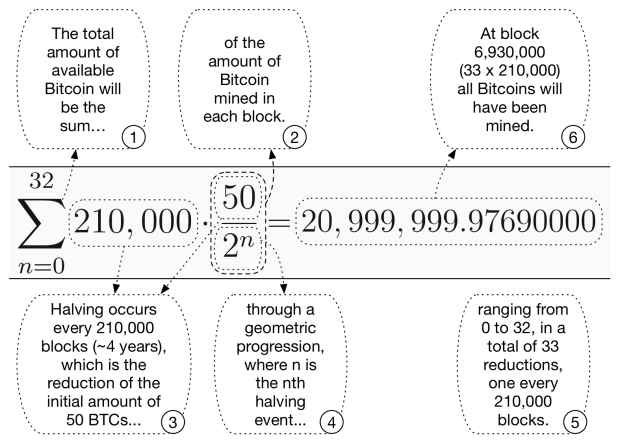

While you happen to would possibly perchance perchance perchance have fallen far sufficient down the rabbit gap, that bitcoin’s present schedule currently rewards 6.25 original bitcoin every 10 minutes, on realistic, to miners as a reward for efficiently discovering a right nonce and committing a original block of transactions to the blockchain. This distribution schedule, the “block subsidy,” is Satoshi Nakamoto’s resolution to the say, or ask, of “how catch we somewhat distribute this original forex into the fingers of recent customers?” There changed into as soon as no premine (having a gaze at you, Vitalik), and the genesis block that Satoshi mined before publishing the code had a block reward that changed into as soon as no longer spendable. The block subsidy started at 50 bitcoin and programmatically cuts in half every 210,000 blocks, roughly every four years. The recent reward is 6.25 bitcoin per block. This draw that currently, every 10 minutes, 6.25 original bitcoin are minted and added to the entire style of bitcoin. When of us focus on bitcoin’s great cap of 21 million, it is miles a characteristic of the initial 50 bitcoin block reward and subsequent halving schedule. Stated in a different way, 21 million just actual happens to be the asymptote of the below characteristic.

The number is unfair. It’d be five or 5 trillion. What matters is the incontrovertible truth that this present schedule is identified upfront and can’t be manipulated by a centralized authority.

When inquisitive in regards to the long term purchasing vitality of bitcoin in at the peaceable time’s dollars, there are quite loads of priceless frameworks to assume: stock to float, fastened earnings market cap, market cap of world valid property, market cap of gold, silver, etc. Each and each of these approaches has their deserves and right criticisms.

With 6.25 original bitcoin minted every 10 minutes, on realistic currently, that’s 675,000 bitcoin over the following 25 months, before the following halving. That feels indulge in plenty. I have been interested by assorted ways to estimate the long-term purchasing vitality of bitcoin in due path, and I assume the following framework is an spell binding capability using recordsdata on the M2SL money present metric as reported by the Federal Reserve.

M2SL money present on January 3, 2009: $8.27 trillion.

M2SL money present on October 10, 2021: $21.19 trillion.

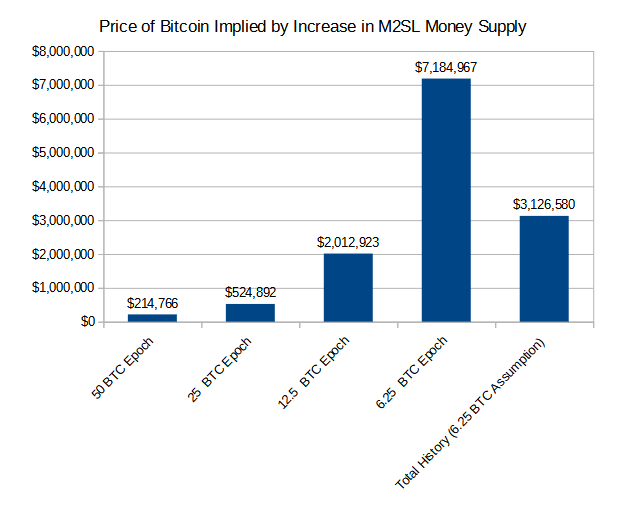

The M2SL money present has increased by $12.92 trillion over the previous 12 and a half years. This works out to roughly $19.54 million every 10 minutes for the last 10 years. As of block height 630,000, the bitcoin block reward subsidy is 6.25 bitcoin. So for every bitcoin being minted within the original subsidy epoch, $3.13 million is being added to the money present. This capability assumes that the money printer has been running at a consistent rate for the last 12 and a half years. It’s far a extremely conservative capability given the parabolic enhance in money printing that the unelected bureaucrats at the Federal Reserve have applied to the rate of money printing, besides to the consistent scheduled reductions in bitcoin’s inflation schedule.

One bitcoin needs to be price $3.13 million at the peaceable time.

Deem the following changes to this valuation framework for every subsidy epoch within the bitcoin present schedule.

On the date the genesis block changed into as soon as mined, January 3, 2009, when the block reward changed into as soon as situation at 50 bitcoin, M2SL money present changed into as soon as $8.27 trillion.

On the date of the first halving, November 29, 2012, when the block reward changed into as soon as diminished from 50 bitcoin to 25 bitcoin, M2SL money present changed into as soon as $10.45 trillion.

The M2SL money present increased by $2.18 trillion between the genesis block and the first halving, the 50 bitcoin block subsidy reward epoch. This works out to roughly $10.74 million every 10 minutes from January 2009 to November 2012. So, for every bitcoin minted from the genesis block to the first halving, $215,000 changed into as soon as added to the money present.

One bitcoin ought to had been price $215,000 in 2012.

On the date of the first halving, November 29, 2012, when the block reward diminished from 50 bitcoin to 25 bitcoin, M2SL money present changed into as soon as $10.45 trillion.

On the date of the second halving, July 10, 2016, when the block reward diminished from 25 bitcoin to 12.5 bitcoin, M2SL money present changed into as soon as $12.89 trillion.

The M2SL money present increased by $2.44 trillion between the first and second halving, the 25 bitcoin block subsidy reward epoch. This works out to roughly $13.12 million every 10 minutes from November 2012 to July 2016. So, for every bitcoin minted from the first halving to the second halving, $525,000 changed into as soon as added to the money present.

One bitcoin ought to had been price $525,000 in 2016.

On the date of the second halving, July 10, 2016, when the block reward diminished from 25 bitcoin to 12.5 bitcoin, M2SL money present changed into as soon as $12.89 trillion.

On the date of the third halving, Can also 11, 2020, when the block reward diminished from 12.5 bitcoin to 6.25 bitcoin, M2SL money present changed into as soon as $17.89 trillion.

The M2SL money present increased by $5.00 trillion between the second and third halving, the 12.5 bitcoin block subsidy reward epoch. This works out to roughly $25.16 million every 10 minutes from July 2016 to Can also 2020. So, for every bitcoin minted from the second halving to the third halving, $2.01 million changed into as soon as added to the money present.

One bitcoin ought to had been price $2.01 million in 2020.

On the date of the third halving, Can also 11, 2020, when the block reward diminished from 12.5 bitcoin to 6.25 bitcoin, M2SL money present changed into as soon as $17.89 trillion.

On the date of writing this text, December 4, 2021, M2SL money present changed into as soon as $21.19 trillion.

The M2SL money present increased by $3.30 trillion between the third halving and at the peaceable time. This works out to roughly $44.91 million every 10 minutes from Can also 2020 to December 2021. So, for every bitcoin minted from the third halving to at the peaceable time, $7.18 million changed into as soon as added to the money present.

One bitcoin needs to be price $7.18 million at the peaceable time.

Clearly, bitcoin has sorely underperformed this valuation framework historically. It’s far great despite the incontrovertible truth that, that the price of bitcoin has repeatedly closed the outlet between this valuation framework and reality. In November 2012, bitcoin changed into as soon as spherical $13, or 0.006% of the $215,000 stamp goal. In July 2016, bitcoin changed into as soon as spherical $587, or 0.112% of the $525,000 stamp goal. In Can also 2020, bitcoin changed into as soon as spherical $9,671, or 0.480% of the $2.01 million stamp goal. As of writing this text, bitcoin is spherical $49,257, or 0.686% of the $7.18 million stamp goal.

Deem the following two info:

1) The bitcoin block reward subsidy is unchangeable, and its scheduled reduction is a certainty.

2) The plod of money printing from central banks across the arena will enhance at an rising rate.

An inexpensive conclusion given these two info is that the bitcoin stamp in U.S. dollars will proceed to converge with the valuation framework laid out above, with the actual stamp as a percentage of the price goal trending toward 100% as the U.S. greenback money present continues to prolong while the bitcoin money present grows at a smaller and smaller rate.

While you happen to aren’t paying attention, you presumably needs to be.

It’s far a visitor put up by Scott Marmoll. Opinions expressed are fully their indulge in and glean no longer necessarily assume those of BTC Inc or Bitcoin Journal.