originate sure tasks that the automaton itself can no longer raise out.”

As Buterin notes, DAOs quiet need humans. It’s not the human action that’s automatic, however rather the interplay between these human actors. A contributor to a DAO might perhaps perhaps propose a undeniable challenge to the neighborhood, equivalent to constructing a web plan detailing their activities and join a undeniable heed for his contributions. The heed shall be denominated in either a buck figure or in the DAO’s governance token. If ample contributors of the DAO vote for the proposal, the DAO will robotically send the agreed-upon heed to the contributor.

The greatest strength of DAOs lies of their world, permissionless nature. Contemporary firms are a pair of of potentially the most closed organizations in history. To be a half of a firm, individuals want to trace that they’ve extensively studied a undeniable subject, expose experience in a linked enviornment, and full a number of interviews with present contributors.

Nonetheless, there are no physical barriers to joining a DAO. There might perhaps successfully be a conscious different to restrict participation on a geographical basis, however factual to crypto’s Recordsdata superhighway-native nature, DAOs are on the total international organizations. This enables them to grow great faster than firms as they’re each more horizontal and beginning to access. To be a half of a DAO might perhaps be as straight forward as joining a Discord server or looking out for a governance token.

DAOs in Discover

Some would argue that Bitcoin became as soon as the main DAO. No one governs Bitcoin. Very exact, immutable principles deem who in the Bitcoin neighborhood is rewarded for action and how those rewards evolve over time. Within the case of Bitcoin, miners are incentivized to uncover the network’s Proof-of-Work consensus mechanism by BTC block rewards that half of each four years. These straight forward principles maintain created a diehard neighborhood spherical one amongst the greatest monetary innovations of this century. Discussing Bitcoin as a self-governing protocol, Graham adds:

“The Bitcoin network is self-governing and self-sustaining with out a manner of centralized administration, and emerges from individuals behaving in conserving with incentives embedded within the Bitcoin protocol. Bitcoin became as soon as designed to characteristic without the need for its users to coordinate outdoors of the protocol itself. In distinction, in the final few years we’ve seen DAOs embracing a more neighborhood-pushed, human-centric coordination carry out.”

Whereas Bitcoin shall be described because the main DAO, the integration of dapper contracts in blockchain has been the principle technical style that allowed DAOs to satisfy their doubtless. DeFi protocols built on Ethereum maintain been the appropriate beta-testers for DAOs. First, DeFi protocols additionally spend the identical dapper contract infrastructure to spend believe and intermediaries from the interactions between users. 2d, cryptocurrencies are potentially the most appropriate form of forex to permit permissionless, worldwide interplay between contributors. Discussing the integral role cryptocurrencies play in DAOs, Graham says:

“Presumably cryptocurrency isn’t any longer needed for DAOs to exist, however it completely’s certainly crucial for DAOs to reach their fleshy doubtless. Any DAO’s sole purpose is to facilitate coordination spherical its impartial, an amazing segment of which includes deploying sources equivalent to capital. If a central celebration can shut down a DAO’s medium of change (i.e., its forex), then they’re going to shut down its main avenue for achieving its impartial.”

Most DAOs maintain their very own governance token for rewarding real behavior that favors the DAO’s progress. These tokens, in total labeled as “nugatory” by their creators, give their holders voting vitality on the approach forward for the protocol or organization. These DAOs might perhaps be centered on many various domains, NFT artwork being one amongst the quickest-growing categories.

As very active secondary markets exist for tokens, they’re in total traded esteem shares in a veteran firm. In many conditions, users can receive a token merely by interacting with a protocol. This methodology creates a particular strategies loop for every particular person and protocol.

To illustrate, DeFi change Balancer no longer too long ago supplied users a compensation of their gas charges in Balancer’s governance token BAL. First, this drew users to make spend of the protocol when gas charges soared. 2d, these users purchased BAL tokens, which incentivized them to detect the total heed of the protocol grow, because it will again their portfolio’s heed grow. This led them to make spend of Balancer more in total, take part in governance with their BAL tokens, and discuss about Balancer to their company.

Governance tokens align incentives for every recent and future contributors to the DAO at some level of the progress of the organization and its future prosperity. These tokens can additionally act as a kind of popularity system, letting those with potentially the most pores and skin in the recreation maintain the essential converse in its governance. Buterin says of the structure of DAOs:

“As an alternative of a hierarchical structure managed by a plan of humans interacting in particular person and controlling property during the honest system, a decentralized organization contains a plan of humans interacting with each other in conserving with a protocol specified in code, and enforced on the blockchain.”

DAOs are in total pure extensions of DeFi protocols because the builders’ protocols peep to decentralize governance and walk from group-resulted in neighborhood-led, whereas quiet having built-in incentivization mechanisms in play to reward each core contributors and users of the protocol. Those methods reward participation and gradually develop the monetary incentive to participate actively in the progress of DeFi protocols.

Groups distribute governance tokens to incentivize early participation. Tokens then compose a monetary incentive to additional the progress of the protocol from serving to style, to merely evangelizing the challenge to other DeFi users. That is additionally the essential formula to be sure innovation and pretty competitors between incumbent protocols and recent ones.

To illustrate, a recent change will constantly maintain much less liquidity in its swimming pools than, reveal, Uniswap. DeFi projects need deep liquidity to characteristic successfully; for decentralized exchanges, lower liquidity outcomes in elevated slippage and never more favorable costs for users. To compete with Uniswap, a recent change might perhaps perhaps offer governance tokens in change for the utilization of the protocol (SushiSwap took this means to launch at the head of the “DeFi summer season” of 2020). In essence, the protocol proposes voting vitality in the approach forward for its governance in opposition to comparatively worse costs in the recent. Very in total, protocols focal level on incentivizing liquidity suppliers, as they’re the principle ingredient to providing the appropriate costs.

The Doable Considerations of DAOs

No topic the gargantuan doubtless of DAOs, there are additionally many linked considerations. DAOs are particularly weak to collusion and oligarchy. If a pair of contributors retain too great vitality, they’re going to flip the virtuous cycle of DAO governance on its head. As an alternative of all users being incentivized to carry out the DAO more prosperous to carry out their very own stake in it more critical, great spoiled actors might perhaps additionally unprejudiced abuse a DAO for their very own monetary prevail in. Nonetheless, Graham argues that collusion is trickier to assemble in DAOs than in veteran organizations. He says:

“DAOs are more resistant to collusion than veteran organizations. In any organization, particularly bigger ones, it’s attainable for a subset of its contributors to maintain incentives or goals that compete with the target of the organization. When vitality is extremely concentrated esteem in a veteran organization, it finest takes a pair of colluders to reach hurting the broader organization. Nonetheless in a DAO, where vitality is plan more dispensed, many more contributors would must collude to maintain an impact. In other phrases, the Nakamoto coefficient of DAOs is on the total great elevated than veteran organizations.”

DAOs additionally incentivize the industrial style of a protocol, which dampens all non-monetary motivations a undeniable DAO will maintain. To illustrate, if a DAO centered on seed investing in inexperienced projects distributes its governance tokens and a majority of contributors deem to merely invest in potentially the most financially viable projects, there might be nothing the DAO can raise out about it.

One other example of a subject shall be a DAO centered on promoting recent NFT artists where the neighborhood votes to maintain interplay sure artworks from those recent artists. There is a wretchedness that monetary interests might perhaps perhaps retract over human ones, with the neighborhood specializing in potentially the most lucrative affords rather then promoting recent artists.

Whereas a clear framework and governing structure might perhaps be coded loyal into a dapper contract, some issues esteem culture and social values are no longer the appropriate candidates for code. If that is so, it’s all of the manner down to the prerogative of the neighborhood to adapt in a direction that suits its defining ideology. The fluidity of DAOs is a strength in a fast-evolving world, however it completely’s additionally one amongst its most crucial vulnerabilities as monetary interests maintain a built-in advantage for that reason of the governance model.

The Future of DAOs

DAOs empower online communities to raise out great bigger than became as soon as ever attainable earlier than. Believe in online, regularly nameless, folks has been a bottleneck to better cooperation. Laborious-coded principles over administration of the treasury of a web based neighborhood allow great better monetary cooperation in a world where money is digital.

Orderly contracts provide an immutable structure that permits for better transparency and administration than many smartly-liked organizations. To illustrate, charities are one amongst the appropriate candidates for DAOs. One in all the principle components charities face is the misappropriation of funds and inefficiencies in distributing funds. DAOs can again immensely in these areas.

The transparency assured by an beginning blockchain enables for a level of administration that’s never beforehand been attainable with organizations. Presumably more importantly, the administration doesn’t approach from an overarching supervisor. Someone in any organization can test their boss’ wage and whether the agreed allocation of funds is revered.

Different key candidates for DAOs shall be grant programs where somebody can propose to present segment of the DAO’s treasury to a bunch growing a explicit challenge the DAO wants to support. These days, DAOs maintain emerged for play-to-execute guilds, which maintain one plan more great infrastructure to address their fast-growing treasuries. Reflecting on how DAOs might perhaps perhaps grow in the end, Graham says:

“The total addressable market of DAOs is the total addressable market of firms and non-income organizations. Genuinely, it’s potentially bigger—what number of firms and veteran organizations are no longer created this day thanks to how sophisticated they’re to launch? We deem the transition is inevitable, however it completely’s a enormous shift—culturally, structurally, and procedurally—so this will doubtless be uninteresting.”

These days, token-based completely DAOs are an needed characteristic of DeFi. The most successfully-known example is MakerDAO, the organization controlling the issuance and administration of DAI, the crypto asset-backed stablecoin. Participation in the DAO is beginning to somebody who owns the platform’s governance token, MKR. Thanks to recent innovations, voting in governance choices is now free. Initiatives esteem Snapshot again in providing governance tools that allow better dialog in DAOs without requiring pricey on-chain transactions.

The complementary nature of DeFi protocols and DAOs became as soon as the turning level for adoption. Now that DAOs maintain shown they’re going to take care of the big treasuries of DeFi protocols, it is finest a topic of time earlier than veteran organizations and establishments realize the aptitude for blockchain-based completely infrastructure. DAOs are already elevating gargantuan sums from a pair of of the essential figures in tech, and it appears to be like to be to be like esteem their account is finest factual foundation.