YIELD App is a custodial app that lets in users to assemble up to 17% APY for YLD token holders on a diversity of cryptocurrency assets.

There are a few important aspects of YIELD App’s worth proposition:

- It’s custodial however supplies exposure to DeFi and varied digital asset investment ideas.

- It doesn’t price fuel charges. Most DeFi yields succumb to high fuel charges.

- It’s going to pay hobby day-to-day.

Customers can assemble up to a whopping 17% when maxing out the YLD loyalty and rewards program, which we’ll win into below.

YIELD App at the moment helps four assets (USDT, USDC, ETH and BTC) for earning APY. Its native YLD token is mechanically staked when held on the platform to assemble extra rewards and present entry to higher tiers.

“As soon as we launched YIELD App it became once with the explicit procedure to begin up DeFi to manufacture the high yielding alternatives on this sector available in the market to everyone,” says Tim Frost CEO of YIELD App. “We are tickled to claim that we are succeeding on that mission, with near 60,000 users now enjoying our platform internationally. In due direction, we predict DeFi and the broader digital asset wealth management ecosystem to continue to spice up its client indecent, specifically in the increasing world where companies and products and products similar to our comprise are most dear.”

Rewards are disbursed every 24 hours and will be redeemed at any moment. They are no longer mechanically added or compounded though, as an different ought to it’s essential to reinvest your rewards you then make a selection to reinvest them inside of your list. The corporate plans so to add auto-compounding in some unspecified time in the future.

The YLD rewards earned for your assets are stored for your portfolio whereas the YLD you assemble for your staked YLD (wallet balance) will handiest mechanically compound and accrue for your YLD wallet.

YIELD App’s minimum investments are situation at 0.03 BTC, 0.1 ETH, and 100 USDC/USDT, respectively.

How Does YIELD App Work?

YIELD App is a digital asset wealth management platform that targets a minimum price of return for our users.

YIELD App claims to see the absolute most practical risk-adjusted price of return right throughout the cryptocurrency financial ecosystem through a diversified portfolio that is designed to lower volatility.

The portfolio team aggregates all client funds and invests them all the absolute most practical draw through varied crypto-based mostly mostly investment ideas and DeFi protocols. YIELD App goals to lower the capital required as smartly because the transaction funds, complexities, and time worth a person would face trading on their comprise.

In line with the placement, YIELD App curates “bespoke alternatives in partnership with industry-leading quant funds, miners, market makers, and varied proven DeFi investment managers.”

YIELD App uses its comprise automated and proprietary portfolio allocation tools, analysis, trim contract auditors, and approved counterparties to deploy and prepare the assets it manages for users.

“We bustle an actively managed portfolio that is overseen by a team of consultants in decentralized and centralized ragged finance,” adds Frost. “We care for extremely liquid investment alternatives which would possibly perchance also very smartly be low volatility and, most importantly, sustainable. We just recently hired a brand new Chief Funding Officer, Lucas Kiely, who brings a wealth of skills from high tier firms similar to UBS and Credit Suisse and who will be serving to to enhance our fund technique extra.”

Even supposing the baseline passive earnings APY that YIELD App supplies for cryptocurrencies like BTC, ETH, and USDC is above-real looking, the worth proposition drastically increases when blended with its utility reward token, YLD.

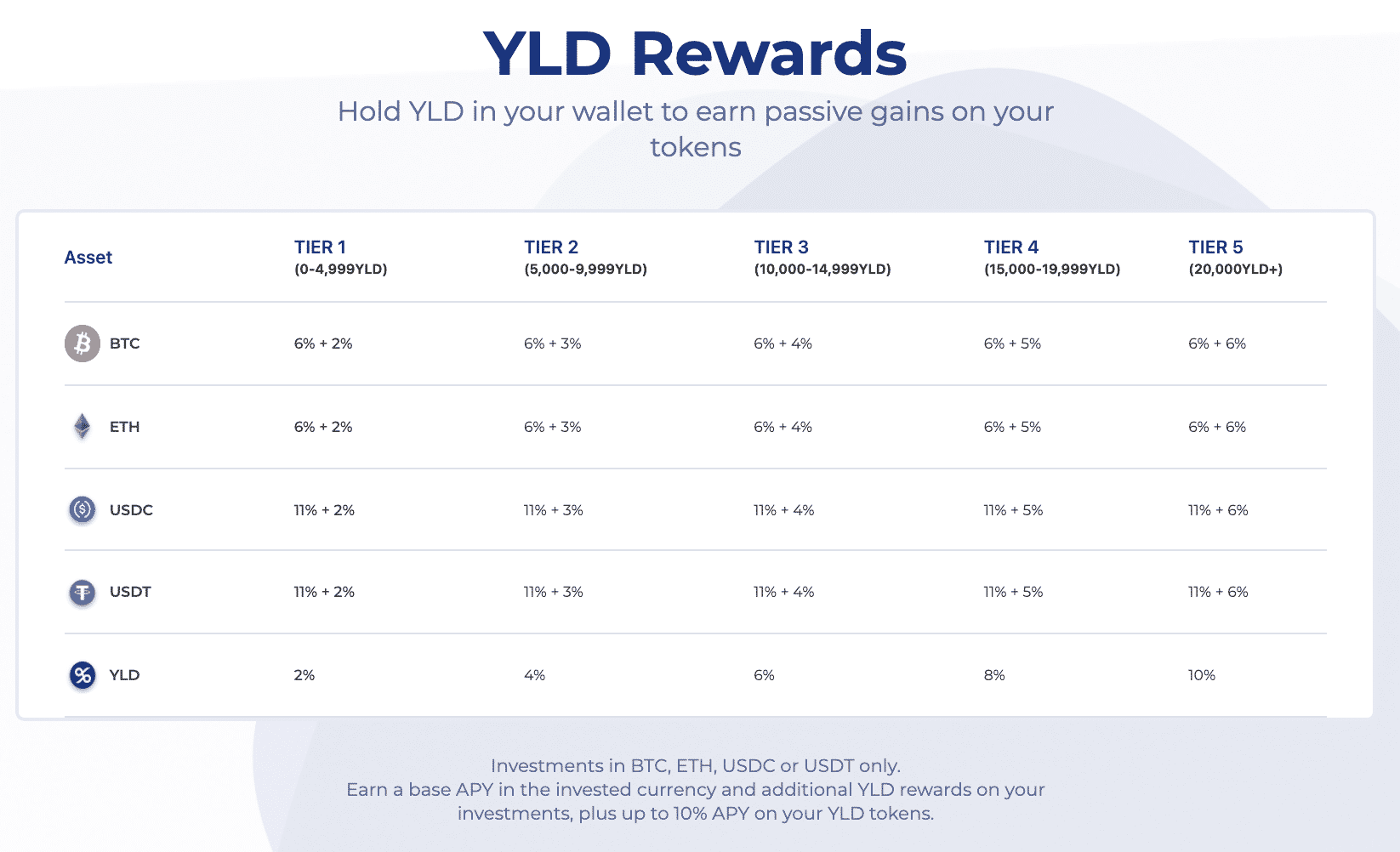

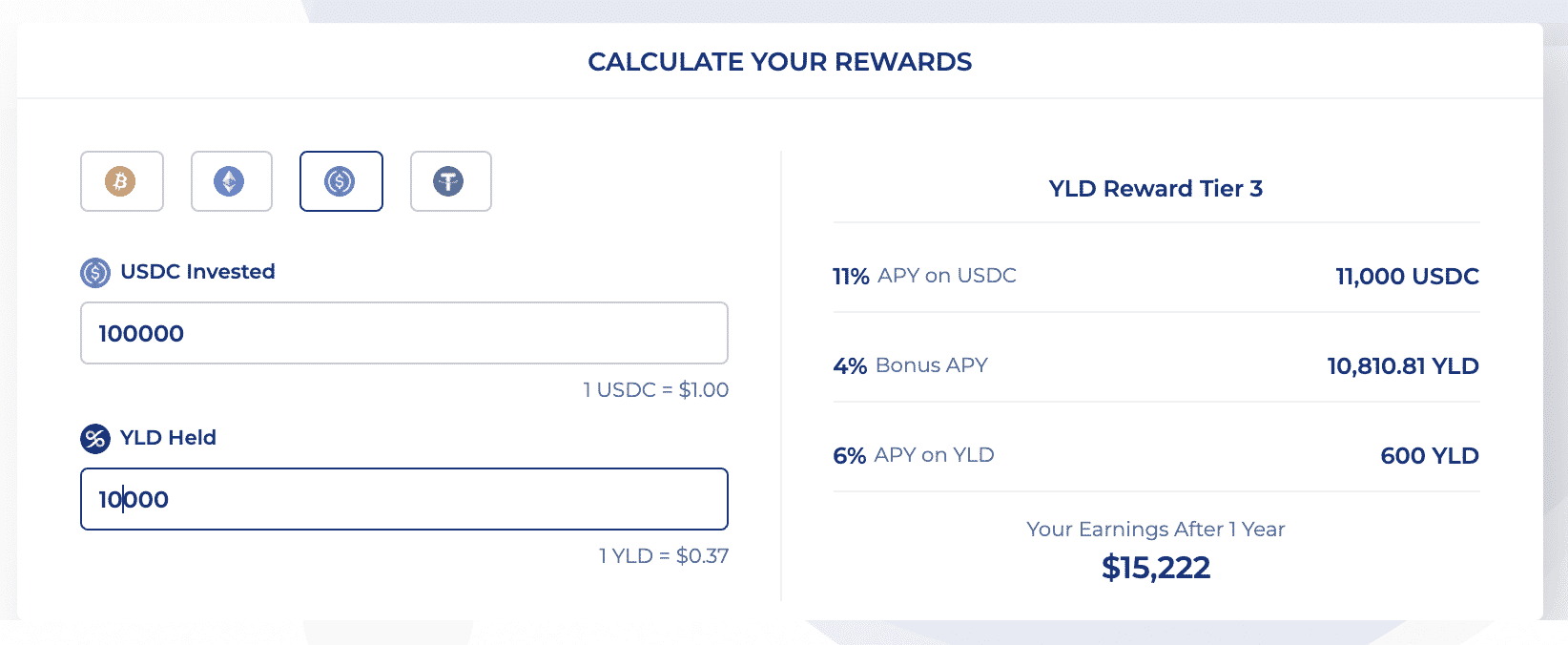

YLD holders can scale their Tier level with the preference of tokens held, per chance adding a further 7% APY on the indecent asset and 10% YLD on YLD when keeping 20,000 YLD tokens.

Frost explains: “Proudly owning the YLD token is one draw for our users to spice up their returns up to a maximum of 17% APY. We possess a Tier diagram, which draw the extra YLD users acquire of their wallets, the extra they assemble. As an instance, the indecent APY on stablecoins (USDT and USDC) is 11%, however Tier 5 users that acquire higher than 20,000 YLD assemble a further 6% in YLD on the indecent asset, plus a further 10% on the YLD they acquire, also paid in YLD.

“On high of this, users win rewarded for supporting our ecosystem through extra rewards on the YLD portion of their portfolio. Remaining however no longer least, it lets in users to participate in the growth of the token’s heed because the YIELD App grows and expands. We manufacture it indubitably worthwhile to put money into our token.”

YIELD App’s documentation states that the corporate generally adjusts rates each and each up and down in response to market stipulations in uncover to be definite the sustainability of its mannequin.

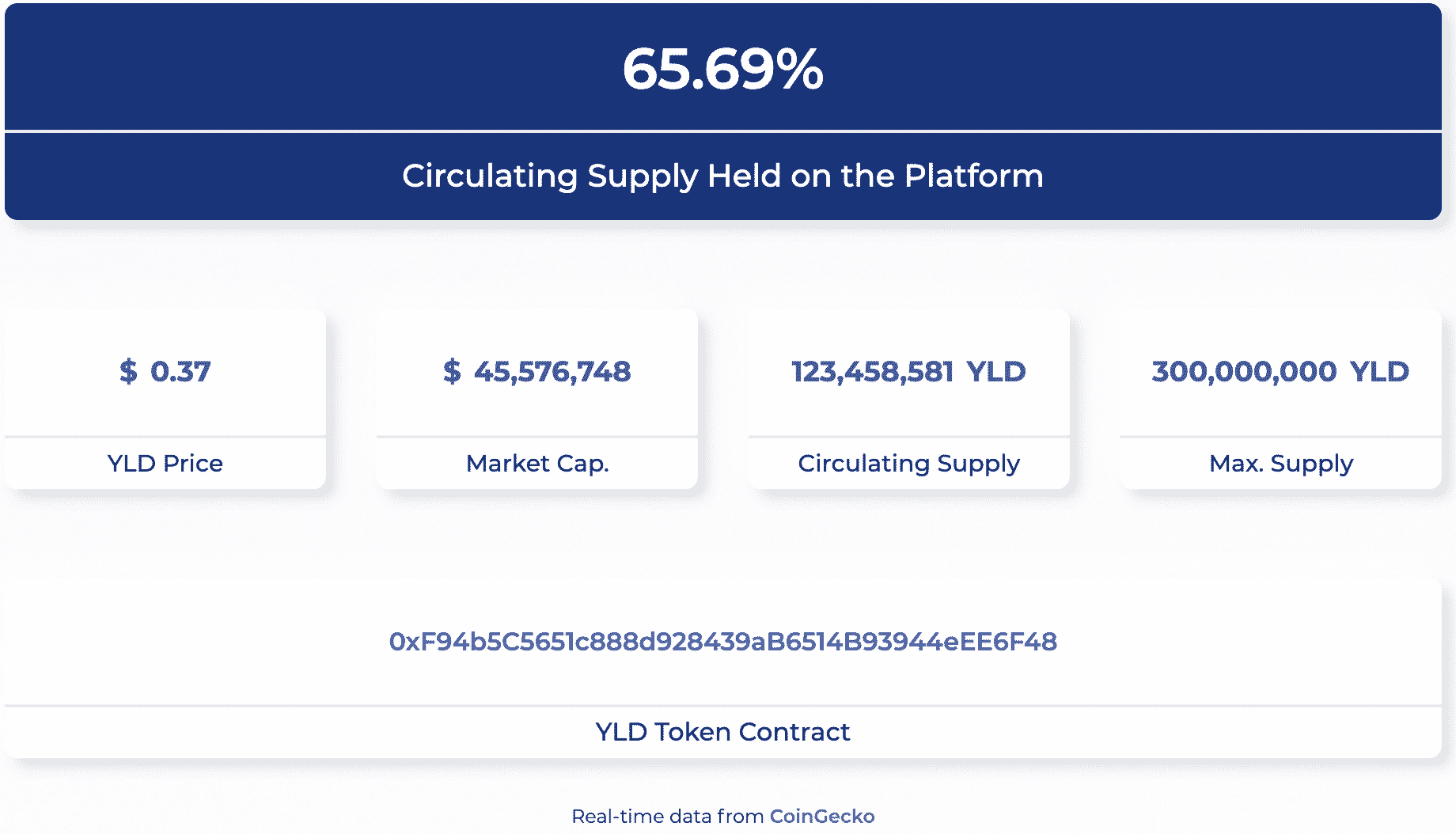

The corporate also helps the steadiness of the YLD token by periodically procuring YLD tokens on the delivery market. This would possibly perchance be viewed here: https://etherscan.io/token/0xf94b5c5651c888d928439ab6514b93944eee6f48?a=0x1a11848434cafa84a676e70459015407ec15b542

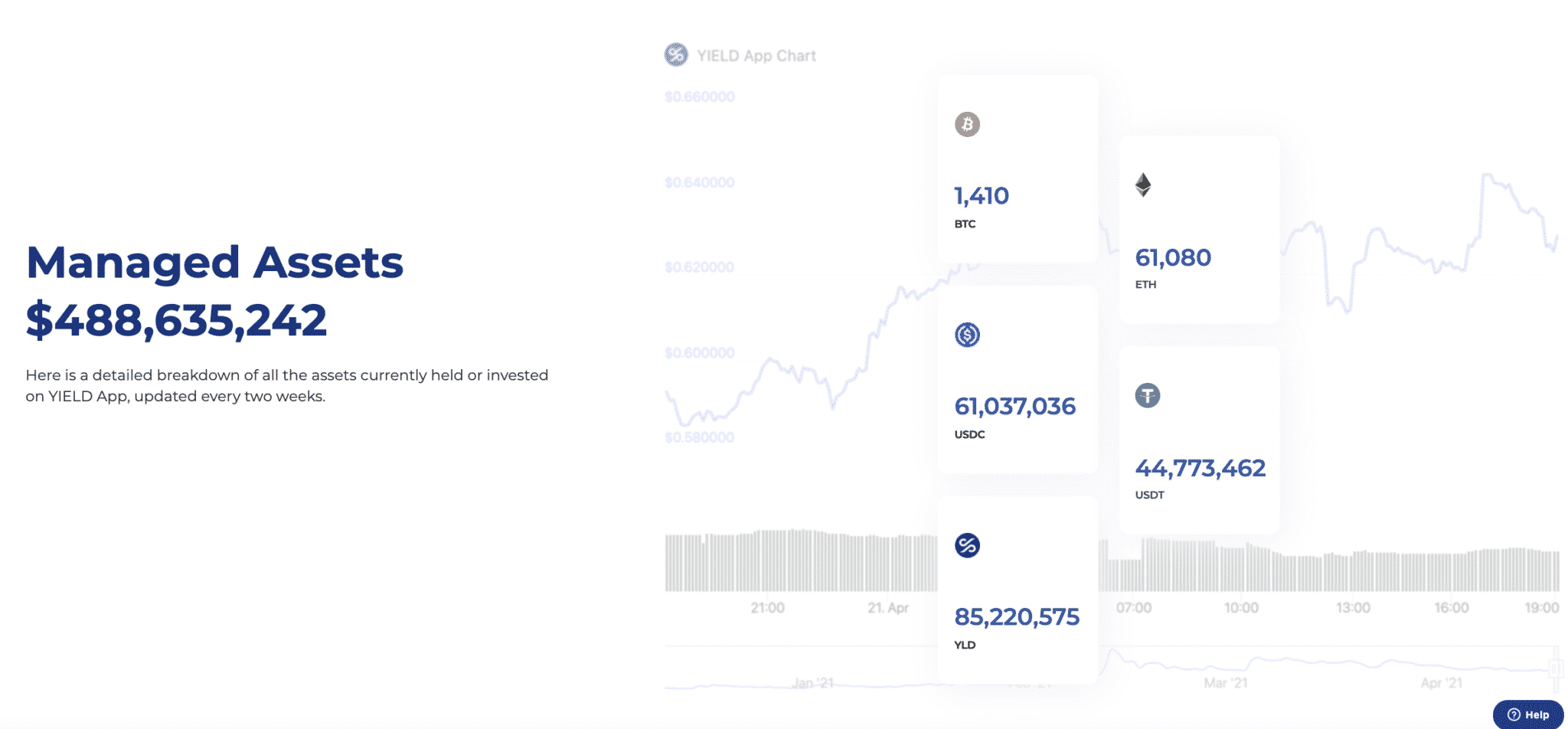

YIELD App publishes company efficiency and varied relevant metrics bi-weekly. To boot to the total preference of assets on the platform, it also publishes treasury rebalancing addresses (where the corporate buys support its YLD on the delivery market) and the total preference of tokens purchased.

What are the Risks?

- Upward thrust and tumble of the U.S. Buck. Many DeFi devices are stablecoin-backed, which would possibly perchance also very smartly be in step with the US Buck. YIELD App structures its positions as greenback-neutral (for stablecoin pools) and asset-neutral for others.

- The DeFi industry is infamous for its intense volatility, largely attributable to the rental’s infancy and the overarching volatility of cryptocurrency assets. YIELD App’s multi-technique attain goals to mitigate the volatility with a diversified portfolio.

- Provocative and unexpected market crashes and “Shaded Swan” level events.

Justin Wright, CFO and COO of YIELD App, says: “Sadly, there stays the ever-demonstrate risk of hacks or exploits in DeFi, where a canny particular person is in a exertion to take profit of a weak point in the armor of a trim contract (by which all DeFi protocols are bustle) and drain the liquidity pool of a protocol.”.

“Naturally, we are conscious about this and we are taking all that that you just would per chance per chance judge of steps to lower the hazards to our users. We possess most productive-in-class skills and workers limiting such risks. To boot, we handiest deploy funds real into a hand-picked different of smartly-proven protocols on which we’ve undertaken forensic due diligence and we manufacture an emphasis on diversifying.”

How Does YIELD App Create Your Cash?

YIELD App deploys several investment ideas all the absolute most practical draw throughout the digital asset universe, amongst others in the decentralized finance (DeFi) ecosystem.

The corporate is appealing in that it undertakes active portfolio management, whereas most cryptocurrency hobby list platforms are inclined to rely on automated lending mechanisms. YIELD App goals to mix risk mitigation, social intelligence and analytics, trim contract auditing, and batched transactions with beefy technical and industry due diligence.

Wright adds: “Our portfolio technique contains comprehensive investment risk mitigation, whereas our platform is protected to basically the most inspiring extent that that you just would per chance per chance judge of against breaches the use of a raft of security features. YIELD App is repeatedly monitoring and evaluating basically the most worthwhile market-neutral ideas all the absolute most practical draw throughout the DeFi ecosystem, including liquidity mining, arbitrage, liquidations, margin and collateralized lending, with varied earnings-producing ideas. We deploy funds in curated liquidity pools that meet our strict risk and security standards. We also use a extremely sophisticated risk management direction of, which lets in us to enact an optimum risk/reward ratio.”

Diversification and active portfolio management appear to be the staples of YIELD App’s management technique.

“YIELD App invests in enormous, curated liquidity pools where our assets are a tiny share of the total. Inside of these, we diversify to unfolded the risk. On high of this, we’ve an active investment team of specialists monitoring our positions 24/7. Here is backed up by automated triggers that can mechanically transfer funds into protected-haven assets throughout enormous trading events earlier than the higher market can take movement,” says Wright.

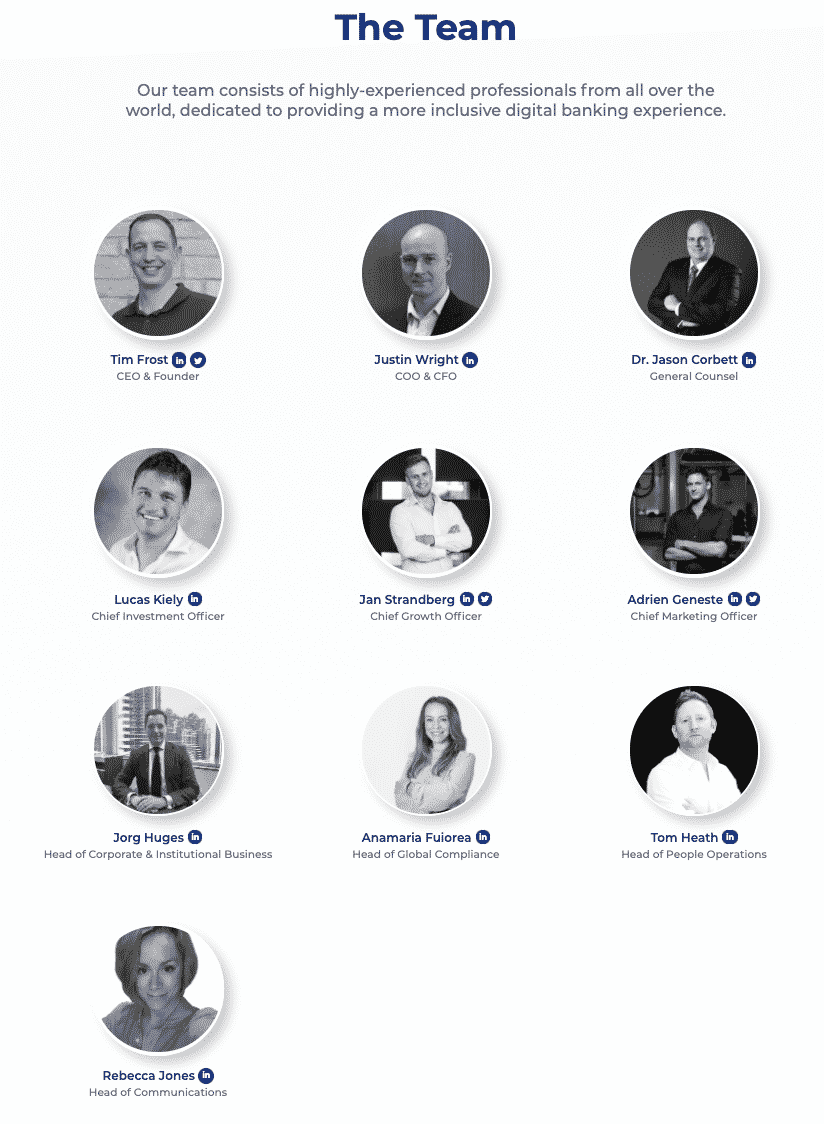

The Team

YIELD App has a globally disbursed team of over 40 workers.

Many, including CFO and COO Justin Wright, and Chief Funding Officer Lucas Kiely, come from ragged financial backgrounds, bringing skills in financial skills, investment and banking.

YIELD App’s development and advertising and marketing team contains regular financial journalists, creative designers and crypto-native digital entrepreneurs. Chief Enhance Officer Jan Standberg and Chief Advertising Officer Adrien Geneste possess a background in crypto and digital advertising and marketing, having helped to steer crypto company Paxful to success.

CEO Tim Frost has a background in fintech and financial delivery-up firms. Frost also spent a decade taking part in legit basketball all the absolute most practical draw throughout the sector.

Closing Tips: Is the YIELD App Legit?

YIELD App is a centralized draw by which to possess interaction with the sector of decentralized finance. Customers deposit cryptocurrency, which is then managed by the platform’s team of in-rental fund managers, who in flip explore varied ways to generate a yield in the cryptocurrency ecosystem.

“As financial regulators all the absolute most practical draw throughout the sector are customarily at concern to level out, previous efficiency is no declare of future efficiency and would possibly perchance just no longer be worn as an indicator of future returns,” says Frost.

YIELD App companions (supply: YIELD App site)

“Inside of our comprise technique, we focus heavily on finding low volatility, sustainable alternatives that would possibly perchance vow the high yields our users possess come to predict from us. Our portfolio team adopts a diversified attain that ensures assets are managed with effectivity and balance.”

The mission is quiet largely in its nascent phases, however as indubitably one of the vital first-of-its-kind DeFi fund companies, it’s worth taking note of.

Frost concludes: “For the time being, YIELD App is clearly grand smaller than both BlockFi or Celsius, on the opposite hand, this makes us nimble. We present a bridge between the high-yielding worlds of DeFi that, customarily, handiest very experienced investors with time on their hands can entry, and these extra centralized companies and products. This suggests higher rates of return with much less friction for our users.”

YIELD App is delivery to all users globally, other than for a few dozen worldwide locations such because the US. The team is at the moment focusing its growth efforts on increasing worldwide locations and areas including Asia and South America.