Irrespective of the most modern downfall of the crypto market, the projection of Bitcoin (BTC) to sinful the $100sufficient threshold stays viewed as a topic of time. Abet in December, Bloomberg Intelligence indicated that the expected ticket would happen at last “as a result of industrial fundamentals of accelerating seek data from vs. lowering offer,” and original data shed some gentle on that conception.

Bitcoin Vs. Coarse Oil

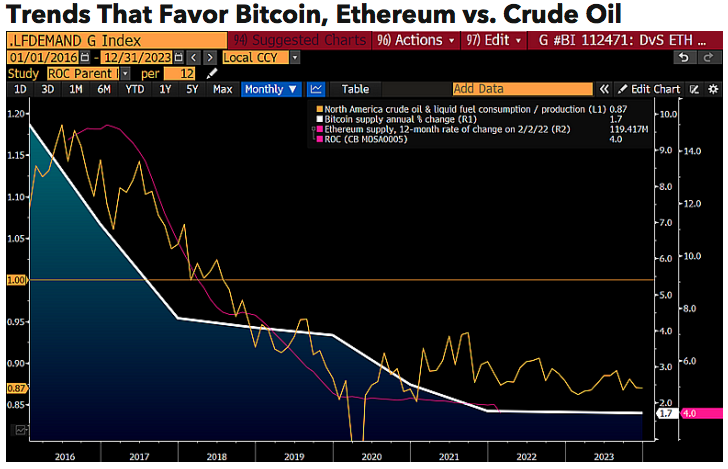

In a brand original Bloomberg Intelligence file, data reveals trends that can perchance well favor Bitcoin and Ethereum prices.

The file noted that “Representing advancing technology, Bitcoin is gaining traction as a benchmark global digital asset, while oil is being modified by decarbonization and electrification.”

Lack of offer elasticity is an attribute shared by Bitcoin and Ethereum that “objects them except for commodities”.

For commodities, “rising prices thwart seek data from and enlarge offer”, but the tip cryptocurrencies might perchance well uncover a particular account.

“Rising Bitcoin and Ethereum seek data from, and adoption vs. diminishing offer, must mute apply the elementary rule of economics and lift prices.”

Within the following chart, Bloomberg reveals a juxtaposition of the lowering BTC and ETH offer alongside with the procedure in which more than excessive oil and liquid-gas manufacturing compared to consumption heading toward 13% in 2023, noting that the U.S. “has been a top headwind for commodity prices”.

Associated Studying | Why The Bitcoin At $100K Discourse Stays Stable Irrespective of Market Crashes

Mainstream Adoption

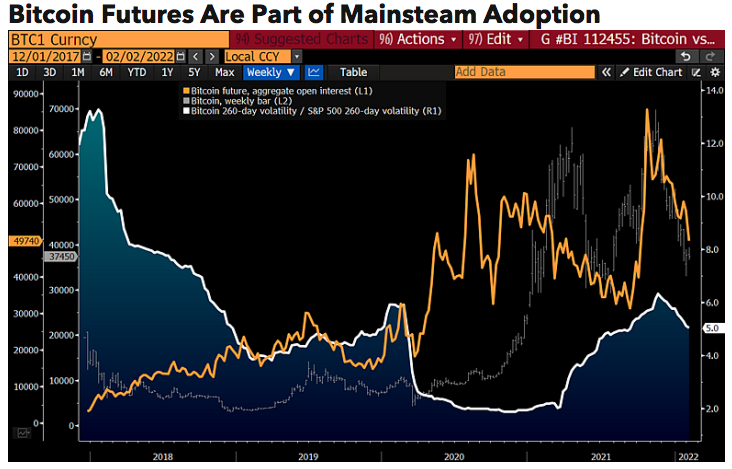

Consultants think that BTC “is successfully on its manner to changing into global digital collateral”, while its revolution in the “digitalization of finance” is in its early days. Future mainstream adoption will lead to increased seek data from for bitcoin.

The file predicts that the future tendencies in the macroeconomics and politics of the U.S. –dollar dominance, jobs, votes, taxes, and the map to oppose China’s insurance policies and get dangle of leverage in opposition to them– will lead U.S. policymakers into setting up honest laws for cryptocurrencies and ETFs.

Past El Salvador adopting BTC as ethical mushy, the proximity of the U.S. midterm elections has evidenced the American senators and politicians’ flee to apply alongside. In Wyoming, Arizona, and Texas politicians are pushing to flip the digital coin accurate into a ethical mushy, pointing at Bitcoin as a brand original defining aspect to enhance positioned in the polls.

A valuable broader acceptance of bitcoin is expected to happen with more regulatory clarity because fright and misinformation might perchance well diminish, thus more investors would soar at some stage in which manner mainstream adoption.

The file also notes that this greater mainstream adoption of Bitcoin is taking a detect unstoppable, which would most likely encourage its sign.

“The open of U.S. futures-based entirely commerce-traded funds in 2021 looks as a itsy-bitsy one step by regulators that we predict culminates with ETFs tracking accurate cryptos through gigantic indexes.”

Bloomberg data reveals that “Rising seek data from, adoption and depth of Bitcoin must mute crawl away few alternate choices for volatility but to decline.” For this cause, they think it’s going thru a “sign-discovery stage”.

The following chart reveals “the upward trajectory of Bitcoin futures open passion vs. the downward slope in the crypto’s volatility vs. the stock market”, noting that Bitcoin’s 260-day volatility is 3x of the Nasdaq 100, which contrasts its volatility for the length of the open of futures in 2017, which modified into once closer to 8x.

Referring to the Federal Reserve’s tightening measures, Bloomberg consultants had beforehand predicted that “Bitcoin will face initial headwinds if the stock market drops, but to the extent that declining equity prices stress bond yields and incentivize more central-financial institution liquidity, the crypto might perchance well come out a principal beneficiary.”

Associated Studying | Bitcoin Leverage Ratio Suggests Extra Decline Might perchance per chance also merely Be Coming