Because the Bitcoin market steps into 2025, investors are keenly inspecting seasonal trends and historical details to foretell what February might perchance perchance retain. With Bitcoin’s cyclical nature generally tied to its halving events, historical insights present a precious roadmap for navigating future performance. By inspecting historical details—including Bitcoin’s common month-to-month returns and its put up-halving February performance—we procedure to develop a clear image of what February 2025 might perchance perchance peek love.

Realizing Bitcoin’s Seasonality

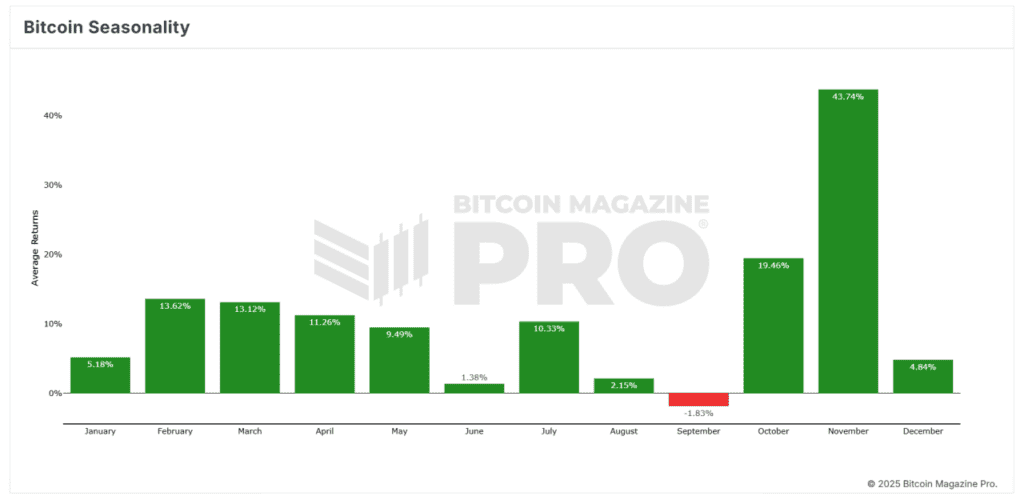

The first chart, “Bitcoin Seasonality,” highlights common month-to-month returns from 2010 to the most up-to-date month-to-month terminate. The records underscores Bitcoin’s most effective-performing months and its cyclical trends. February has historically shown a median return of 13.62%, ranking it as one in all the stronger months for Bitcoin performance.

Severely, November stands out with the excellent common return at 43.74%, adopted by October at 19.46%. Conversely, September has historically been the weakest month with a median return of -1.83%. February’s solid common areas it within the simpler tier of Bitcoin’s seasonality, offering investors hope for definite returns in early 2025.

Historical Efficiency of February in Put up-Halving Years

A deeper dive into Bitcoin’s historical February returns shows involving insights for years that apply a halving tournament. Bitcoin’s halving mechanism—which occurs roughly every four years—reduces block rewards by half of, rising a supply shock that has historically driven stamp will improve. February’s performance in these put up-halving years has repeatedly been definite:

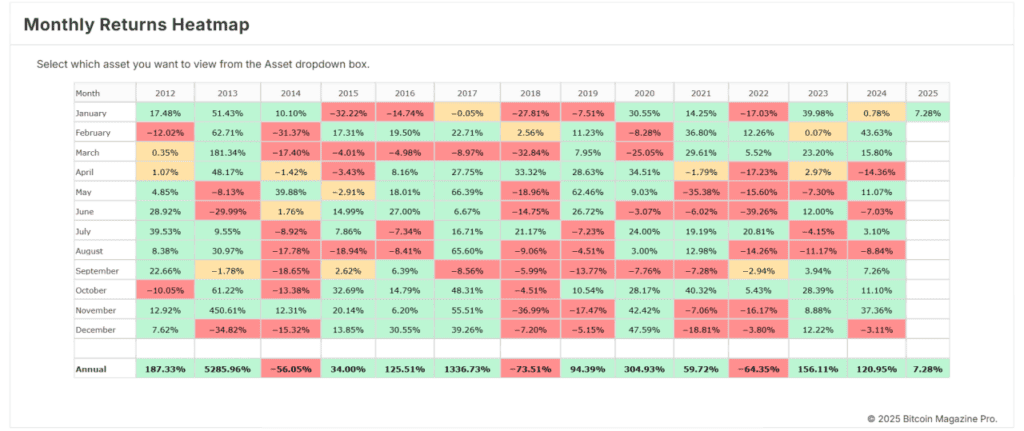

- 2013 (Put up-2012 Halving): 62.71%

- 2017 (Put up-2016 Halving): 22.71%

- 2021 (Put up-2020 Halving): 36.80%

The common return all over these three years is an spectacular 40.74%. Every of these Februarys reflects the bullish momentum that over and over follows halving events, driven by reduced Bitcoin supply issuance and elevated market inquire of.

January 2025’s Efficiency Units the Stage

Whereas February 2025 is but to unfold, the year began with a modest 7.28% return up to now in January, as shown within the “Month-to-month Returns Heatmap.” January’s definite performance hints at a continuation of bullish sentiment within the early months of 2025, aligning with historical put up-halving patterns. If February 2025 follows the trajectory of past put up-halving years, it might in all probability perchance perchance leer returns within the vary of 22% to 63%, with a median expectation around 40%.

What Drives February’s Solid Put up-Halving Efficiency?

Plenty of factors make contributions to February’s historical strength in put up-halving years:

- Provide Shock: The halving reduces glossy Bitcoin supply entering circulation, rising shortage and utilizing stamp appreciation.

- Market Momentum: Investors generally reply to the halving tournament with elevated enthusiasm, pushing prices better within the months following the tournament.

- Institutional Passion: In most up-to-date cycles, institutional adoption has accelerated put up-halving, adding most considerable capital inflows to the market.

Key Takeaways for February 2025

Investors must procedure February 2025 with cautious optimism. Historical and seasonal details indicate the month has sturdy capability for definite returns, notably within the context of Bitcoin’s put up-halving cycles. With a median return of 40.74% in past put up-halving Februarys, investors might perchance perchance seek details from identical performance this year, barring any most considerable macroeconomic or regulatory headwinds.

Conclusion

Bitcoin’s historical past provides a precious lens by which to seek for its future performance. February 2025 is shaping as much as be but another definite month, driven by the same put up-halving dynamics which indulge in historically fueled spectacular gains. Combining historical details performance with a definite regulatory atmosphere, the incoming respectable-Bitcoin administration, and the news that The Financial Accounting Standards Board (FASB) has issued a brand glossy guiding thought (ASU 2023-08) fundamentally altering how Bitcoin is accounted for (Why A full bunch of Corporations Will Aquire Bitcoin in 2025), 2025 is shaping as much as be a transformative year for Bitcoin. As repeatedly, investors must mix these insights with broader market diagnosis and remain ready for Bitcoin’s inherent volatility.

By leveraging the teachings of historical past and the patterns of seasonality, Bitcoin investors can originate told selections because the market navigates this pivotal year.

To in discovering dwell details and put told on the most up-to-date diagnosis, consult with bitcoinmagazinepro.com.

Disclaimer: This text is for informational functions easiest and can merely not be regarded as monetary advice. Repeatedly salvage your indulge in compare earlier than making any funding selections.