Avalanche is a neat-contract enabled layer-1 blockchain that affords cheap excessive-hurry transactions.

Avalanche targets three kinds of customers:

- Users who’re searching to switch crypto sources suddenly and economically.

- Builders who’re searching to plan application-particular blockchains, whether non-public or public,

- and institutions, enterprises, and governments taking a peek to mix digital providers much like digital identification processes, doc tracking, or arena Central Bank Digital Foreign money (CBDC).

This text will facts you thru the total aspects of the Avalanche blockchain, one in every of the most talked about DeFi ecosystems in 2022.

Avalanche: Protocol Overview

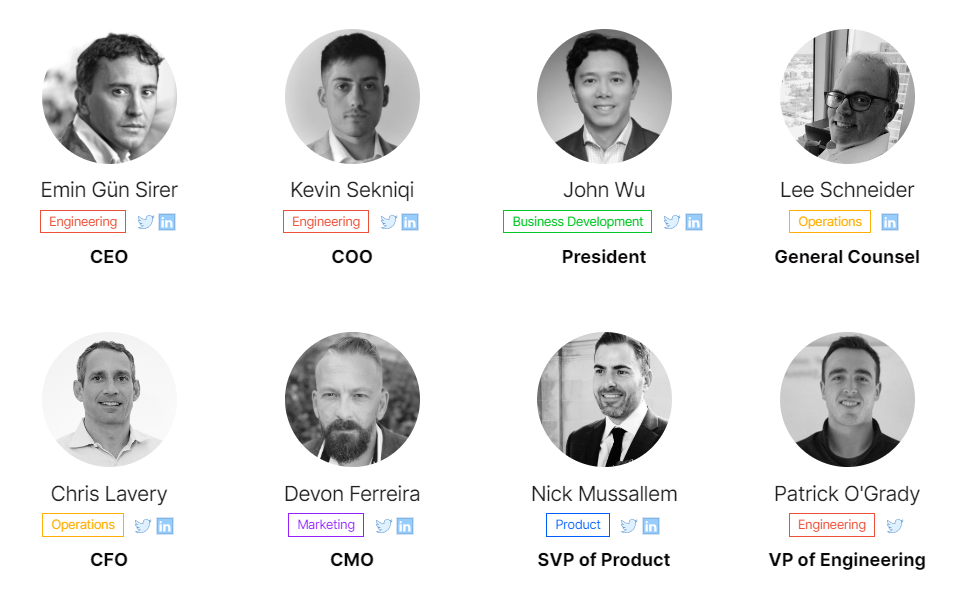

Avalanche started as a research mission in 2018, led by an nameless crew of builders called Crew Rocket. That twelve months, Emin Gün Sirer, a application engineer and professor of pc science created Ava Labs to purchase on the mission alongside a crew of researchers from Cornell University.

Ending the research stage in expressionless 2019, Ava Labs held lots of private and public gross sales to enhance money for the improvement of the blockchain. 360 million AVAX were minted and offered at $0.30 all thru the seed sale, $0.50 all thru the non-public sale, and $0.85 all thru the public gross sales.

The Preliminary Coin Offering resulted in July 2020, elevating over $40 million. In April 2022, Ava Labs started a fundraise to reach $5 billion in valuation.

How Does Avalanche Work?

Avalanche is a layer-1 blockchain that makes expend of AVAX, the native token, to energy the overall ecosystem.

On the diverse hand, Layer-2s, such because the Polygon protocol, are chains that sit parallel to the contemptible blockchain to abet lengthen the community’s capability concerning throughput and scalability.

The Avalanche community is split into three chains. While every chain carries out particular tasks, rookies to the protocol are usually at a loss for phrases about which one they wish to unexcited expend.

The Switch Chain (X-Chain):

The x-chain enables users to send and get funds and pay for transactions the expend of AVAX.

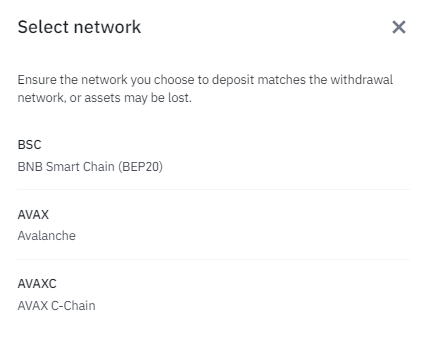

As an instance, while you happen to would maybe well furthermore be searching to deposit/withdraw AVAX on Binance the expend of your Avalanche pockets, you’ll maintain two alternate choices: Avalanche (which is the x-chain) and c-chain.

By now, it shall be optimistic that deciding on the c-chain as a replace of the x-chain will end result in shedding your funds, with no likelihood of retrieving them.

Furthermore, the x-chain is interoperable with Avalanche’s subnets (we’ll tell this in but every other share) and enables users to derive “digital neat sources,” including digital representations of right-lifestyles shares, commodities and sources much like equity or bonds.

The Contract Chain (C-Chain)

The c-chain is for DeFi functions. It enables users to derive neat contracts neatly suited with the Ethereum community. Prove that the c-chain makes expend of an address with a same string as Ethereum, starting off with 0x, and it’s neatly suited with MetaMask.

The Platform Chain (P-Chain)

The p-chain enables users to stake AVAX to turn into validators (the minimum replace of tokens a validator must stake is 2000 AVAX). The chain shows and coordinates all validators on the Avalanche ecosystem and distributes the rewards to both validators and delegators.

The p-chain also enables builders to derive recent subnets and withhold music of their performances.

Avalanche Subnets

Avalanche enables builders to derive subnets: sovereign blockchains that can arena their tokens and their respective economics, much like distribution and community charges.

Overall, builders can customize their subnets in step with their wants and space their very maintain rules concerning governance and DAOs (decentralized self reliant organizations), security properties, membership, and digital machines.

Validators on subnets are a subset of validators of the Avalanche community that work together to set aside consensus on one or two subnets. Nonetheless, a subnet would maybe well furthermore require validators to meet certain cases and requirements. As an instance, passing a Know Your Buyer (KYC) verify and proving they’re located in the nation they claimed to be.

Avalanche Proof of Stake and the Snowman Protocol

Avalanche makes expend of the Proof-of-Stake (PoS) consensus algorithm. It depends on hundreds of users that act as validators, also identified as community nodes. These validators must stake a undeniable amount of AVAX sooner than being able to vote and validate recent transactions coming into the blockchain.

Nonetheless, Avalanche’s PoS mechanism is DAG-primarily based entirely entirely.

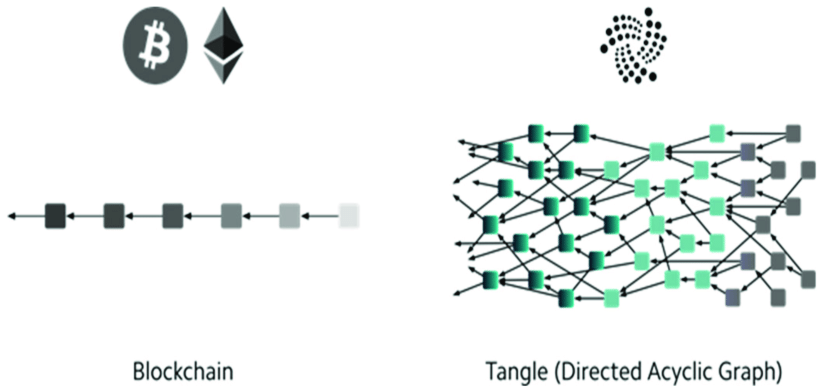

Avalanche’s x-chain achieves its excessive transaction throughput thru a mechanism called DAG (Directed Acyclic Graph). The DAG is a make of distributed ledger technology that constructions data otherwise from the blockchain.

A DAG includes vertices and edges that enable transactions to be recorded on top of earlier transactions. In replace phrases, all recent transactions must reference a earlier one to be efficiently confirmed as a replace of being gathered in a block, as proven in the picture underneath:

Ultimate a pair of DeFi protocols expend the DAG plot to crimson meat up throughput. One original example is Fantom.

Against this, the p-chain and the c-chain expend the snowman protocol (which is blockchain-primarily based entirely entirely) to produce sequential ordering. The rationale right here is that both chains want absolute ordering of all dApps and neat contracts created within and orchestration of validator nodes.

AVAX Token: Utility and Governance

AVAX has three expend cases:

- Act because the predominant unit of story for trade all over the Avalanche ecosystem, including subnets.

- Pay for transaction charges.

- Stake AVAX to purchase part in the community and vote on governance proposals.

AVAX Token Distribution

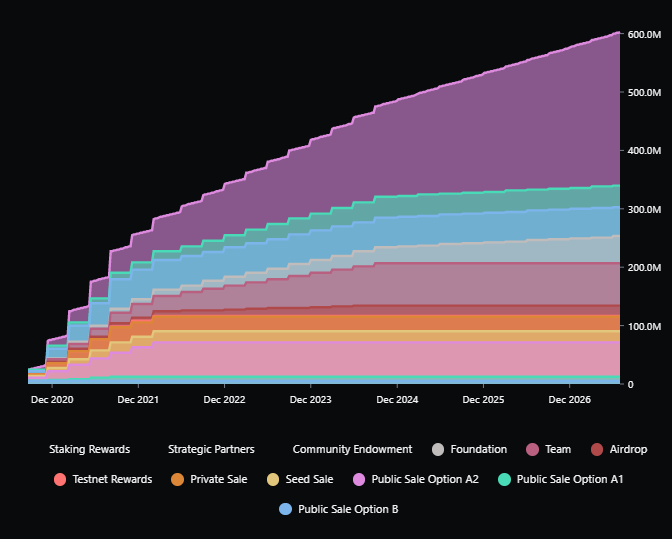

AVAX has a capped supply of 720 million, with 360 million final on the mainnet. The circulation —the replace of tokens in public fingers— is 284.4 million at the time of writing, according to CoinMarketCap

The AVAX token distribution is as follows:

- Founders and mission: 19.3%

- Shareholders: 16%

- Rewards and airdrops (pre-mined stage): 64.7%

AVAX is an inflationary token, and the governance protocol can judge to alternate certain parameters, including the inflation price. As an instance, in November 2021, the inflation price was over 35%; as of August 2022, 24.64%. The rationale right here is to alter inflation emissions in step with changing financial and market cases.

Avalanche Ecosystem: What dApps are on Avalanche?

There are over 300 dApps of all forms on Avalanche at the time of writing. The close four preferred are:

- Trader Joe: a preferred one-dwell decentralized platform for getting and selling, lending, borrowing, farming and staking cryptocurrency.

- Aave: a cryptocurrency platform constructed on the Ethereum blockchain. It enables users to lend, borrow and waste interest on their crypto funds.

- Benqi: Avalanche’s main staking protocol with over $300 million in Total Designate Locked (TVL).

- Pangolin: a decentralized trade (DEX) that permits negative-chain switch between Avalanche and Ethereum at excessive throughput and low transaction charges.

Where Can You Take AVAX?

AVAX is widely original in the crypto neighborhood, so that you won’t must dig that worthy to purchase the token. It is doubtless you’ll maybe furthermore fetch it on original centralized exchanges much like Binance, Gate.io, Kraken and Coinbase.

Closing Thoughts: Avalanche: The Fastest Layer-1 Protocol

Avalanche is one in every of the largest decentralized platforms with over $2.2 billion in TVL at the time of writing. It’s a widely talked about layer-1 protocol in the crypto neighborhood. Its core aspects entice a diverse viewers: from day after day traders and traders to blockchain builders, validators, and digital sources institutions in its technological stack.

Never Miss One other Opportunity! Catch hand chosen facts & info from our Crypto Experts so that you would possibly well plan professional, informed choices that immediately affect your crypto revenue. Subscribe to CoinCentral free e-newsletter now.