Fantom is a blockchain protocol that affords excessive-breeze transactions at an much less dear and several tools for DeFi developers to invent on its ecosystem.

Fantom is a Layer-1; a layer-1, normally identified as the mainnet or mainchain, is the misguided blockchain, akin to Bitcoin, Ethereum, Binance Chain, Solana, Cardano, and tons others.

Layer-1s own their enjoy infrastructure to course of transactions and count on their enjoy safety protocols. In incompatibility, a layer-2 is constructed on high of layer-1. Some widespread examples are Polygon, Arbitrum, and Loopring, that are protocols constructed on high of Ethereum.

Fantom stands out from its opponents, look after Solana, as one of many few layer-1s properly matched with the Ethereum Digital Machine (EVM) permitting users to port their capabilities and projects from Ethereum to Fantom and vice versa.

Fantom is widespread on chronicle of it:

- Offers users excessive-breeze transactions with settlement cases of around 1 2nd

- Offers developers with several straightforward-to-boom tools to impact capabilities and natty contracts on its ecosystem

- It’s interoperable with the Ethereum community and the Binance Good Chain

- Is dwelling to several DeFi projects constructing on its ecosystem, alongside with widespread decentralized exchanges look after SpookySwap and lending protocols akin to Aave and Alchemix.

Fantom: How Does it Work?

Fantom permits users to switch cryptocurrency seamlessly via Opera, the protocol’s necessary blockchain. Fantom has a utility token known as FTM, which also has an ERC-20 model to make boom of on the Ethereum blockchain and a BEP-2 to make boom of on the Binance Chain.

Fantom affords developers with a stack of resources and tools to impact natty contracts and decentralized capabilities (dApps), and even impact their enjoy blockchains with customizable facets.

Let’s destroy down Fantom’s parts and core parts.

Lachesis: Fantom’s Consensus Algorithm:

Lachesis is Fantom’s consensus algorithm derived from the proof-of-stake (PoS) consensus. In each mechanisms, validators must stake a determined quantity of money to validate blocks in a blockchain. The variation is that Lachesis uses a completely different mechanism known as Asynchronous Byzantine Fault Tolerance (aBFT.)

In additional fair right phrases, the aBFT mechanism permits validators to full commands (akin to validating a block to course of transactions) at their enjoy slouch with out anticipating other validators to realize an agreement (consensus.) This enables a sooner transaction throughput whereas preserving decentralization and safety (we’ll dive deeper into this final level in a single other part.)

Fantom says Lachesis is its strive to resolve the Blockchain Trilemma which states it’s virtually very unlikely for a blockchain protocol to balance three particular traits in team spirit: decentralization, safety, and scalability. For example, if a blockchain has a excessive stage of safety due to the decentralization, then it sacrifices breeze.

Right here are the necessary characteristics of Lachesis:

- Asynchronous: validators can course of transactions at completely different cases, ensuing in efficient and quick transaction throughput.

- Leaderless: the aBFT consensus is a leaderless draw as no participant performs a determined role in the community

- Interoperable: all chains on Fantom are linked to Lachesis, permitting them to talk with every other.

Fantom’s Multiple Chains

Customers can impact their enjoy customizable blockchains to host their projects. These blockchains can check with every other and the Opera Chain as they’re plugged into the Lachesis consensus whereas preserving their autonomy.

Developers can regulate blockchains constant with their wants referring to boom conditions, tokenomics, governance, and more. We can characterize Fantom then as a Layer-1 that hosts more than one Layer-2s.

Fantom and the Directed Acyclic Graph (DAG)

Right here we’re diving pretty deeper into Fantom’s technological stack, specifically on the Lachesis consensus layer. Let’s strive to interrupt it down: Lachesis’ underlying infrastructure is a Directed Acyclic Graph (DAG).

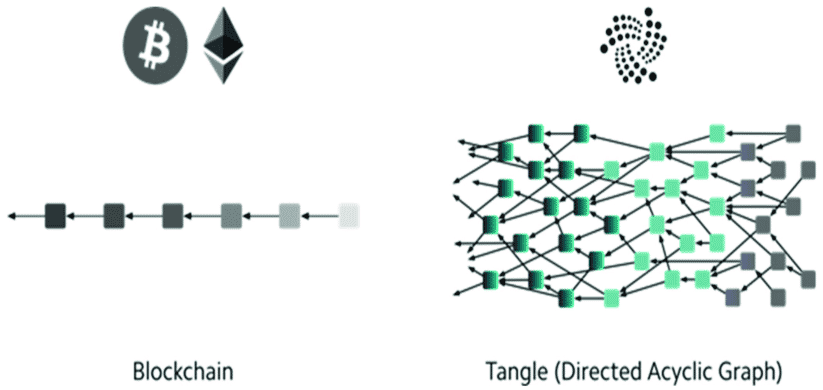

A DAG is a files structuring draw that processes transactions in a completely different manner than a blockchain. As a change of blocks, a DAG contains vertices and edges that enable transactions to be recorded on high of outdated transactions. A DAG appears to be more look after a tree-look after graph as an different of a, properly… a chain of blocks.

Blockchain primary infrastructure when put next to Directed Acyclic Graph. Source: Research Gate

All transactions must reference a outdated transaction to be successfully confirmed as an different of being gathered in a block. DAGs can provide greater transaction breeze as every node in the draw can course of transactions from bigger than one parent root. The reason here is that nodes don’t must lend a hand for transactions to full to course of a new one.

The Fantom Token: (FTM)

Fantom’ has a utility token known as FTM, outdated faculty to pay for transaction charges, staking, and secure balloting rights in Fantom DAO (Decentralized Self sustaining Organization.) FTM has an ERC-20 and a BEP-2 model, that are no longer usable on the Opera Chain.

The complete FTM provide is 3.175 billion, with over 2.5 billion FTM in circulation as of July 2022. The token distribution is as follows:

- 40.18%: public and deepest sale investors

- 38.76% vested for staking rewards, distributed each day unless 2024. After that duration, the protocol will introduce new systems to incentivize validators.

- 12%: advisors

- 7.49%: crew and founders

- 1.57%: public investors

You finest need no longer no longer up to 1 FTM to originate staking. You perchance can lock up your FTM with a reward rate proportional to the lock-up duration, which is up to 365 days and a maximum of 15% annual share yield (APY) as of July 2022. The minimum lock-up duration is 14 days and a 4.96% yield.

Turning right into a Validator

To alter into a validator, users must stake a minimum of 3,175,000 FTM. As of July 2022, the mark of FTM is $0.26, in order that’s roughly $825,000.

Where can you have interaction FTM?

You perchance can have interaction FTM in almost any high crypto alternate look after Binance, Coinbase or Kraken. Protect in thoughts it is probably going you’ll perhaps well also have interaction the ERC-20 and the BEP-2 versions of FTM as properly.

Fantom: History & Founders

Michael Kong and Quan Nguyen founded the Fantom Foundation in 2018. The protocol was once launched that twelve months, raising over $40 million in an Preliminary Coin Offering (ICO.) Andre Cronje —a widespread blockchain developer in the crypto community— participated in the birth of Fantom as a key advisor however departed on March 6, 2022. Cronje was once identified for his early work on several projects, alongside with Yearn Finance, which is constructed-in into the Fantom ecosystem, and Sushiswap.

Fantom was once designed to address several factors in the blockchain panorama. The Fantom Foundation has made several partnerships with other blockchain protocols to give a multi-asset and horrifying-chain ecosystem. In Would perchance well well 2019, Fantom partnered with Binance Chain to introduce a new token traditional for FTM and red meat up interoperability.

What Initiatives Are on Fantom?

There are over 200 decentralized projects from completely different fields on Fantom, alongside with decentralized exchanges, horrifying-chain bridges, lending protocols and NFT platforms. Right here are the high 3:

- SpookySwap (BOO): currently primarily the most widespread decentralized alternate and horrifying-chain bridge on Fantom, also properly matched with Ethereum Binance, Avalanche, and other blockchains.

- Aave: before the total lot constructed on the Ethereum community, Aave shall be on hand for lending and borrowing crypto in the Fantom blockchain.

- Fleshy Finance: a yield-producing protocol that enables users to scheme compound ardour on their cryptocurrency funds.

Final Thoughts: Fantom is a Layer-1 Unlit Horse

Ethereum remains the amount one protocol for decentralized apps of all types —yet the difficulty remains the same: the fair right quantity of community activity in most cases outweighs the community’s processing capacity.

Fantom is competing in opposition to some distinguished blockchains akin to Solana, Cardano, and Avalanche. Fantom can even fair no longer own the same originate of community activity as Ethereum, it has demonstrated an potential to seamlessly tackle its recent ecosystem with ease.

Fantom is dwelling to a various array of decentralized capabilities projects constructing on its blockchain– your complete same, stuff you’d look from one other Layer-1 look after DAOs, DEXs, to NFT and GameFi platforms.

Despite no longer commanding the same originate of mindshare of an Ethereum or Solana, the Fantom has been constructing for years, priming it as one of many high Layer-1s in crypto.