Key Takeaways

- Aptos is a new high-throughput Layer 1 blockchain that uses a peculiar dapper contract programming language known as Transfer.

- The undertaking is even handed the technological successor of Meta’s abandoned blockchain community, Diem.

- On account of its said theoretical throughput of 100,000 transactions per second, Aptos has been dubbed a doable “Solana killer.”

Aptos is a scalable Proof-of-Stake Layer 1 blockchain that uses a peculiar dapper contract programming language known as Transfer. The undertaking is developed by Aptos Labs, a blockchain startup led by two aged Meta workers.

Aptos Unpacked

Aptos is a Proof-of-Stake-essentially essentially based fully Layer 1 blockchain that mixes parallel transaction processing with a new dapper contract language known as Transfer to enact a theoretical transaction throughput of over 100,000 transactions per second. The undertaking is the brainchild of two aged Meta engineers, Mo Shaikh and Avery Ching, and is even handed the technological successor of Meta’s abandoned blockchain undertaking Diem.

Aptos first made waves in the crypto industry in March this one year after it emerged that it had raised $200 million in a seed spherical led by the neatly-known venture capital agency Andreessen Horowitz. In July, the startup raised one other $150 million at a $1.9 billion pre-money valuation in a Series A funding spherical led by FTX Ventures and Soar Crypto, before its valuation hit $4 billion two months later in a venture elevate led by Binance Labs.

It’s price highlighting that Aptos did all this before launching its blockchain, which only went dwell on mainnet on October 17. To reward the early users of its testnet and somewhat distribute the preliminary token allocation, Aptos airdropped 150 APT tokens (price approximately $1,237 on originate) to 110,235 eligible addresses. Per CoinGecko recordsdata, Aptos at this time has an completely diluted market capitalization of around $9.2 billion no topic launching only about a days in the past with minute activity going down on the community. Past its provenance and hyperlinks to Meta, the undertaking’s valuation has raised questions.

What Makes Aptos Particular?

From a technical perspective, the motive force in the support of Aptos is also boiled all the vogue down to 2 things: Transfer, the Rust-essentially essentially based fully programming language independently developed by Meta, and the community’s extraordinary parallel transaction processing abilities.

Transfer is a new dapper contract programming language that emphasizes security and flexibility. Its ecosystem contains a compiler, a virtual machine, and a number of other developer instruments that successfully abet as the backbone of the Aptos community. Though Meta on the starting build wished Transfer to vitality the Diem blockchain, the language used to be designed to be platform-agnostic with ambitions to adapt into the “JavaScript of Web3” in the case of utilization. In other words, Meta intended for Transfer to alter into the developers’ language of alternative for writing protected code involving digital sources immediate.

The utilization of Transfer, Aptos used to be constructed to theoretically enact high transaction throughput and scalability with out sacrificing security. It leverages a pipelined and modular formulation for the serious phases of transaction processing. For context, most blockchains, especially the end ones indulge in Bitcoin and Ethereum, enact transactions and dapper contracts sequentially. In straightforward terms, this means that every body transactions in the mempool—where all submitted transactions dwell unsleeping for affirmation by the community’s validators—needs to be verified for my fragment and in a affirm define. This means that the express of the community’s computing vitality doesn’t translate into faster transaction processing since the total community is successfully doing the same ingredient and performing as a single node.

Aptos differs from other blockchains in its parallelized technique to transaction processing and execution, that device that its community leverages all accessible bodily resources to project many transactions simultaneously. This ends in mighty elevated community throughput and transaction speeds, ensuing in tremendously decrease expenses and a better user skills for blockchain users. Growing on this disaster in its technical whitepaper, Aptos says:

“To maximize throughput, lengthen concurrency, and cut engineering complexity, transaction processing on the Aptos blockchain is split into separate phases. Every stage is totally just and for my fragment parallelizable, akin to as much as the moment, superscalar processor architectures. Not only does this present vital efficiency advantages, nonetheless additionally permits the Aptos blockchain to give new modes of validator-client interaction.”

Nonetheless, while Aptos claims to procure already achieved 10,000 transactions per second on testnet and objectives for 100,000 transactions per second as the next milestone, users ought to composed take hang of its claims with a grain of salt as they’re but to be fight-tested. Hundreds of Layer 1 networks and sidechains making identical claims, including Solana and Polygon, procure suffered rather about a community outages since their inception and procure otherwise been criticized for being too centralized.

Uncertain Tokenomics

On October 17, Aptos introduced on vital outrage all the device by device of the crypto neighborhood when it launched its blockchain and native governance and utility token APT with out first disclosing its total present, distribution, or issuance rate to the general public. After APT’s mark plummeted by roughly 40% in the preliminary trading hours, Aptos tried to rectify its mistake and composed the neighborhood’s outrage by revealing its tokenomics.

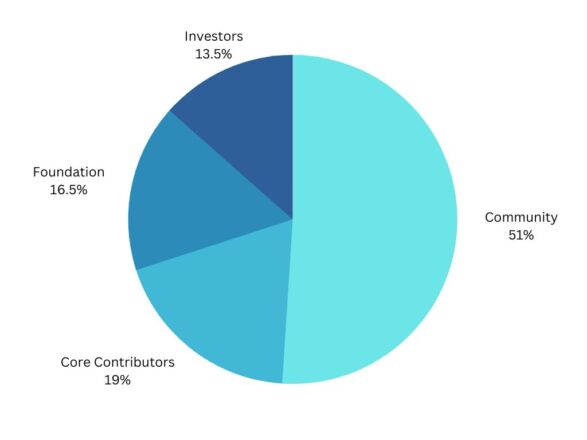

No topic the generous airdrop to over 100,000 addresses, the proceed toward transparency used to be met with even extra outrage after the neighborhood realized that the total token present used to be allotted to early investors and the firm. Namely, as a substitute of giving the neighborhood the 51% of tokens allegedly assigned to it without prolong, either by device of airdrops, grants, or staking rewards, Aptos allotted them to Aptos Labs and the Aptos Foundation. Moreover, consistent with the crew’s weblog post, “82% of the tokens on the community are staked across all categories,” that device that the firm and early insiders will fabricate the majority of staking rewards which will almost definitely be no longer field to lockups.

Past that, Aptos at this time has a circulating present of 130 million tokens, a total present of 1,000,935,772, and an uncapped maximum present. In step with the legit token present time desk, the inflation rate will start at 7% and decline by 1.5% annually till it reaches an annual present rate of three.25% (expected to take hang of over 50 years). The transaction expenses will on the starting build be burned, though this mechanic will almost definitely be revised by device of governance vote casting in some unspecified time in the future.

Is Aptos the Next Solana Killer?

No topic running for only per week, Aptos has already been heralded as a doable “Solana killer.” That is essentially ensuing from its said throughput of 100,000 transactions per second. For comparability, Solana can only take care of about 60,000—nonetheless it suffers community-vast outages on a typical foundation.

Past the high scalability, Aptos shares other similarities with Solana, including the solid venture capital backing and the end-down technique to ecosystem constructing. With a war chest counting a number of billion bucks from the procure-proceed and the entice of being the “sparkling new ingredient,” Aptos would possibly also very neatly take hang of Solana’s spotlight in some unspecified time in the future if it would grow a thriving ecosystem. Besides, it is going to composed completely support that Austin Virts, the aged Head of Marketing at Solana, is now guilty of ecosystem constructing at Aptos.

All regarded as, Solana is composed miles forward of Aptos in the case of ecosystem neatly being and community adoption. By keeping its tokenomics opaque and allocating many of the provision to early investors and insiders, Aptos began its crypto lag on shaky terms with the crypto neighborhood, which would possibly also damage it in the long bustle. Nonetheless, if Aptos delivers even half of of what it has situation to enact on the technological front, then it has a shot at taking pictures a vital market fragment from all other dapper contract-enabled Layer 1 networks.

Disclosure: At the time of writing, the author of this characteristic owned ETH and a number of other other cryptocurrencies.

The recordsdata on or accessed by device of this web keep is obtained from just sources we imagine to be handsome and legit, nonetheless Decentral Media, Inc. makes no representation or guarantee as to the timeliness, completeness, or accuracy of any recordsdata on or accessed by device of this web keep. Decentral Media, Inc. is not any longer an funding consultant. We enact no longer give personalized funding advice or other monetary advice. The recordsdata on this web keep is field to swap with out scrutinize. Some or the total recordsdata on this web keep would possibly also procure older-popular, or it would be or change into incomplete or wrong. We would possibly also, nonetheless are no longer obligated to, substitute any outdated-popular, incomplete, or wrong recordsdata.

You ought to composed never procure an funding resolution on an ICO, IEO, or other funding consistent with the guidelines on this web keep, and you ought to composed never define or otherwise rely on any of the guidelines on this web keep as funding advice. We strongly imply that you seek the advice of a licensed funding consultant or other licensed monetary professional as soon as you would possibly maybe also very neatly be seeking funding advice on an ICO, IEO, or other funding. We enact no longer accept compensation in any make for inspecting or reporting on any ICO, IEO, cryptocurrency, forex, tokenized sales, securities, or commodities.

Watch burly terms and cases.

Aptos Airdrops Tokens to Hundreds in Trading Starting up

Info

Oct. 19, 2022

Over 20 million APT tokens are in a position to be claimed by 110,235 participants. Aptos Launches Token Aptos has launched its token—and early users are getting an airdrop. The Transfer-essentially essentially based fully Layer…

Ex-Diem Builders Notify Fresh Aptos Blockchain

Info

Feb. 24, 2022

Aptos, a new Layer 1 blockchain constructed by among the principle developers formerly from Diem, Meta’s no longer too long in the past-abandoned crypto undertaking, used to be launched this day. Fresh Layer 1 Introduced There is a…