- Custodial vs. Non-Custodial, Centralized vs. Decentralized

- A Deeper Study on the Decentralized Commerce Benefits

- Drawbacks of DEXs

- Prime DEX Projects

- Closing Thoughts: What’s the Diagram forward for Decentralized Exchanges

A decentralized change, or DEX, is precisely what it sounds luxuriate in– a cryptocurrency change that is fully decentralized. Here are three reasons DEXes are price taking be conscious of:

- Decentralized exchanges are peek-to-peek hubs where customers can straight change crypto with out intermediaries luxuriate in centralized exchanges or other financial gatekeepers.

- It’s a booming sector– The pinnacle 10 centralized exchanges have nearly about $9 billion in Complete Price Locked, with chief Uniswap facilitating between $1.5 to $3.5 billion per day.

- DEXs are a residing, respiratory instance of easy contracts and liquidity swimming pools at work. The expertise is appealing– DEX easy contracts assign prices algorithmically; customers can deposit funds and effect rewards in liquidity swimming pools, which makes trading doable.

DEXes supply well-known advantages over their centralized counterparts, at the side of wider kinds of tokens and trading pairs, the needed utilize of non-custodial wallets, utility in locations with unhappy banking infrastructure, and anonymity– perchance their most controversial feature.

Decentralized exchanges also advance with a basket of drawbacks and dangers, at the side of easy contract vulnerabilities, a greater threat of scams on account of the broader availability of unvetted tokens, and normally even extremely excessive charges linked to excessive fuel fees, comparable to those viewed on the Ethereum network.

The following DEX e-book explores every part you’ll want to learn about decentralized exchanges.

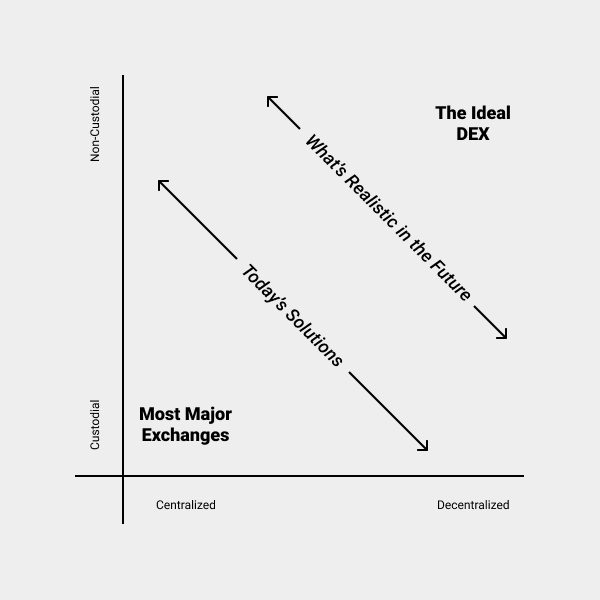

Custodial vs. Non-Custodial, Centralized vs. Decentralized

In characterize to dangle DEXs, it’s significant to luxuriate in that cryptocurrency exchanges exist on two overall axes: custody and centralization.

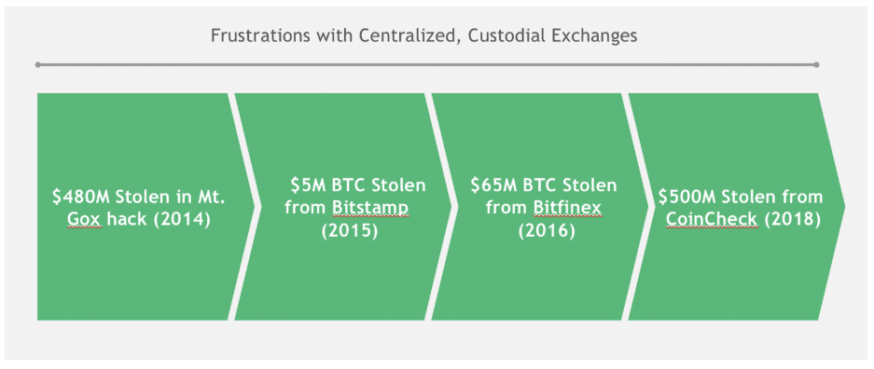

Custody refers to who holds the keys to accounts on the change. If you purchase a Bitcoin on Coinbase, as an instance, it reveals up to your Coinbase legend, but you don’t if truth be told comprise and control that Bitcoin but. You may per chance well request a switch off Coinbase to an exterior pockets tackle that you just control earlier than the Bitcoin is basically yours. If Coinbase is attacked, slowed down, or has technical considerations, you don’t have recourse to valid your Bitcoin. This has been a hassle so normally with many exchanges that “funds are valid” has grow to be a meme within the neighborhood as change operators strive to reassure customers within the wake of gadget considerations.

A non-custodial change leaves all funds within the private wallets of its customers. Customers can then put up and guarantee trades on their very comprise from their private wallets, truly the utilize of the change as an identical carrier. An in-between solution involves customers submitting funds to begin-supply, verified easy contracts that intention when a match is made and may per chance seemingly be canceled at any time. This has the profit of security and automation, but there may per chance be a duration of time when funds aren’t in customers’ wallets. If there’s a hassle with the contract, the funds may per chance seemingly fade.

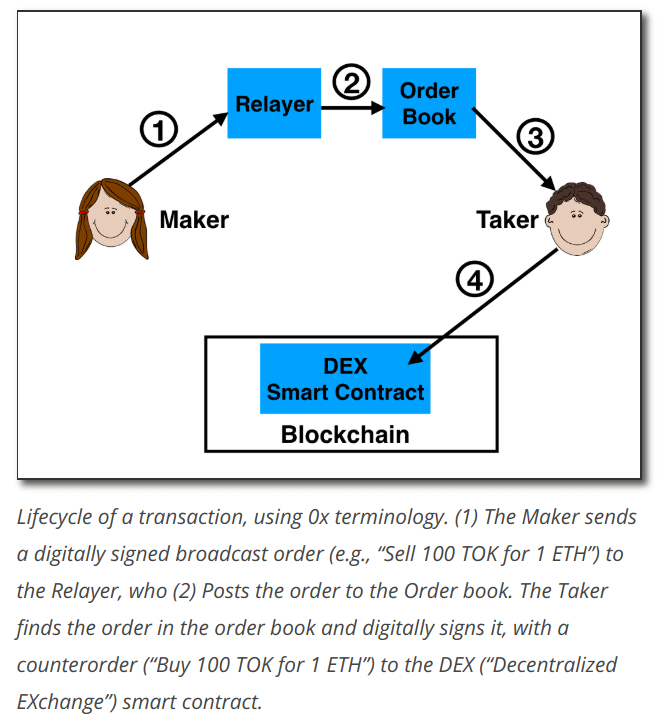

Centralization refers to where the characterize matching, routing, and execution take hassle. In a centralized change, there’s a proprietary characterize e-book that reports all incoming orders and creates fits between customers. The change gadget and servers then intention the transaction.

Decentralized exchanges operate on a network of computers. Some characteristic straight on-chain by means of the utilize of fresh contracts. Others rely on 2d-layer networks of depended on nodes, identified as relayers, to search out and fetch characterize fits.

Decentralized exchanges most regularly change at about 10% to twenty% of centralized change quantity, up from the meager 1% in 2018, when we first wrote this article. Silent, the overwhelming majority of crypto trading happens by means of centralized institutions. To some, here is an plenty of shortcoming of the cryptocurrency assign, constructing a decentralized future atop centralized change services.

For others, it appears to be like apparent that an change need to be centralized. Undoubtedly, many have argued that “decentralized change” is an oxymoron. In any case, an change is a gathering level where of us congregate to change. Of course, it’ll be a single entity to quickly facilitate transactions.

As with most debates, every facet have merit in their arguments. The challenges of constructing a mountainous non-custodial DEX are highly nuanced, but the advantages are also tough to direct.

A Deeper Study on the Decentralized Commerce Benefits

Shopping and selling on a DEX comes with many advantages that fetch it relaxed to cryptocurrency customers. Most importantly, DEXs disintermediate the change ecosystem, inserting off middlemen and allowing free, notify change between events. This suits with the decentralizing philosophy and mission of crypto normally. That by myself makes DEXs a rallying sigh for the decentralization-at-any-fee, libertarian diehards, of which the crypto neighborhood has a dazzling few.

But there are other advantages to DEXs that the neatly-liked particular person may per chance seemingly moreover fetch relaxed.

1. Decentralized Commerce Anonymity Shopping and selling

Since DEXs in their purest intention utilize handiest blockchain data, all or no longer it is vitally significant share in characterize to make utilize of a DEX is a public tackle. Most centralized exchanges require a complete signup course of with title, email, and even bank legend data. Even nameless crypto-to-crypto exchanges aloof require space data and other private particulars to look at authorities regulations and restrictions.

That mentioned, if DEXs advance to greater prominence, they’ll seemingly meet up in opposition to regulators. Most DEX creators belief to suppose they’re handiest releasing delivery supply gadget and are no longer responsible for what the neighborhood does with that gadget, thus fending off the KYC and AML considerations. On the other hand, it remains to be viewed if that argument holds up legally long-duration of time, especially if damages result from a poorly written easy contract or security flaw.

2. DEX Wait on a watch on of Funds

DEXs are normally, but no longer necessarily, non-custodial. As a result, customers tackle control of their funds for the duration of your complete switch course of till the moment of change, when a easy contract executes the signed change. No extra “funds are safu” messages. Holding your funds valid is your comprise duty of a DEX.

3. Hacks: DEX vs CEX

Since a DEX exists across a network of computers, it becomes grand extra tough to assault. There’s no single level of entry or failure. This makes DEXs exponentially extra valid on this entrance.

On the other hand, DEXes can aloof be hacked and funds can be build apart in hazard by means of easy contract bugs and other exploits.

4. Downtime

Because there’s no single level of failure in a dispensed change, there’s less likelihood of DEX happening. Rollouts of updates happen on a node-by-node foundation. Although particular person nodes have to fade down on account of upkeep or an assault, the last nodes can aloof operate the change network.

Drawbacks of DEXs

DEXs are inherently extra tough than their centralized counterparts. This outcomes in challenges in implementation and usefulness that major DEXs have but to totally tackle.

1. Usability

The first and greatest disaster is particular person-friendliness. Creating an legend on a first-rate centralized change is a rather easy course of, and it choices grand luxuriate in banking and brokerage choices that customers are conscious of. On the other hand, the utilize of a DEX requires connecting to a DApp or even inserting in a standalone DEX client.

At its easiest, you may per chance seemingly per chance also handiest need to assign up a MetaMask pockets, fund that pockets, then connect with an Ethereum-based fully DEX DApp. At its most tough, you may per chance seemingly per chance need to assign up an independent node and tackle on-line for long sessions of time to signal transactions.

2. Simplified Shopping and selling Instruments

Centralized exchanges supply evolved instruments luxuriate in alternate choices and margin trading. These merely aren’t doable for this day’s DEXs. Shopping and selling on a DEX most regularly involves purchase or promote orders handiest.

3. Low Liquidity

DEXs listing about one p.c of the cryptocurrency market’s trading quantity. As a result, handiest low quantity trading of common coins is doable. There’s no longer enough liquidity to enable for excessive-quantity trading, and there are no longer any centralized institutions providing market-maker products and services.

4. Latency

If you fetch a change on an change, you need as discontinuance to quick execution as doable. Otherwise, you may per chance seemingly per chance fail to be conscious a price change. Sadly, DEXs to this level have shown slack cancelation and slack characterize processing times, since all requests have to propagate across the decentralized network. As a result, price slipping–price adjustments between characterize time and execution time–is overall.

5. Front-running

Because or no longer it is vitally significant broadcast your intentions to your complete network in characterize to intention a change, it’s doable for corrupt actors on the network with quickly connections to soar prior to you in line and purchase up coins at a decrease price in characterize to promote them support to you. Recognized as entrance-running, this observe undermines the fairness of the change. There’s no real technique to be certain miners or relayers on a decentralized change can’t soar in line for orders. For the time being, DEX creators are working on doubtless alternate choices that involve signatures or collateral, but no concrete solution exists to this level.

6. Precise Decentralization?

Some DEXs aloof require you at quit custody of your coins. Others involve small, centralized node networks of relayers. Silent, others inch an off-chain characterize e-book that need to be maintained in a roundabout design by third-celebration entities. These caveats all subvert the exchanges’ claims of decentralization.

Prime DEX Projects

Ethereum-based fully DEXes luxuriate in UniSwap lead the pack, but several Ethereum-based fully Layer-2 DEXes have emerged with decrease network fees, as well to Layer-1 opponents luxuriate in Solana.

Closing Thoughts: What’s the Diagram forward for Decentralized Exchanges

Decentralized exchanges are neatly-positioned for repute and affirm within the approach future on account of a pair factors:

- 2022 saw several custody-based fully corporations luxuriate in FTX, Celsius, and Voyager fade bankrupt, locking up billions of particular person funds right by means of. No longer a staunch peek for custody-based fully products and services.

- The SEC has been gunning after centralized exchanges in 2023: it charged common change Bittrex with working as an unregistered nationwide securities change, broker, and clearing agent, with the change filing financial anxiety in Could seemingly per chance also merely. It has also been going after Kraken and Binance with identical claims.

- DEX trial and error continues to catch favorable data.

Never Coast over One other Different! Acquire hand chosen news & data from our Crypto Consultants so that you just may per chance seemingly per chance also fetch expert, instructed choices that straight have an affect to your crypto earnings. Subscribe to CoinCentral free publication now.