- Liquid Staking into Liquid Re-Staking: A Temporary History

- From Liquid Staking to Re-Staking

- Re-Staking (and Liquid Staking) Dangers

- Additional Re-staking Concerns

- Closing Thoughts: Liquid Restaking and the DeFi Evolution

Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs) are a number of the most most pleasurable DeFi traits you ought to know about.

LSTs, esteem stETH from Lido, can wait on you to stake your Ethereum and accomplish staking rewards whereas keeping liquidity.

This potential you might perhaps well spend your staked sources in varied DeFi actions, comparable to lending, buying and selling, or providing liquidity, all whereas aloof incomes staking rewards. This dual efficiency has saved many of us’ fingers chunky, boosting the capital efficiency and allure of staking.

Liquid Re-Staking Tokens, LRTs, scheme close this a step additional by enabling restaking, meaning you might perhaps well re-stake your already staked tokens to accomplish additional rewards.

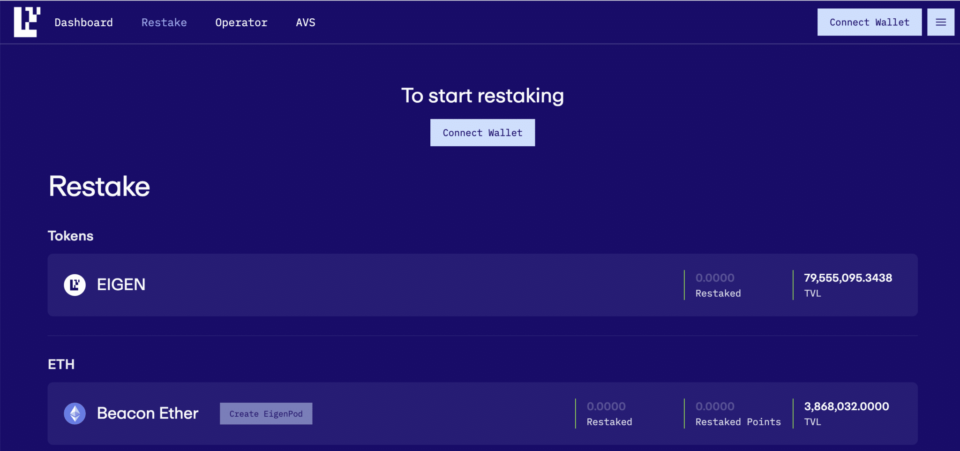

Platforms esteem EigenLayer enable stakers to scheme close half in securing fresh blockchain initiatives or DeFi products and companies, incomes yields from the deplorable Ethereum staking, liquid staking actions, to boot to staking actions.

Liquid Staking into Liquid Re-Staking: A Temporary History

As of writing, there are 1,023,467 validators actively securing the Ethereum blockchain, with a staggering 32,709,951 $ETH staked– about $115 billion in frequent folks terms.

Of that lump sum, $47 billion is accomplished through liquid staking, a testament to the explosion of ardour and investment in Liquid Staking Derivatives (LSDs).

The spark was The Ethereum Shanghai Strengthen in April 2023, which revolutionized staking by enabling stakers, who had locked up their ether since December 2020, to withdraw each and each their important and their rewards.

This newfound flexibility turned heads and opened wallets, driving a surge in LSDs. But let’s rewind.

The actual game-changer was the Merge in September 2022; Ethereum shifted from its energy-hungry Proof-of-Work (PoW) model to the sleek and efficient Proof-of-Stake (PoS) draw.

Validators was the gatekeepers of the Ethereum network, and are rewarded handsomely with an annual return of spherical 4-5% on their staked ETH. This has transformed Ethereum from a few mining whales to a bustling hub of over 1,000,000 validators.

Now not like miners who want sizable resources to resolve advanced puzzles, validators merely want to stake 32 ETH to attach the privilege of adding blocks to the blockchain; of us and not utilizing a longer up to 32 ETH might perhaps well delegate their holdings to a validator and accomplish yield as smartly.

This democratization of block advent intended lower charges and increased participation.

So, each and each validator earns roughly 1.25 to 1.6 $ETH per twelve months– about $4,300 to $5,600, to boot to to any token appreciation, forming a fairly conservative financial system spherical fairly passive earnings.

The lunge from the Merge to the Shanghai Strengthen space the stage for the DeFi momentum from which Liquid Staking Derivatives emerged.

With earlier college staking, you lock up your cryptocurrency to wait on validate transactions and retain the network’s integrity.

With liquid staking, you’d aloof lock up your cryptocurrency ($ETH) and accomplish yield, nonetheless in return, you’d win a liquid staking token, stETH (Staked ETH), which you might perhaps well spend for quite a variety of other DeFi capabilities.

For instance, you stake 10 ETH on a platform esteem Lido and receive 5 stETH in return. These tokens might perhaps also be utilized in varied DeFi actions, comparable to crypto swaps, providing liquidity, lending, and the spend of them as collateral.

In general, Ethereum staking yields about 3-5%. Relying in your explicit actions, you might perhaps well red meat up your returns additional by enticing in DeFi alongside with your stETH (3-5% + x%). Demonstrate that, earlier than the re-staking infrastructure we’ll articulate below, staking your LSTs wasn’t conceivable.

Lido is the most a success liquid staking protocol, shooting the broad majority of the Ethereum DeFi Liquid Staking Derivatives (LSD) market.

Demonstrate on TVL: TVL calculations are in general contentious, keen double-counting of tokens. For instance, if a consumer deposits ETH into Lido, it’s miles counted in Lido’s TVL. If the resulting stETH is then deposited into EigenLayer, it’s miles counted again in EigenLayer’s TVL, main to inflated and potentially misleading representations of price. This double-counting ends up in TVL figures which might perhaps well well be thought of as unreliable, distorting the DeFi landscape.

From Liquid Staking to Re-Staking

Liquid restaking, pioneered and launched by EigenLayer in June 2023, presented the capacity for liquid staking tokens (LSTs) to be additional tokenized into liquid restaking tokens (LRTs).

Very meta, certainly.

LRTs provide stakers fresh strategies to maximize their sources through a broader vary of actions previous merely increasing yield. Particularly, it supports Actively Validated Services and products, or AVS, including layer-2 networks, recordsdata layers, dApps, foul-chain bridges, and more.

The pitch for AVSs is that by integrating with Ethereum’s consensus mechanism, AVSs no longer want to win their receive costly consensus techniques.

Security + price savings = receive/receive for AVSs

In this methodology, LSTs might perhaps also be restaked (supporting the AVSs) and converted into LRTs, which will then be aged to scheme close half in varied DeFi actions.

So, stakers accomplish rewards from the principle staking network and the additional AVS applications they make stronger.

Re-Staking Within the support of the Scenes

Node operators register with EigenLayer, permitting stakers to delegate their tokens to them. Operators then validate AVS projects and stable transactions by restaking their ETH, performing in a similar vogue to Ethereum validators.

AVSs attach network safety, and restakers accomplish supplemental rewards.

The flexibility to accomplish staking rewards from each and each the native network and the fresh protocol, alongside additional AVS rewards, has made liquid restaking a rather beautiful option for professional yield seekers.

EigenLayer’s first Actively Validated Provider, EigenDA, launched in Q2 2024, with more products and companies anticipated to note.

Re-Staking (and Liquid Staking) Dangers

For starters, liquid staking introduces a few definite risks.

Staking through a liquid staking protocol outsources the accountability of asserting a validator node. In proof-of-stake networks, staked sources might perhaps also be slashed attributable to malicious or negligent behavior from validators.

Being slashed potential you lose a fraction of the sources you’ve staked.

While liquid staking derivatives goal to minimize these risks, they are able to not totally eradicate them, leaving stakers at possibility of doable losses if validators are penalized.

LST price is influenced by market dynamics, including provide and ask, liquidity constraints, and worth volatility. Theoretically, these tokens might perhaps well “depeg” vastly from the underlying staked cryptocurrencies, main to a sizable deviation from the native token’s price.

This form of de-pegging tournament can trigger a cascade of liquidations, compounding the financial influence on users.

For instance, if stETH is worth vastly no longer up to ETH for some cause, folks would likely promote stETH to transfer into the safer deplorable layer asset (or totally exit the ETH ecosystem.)

The custodial ache linked to the doable for malicious actions by liquid staking protocols might perhaps well merely discontinuance up within the shortcoming of staked sources.

Additional, liquid staking derivatives rely carefully on natty contracts to administer staked sources and articulate spinoff tokens. Natty contracts can receive bugs and vulnerabilities or be exploited, main to essential financial losses for users.

Similarly, restakers attach this trust within the platforms they spend for staking.

While Liquid Restaking Tokens (LRTs) provide increased profit doable when put next to native tokens or Liquid Staking Tokens (LSTs), they also reach with a increased ache of sizable loss.

A fresh incident with Renzo Protocol illustrates these risks: users keeping Renzo Protocol’s liquid restaking token, ezETH, skilled essential losses when the token depegged all over a controversial airdrop of the REZ native token, main to a $60 million liquidation cascade.

As of June 2024, Renzo Protocol is aloof operational and has continued to grow and evolve. The protocol has been actively increasing its ecosystem and is now built-in with more than one platforms, including Morpho Blue, Balancer, Curve, and Pendle. Renzo has also been added to Binance’s Launchpool as its 53rd mission, highlighting its prominence within the DeFi home.

Despite these inherent risks, the allure of liquid staking derivatives aloof draws many validators, and ETH (and stETH) holders.

Additional Re-staking Concerns

On one hand, “restaking” has the vibes of hypothecation, the culprit on the support of the loss of life of Luna and Celsius. This line of thought would articulate this as the next dim swan tournament within the crypto home if something goes inappropriate.

Customers ought to rightfully be skeptical about any DeFi innovation if true for the sake of poking holes through ragged designs that will give contrivance and price folks their shirts.

On the different hand, a closer examination means that the apprehension shall be exaggerated, likely influenced by previous stressful events esteem the Luna give contrivance.

Eigen’s docs truly command that “rehypothecation” isn’t conceivable since the layer doesn’t receive financial actions– have in mind, rehypothecation has to enact with the domino outcomes of lending borrowed funds.

EigenLayer’s important feature is to ride financial safety to fresh initiatives enforcing proof-of-stake mechanisms somewhat than enticing in financial actions that will originate a domino construct.

Then again, the supreme, in general misplaced sight of, ache is its inherent centralization.

Exciting more than one off-chain networks complicates the verification of merely behavior. A essential slashing tournament on EigenLayer depends on manual triggers, elevating concerns about the draw’s transparency and reliability. While evolved cryptography might perhaps well tackle these issues within the future, it hasn’t but equipped a acknowledge.

For U.S. traders, there’s an added layer of ache. EigenLayer might perhaps well potentially meet the criteria of the Howey Test, classifying it as a security below SEC regulations. Right here’s particularly relevant since EigenLayer accepts deposits from non-validators for yield, corresponding to staking on a centralized exchange. This scheme truly locations traders in a securities contract, relying on the entities to administer their investments properly.

Making the course of permissionless might perhaps well introduce additional issues. Malicious entities might perhaps well potentially manipulate the draw by overwhelming it with votes to trigger slashing events. If collateral is required to vote, then this collateral is also classified as a

safety, creating a flowery genuine and operational anguish. This jam might perhaps well merely discontinuance EigenLayer from reaching chunky decentralization, limiting its doable growth and steadiness.

Total, whereas restaking items opportunities for enhanced yields and safety, these doable risks and regulatory challenges want to be rather thought of as by traders and developers alike.

Closing Thoughts: Liquid Restaking and the DeFi Evolution

Liquid staking and restaking are fresh, albeit experimental, fixtures of DeFi that mix enhanced yield opportunities with liquidity.

The Shanghai Strengthen and the Merge facilitated this growth and made Ethereum staking more accessible and worthwhile. This has drawn essential consideration from crypto OGs, technologically evolved DeFi crowds, and more institutional traders’ ardour.

By proxy, an ETH ETF would stimulate and urge innovation (and breaking aspects) for each and each liquid staking protocols esteem Lido and staking protocols esteem Eigen Layer.

Trying forward, the success of liquid staking and restaking will hinge on addressing the hazards and concerns notorious above.

By no means Inch away out One more More than a few! Accept hand chosen recordsdata & recordsdata from our Crypto Consultants so you might perhaps well form professional, instant choices that presently have an effect on your crypto earnings. Subscribe to CoinCentral free e-newsletter now.