They express that essentially the simplest technique to beat the machine is thru emotionless investing. The irony, on the opposite hand, is that there’s not this form of thing as a operate of investing in which emotions are not concerned.

While you may well had been share of the Bitcoin community, then you definately are not outlandish to tag predictions starting from zero to an total bunch of millions of greenbacks. While fully a pair of of these predictions are backed by technical diagnosis, most of them are lawful guesses pushed by other folks’s feelings at reasonably a spread of occasions.

As cryptocurrencies are becoming more mainstream with every passing day, companies as mountainous as Tesla are jumping in on the Bitcoin educate and investing billions of greenbacks. The bulls are working in, pouring huge amounts of capital into bitcoin. Nevertheless whereas you would spend to reach success, not lawful in bitcoin but in any operate of funding, the important thing rule is to zoom out.

So, what if I informed you that there’s a trademark that had in point of truth predicted this bitcoin tag bustle? As a topic of truth, that it had in point of truth predicted the runs which ranking took position previously? And that it may well perhaps predict one that’s but to return?

As a technical analyst, I’m a firm believer that the wicks in the charts repeatedly take into tale the reality that’s going down on the ground. Now, obviously, no indicator can also moreover be extinct entirely by itself to retain out an diagnosis. Nevertheless it certainly can repeatedly be added on your arsenal whereas making a good judgment.

In the case of bitcoin, that arsenal can encompass almost anything else. Mumble, the Bitcoin network’s mining energy or the worthlessness of our most contemporary financial machine. Nevertheless the indicator that I’m talking about here is the stock-to-drift ratio. Now, earlier than I am going on to focus on the stock-to-drift ratio, we must first understand the mechanism of Bitcoin mining and the mining subsidy halving.

What Is Bitcoin Mining?

The strategy of Bitcoin mining is fully the bolt of finding a key to a undeniable lock. Or, it’s seemingly you’ll perhaps perhaps express, it’s a ways the strategy of finding a plan to a extremely complex mathematical order. A order so complex that many strive and fail earlier than any individual comes up with essentially the most involving resolution. In other words, it may perhaps most likely also moreover be like finding a needle in a haystack.

So, then the request arises: Why attain other folks mine Bitcoin in the important thing position? The reply is de facto reasonably straightforward: for their very have merit. Every single time a miner efficiently mines bitcoin or, referring to our analogy above, every time they fetch the plan in which to that complex order, the miners salvage a reward. The reward is that they salvage to write the next block in the Bitcoin blockchain and they also salvage rewarded with a undeniable series of bitcoin (known as a “subsidy”) and transaction expenses.

The strategy of Bitcoin mining is priceless both to the miners and the Bitcoin blockchain as a total. They retain the Bitcoin wheel rolling.

What Is The Bitcoin Halving?

Now that we have discussed Bitcoin mining, we must focus on one amongst essentially the most extra special ideas in Bitcoin: the halving.

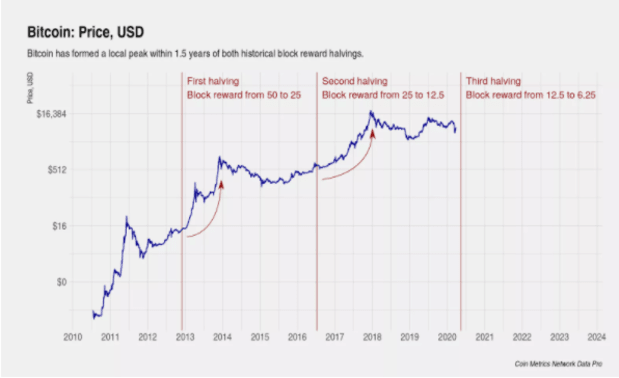

As talked about above, the miners salvage rewarded every time they are successful. On the present time, the subsidy is 6.25 BTC. Four years ago, in 2016, the block subsidy turned into once 12.5 BTC. And, four years earlier than that, in 2012, it turned into once 25 BTC, as depicted in the graph beneath.

About every four years, the Bitcoin block subsidy halves. And since the fresh offer of bitcoin created through this subsidy is continually reducing, every halving cycle is followed by a parabolic tag bustle. These runs are factoring the reduced offer into the bitcoin tag.

What Is A Stock-To-Scramble alongside with the circulation Ratio?

A stock-to-drift ratio is a trademark that has been extinct in commodities for a protracted time. Nevertheless its utility to Bitcoin turned into once famously originated by Map B in 2019.

Because the name suggests, a stock-to-drift ratio in overall measures the stock of a undeniable handy resource — i.e., how grand of it’s a ways readily available at the 2nd in circulation — against the drift of the handy resource — i.e., how grand of it’s a ways being produced. Because it’s seemingly you’ll perhaps perhaps look by definition, the indicator is intrinsically per the availability and demand mechanism. This is why the halving affects this ratio seriously.

The relationship between a Bitcoin Halving and the stock-to-drift ratio can also moreover be viewed clearly whereas you evaluate the 2 charts against every other. That is because every time Bitcoin Halving occurs, the drift (manufacturing) of bitcoin is reduced. As a result, the stock-to-drift ratio jumps. And, whereas you search for at the bitcoin tag, it almost follows to a tee.

What Does The Stock-To-Scramble alongside with the circulation Ratio Mumble About Bitcoin’s Future Designate

Coming aid to my customary point, the bitcoin tag this day (at the time of this writing) is around $57,000. Of us are giving reasonably a spread of explanations for why. Some express a undeniable investor has set in a correct chunk of cash. Others express the cost is littered with Elon Musk’s determined tweets and whatnot.

Of course, the indispensable diagnosis and, more importantly, bitcoin’s rising adoption play large roles in the bitcoin tag. Nevertheless the bitcoin tag can also moreover be predicted to a pair of extent by the stock-to-drift ratio.

Because it’s seemingly you’ll perhaps perhaps look from the outdated Halving cycle, the bitcoin tag overshot during the stock-to-drift ratio earlier than coming aid down and averaging alongside the stock-to-drift ratio. On the 2nd, the bitcoin stock-to-drift ratio indicates that bitcoin must hit a tag of $100,000 by the discontinue of 2024. Brooding in regards to the ancient overshoots, a conservative estimate of a bitcoin tag of $150,000 right this moment looks imaginable.

Too Lengthy; Didn’t Read (TL;DR)

Bitcoin’s adoption is rising and reaching more mainstream merchants with every passing day. And the bitcoin tag has elevated seriously over the glorious couple of months. Nevertheless, there has been one indicator that simplest predicted this bustle, and that indicator is the stock-to-drift ratio.

To admire the stock-to-drift ratio, it’s a ways extreme to know in regards to the ideas of Bitcoin mining and the Halving. The stock-to-drift ratio is a ratio of bitcoin in circulation to bitcoin manufacturing (facilitating through mining). Since Bitcoin manufacturing is reduced by the Halving, the stock-to-drift ratio is elevated. The bitcoin tag follows the ratio almost to a tee.

Traditionally, the cost overshoots the stock-to-drift ratio earlier than coming down and averaging out. So, a bitcoin high of around $150,000 throughout the following couple of years looks imaginable.