Gold-pegged tokens (also recognized as gold-backed cryptocurrency) are digital resources which may perhaps be both backed by bodily gold or are algorithmically derived from the value of gold. In feature, the tokens are both pegged to the value of fiat currency equivalent to the U.S. greenback or to the genuine commodity value of gold.

The fresh value of gold to which tokens are pegged varies by provider, however most in most cases consume the same ratio. Gold-backed tokens in total signify a bodily sequence of gold that occupy to be owned by the stablecoin issuer; the quantity of tokens a provider can field is runt to how great it bodily owns.

Since gold-pegged tokens leverage the flexibility and advantages of cryptocurrency and the soundness of gold’s value, they provide:

- Extra stable value storage than the extra volatile resources treasure Bitcoin and Ethereum.

- The facility to “abet” gold with out desiring to bodily occupy possession of the asset.

- A arrive to purchase gold with out desiring a minimum funding

Each and every of the completely different gold-pegged tokens within the marketplace objectives to present uncommon advantages over the assorted, equivalent to faster transactions, gold bullion choices, and no prices. Tether Gold, for instance, has a market cap of $469 million and enables for multiple redemption choices.

$100,000 value of gold weighs about 3.59 kilos– a dense dinky brick of value storage. This may no longer seem treasure great to the frequent health club-inclined reader, however that’s genuine the build the value of gold-pegged tokens starts:

- Within the occasion you mandatory to sell $20,000 of this gold brick, how would you breeze about it?

- Within the occasion you had to pass homes or worldwide locations, would you lose sleep over transporting it safely?

- Within the occasion you’re storing this brick to your non-public home, how assured are you to your safety?

Now, gold-pegged tokens aren’t the knight in curious armor ready to repair each one amongst gold’s complications, however they attain offer some aggressive technological advantages. As an illustration,

- Within the occasion you mandatory to sell $20,000 of your $100,000 of gold-pegged tokens, that you would perhaps perhaps perhaps also seemingly attain so in minutes on a cryptocurrency alternate (equipped the alternate has liquidity to your token) at that tokens’ market value. That you just would be able to perhaps also add extra gold-pegged tokens to your stockpile genuine as with out disaster.

- Within the occasion you had to relocate, you’d handiest occupy to give protection to your hardware pockets and restoration phrases. Within the occasion you abet your tokens on-line someplace, you won’t even must misfortune about conserving a bodily object.

On the different hand, the safety of your gold-pegged tokens is quiet paramount– rather than fearing a bodily break-in, you’d occupy to bewitch preventative measures to give protection to from a digital one.

The next files explores the history of gold-pegged tokens, their advantages, disadvantages, and the ideal intention to make investments.

History of Gold-Pegged Tokens

Even if even handed as a brand new kind of currency, the foundation of ‘digital gold’ spans reduction to the founding of the cyber net.

In 1995, E-Gold was the first digital currency that was backed by gold. The currency was held by millions of folks all over the globe, till it was shut down by the US Government on account of licensing complications.

Several decisions occupy since been made, however occupy been unsuccessful on account of the lack of supporting abilities. Now, with the back of blockchain abilities as a stable accounting arrive, the theorem that of gold-backed digital currencies is palpable.

Companies can consume the blockchain to field tokens that signify bodily gold. As an illustration, 1 gram of gold is equal to one token. This gram of gold is bodily held by the custodian in a stable arrangement and may moreover be traded with assorted coin holders.

If shoppers don’t want to alternate, most companies also enable shoppers to alternate their tokens for bodily gold within the occasion that they want to retailer it themselves.

Advantages of Gold-Pegged Tokens

Gold-pegged tokens occupy a total lot of benefits over both aged gold and their cryptocurrency decisions.

Much less Volatile than Most Crypto

One of the best fair genuine thing about gold-pegged tokens is that they’re enormously much less volatile than most cryptocurrency investments.

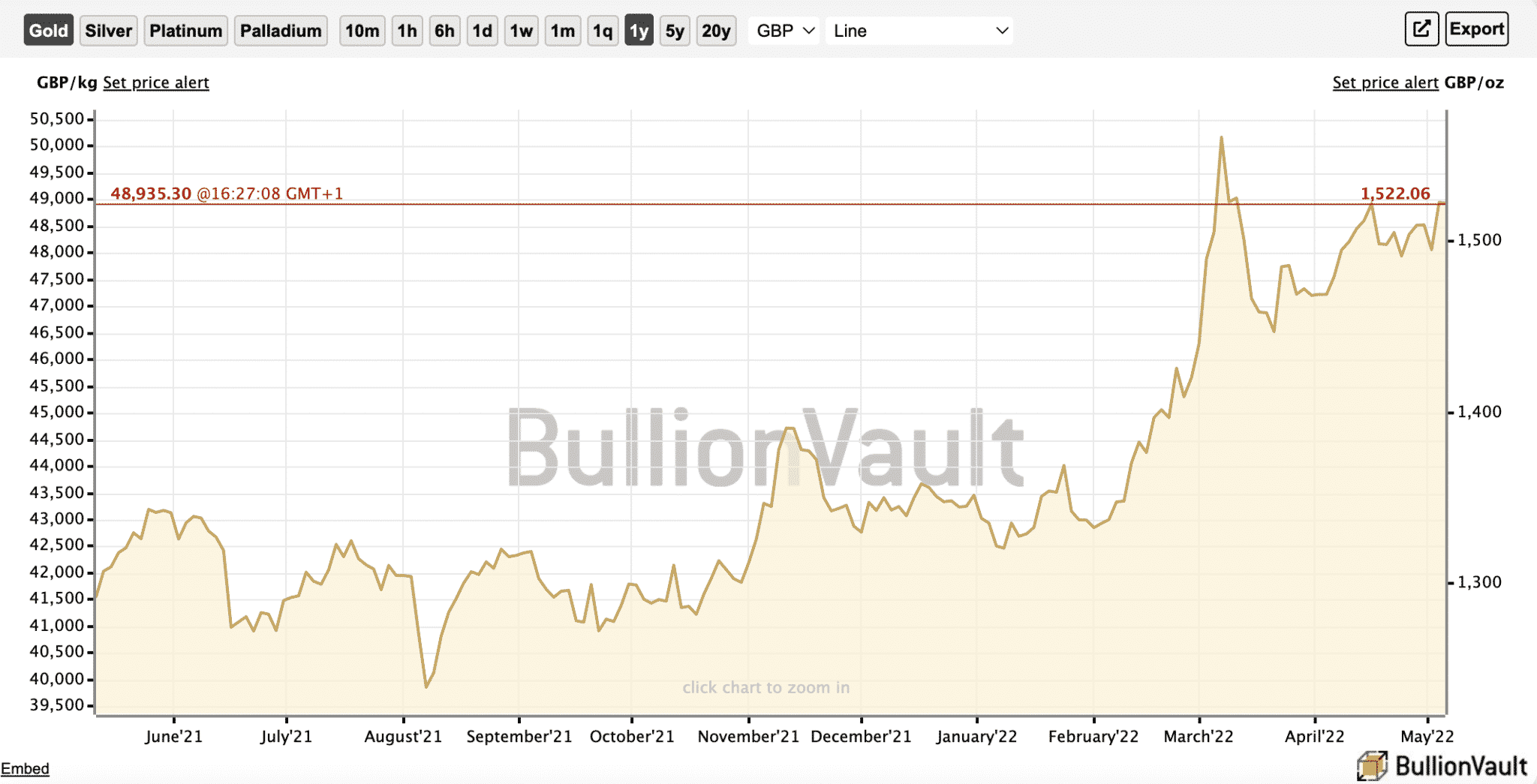

In 2021, Bitcoin’s value ranged from $69,045.00 to $29,795.55.

Within the same one year, gold’s value ranged from $1,954.40 to $1,678.00.

This decrease in volatility enables shoppers to add balance to their cryptocurrency portfolio, or no no longer as a lot as diversify away from the wild swings cryptocurrency tends to occupy.

In aged investing, gold is in total aged as a hedge all over intervals of uncertainty and coarse market stipulations. By applying this to a seriously unpredictable cryptocurrency market, shoppers can add increased balance to their portfolios.

Removes Storage Concerns

Gold-pegged tokens enable bodily gold to be traded with ease.

Within the previous, owning gold was problematic; It’ll be held thru bullions (gold bars) which may then be kept by third-party establishments or by the owner in their condominium.

Holding gold to your non-public home may moreover be perilous, and costs can mercurial add up when paying a third party.

Gold-pegged tokens overcome both of these considerations. Once a token is purchased completely just a few companies fee storage prices. This permits shoppers to give protection to their gold and repair money within the formulation.

To manufacture a income, a total lot of companies will fee transaction prices, whereas others field loans to establishments and manufacture investments.

With out direct Transferable

Yet one more field typically associated with gold is its transportability. If an investor held a big quantity of gold, promoting or transferring it was problematic. It will routinely involve extra prices, and would require the gold to be moved from one vault to one other.

With gold-pegged tokens, shoppers can merely switch their contract over and the deal is full.

No Minimum Investment Restrict

Traditionally, an investor would must exhaust a definite quantity to purchase gold. Ensuing from fractionalized tokens, there isn’t a minimum limit on how great any individual can make investments.

This eliminates the obstacles to entry and enables runt shoppers to encompass gold in their portfolios.

Much less Human Intervention

The shopping and selling of gold-pegged tokens is in total ruled by neat contracts; by their default programming, interplay with assorted human parties is minimized.

In its build of getting to prepare the transportation of gold from one investor to the next, an investor can switch their gold by strategy of a neat contract.

Disadvantages of Gold-Pegged Tokens

No topic their advantages, there are also just a few downsides to gold-pegged tokens.

Lower Doable ROI

In a market that’s recognized for its excessive-possibility excessive-reward pleasure, the returns of gold-pegged tokens may moreover be seriously underwhelming.

In a sense, gold is a greater retailer of value than altcoins, however it absolutely constructed its recognition on balance no longer ability upside.

Reliance On Centralized Service Suppliers

No topic being a cryptocurrency, gold-pegged tokens are quiet reliant on centralized provider companies. These companies take care of the bodily gold and in total require shoppers to cross KYC (know-your-customer).

This may require an investor’s deepest records, that would even be considered as a downside for anonymous crypto shoppers.

Wallets Can Be Hacked

Even if much less perilous in the case of market fluctuations, holders are quiet required to give protection to their hardware wallets. With most gold-pegged tokens being ERC-20 tokens, they’ll moreover be kept in digital wallets equivalent to MetaMask, and hardware wallets equivalent to the Ledger Nano X.

These wallets may moreover be hacked and within the formulation, gold-pegged tokens may moreover be stolen.

How To Bewitch Gold-Pegged Tokens

To purchase gold-pegged tokens, you’ll first must make consume of a fiat onramp that enables you to switch fiat currency into cryptocurrency, whether that be Bitcoin (BTC) or Ethereum (ETH), and even straight to the gold-pegged token.

Gemini and Kraken, for instance, are two well-liked centralized U.S. exchanges that enable folks to purchase a popular gold-pegged token PAXG at the moment with USD.

Other tokens occupy fetch admission to in assorted exchanges– we propose sorting out our listing of the tip gold-pegged tokens to secure the most effective arrangement to alternate.

Last Tips: Are Gold-Pegged Tokens Worth It?

Gold-pegged tokens are a blinding application of blockchain abilities– tokenizing a heavy and precious steel opens the gold market to wider diversity of ability shoppers.

Because the cryptocurrency market continues to develop, the inquire of for gold-pegged tokens will seemingly follow. It’s major to grab the benefits every token provider affords earlier than making a purchase roar.

Assign they align alongside with your requirements? As with every funding, attain your due diligence.

Who backs your token?

The build are the companies and products the build your gold will most seemingly be kept?

The build can you sell your token?

The build will you retailer your token?

Gold-pegged tokens are a factual arrive to fetch exposure to this commodity. On the different hand, gold-pegged tokens quiet occupy technological dangers to give protection to towards.

Hackers, for instance, can pry launch a poorly secured alternate story or pockets and genuine as with out disaster siphon millions or millions of bucks of value.

Owning a token is the easy segment– preserving it stable would require an adept idea of the ideal intention to abet your crypto stable.