- How Does Polkadot Solve These Problems?

- How Does Polkadot Work?

- The Polkadot Token (DOT): Tokenomics and Governance:

- Polkadot (DOT) Mark

- Polkadot Staking

- Closing Suggestions

Polkadot connects assorted particular person blockchains into a single community; it wants to construct to the blockchain what the Net did for solitary computers worldwide.

Polkadot turned into once based mostly by Dr. Gavin Wood, Robert Habermeier, and Peter Czaban beneath the Web3 Basis, a Swiss foundation dedicated to facilitating a user-pleasant and completely functional decentralized internet.

Wood is a Thiel Fellow and essential technologist and has an wide resume in the cryptocurrency and blockchain condo– he’s an Ethereum co-founder, founder of Parity Applied sciences, and the creator of tidy contract programming language Solidity. Habermeier, also a Thiel Fellow, is a revered blockchain and cryptography developer. Czaban is the Expertise Director of the Web3 Basis.

Polkadot turned into once first proposed in a whitepaper on November 14, 2016, as a capability to resolve numerous the pressing problems with the many blockchains at the time.

Why is Polkadot particular?

Polkadot can path of just a few transactions on numerous assorted blockchains in parallel using its “Parachain” feature. Dubbed a sharded multichain community, Polkadot could per chance aid blockchains reminiscent of Ethereum change into more scalable. Further, users can add personalized blockchains to the Polkadot community with runt to no friction.

To better ticket Polkadot’s value add, it’s simplest to explore the many points which admire restricted and restricted blockchains. Let’s dive into our Polkadot book.

Jam #1: Scalability.

Most smartly-most smartly-liked blockchains have to now not scalable attributable to their construction.

As an instance, once upon a time, transacting on Ethereum, the world’s most smartly-most smartly-liked blockchain, label loyal just a few cents to just a few greenbacks ETH the same. As we reveal, Ethereum gasoline prices were as high as $250+.

The vast majority of blockchains bump into scaling points in a technique or one more. It’s very unlikely to tempo up transactions, and as the seek data from for transaction processing increases, every transaction begins to label more.

Bitcoin, which is established as a medium to switch value test out-to-test out, can simplest path of 4.5 transactions per 2d.

Ethereum, launched as Blockchain 2.0, fares a runt better at about 12 transactions per 2d.

When put next, Visa/Mastercard processes upwards of two,500 transactions every 2d.

The gradual processing of funds is with out doubt one of many principle boundaries for Bitcoin and assorted cryptocurrencies in turning into commercial ideas of rate.

Jam #2: No or Restricted Conversation and Interchanging of Files.

Dozens of blockchains had been created in isolation, and it’s now not likely for them to be in contact or replace value between every assorted. As an instance, it is probably going you’ll per chance per chance presumably also’t ship BTC on the ETH community. Even with DeFi companies and products that enable for working all the strategy in which thru just a few currencies and blockchains, oracle companies and products esteem ChainLink must be weak to fetch factual right-time data on every coin’s most up-to-date value.

Jam #3: Lack of Customization.

Until the arrival of Ethereum, blockchains didn’t toughen any customization of the switch of value from one proprietor to 1 more. Bitcoin, for instance, simplest allowed for test out-to-test out transactions. Desirable Contracts made it likely to customise and program what could per chance per chance even be done on a blockchain, to a restricted extent.

How Does Polkadot Solve These Problems?

Most blockchains are inclined to construct one single thing very properly. As user adoption increases, many blockchains are pushed to switch far from specialization into generalization to protect aggressive.

Collectively with unusual facets on top of legacy blockchains tends to label significantly more community resources and in general isn’t very effective.

Polkadot is a blockchain community that makes a speciality of underlying processes reminiscent of interoperability and verbal replace, safety, scalability, and transaction verification.

By utilizing Polkadot, assorted cryptocurrency projects with their very admire blockchains can have faith their core strong point reasonably than building sub-par facets for integration and scalability.

How Does Polkadot Work?

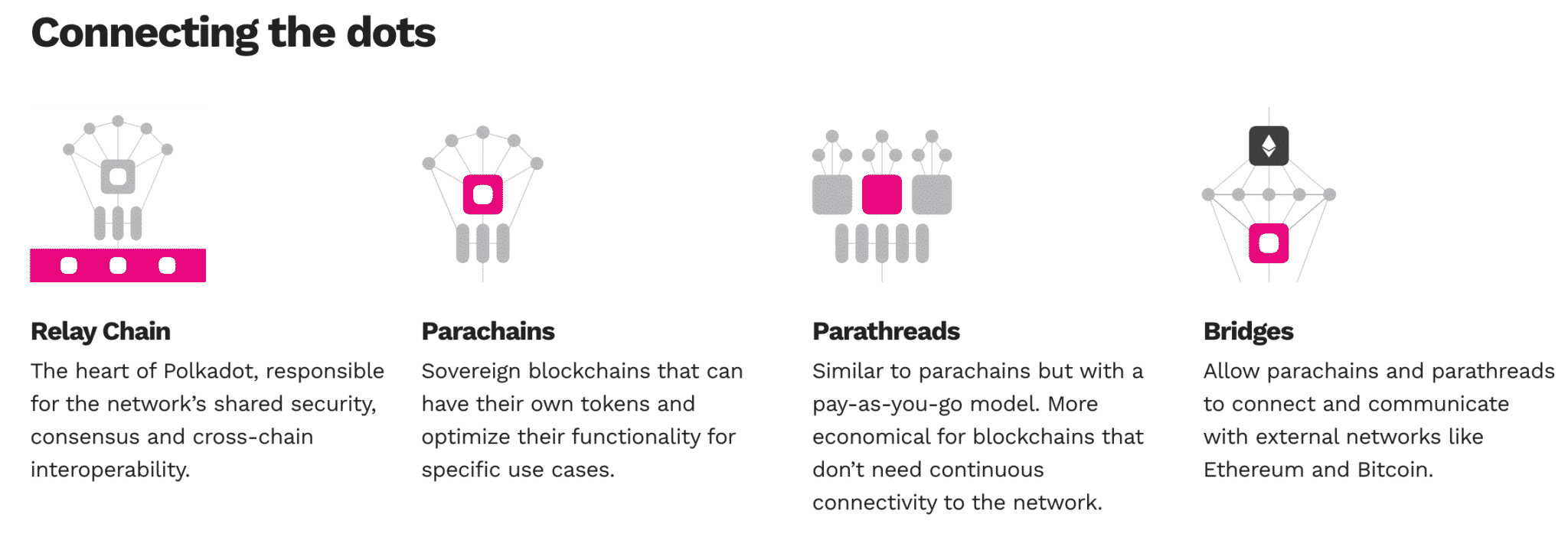

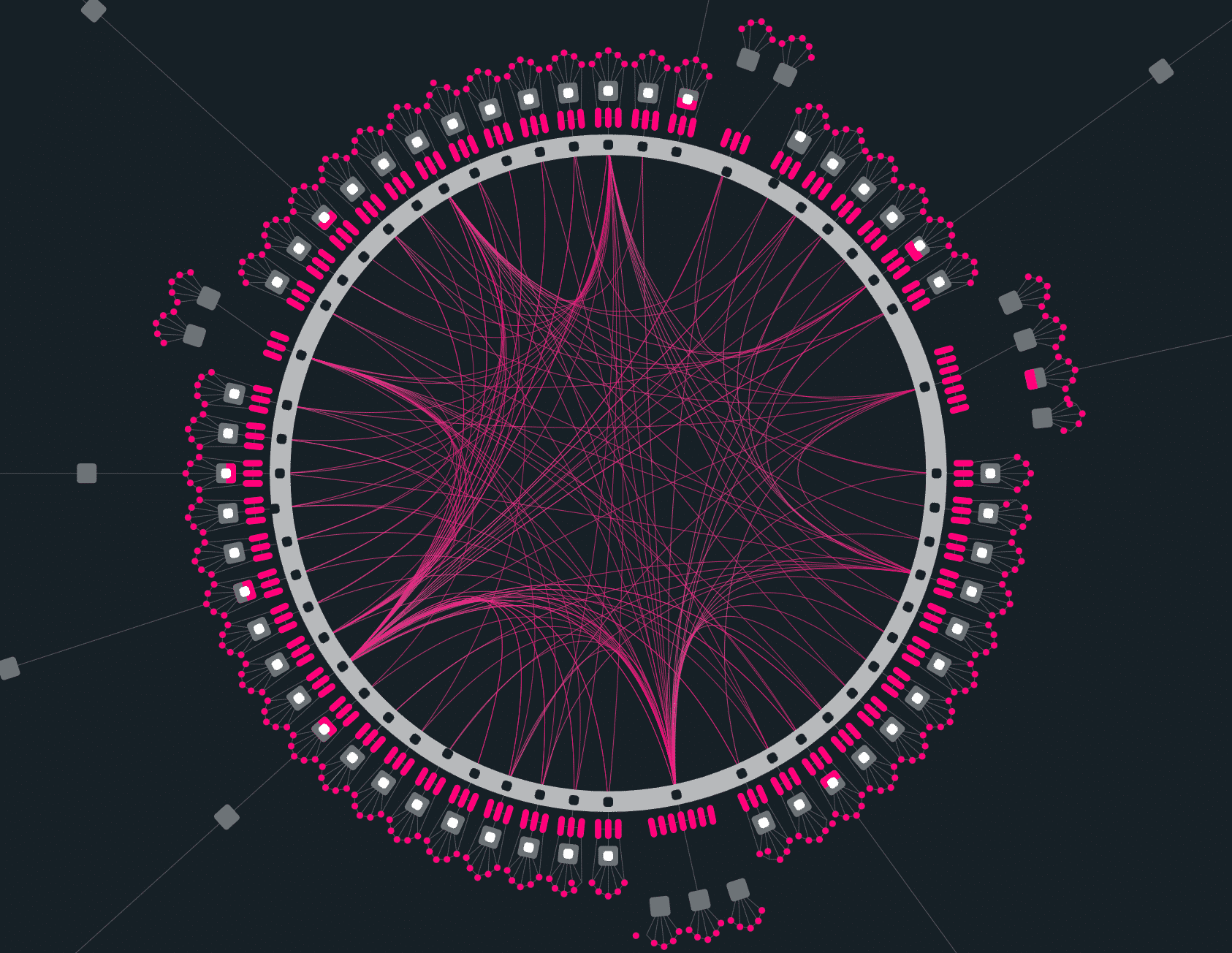

Polkadot leverages four foremost ingredients to construct its targets: Relay Chain, Parachains, Parathreads, and Bridges.

The Polkadot Relay Chain:

The Relay chain is the principle structure that holds every part collectively. Polkadot makes spend of the Relay Chain basically to test transactions, equivalent to how Bitcoin and Ethereum spend Proof of Work and Proof of Stake (POS) processes to test transactions. On Polkadot, users can stake the native token DOT to aid in the work of verifying transactions.

Because the central factor of Polkadot, the Relay Chain stage coordinates the machine as a complete, performing distinguished solutions esteem the verifying transactions and in making choices on the excellent technique to bustle the full Polkadot structure. There aren’t many programmable or customizable alternate solutions at this layer of Polkadot.

The listing of Relay Chain solutions involves:

- Transaction validation.

- Nomination of events who will stake their money for validation.

- Retaining historical data.

- Monitoring the full Polkadot machine’s health.

The Parachain:

A Parachain is a plump-fledged blockchain application that sits on top of the Relay Chain. Polkadot describes it in its whitepaper as “an application-specific data construction that is globally coherent and validatable.”

The Relay Chain, or the heart-broken layer, handles the protection, transaction validation, and governance solutions of every Parachain.

The Parachain is equivalent to assorted blockchain networks reminiscent of Bitcoin or Ethereum Blockchain. Polkadot is unfamiliar in that it goes to possess just a few blockchains within itself. Hypothetically, it goes to condo each the Bitcoin and the Ethereum blockchains within itself and field every as a Parachain.

If each the Bitcoin and Ethereum blockchains are in Parachains within Polkadot, they’ll be in a location to be in contact with every assorted and pass transactions from one to the assorted—imagine changing BTC into ETH with out an replace. The blockchains be in contact thru a protocol called XCMP, which stands for “Inferior-Chain Message Passing.”

The Parachain stage simplest has a restricted selection of slots accessible, that are auctioned off by the Polkadot community.

Parachains provide a assorted side of safety. In principle, a 51% attack could per chance per chance even be weak to hack the Bitcoin blockchain. Nonetheless, the collective nature of Parachains beneath the general safety construction of the Relay Chain could per chance per chance also prevent such an attack.

Parathreads:

Parathreads are non eternal slots on the Polkadot community, basically weak to test out solutions.

Parathreads are equivalent to Parachains in that they enable for the building of a assorted-spend blockchain or application.

The variation between Parathreads and Parachains is that Parachains are more helpful resource-intensive and more eternal than Parathreads– Parachains require a fundamental up-front investment to duvet the high throughput.

As Polkadot puts it, “Parathreads admire the actual same API and efficiency as parachains, but on a pay as you creep basis.”

Call to mind Parathreads and Parachains as a Direction of and a Thread that runs on a laptop’s CPU. A Direction of could per chance per chance also admire many Threads, and the Threads in a Direction of must piece the path of’s resources.

Equally, Parathreads must also piece resources within a Parachain because they are temporarily leased spots on a Parachain to almost test solutions in a stay surroundings.

Parathreads also enable smaller community projects that couldn’t compete in an auction for an unfamiliar Parachain to experiment and point to efficacy earlier than committing to the upfront prices of a Parachain.

Since Parathreads must piece scarce resources among a kind of Parathreads working on a specific Parachain; as such, the communities on every Parathread must compete for resources with every assorted and must pay for every processing block to the householders of the internet hosting Parachains.

Parachains which admire lowered in community size and don’t spend validation resources could per chance per chance even be moved to change into Parathreads to liberate the restricted Parachain slots while preserving efficiency.

Chains that can per chance per chance otherwise be unable to compete in an auction of a Parachain of their very admire or construct now not judge that to be economically viable can piece the Polkadot safety resources by paying for processing every block to the internet hosting Parachains.

Bridges:

Bridges, or the flexibility of an particular person blockchain to be in contact and switch value to 1 more, were lacking in long-established blockchain know-how.

Mumble you like to must aquire an NFT priced in ETH, but you simplest admire BTC. Traditionally, you’d must convert BTC into fiat after which convert into ETH, or aquire ETH for BTC on an replace. You simply can’t switch value or data from one Blockchain to the assorted with out an middleman layer, whether or now not that be an replace or fiat.

Bridges replace that restriction, and so that they enable Parachains, that are if truth be told blockchains encased throughout the Polkadot ecosystem, to be in contact and piece data.The financial sovereignty and differ of the respective blockchains is now not affected when speaking or transacting thru bridges.

Bridges are accessible each in centralized or decentralized versions, presumably leading to a path of verbal replace with central banks if (when) they inaugurate minting digital fiat currency.

It is far a necessity to deliver that Bridges are a planned feature of the Polkadot Blockchain, and tranquil must be place into production. In preserving with Polkadot, “This could be up as far as more data is decided and accessible.”

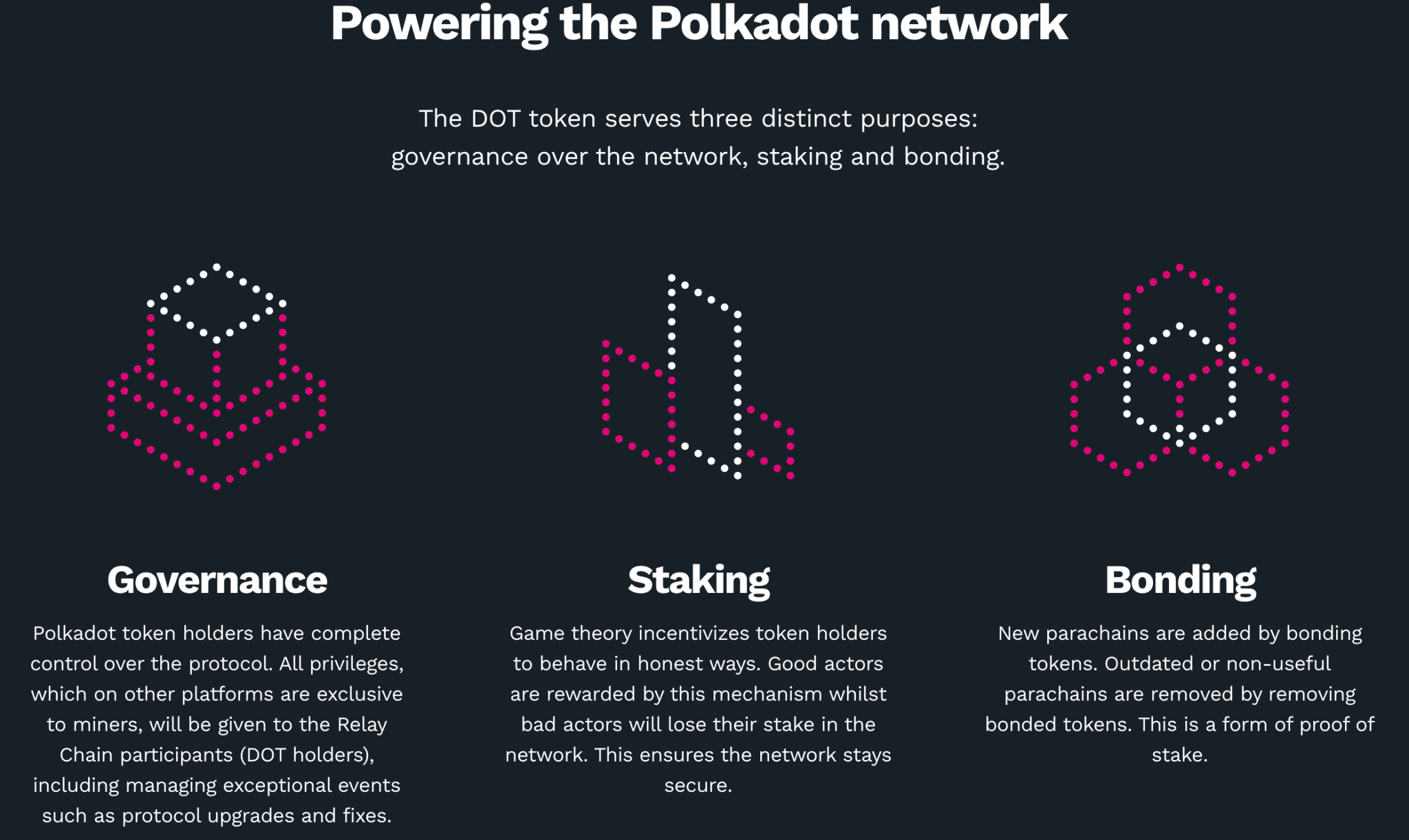

The Polkadot Token (DOT): Tokenomics and Governance:

Polkadot utilizes its native token, DOT, for transaction processing, funds and governance. DOT will doubtless be weak for staking on the Relay Chain PoS (Proof of Stake) validation.

The DOT token plays just a few roles all the strategy in which thru the Polkadot community esteem compensating validators, as a governance token, or as a currency.

There are currently 1 billion disbursed DOT tokens, up from the preliminary max provide of 10 million DOT attributable to a community redenomination.

Polkadot (DOT) Mark

Since its inaugurate in August 2020, the DOT token has traded between $2.90 and $40.70. The important exchanges trading Polkadot (DOT) are in general Binance, OKEx, and Houbi World.

Polkadot Staking

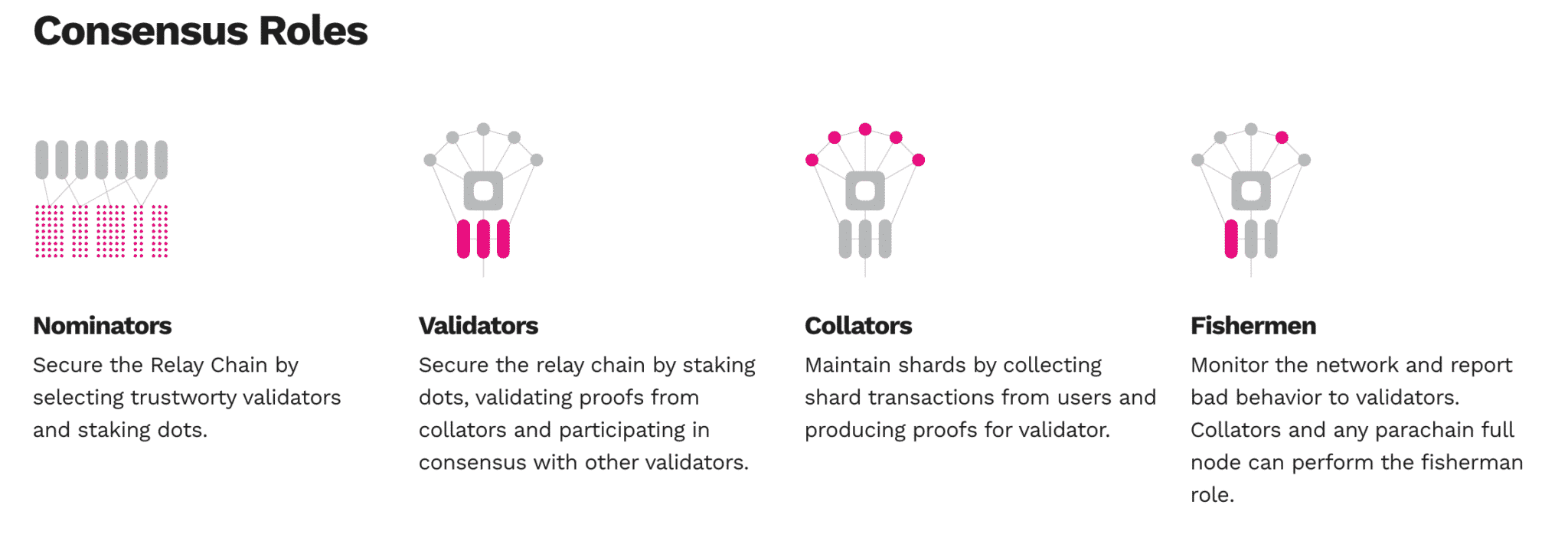

Unlike the Energy of Work (PoW) consensus the put miners spend electricity to validate blocks to be added to the Blockchain, the Proof of Stake (PoS) requires users to validate blocks by staking their money. In the PoW consensus, any individual can make a node and mine the blocks. In distinction, in the PoS, the Validators are specific people that bustle the nodes (also called Validator Nodes) to indicate and validate blocks to be added.

Like assorted PoS methods, Polkadot users can spend a DOT to:

- to stake and for the proprietor to change into a validator of the full ecosystem’s transactions.

- nominate their DOT to assorted validators,

- or change into a nominator themselves to piece the rewards.

If a DOT holder would now not must construct the verification itself they could per chance nominate one more DOT holder to stake their DOT tokens; it’s as even as you happen to is liable to be deciding on somebody to be your representative. A DOT holder can nominate up to 16 validators to stake their tokens for them. Subsequently, Polkadot’s consensus mechanism in most cases called NPoS (nominated proof-of-stake.)

Closing Suggestions

It’s no twist of fate that the same developers engaged on scaling Ethereum into Ethereum 2.0 are also introducing the Polkadot ecosystem to the world.

In building Polkadot, the team has paid specific consideration to remedying the full deficits that plagued and restricted earlier blockchain methods, reminiscent of Bitcoin’s lack of customizability or Ethereum 1.0’s lack of scalability.

Will Polkadot be in a location to fulfill its vision of connecting the world’s blockchains into one cohesive, interoperable ecosystem? It’s rather a deliver, however the Polkadot team appears to be like to be exceptionally qualified to construct so.

No doubt now not Miss One more Opportunity! Pick up hand selected news & data from our Crypto Experts so it is probably going you’ll per chance per chance presumably also form educated, educated choices that straight away affect your crypto earnings. Subscribe to CoinCentral free newsletter now.