The Dogecoin model has been gearing up for a essential bull rally because it rose to the $0.4 threshold and started attempting out this resistance. Shedding gentle on Dogecoin’s future bullish trajectory, a crypto analyst has discussed the significance of the $0.22 50-day Transferring Life like (MA) in determining the Dogecoin model actions on this bull cycle.

How The 50-Day MA Impacts The Dogecoin Rate Rally

The 50-day MA is a technical indicator that highlights a cryptocurrency’s life like model over the remainder 50 trading days. It is primarily weak to title model trends, resolve resistance and attend ranges, and generate purchase and sell indicators.

Kevin, a crypto analyst on X (formerly Twitter), has underscored the significance of this serious technical indicator in the present Dogecoin model actions and its affect on the meme coin’s future bull rally. The analyst disclosed that traditionally, at some level of Dogecoin’s outdated bull markets, its model consistently stayed above the 50-day MA, by no manner shedding this essential threshold despite attempting out it multiple times. Normally, staying above the 50-day MA is considered as a bullish indicator, whereas consistently losing beneath this life like suggests a downtrend.

Presenting a detailed chart of Dogecoin’s model action in the remainder bull cycle in leisurely 2020 to this level, Kevin disclosed that the present 50-day MA for the meme coin is at $0.22. Alternatively, this model threshold is rising mercurial as Dogecoin closes on a conventional basis by day candle.

Moreover, the like a flash lengthen means that if Dogecoin can remain in vogue around or above the 50-day MA, its model must peek a gigantic bullish pattern continuation, providing a win foundation for even elevated prices.

Dogecoin Enters Distribution Section, $9.5 Purpose In Ogle

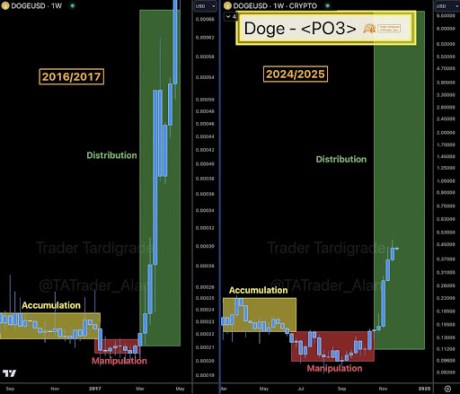

In a sure X post, Trader Tardigrade, a prominent crypto market professional, declared that Dogecoin has officially entered the Distribution segment in the classic Energy of Three (PO3) market cycle. The PO3 cycle is a hottest belief in technical diagnosis weak to title key market phases — Accumulation, Distribution, and Manipulation.

With Dogecoin now firmly in the Distribution segment, mountainous holders might well well be offloading their sources, presumably locking in earnings following DOGE’s present model lengthen. Whereas the distribution segment might well well perhaps merely be considered as the dwell of a bull rally characterised by sell-offs and slack momentum, Trader Tardigrade believes that this segment might well well perhaps merely be accrued sooner than a gigantic model surge.

The analyst shared two model charts evaluating Dogecoin’s actions at some level of the bull cycle between 2016 and 2017 and its future model action in 2024 and 2025. In the 2017 bull market, Dogecoin entered a distribution segment, which led to a gigantic bull rally to recent ranges above $0.00066.

If this pattern holds upright for Dogecoin’s present distribution segment, Trader Tardigrade has predicted that its model might well well surge as high as $9.5 from its present payment of $0.4.

Featured image created with Dall.E, chart from Tradingview.com

Disclaimer: The facts came upon on NewsBTC is for academic functions

easiest. It would no longer portray the opinions of NewsBTC on whether to purchase, sell or withhold any

investments and naturally investing carries dangers. It is possible you’ll perhaps well be suggested to behavior your relish

research sooner than making any investment decisions. Use data offered on this online page

entirely at your relish risk.