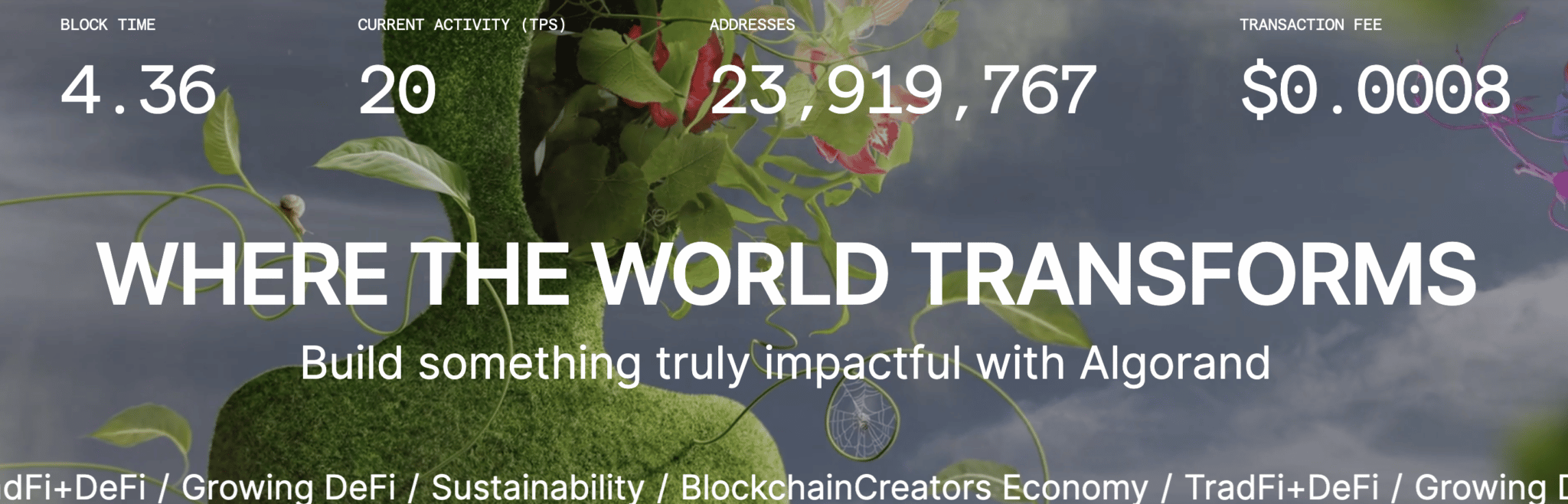

Algorand is the sector’s first proof-of-stake (PoS) blockchain, aiming to resolve the “Blockchain Trilemma” of warding off tradeoffs between tempo, security, and decentralization. The project competes with the likes of Ethereum and diverse layer 1s for developer and user project, boasting a community of 13 dapps.

While Ethereum has feeble proof-of-work (PoW) because it launched, Algorand’s PoS lets in for sooner and fewer expensive transaction occasions; by allowing holders to stake cash, it democratizes the skill to form rewards on the community that can perhaps perhaps otherwise drag to mining monopolies in PoW blockchains.

The Algorand token (ALGO) used to be launched by the Algorand Foundation in 2017 and raised $60 million with an preliminary sale on Coinlist. Following the sale, the Foundation announced this would perhaps perhaps even merely free up 600 million Algos per year, with a total present of 10 billion tokens. Algorand’s entire market capitalization has on the total stayed spherical $4.5 billion USD, touchdown it a consistent explain among the tip 30 cryptocurrencies.

The next Algorand book explores the know-how in the relief of Algorand, its security protocols, dev group and native ALGO token.

How Does Algorand Work?

Algorand operates utilizing two diverse nodes: participation nodes and relay nodes. By nodes, we’re referring to a pc that connects with diverse pc methods to fragment records and apply Algorand principles.

Participation nodes present the computing vitality required to validate transactions.

Relay nodes work as community hubs, they’re feeble by participation nodes to connect and preserve the ledger.

Both nodes would possibly well perhaps be slump by any particular individual and form rewards, although participation nodes receive increased rewards for their work.

As a node, a individual is required to put in a instrument named Algorand Digital Machine (AVM). AVM is a really remarkable for both node kinds and helps to remove into story and fabricate natty contracts.

Tidy contracts grasp two layers. The principle layer is on-chain and supports Algorand Standard Sources (ASA). These resources quilt contemporary and unusual tokens on the blockchain, easy natty contracts, and atomic swaps.

Every natty contract provides one other layer of ‘traffic’ to the Algorand community, which if too mammoth can leisurely down the community.

This sing is overcome by a 2nd layer designed for more complicated natty contracts and decentralized apps. It operates off-chain, recording in the blockchain ledger as an different of including traffic to the community, allowing Algorand to characteristic as successfully as mammoth cost networks.

Byzantine Agreement Protocol

Algorand is paired with a Byzantine settlement protocol (BA) to characteristic. BA ensures the protocol runs as without problems as seemingly, disincentivizing unsuitable project, producing a single source of verified fact and supporting nodes.

Algorand can reach consensus contemporary block without forks or delays by verifiable random functions (VRFs); to level all output is correct, the VRFs spend customers privately and at random.

As soon as a block has been agreed upon, it’s transmitted by the community utilizing a digital signature from the verifier. To quit delays, two blocks can never be added to the chain at the the same time– all transactions are accomplished within seconds of every diverse.

Security on The Network

To stable the Algorand community an investor desires to possess a crypto story that holds ALGO. MetaMask or Binance are mammoth alternatives.

From right here, they grasp to expose their interest. Consumers are chosen at random but can magnify their odds of being chosen by conserving more ALGO than diverse traders who grasp proven an interest.

Nevertheless, there are three flaws in this technique.

In the muse, Algorand will grasp to collected be safe against Sybil assaults. These are assaults on a pc community exact by which a individual creates many pseudonymous identities. These identities abet contain a mammoth affect over the community and crash the provider’s repute.

The 2nd flaw is that BA is required to cater to millions of customers. Here is greatly increased than what contemporary BA protocols can care for.

Lastly, Algorand desires to be resistant to a Dential-of-Provider (DoS) attack. This attack is designed to shut down a community by flooding it with traffic and causing a crash.

Algorand has utilized several recommendations to overcome these flaws.

In the muse, Algorand affords with dishonest customers by a weighting blueprint. So long as correct customers story for over two-thirds of the blueprint’s entire stake, dishonest customers can’t grasp any affect.

Secondly, BA is willing to scale by consensus by committee. Every step of the protocol is assigned to a committee, made up of a shrimp community of representatives that are chosen at random. Random different ensures that a majority of the committee participants are unbiased.

As soon as a committee member has submitted their message, they’ll’t submit one other. This prevents the difficulty of a member being threatened. At every stage, contemporary committee participants are then elected to contain definite older participants are no longer required.

If a individual has been elected by the blueprint but doesn’t favor to be on the committee, they’ll decline the invitation. This keeps elections animated and affords customers a stage of freedom on whether or not they favor to participate.

Who Are the Founders of Algorand?

Algorand used to be primarily based by Silvio Micali, an Italian pc scientist and professor at the Massachusetts Institute of Expertise (MIT).

Silvio is a recipient of the 1993 Gödel Prize for his work in theoretical pc science, the 2004 RSA Award for Excellence in Arithmetic, and the 2012 Turing Award for his work in pc science.

He in the meantime operates several learn companies and products on cryptography and performs a no doubt important characteristic as a member of the Nationwide Academy of Sciences, the Nationwide Academy of Engineering, the American Academy of Arts and Sciences, and Accademia dei Lincei. It’s animated to command, he’s a busy man.

Algorand operates as both a company and a foundation. The Algorand Foundation specializes in cryptographic learn, on-chain governance, decentralization, award funding and the development of the ecosystem.

Algorand Inc. specializes in the advance and upkeep of the Algorand protocol and operates as a non-public company positioned in Boston, Massachusetts.

In April 2019 Algorand launched its take a look at community to the general public, and in June 2019 the foremost community used to be launched.

The ALGO Token

ALGO is the native cryptocurrency of the Algorand Protocol, with a total present of 10 billion tokens. ALGO used to be launched on Coinlist by an preliminary alternate offering (IEO), which is same to a outdated stock originate.

It used to be disbursed by a technique identified as a Dutch auction, the assign apart the value is trip once all bids had been bought. Dutch auctions build the utmost impress at which the offering would possibly well perhaps be offered, as traders submit a expose in line with the quantity they’re willing to pay. At some level of the auction, a compensation policy used to be in assign apart and 25 million tokens were offered at a impress of $2.49 per token.

Since its originate, Algorand has released a agenda of how the very best ALGO tokens will be disbursed. All ALGO is anticipated to be launched within 5 years with Algorand utilizing a block explorer to video display the provision.

Here’s how the tokens will be disbursed:

- 3.0 billion: the total different of ALGOs in circulation by auction.

- 1.75 billion: participation rewards.

- 2.5 billion: rewarded to relay node runners

- 2.5 billion: held by the Algorand Foundation and Algorand, Inc.

- 0.25 billion: discontinuance-user grants

Customers and traders had been instructed straight when they’ll predict to receive their funds in line with their community.

As of Would perhaps well 2022, it’s not seemingly to mine Algorand utilizing pc hardware. Nevertheless, customers can form ALGO rewards by staking their Algorand in an Algorand wallet.

Algorand Pockets

Whilst there are some ways to retailer crypto, the Algorand wallet has been rated one amongst the absolute most life like to sing and most aesthetically ravishing. It’ll even be constructed-in with the Ledger Nano X and utilizes a explain-of-the-paintings security interface for customers.

As of February 2022, the Algorand Pockets has been rebranded because the Pera Pockets. Moreover changing the name and emblem, Algorand has already released a recent roadmap, partner integrations and a mission to focal level on the neighborhood. The general efficiency of the wallet remains the the same.

Unlike many crypto wallets that require a individual login to come exact by, Pera Wallets enable customers to search in any appreciate of their accounts in a single centralized come exact by as an different of having to take into accout several passwords for diverse wallets.

The Pera Pockets also notifies customers of any ALGO rewards they’ve earned and when awards are due. Must collected there be any diverse project in their wallet, equivalent to a transaction, owners will even be notified.

For crypto traders who spend to usually take a look at how noteworthy their holdings are value, the Pera Pockets also affords valid-time in-app calculations. The value of a holder’s ALGOs are proven in USD and updated in valid-time to substantiate they’re as correct as seemingly.

As soon as you wish to preserve ALGO, probabilities are you’ll perhaps perhaps also win it on most long-established crypto exchanges equivalent to Coinbase or Binance.

On these exchanges, you would preserve ALGO utilizing a range of cryptocurrencies equivalent to Ethereum (ETH) and Bitcoin (BTC), as nicely as with fiat equivalent to $USD and $GBP. When looking out for with cryptocurrency, you’ll favor to spend a procuring and selling pair equivalent to BNB or BUSD, all of which is willing to be stumbled on in the procuring and selling tab. As soon as bought, you would then switch your ALGO to an Algorand Pockets or one other wallet of your different equivalent to MetaMask.

Ultimate Tips: Will Algorand Became The Scheme forward for Finance?

Algorand has already proven itself to be a remarkable platform that utilizes innovative know-how to push the boundaries of decentralized finance. It has one amongst the alternate’s most extremely certified groups constructing the project, as nicely as an intensive checklist of traders.

These contain:

- Lemniscap

- Nirvana Capital

- Bixin Capital

- Alumni Ventures Community

- Foundation Capital

- Visary Capital

- Multicoin Capital

- Eterna Capital

The dev group describes Algorand as “the long slump of finance” on its net page and has accomplished important success with its first DeFi ecosystem Yieldy.

Yieldly has bought WAGMIswap, to alter into the stand-out chief in GameFi and DeFi on the Algorand blockchain. In merely 6 months WAGMIswap received important traction, hitting a procuring and selling quantity of $40M in its first week.

This acquisition technique AMM functions will be added to Yieldly, increasing earning initiates for customers.

Algorand has also made headlines following the announcement of an legit partnership with FIFA, increasing the value by 15%. Algorand’s success will largely make sure by its skill to safe market fragment from natty contract platform competitors equivalent to Ethereum, Cardano, and Solana.