The Nixon shock and subsequent dissolution of the Bretton Woods gadget have resulted in untenable inflation, mounting national debt, and crude profits and wealth inequality because the realm’s largest economy stands on the point of hyperinflation.

In June this one year, Deutsche Financial institution issued a stark warning to the US after the Federal Reserve’s steadiness sheet doubled all around the pandemic,

“US macro protection and, indeed, the very role of executive within the economy, is undergoing its very very best shift in direction in 40 years. In turn, we are concerned that this might perhaps perhaps result in downhearted ranges of inflation.”

How did we glean here? How did money change into so fundamentally broken? Who broke it? Let’s dive into that narrative.

Bretton Woods Agreement (1944)

The total premise of the Bretton Woods agreement became to pursue a mounted replace charges gadget backed by gold because the universal fashioned to forestall competitive devaluation of sovereign currencies and promote free alternate within the aftermath of WWII.

Britain wished versatile charges. Nevertheless, on condition that Britain emerged from the war because the debtor and the US now poised to steal the role of creditor, Britain needed to settle for a compromise of mounted but adjustable charges.

As per the agreement, the US had a dedication to lend a hand bucks held in foreign reserves with gold at a payment of $35 per ounce. Assorted sovereign currencies had been pegged in opposition to the dollar and had been required to be saved within 1% of the mounted-payment by procuring/selling bucks.

Distant places currencies pegged to the dollar. Dollar pegged to gold

For so lengthy because the US held the massive majority of the realm’s gold reserves, this gadget would work, and it did work successfully within the early years because the US had a surplus of steadiness of payments.

What ended in the fall down of this gadget?

The Marshall thought and US adoption of expansionary insurance policies within the uninteresting fifties reversed the steadiness of payments in favor of alternative worldwide locations. By 1960, the US started working a deficit.

This, combined with the depletion of US gold reserves, would portend the starting of the kill for the Bretton Woods gadget. As dollar claims on gold outpaced the provision of gold, it created an arbitrage opportunity for other worldwide locations to further burn up US gold reserves.

What prevented this space became that everybody had a general pastime in preserving the gadget, but equipped that the US would no longer resort to devaluing the dollar. In 1960, even sooner than assuming space of labor, JFK became forced to rapidly pass to allay such fears.

Nevertheless with out the US devaluing the dollar, other worldwide locations had been required to revalue their own forex to redress the steadiness, which they had been no longer focused on pursuing as it could perhaps perhaps perhaps well adversely have an impact on home protection.

A gold pool, is known as The London Gold Pool, became formed with European worldwide locations to pool your total gold reserves to capture the ratio in examine. Nevertheless, attach a query to for gold soon outpaced provide, and the gold pool became abandoned by 1968.

Amongst other abortive measures, a world forex (imagine that!) to change the dollar became mooted in 1964 to salvage this gadget, but an agreement on that (what indirectly grew to alter into SDR) is no longer going to be reached in time.

By 1969, there became a bustle on the US gold reserves as other worldwide locations tried to money their bucks to redeem gold. This ended in emergency measures from President Nixon, is known as the Nixon shock, which canceled the convertibility of the US dollar to gold and closed the gold window.

Thus collapsed the Bretton Woods gadget, and it resulted within the stagflation of the ’70s, a mix of excessive unemployment and excessive inflation, because the US dollar misplaced a third of its rate.

In hindsight, the gadget became repeatedly untenable within the kill as it tried to advertise free alternate whereas allowing one country, the US, the “exorbitant privilege” of having its forex encourage because the realm reserve forex in a extremely competitive macro-ambiance put up-WWII.

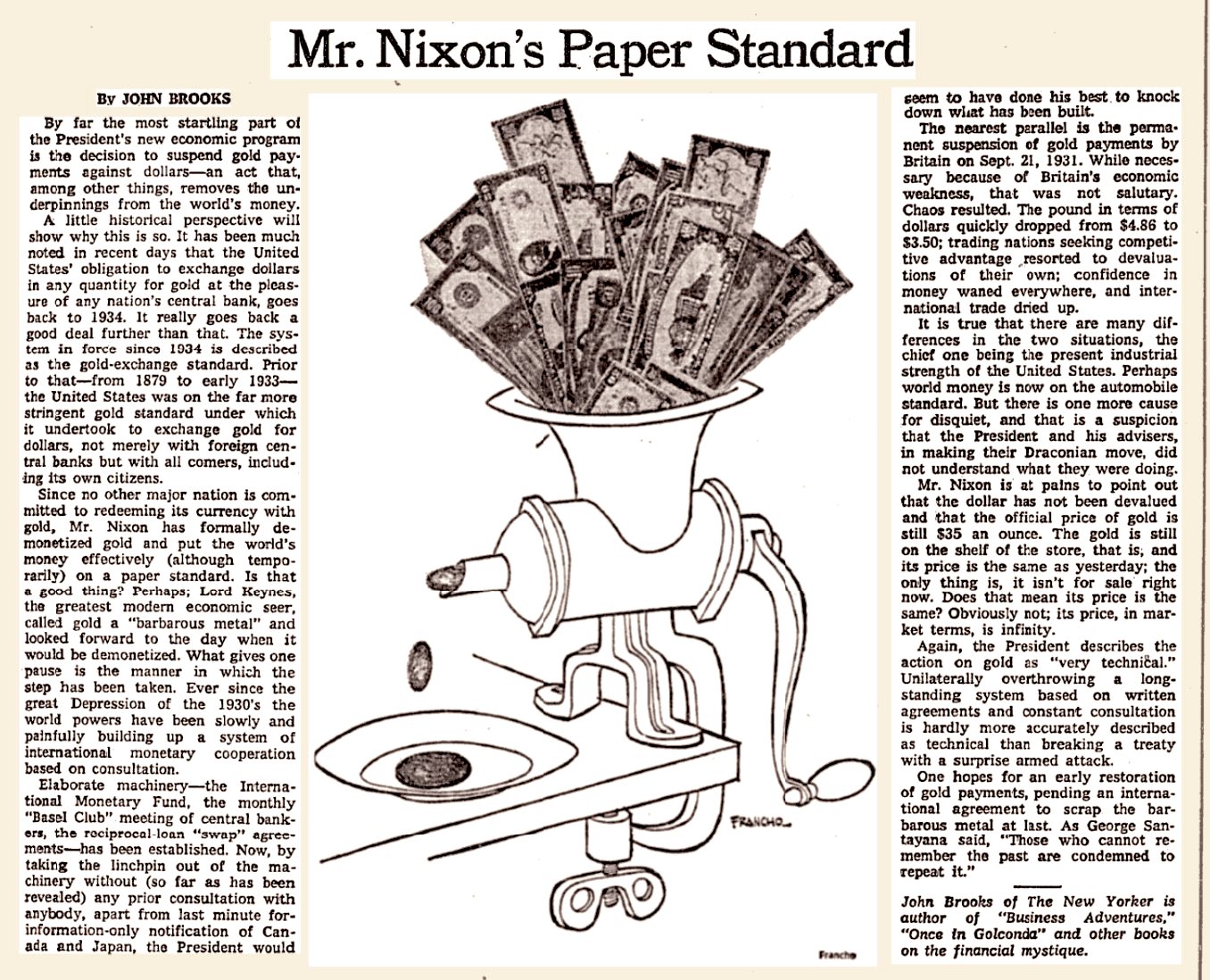

The Contemporary York Conditions pans the Nixon’s paper fashioned, 1971

The Triffin paradox

In 1959, exact because the US started working a deficit, Yale professor Robert Triffin proclaimed that the Bretton Woods gadget became unworkable and would inevitably fall down because the dollar could perhaps perhaps even no longer defend its exorbitant privilege of being the reserve forex with out working up deficits.

Any sovereign forex serving as a world reserve forex is required to bustle up a deficit to meet the realm’s attach a query to for the forex. This creates a battle of pastime between home and world financial insurance policies.

The Nixon shock and subsequent fall down of the Bretton Woods gadget proved the Triffin paradox correct, but ironically only further exacerbated the exorbitant privilege of the US by now allowing the Federal Reserve absolute authority on financial protection because the dollar became no longer required to be backed by gold reserves.

The Fed’s newfound skill to consistently manipulate provide, pastime charges, and velocity of money ended in other deleterious penalties such because the Cantillon attain and exploitation of lawful hazards that inhere for the duration of the fractional reserve banking gadget.

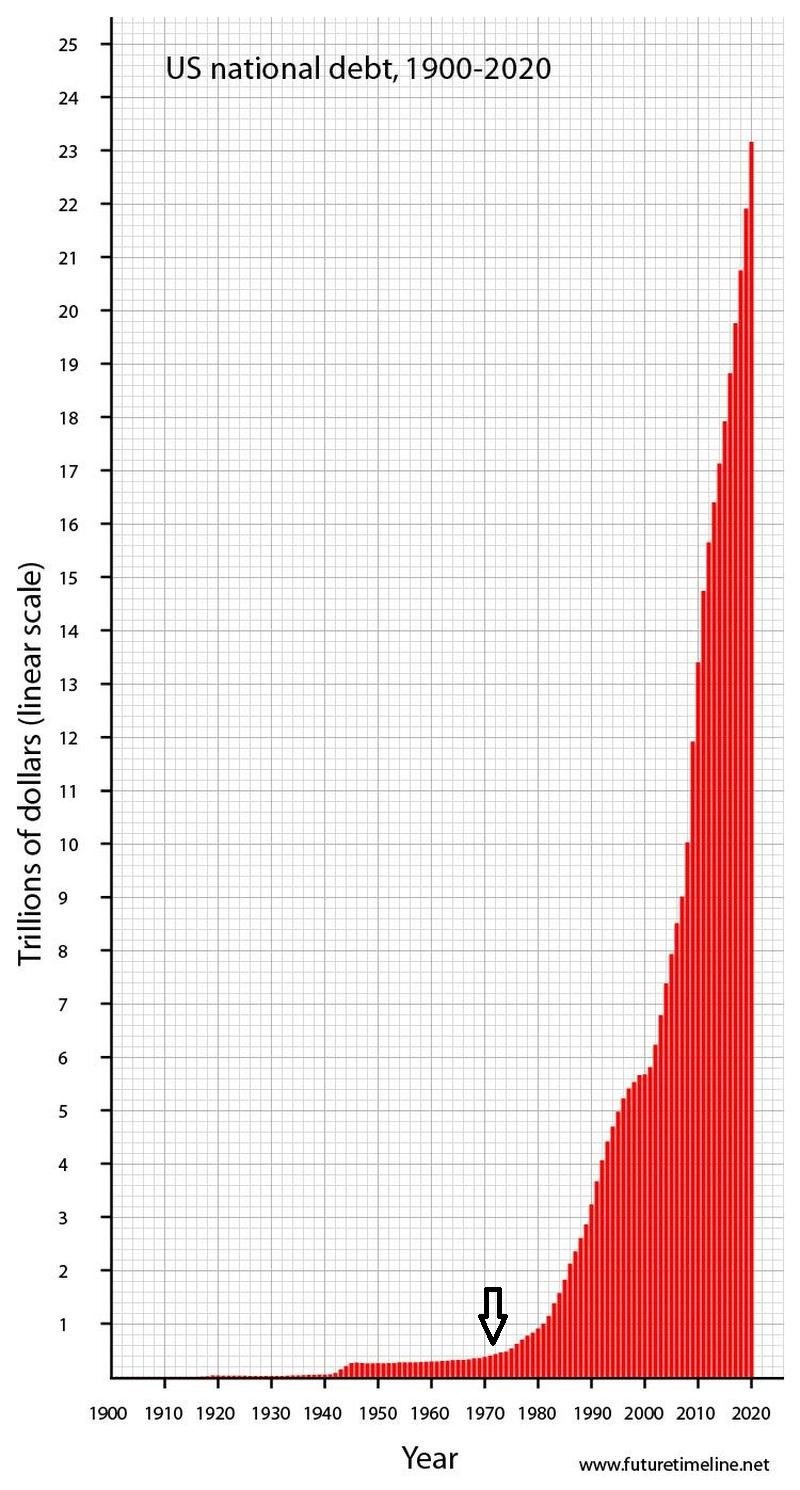

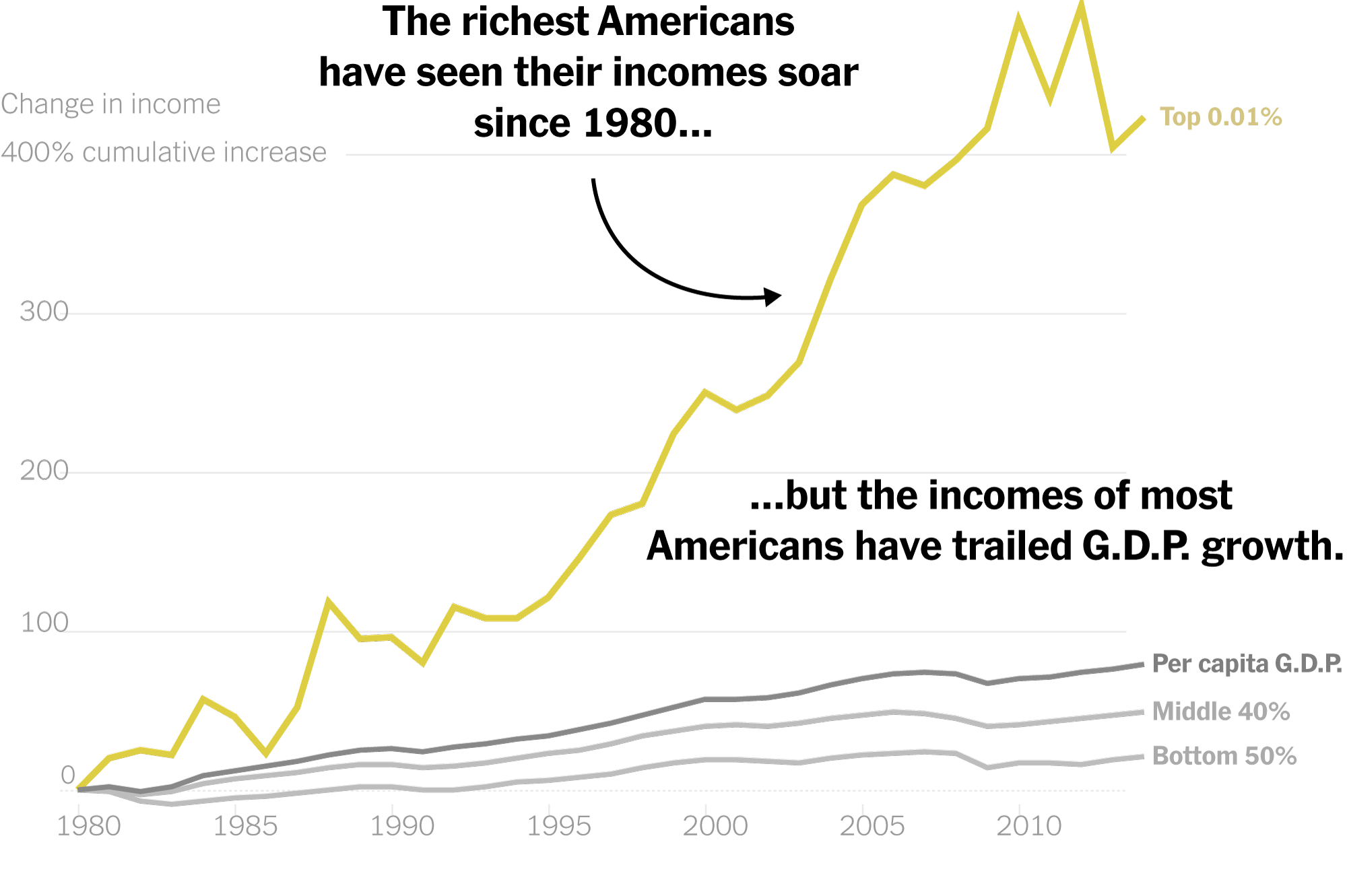

Perpetual growth to spur financial growth sent deficits spiraling out of alter, ensuing in a vicious cycle of inflation and ever-rising, now crude, financial inequality. Let’s undercover agent at the metrics,

US national debt has risen from $398 billion in 1971 to 29 trillion as of this writing.

Earnings of the kill 0.01 parabolic divergence from per capita GDP since 1980

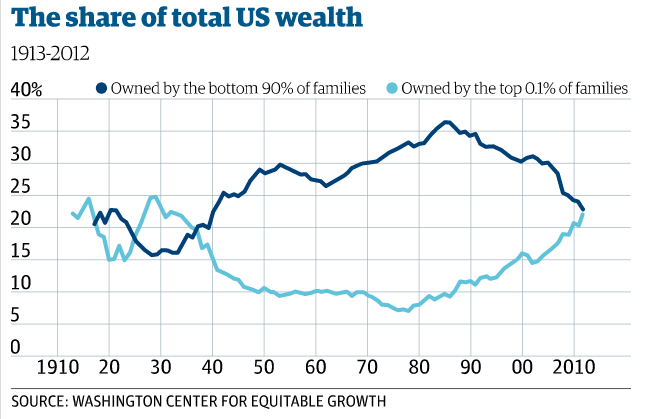

Wealth owned by the kill 0.1% crossed the bottom 90% within the aftermath of the realm financial disaster of 2008

The Triffin paradox has remained an inscrutable puzzle for economists to this day.

What could perhaps perhaps even solve the Triffin paradox?

Presumably a decentralized, borderless, permissionless, sturdy, provably finite, infinitely divisible, straight portable, objectively verifiable different to gold that would no longer allow anyone nation or its central bank an exorbitant privilege?

What if its financial protection wasn’t arbitrary, could perhaps perhaps well no longer be managed or manipulated by other folks, but became predicated on a universal fixed? Something like… arithmetic?

Voila! Fix the money. Fix the realm.