- What is Venus Protocol?

- How Does Venus Protocol Work?

- Venus Protocol: Historical past & Founders

- Venus Protocol: Tokenomics

- Last Thoughts: Plan forward for Venus Protocol)

Venus Protocol is a decentralized money market protocol for lending and borrowing cryptocurrencies. It gives low-designate, snappy transactions and lets in customers to rob out loans with snappy issuance and no credit score check.

Not like centralized lenders, equivalent to BlockFi and Celsius —who declared monetary catastrophe and iced up consumer withdrawals in 2022—customers don’t want to trace in with the conventional CeFi log-in credentials; Venus Protocol customers connect crypto wallets fancy MetaMask.

The next files explores the Venus Protocol in-depth, but whilst you’re shopping for the completely different centralized crypto lenders, check out these 5 crypto ardour accounts that would maybe well well have faith the void left by Celsius.

Venus is the second-biggest lending protocol within the BNB Chain —completely topped by accounting for roughly 30% of the total market fragment in the case of total designate locked (TVL).

As of December 2022, the protocol has lent over $450 million in assets, and its TVL has been floating north of $700 million since mid-2022.

Venus Protocol’s standout advertised parts encompass:

- Lending and borrowing loans in a topic of seconds

- Staking and earning rewards in crypto, up to twenty%

- Liquidity swimming pools offering up to 30% APY

- Mint synthetic stablecoins

- Participate within the neighborhood DAO

Disclaimer: Cryptocurrency, and specifically DeFi protocols fancy Venus Protocol are very dreadful. Listed right here is now not any longer and can just no longer be regarded as a change for funding advice.

How Does Venus Protocol Work?

Venus used to be constructed completely for the BNB Chain (beforehand known as the Binance Orderly Chain (BSC)), which implies that truth its native forex, XVS, makes exercise of the BEP-20 traditional.

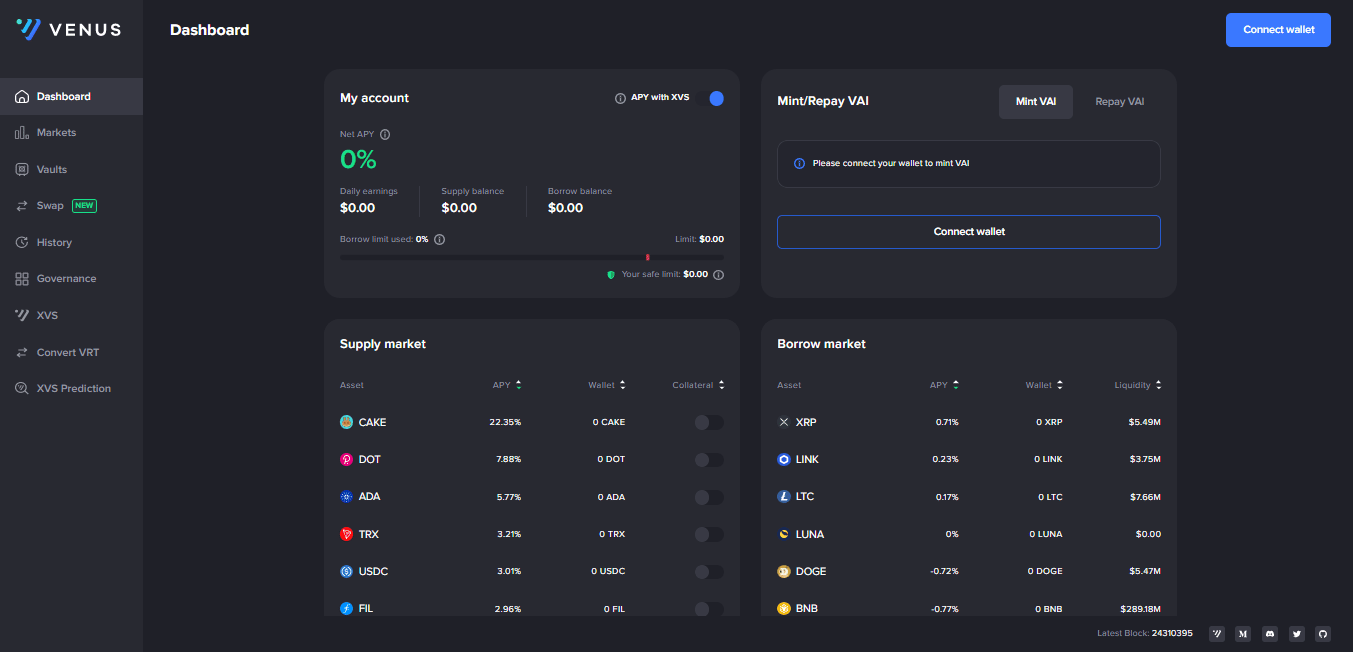

Venus supports extra than one forms of cryptocurrencies and stablecoins that would maybe also be feeble as collateral to borrow from the protocol’s swimming pools or spoil rewards by becoming a liquidity supplier.

Easy strategies to Borrow on Venus Protocol

Loans are over-collateralized, which technique customers who fancy to borrow must pledge collateral with a ratio relying on the fresh governance proposal, but they recurrently fluctuate from 50% to 70%. So, to hypothetically borrow $10,000, you’d want to put up $15,000 of collateral, as an illustration.

This collateral is then locked in a Venus Protocol trim contract for a specified period.

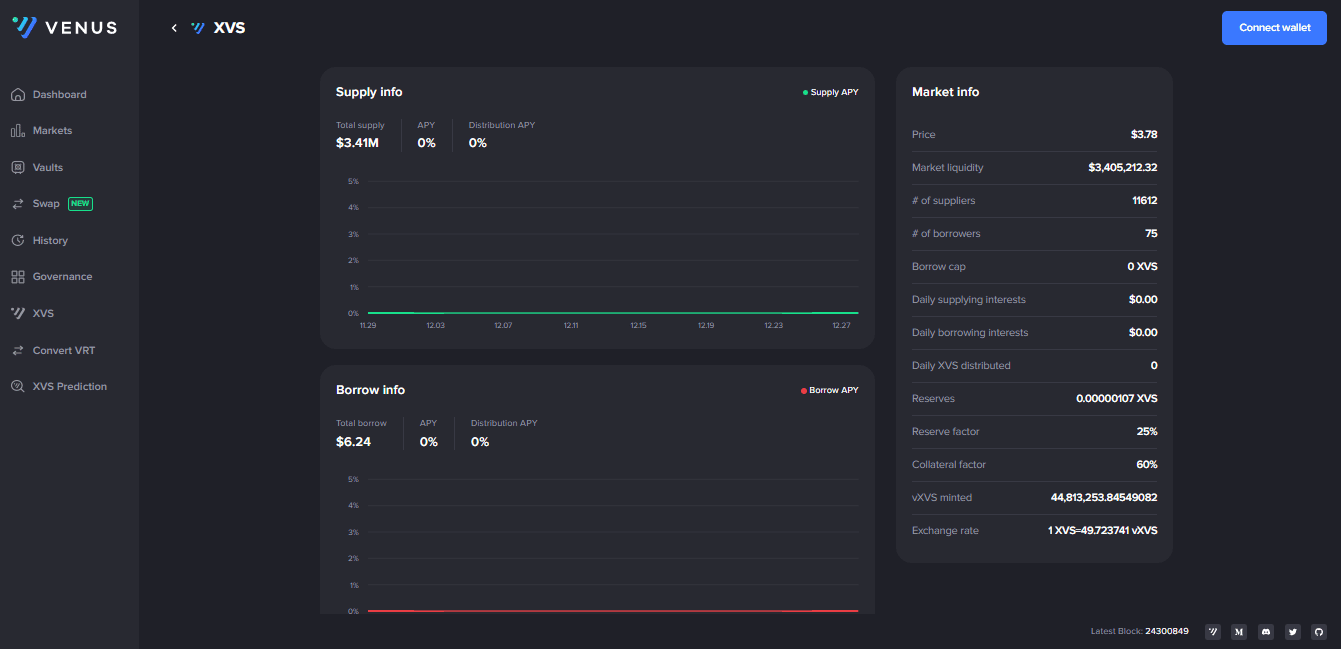

Within the Market section, resolve an asset, and likewise you’ll be ready to ogle the collateral component (besides market liquidity, series of suppliers and debtors, APY, and further.)

Lending on Venus

Users can lend assets to Venus to spoil yield, which varies on the beget of asset.When a consumer loans cryptocurrencies to Venus, the funds are added to the lending swimming pools. In replace, depositors receive vTokens (as an illustration, deposited BUSD becomes vBUSD).

Users can redeem these tokens for the underlying token.

Minting Stablecoins

Users can mint VAI, a synthetic stablecoin mounted at 1 USD (designate will soundless fluctuate relying on market search files from of). This asset would maybe also be feeble for yield farming on other DEXs within the BNB ecosystem. Users can mint VAI the exercise of up to 50% of the final collateral designate from old vToken deposits.

The ardour charges of VAI have faith but to be definite (they’re known as stability costs in other lending protocols fancy MakerDAO), so it is a long way relying on Governance and what the unique V4 upgrade will bring.

Venus Protocol: Historical past & Founders

The project used to be developed by Swipe, a cryptocurrency credit score card issuer, formally delivery in 2020. The team delegated handle watch over to the XVS neighborhood holders. Since then, extra than one proposals were submitted and recommend to replace, upgrade and make stronger the Venus protocol.

Venus used to be born as a fork of Compound (COMP), a favored crypto lender constructed on the Ethereum community, and likewise took some inspiration from MarkerDAO. The protocol is if truth be told a aggregate of the 2 systems and their respective advantages. It used to be also audited by blockchain security firm CertiK in December 2020.

The team didn’t inch a pre-mine for founders or the neighborhood. The completely solution to spoil XVS used to be thru the Binance LaunchPool project or by offering liquidity to the protocol throughout the early days.

Venus V4 Commence

In November 2022, the Venus DAO unveiled its V4 upgrade after months of discussions. The upgrade seeks to enhance the community in three key areas:

- Threat administration.

- Isolated markets: introduce unique tokens of all kinds but pooled into their respective, separate lending swimming pools. This has two predominant advantages: 1) it protects customers and the ecosystem from catastrophe since they’re if truth be told segregating assets with ability probability into remoted swimming pools; 2) it lets in customers to make a decision which swimming pools to rob half relying on their appetite for probability.

-

- Stable ardour charge borrowing: a mechanism that can residing real ardour charges for loans all over all markets.

-

- Better probability administration mechanisms: will present a mechanism that can present shortfall protection for customers, and a stability charge to handle VAI pegged to USD. That is terribly necessary, as in 2021, VAI lost is peg because of oversupply and skilled a giant market promote-off.

- Decentralization

- Improved governance machine: unique governance roles were assigned, longer intervals for contract upgrades and position reassignments,

-

- Trace Feed Redundancy: lets in Venus to enhance extra than one blockchain oracles to handle a long way from single capabilities of failure.

- Consumer expertise:

- Partnership with DEXs: Venus has partnered with extra than one DEXs within the BNB ecosystem, including PancakeSwap, to permit customers to freely pass funds between extra than one protocols with out leaving Venus. This makes Venus a DEX in which borrowing, lending, and swaps all over extra than one DEXs happen in a single UI.

- Original tokenomics:

- Tokenomics 3.0: will bring unique monetary mechanisms to incentivize protocol retention. XVS becomes the core utility token, XVS emissions are slit, designate is reinvested, and shortfall protection is added.

-

- The protocol will introduce the Venus Top Soulbound Token (SBT), which customers can spoil if they stake no longer much less than 1,000 tokens for 90 days within the Venus vault. The advantages of SBT are that it gives customers with outlandish come by entry to to better yield all over varied markets, and dividends would maybe also be paid out within the equipped forex.

Venus Protocol: Tokenomics

XVS is the protocol’s utility token in retaining with the BEP-20 token traditional. XVS’s predominant makes exercise of instances are:

- Staking

- Balloting

- Pay for transaction costs

The token has a max offer of 29 million tokens and a circulating offer of 12 million (or 41% of the total offer.)

XVS & Venus Governance

The Venus neighborhood runs a easy governance machine: delegated and articulate on-chain balloting, the build 1 XVS token = 1 vote. Every time a protocol proposal is submitted thru a Venus Enchancment Proposal (VIP (similar to Ethereum’s EIP)), customers can vote instantly or delegate their balloting rights to but every other consumer.

Proposals designate 300,000 XVS, which at display masks portions to nearly $1 million. Once proposed, balloting is active for three days. To be popular, the proposal must attain a balloting quorum of 600,000 XVS. If a hit, the proposal is timelocked for 2 days forward of implementation.

Last Thoughts: Plan forward for Venus Protocol)

Venus Protocol has a TVL of $710 million, at display masks boasting $1 billion in liquidity as per its web snort and has borrowed over $450 million since its somewhat quick time within the industry.

Regardless of these numbers, Venus Protocol doesn’t if truth be told attract the identical consideration as platforms fancy PancakeSwap. Composed, the protocol has managed to thrive alongside with the DeFi ecosystem, and the V4 upgrade brings better tokenomics, extra probability administration tools equivalent to remoted swimming pools, and an improved governance machine to solidify decentralization.

By no technique Miss One more Opportunity! Salvage hand chosen files & data from our Crypto Experts so probabilities are you’ll well well seemingly also manufacture trained, informed choices that instantly have faith an influence on your crypto profits. Subscribe to CoinCentral free newsletter now.