Key Takeaways

- EIP-1559 will burn an even portion of the transaction charges on Ethereum whereas introducing variable block sizes to present a use to efficiency.

- The give a use to will negatively affect Ethereum miners nonetheless will add worth to ETH holders by making the asset extra scarce. Gasoline charges will also be extra predictable.

- Ethereum’s upcoming London hardfork—anticipated to switch are residing round Aug. 4—will encompass the EIP-1559 proposal.

EIP-1559 is scheduled to ship at block 12,965,000.

EIP-1559 Outlined

Ethereum is getting ready for EIP-1559.

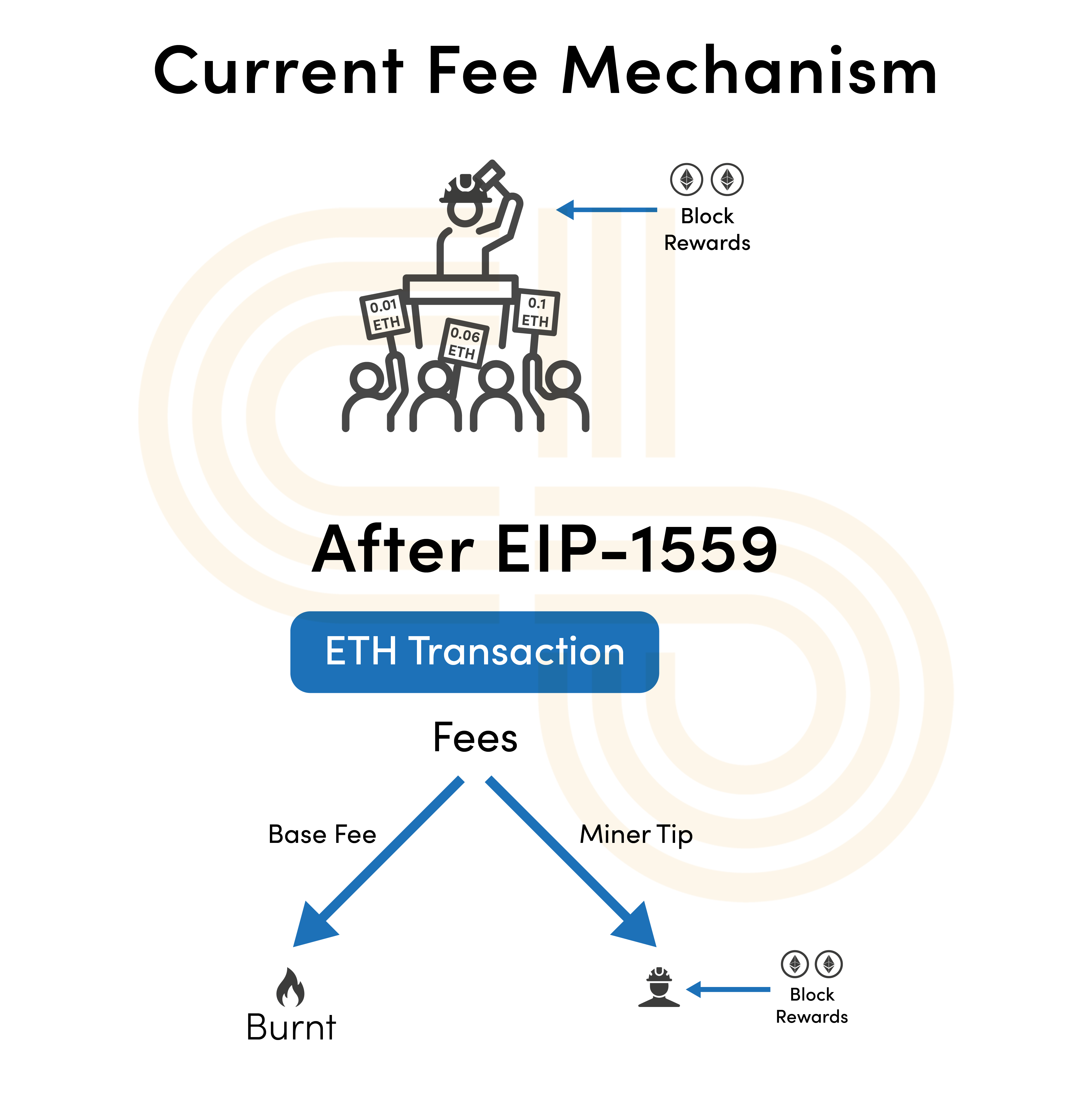

Launching as section of the upcoming London hardfork, EIP-1559 is Ethereum’s finest replace on account of the gas worth modifications implemented in the Berlin hardfork in April. The give a use to will change the first-worth public sale price mechanism to a weird deplorable price mannequin with a further miner tip.

Currently, all Ethereum users location bids to encompass their transactions in unusual blocks. The amount users like to pay can fluctuate very much for the length of lessons of excessive quiz. Ethereum wallet suppliers cherish MetaMask analyze this quiz and offer diversified price alternatives, with confirmation cases customarily lasting up to 12 hours or longer. Nonetheless, even a prolonged wait doesn’t provide a mumble of the transaction being included in a block.

Users on the total like to speed up their transaction by changing their celebrated price with a increased list to live their transaction from getting caught in the mempool for days on finish.

EIP-1559 targets to earn rid of this uncertainty by calculating the deplorable price for a block beforehand essentially based fully on the stage of congestion. The diversified necessary enchancment in EIP-1559 is the introduction of variable block sizes with a increased gas restrict of 25 million units, double the present restrict of 12.5 million.

EIP-1559 will implement a deplorable price looking out on the gas restrict and quiz, calculated as the market-clearing worth. The protocol will dynamically space the block’s gas restrict essentially based fully on these variables and alter the costs accordingly. Then, as but another of passing the associated price to the miner, the ETH paid in the deplorable price will earn burned. The user will like an choice to ship a tip to the miner.

The community will, on practical, target a 12.5 million gas restrict, and the deplorable price will enhance or decrease upon deviation from the 50% GAS restrict attach (i.e. 12.5 million units). Ethereum will enhance a increased gas restrict above 12.5 million for short time intervals ultimate.

Users will like a series of either including their transaction for the given deplorable price or looking ahead to a cheaper block. One mighty succor to EIP-1559 is that it’ll aloof set users from having to rob in a guessing game for confirmation of transactions. The variable block dimension proposed in the give a use to, meanwhile, will abet cushion surprising quiz surges and not using a surprising enhance in charges.

Exorbitant gas charges and prolonged wait cases like negatively impacted Ethereum’s user abilities, and at cases the community has been unusable for retail merchants with less capital. Within the final three years, the total gas passe in a day has been between 60,000 to 80,000 units on daily foundation, with occasional spikes on some days. For instance, gas charges surged from below 50 gwei to 600 gwei Tuesday as Mila Kunis launched her Stoner Cats NFT series.

A neatly-liked false influence of EIP-1559 is that the replace is a prolonged-duration of time scalability resolution. It’s anticipated that the replace shall be ineffective in decreasing charges, with miners seemingly to secure tricks for the length of lessons of excessive quiz.

The Enact on ETH Inflation and Miners’ Earnings

While EIP-1559 has advantages for day after day Ethereum users and ETH holders, it negatively impacts miners. Here’s on account of it at once impacts miners’ earnings by burning a portion of the associated price.

Moreover, there is a probability enthusiastic with the proposal turning into ineffective if the miner tricks turn into very much bigger than the deplorable charges. On this instance, the public sale market for a bigger tip will resemble the present first-worth public sale price mechanism; it would defeat EIP-1559’s impartial. Here’s possibly to be a hiss for the length of lessons of excessive quiz for block reputation, equivalent to for the length of most indispensable NFT drops or worth crashes.

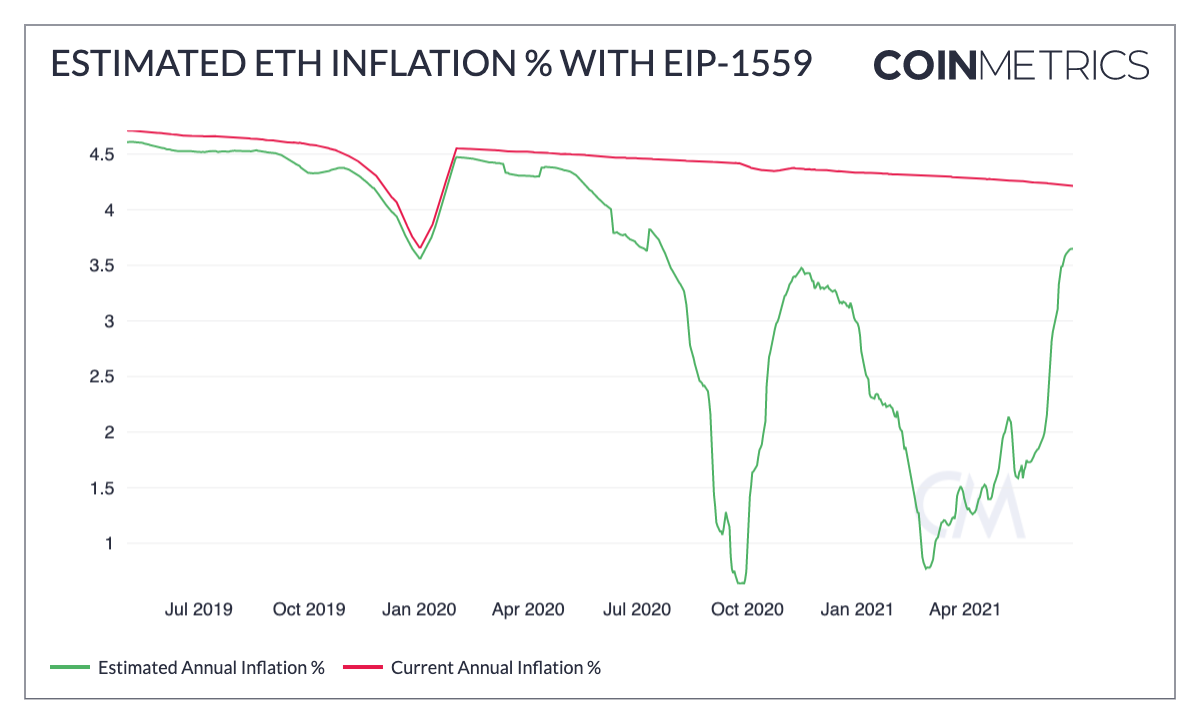

Ethereum’s present annual inflation price is above 4%. It’s decreasing at a sluggish price as the increasing supply is diluting unusual block rewards. After EIP-1559 launches, the community will burn ETH, truly working towards the block rewards of 2 ETH per block. The ask stays as to whether or no longer the associated price burn will make ETH deflationary.

In keeping with a chronicle by Coinmetrics, the anticipated price of inflation is basically unpredictable.

One day of busy lessons on the Ethereum community—cherish in March and April of this yr—the annual inflation price in the EIP-1559 module would prefer fallen below 1%.

Accrued, the replace acquired’t basically like an instantaneous deflationary enact. If roughly 70% of the deplorable price is burned with the leisure paid to miners in tricks, Coinmetrics estimates that the tumble in inflation shall be less than many like forecasted.

Since the crypto market crashed in Also can, the amount earned in charges has very much dropped, raising the inflation price estimate to roughly 3.5%—ultimate 0.5% less than the present price.

After EIP-1559, the transaction charges earnings for miners are anticipated to decrease by 70%, whereas the block rewards will tackle at 2 ETH. Overall, in step with the present proportion earnings in charges and block rewards, the get income loss to miners is anticipated to be between 10 and 20%.

The 10 to 20% estimate is decrease than the earlier predictions of a 30 to 50% prick in miners’ incomes. Nonetheless, these values withhold genuine for the length of lessons of peak quiz, when miners make up to 50% of their income in transaction charges.

Getting ready for Proof-of-Stake

EIP-1559 also marks a transition from Ethereum’s Proof-of-Work consensus mechanism as it handles many of the responsibilities of the miners.

It must introduce Proof-of-Burn in Ethereum along with the present Proof-of-Work mechanism. This truly creates worth for ETH holders by making the asset extra scarce as but another of passing it onto miners.

The community will in the wreck switch to Proof-of-Stake as section of the next portion of Ethereum 2.0, at which point the total block rewards will mosey to ETH stakeholders. Ethereum’s Beacon Chain used to be deployed in December 2020, with over $14.5 billion in ETH currently deposited to the staking contract.

The practical deplorable price will must be sufficiently excessive for the associated price burn to surpass the amount of ETH issued. The amount of ETH staked, stage of job on the community, and merge date will all like an affect on whether or no longer ETH can hit deflation or no longer on a prolonged-duration of time time horizon.

EIP-1559 marks a necessary milestone in Ethereum’s all-round pattern in turning into the deplorable layer for monetary capabilities by introducing predictability and the ability to take in surprising surges in quiz. It must also make ETH extra scarce, which explains why it’s acquired so unparalleled reputation in the Ethereum neighborhood. Nonetheless, the market might well secure a whereas—two to about a months—to fathom EIP-1559’s definite enact on Ethereum’s tokenomics.

The London hardfork is slated to switch are residing at block peak 12,965,000, estimated to reach between Aug. 3 and 5.

The information on or accessed thru this web residence is bought from self sustaining sources we mediate to be genuine and legit, nonetheless Decentral Media, Inc. makes no representation or guarantee as to the timeliness, completeness, or accuracy of any files on or accessed thru this web residence. Decentral Media, Inc. is no longer an funding consultant. We attach no longer give customized funding advice or diversified monetary advice. The information on this web residence is area to alter without peep. Some or the total files on this web residence might well turn into outdated, or it would be or turn into incomplete or incorrect. We might well, nonetheless are no longer obligated to, replace any outdated, incomplete, or incorrect files.