Whenever you’ve been following potential bitcoin trace targets, you know that many analysts count on bitcoin to utterly devour or devour into portions of gold, money provide (M2), global fiat-denominated debt, shares (equities) and real estate.

Whereas you’ve grasped the implications of bitcoin having no counterparty possibility and no dilution possibility, it’s best to aloof undercover agent that bitcoin will completely inhale all wealth stored in gold, M2 and global debt, nonetheless what section of the wealth stored in equities (shares) will probably be reallocated into bitcoin?

It’s a extraordinarily sophisticated belief to ponder.

Two weeks ago, we published our thoughts on how the valuation of a fictional firm, Wyoming Crimson Ribeyes, would substitute post-hyperbitcoinization. Now, we’re going to dive in pretty extra and flee a mission analysis that reveals how remarkable the valuation of a conventional S&P 500 firm would substitute constant with two pretty unknown predictor variables:

- The BTC inflation fee: How will we count on a relative CPI index (trace of items) to pattern over time?

- The BTC fairness possibility top class: What anticipated share return (BTC denominated) will motivate merchants to speculate their BTC into publicly-traded equities?

BTC Inflation Rate

It is sensible to count on the life like BTC shopper trace index (CPI) inflation to tumble somewhere between 0 percent and opposed 10 percent. The sizzling machine attempts to set aside roughly 2 percent CPI inflation every 300 and sixty five days. For the reason that Bitcoin financial customary operates underneath a mounted provide, bitcoin savers will probably be rewarded with all future productiveness enhancements thru decrease and decrease costs.

Most frequently, it’s far affordable to count on a CPI of roughly opposed 5 percent, which indicates that financial deliver underneath a Bitcoin customary will probably be quicker and extra sustainable.

BTC Equity Risk Top fee

An fairness possibility top class is the excess return that investing in shares is anticipated to give over a possibility-free real return of simply HODLing bitcoin (or doubtlessly earning yield on Lightning Network lease channels).

Right here’s tough to predict as this could occasionally sooner or later contrivance all the trend down to the bitcoin HODLers. They’ll be these to uncover the fairness possibility premiums they are prepared to bag for their bitcoin.

Based on fresh bitcoin-denominated lending charges (6 percent at BlockFi), we would probably count on the fairness possibility top class to be above this, since here’s the bustle for pretty safe debt, because of the this truth “fairness possibility top class.” It will even be sensible for an S&P 500 firm to own an fairness possibility top class between 0 percent and 30 percent.

Whereas that is relying on how the market weighs explicit substitute dangers, customarily it’s far affordable to count on around 10 percent, which indicates that merchants won’t be prepared to phase ideas with HODLed BTC except they count on a 10 percent return to accompany the possibility of investing in a publicly-traded fairness.

What Retailer Of Worth (SoV) Share Is In Equities?

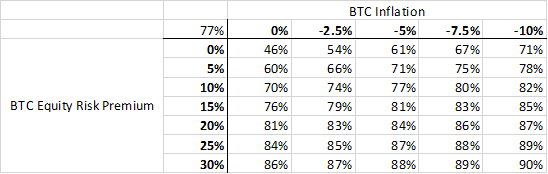

Below is an recordsdata table that displays what share of wealth stored in publicly-traded fairness valuations is barely hunting for a generic SoV (i.e., bitcoin). Instruct that this recordsdata table is using the discounted cash stride along with the circulate (DCF) models of Wyoming Crimson Ribeyes as a conventional fictional S&P 500 firm.

The two predictor variables, BTC inflation and BTC fairness possibility top class, are the solely two variables altering in the DCF models.

Taking a glimpse at our estimations of opposed 5 percent BTC CPI inflation and 10 percent BTC fairness possibility top class, the estimated SoV share on the moment stored in public S&P 500 equities is 77 percent. This indicates that 77 percent of the real wealth stored in the S&P 500 could well perhaps re-allocate to bitcoin.

This estimation varies looking on the 2 predictor variables. To illustrate, on the low cease (0 percent fairness possibility top class and nil percent inflation), bitcoin will solely seize 46 percent of the wealth stored in publicly-traded equities. Nonetheless, on the high cease (30 percent fairness possibility top class and opposed 10 percent inflation), bitcoin will seize 90 percent of the real wealth stored in the S&P 500.

Updated Trace Targets

Beginning with the baseline assumption that Bitcoin eats the wealth stored in gold, M2 and global debt, we initiate at $17.1 million per BTC.

If we spend our analysis to uncover that bitcoin will intake 77 percent of world equities, that pushes the total BTC market cap to $427.9 trillion, indicating a trace of $20.4 million per BTC. From there, we can conservatively add in that bitcoin will capture the SoV out of real estate (50 percent of total real estate), which pushes us to a total BTC market cap of $568.4 trillion, indicating a trace of $27 million per BTC.

In comparison with our old trace target incorporating both shares (50 percent) and real estate (50 percent), it solely elevated by $1 million (from $26 million to $27 million). Nonetheless, $1 million BTC sounds pretty substantial appropriate now.

Future Analysis

We resolve to moreover dive into real estate valuations, since we simply oldschool a baseline of 50 percent to uncover the wealth stored in real estate that will probably be absorbed by bitcoin. This could be elevated or decrease. As nicely as, lets extra attempt to cost in the lengthy flee the productiveness beneficial properties that bitcoin will elevate, as nicely because the high propensity to sustain a counterparty-possibility-free and dilution-possibility-free asset.

The global wealth numbers originated from Visual Capitalist and the ”Mimesis Bitcoin Investment Analysis Fable.”