- Liquidity Pools 101: How a Decentralized Alternate Works

- Why Liquidity in DeFi Is Crucial

- DeFi Liquidity Pools in a Decentralized World 101:

- What’s a DeFi Liquidity Pool in Action?

- DeFi Liquidity Pool Instance #1: Liquidity Pools on Uniswap

- DeFi Liquidity Pool Instance #2: Liquidity Pools on ShapeShift Overview

- What’s the Incompatibility Between Liquidity Pools and Liquidity Mining?

- Final Tips: Are DeFi Liquidity Pools Legit and Value Your Time?

Whenever you’re taking a look up what a DeFi liquidity pool is, potentialities are you’re deep in a decentralized finance rabbit hole. Per chance you’ve performed with DeFi products treasure Uniswap and Aave, and per chance even yield farming.

Or, per chance, you’re lawful getting started and don’t prefer any opinion what that final sentence reach.

Wherever you are on the DeFi records spectrum, you’re at the correct place. We’re going to build one thing few like carried out sooner than: strive to now not create DeFi sound extremely advanced and advanced.

In this e-book, we’re going to transfer over a well-known DeFi puzzle fragment: liquidity pools and liquidity mining.

Why are liquidity pools so well-known? Correctly, that acknowledge depends on you.

From a technical POV, liquidity pools relief create decentralized trading that you just may per chance per chance well per chance per chance imagine. Anyone can change swap tokens at any time with none single centralized entity. Pretty than stare-to-stare (P2P) trading, where Bob trades with Sally, you’ve got got stare-to-contract trading (P2C) where Bob trades with a horny contract. Liquidity pools are at the center of this.

From an investing POV, liquidity suppliers are earning yields of 100% (and exponentially higher) APR from providing liquidity, which is a barely passive nonetheless ideal perilous note.

Let’s start with a key thought, decentralized exchanges.

Liquidity Pools 101: How a Decentralized Alternate Works

Image our ancestors trading chickens for seashells thousands of years ago. Now, imagine Ooga Booga, captain of the prehistoric seashell industry, throwing his seashells into a substantial magic vortex, which automatically spits out a predetermined vivid-market price of chickens.

Right here’s obviously a rotten oversimplification, nonetheless the vibe is the same to stare-to-contract trading in decentralized alternate.

A decentralized alternate (or, even as you would treasure to sound really in the know, a DEX) is basically machine that lets in individuals to alter (or swap) tokens with out a centralized middleman.

A DEX may per chance per chance well even be start-source machine created by just builders, which desires to be audited by third events to assess its efficacy and legitimacy. Many decentralized protocols are owned by a centralized guardian company. Uniswap, as an illustration, is a Brooklyn-primarily primarily based startup with a Series A led by accepted endeavor capital company a16z. In other cases, many DEX upstarts don’t like a centralized company established or an workplace you may per chance per chance well per chance per chance call if issues traipse awry.

Pretty than requiring a human third occasion to custody assets, DEXes exercise horny contracts to create almost instantaneous settlement cases.

A DEX treasure Uniswap makes money by:

- Charging a “protocol price” of between 0.05% to 1%. This characteristic may per chance per chance well even be voluntarily modified into on by UNI token holders per their governance functions.

- Token mark appreciation. 20% of the 4 billion UNI tokens had been assigned to Uniswap employees. Because the protocol and UNI token develop in recognition, so will the wealth of the corporate and of the token holders.

DeFi protocols can differ of their liquidity protocols construction; one may per chance per chance well mark higher costs, and one may per chance per chance well distribute tokens that don’t like governance rights, and so forth.

Since these exchanges are fully decentralized, they need safe entry to to a substantial need of funds to create certain merchants all the time like safe entry to to the token pairs they need.

To transfer deeper into DEXes, test out our decentralized alternate e-book.

This brings us to liquidity.

Why Liquidity in DeFi Is Crucial

Good enough, let’s take a quick-time frame breather sooner than we safe into some nitty-gritty, nonetheless really freaking frosty DeFi stuff.

Liquidity is the extent an asset may per chance per chance well even be rapid purchased or supplied at a mark that shows its correct price; it’s at the center of any purposeful market.

A lack of liquidity correlates to higher-threat categories and is priced accordingly. Without liquidity, or somebody to aquire an asset, the query, and ensuing from this truth the cost, of the asset drops. For instance, if I aquire $1,000 of some vague token, and each cryptocurrency alternate gets rid of it from trading, I’d like nowhere to sell it, making it a a lot much less precious asset.

Low liquidity additionally reach low volume, which ends in a pesky thing called slippage, where your describe executes at assorted tiers of decreasingly preferential costs. For instance, when Elon Musk buys a huge $100M describe of Bitcoin, his describe may per chance per chance well even transfer the market as the describe is being achieved. Let’s converse the first 10M BTC is filled at $50k per BTC, then the following $30M at $52k per BTC, and the final $60M is at $53k per BTC.

Legacy programs provide barely purposeful marketplaces for most desires; if Bob wants to sell his $TSLA inventory, a inventory trading platform can build the change almost without prolong, on the complete without slippage since most revered inventory exchanges simplest elevate assets with foremost volume.

Since DEXes don’t like a centralized describe e book of alternative folks that like to aquire or sell crypto, they like got a liquidity subject.

In other words, in the face of extremely efficient exchanges, an replacement without liquidity sucks– and DEX builders deliberate for this.

There are indubitably infrastructural tradeoffs between the describe e book model that dominates centralized exchanges and the Computerized Market Maker models in DeFi. On the other hand, the blockchain can provide foremost improvements over primitive systems of alternate.

For one, most central marketplaces are confined to limitations similar to market hours, reliance on third events to custody the assets, and each so repeatedly unhurried settlement cases.

A DeFi liquidity protocol enables:

-

- Rapid settlement: stare-to-stare trading settles without prolong on-chain

- Easy to exercise: The liquidity protocol horny contract determines the trading mark algorithmically.

- Non-custodial: A decentralized alternate doesn’t take custody of your non-public keys, which reach merchants all the time like plump support a watch on of their funds.

- Interoperability: Many of DeFi programs are interoperable and may per chance per chance well even be stacked on other treasure minded apps, treasure Lego blocks. Reflect of a company treasure Uniswap as a “Liquidity-as-a-Service” platform, where other third-occasion dApps, wallets, and price processors can grant their customers safe entry to to liquid markets as an ingrained characteristic.

- 24/7/365 World Liquidity: Traders safe liquidity anytime and wherever on this planet.

Reveal books create sense in a world where moderately few assets are traded, now not a lot the madhouse world of crypto where somebody can originate their very have token.

A centralized alternate treasure Coinbase or Gemini takes possession of your assets to streamline the trading job, and they also mark a price for the comfort, on the complete around 1% to a couple.5%.

DeFi targets to assemble the same goal of enabling a hasty “all the time-on” marketplace, nonetheless without conserving somebody’s non-public keys or assets. And right here’s the conundrum: how build DeFi protocols safe safe entry to to funds to beget trades without turbulence?

That’s where liquidity pools come into play.

DeFi Liquidity Pools in a Decentralized World 101:

A centralized alternate treasure Coinbase or Gemini makes exercise of the “describe e book” model, as build primitive marketplaces treasure the Unique York Stock Alternate. In the “describe e book” model, merchants and sellers direct in an start market: merchants prefer the asset for the lowest mark that you just may per chance per chance well per chance per chance imagine, sellers like to sell for essentially the most intelligent mark that you just may per chance per chance well per chance per chance imagine. For the change to occur, merchants and sellers must agree on the price.

That’s where the Colossal Hoss of the total ordeal comes in– the Market Maker. A centralized alternate acts as the market maker by organising a excellent mark where merchants and sellers are willing to fulfill.

The Market Maker is generally willing to aquire or sell assets at a particular mark, on the complete the exercise of its have pool of assets to make certain there’s generally one thing available. This means customers can all the time change on the alternate– cryptocurrency is unique in that exchanges operate 24/7/365, whereas one thing treasure the NYSE opens at 9:30 AM and closes at 4 PM EST.

Centralized exchanges invest resources to create a helpful and vivid marketplace for customers to alternate cryptocurrency, and create a hefty chunk of income from what they mark for facilitating the transaction.

Deeper dive: To stare how a centralized alternate functions as a industry, Coinbase is a public company– test out its S1 Statement or frequent earnings studies.

The “describe e book” model is just not likely with out a market maker.

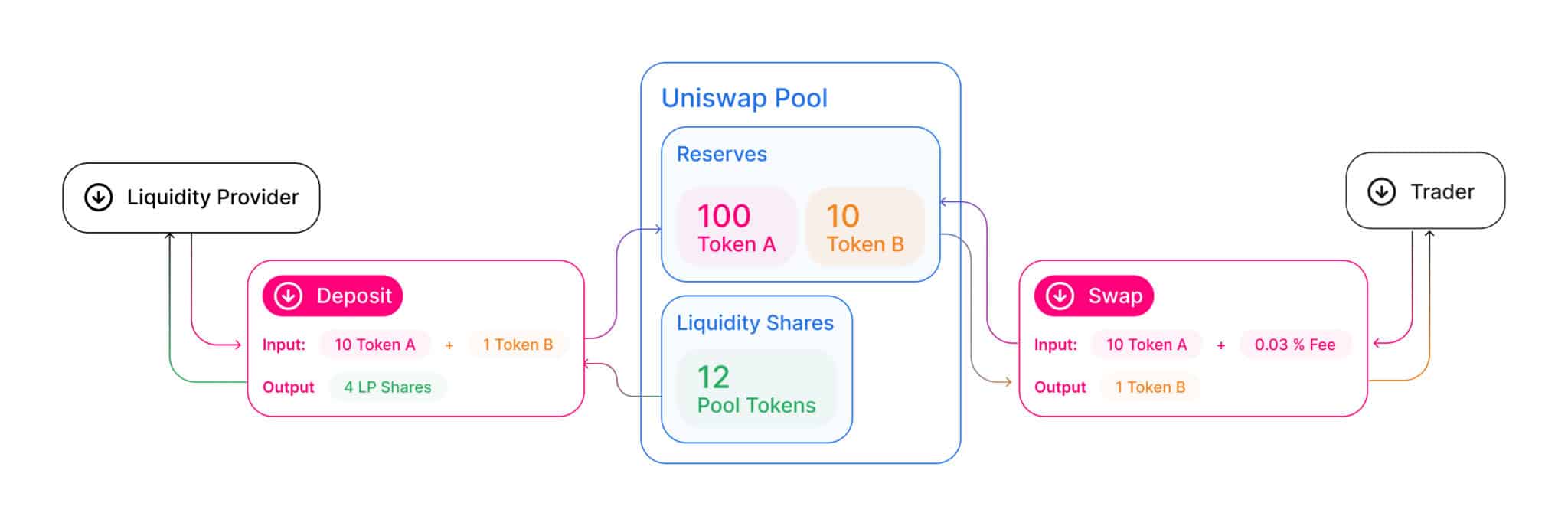

Rather then merchants and sellers being matched by a central market maker treasure Coinbase, merchants the exercise of liquidity protocols change straight towards a horny contract. Scrutinize-to-contract!

Where build the horny contracts safe safe entry to to deep pools of funds to create trading that you just may per chance per chance well per chance per chance imagine? You guessed it– liquidity pools!

A liquidity protocol (ponder Uniswap, Bancor, or Balancer) acts as an Computerized Market Maker (AMM) permitting customers to safe entry to a liquid market at any given 2d.

A liquidity pool is a aggregate (“pool”) of as a minimum two tokens, locked in a horny contract.

Now, why would somebody build this kind of thing?

Correctly, it’s ideal lucrative (and perilous) and a lot yield seekers soar into liquidity pools in quest of monetary assign. Others with a more technological zigzag glimpse their participation in liquidity pools as a reach to uphold a decentralized project.

These forms of issues are better skilled than understood, so let’s flee through some proper-world examples.

We lawful mentioned individuals trading on DEXes change towards horny contracts designed to create liquidity at a excellent mark. These horny contracts safe entry to liquidity pools for those actively traded tokens.

We additionally talked a few liquidity pool being a aggregate of as a minimum two tokens locked in a horny contract.

Let’s dive into a liquidity pool– positioned for your snorkels.

Liquidity pools had been popularized by Uniswap, a decentralized alternate faded by many in the DeFi world. The Uniswap protocol costs about 0.3% in network trading costs when individuals swap tokens on it.

Impart I’m an aspiring liquidity provider. As such, I’m incentivized by liquidity pools to create an equal price of two tokens in the liquidity pool.

Liquidity suppliers are rewarded. Your complete 0.3% trading price (more or much less, counting on the pool) paid by merchants is disbursed proportionately to the total liquidity pool suppliers.

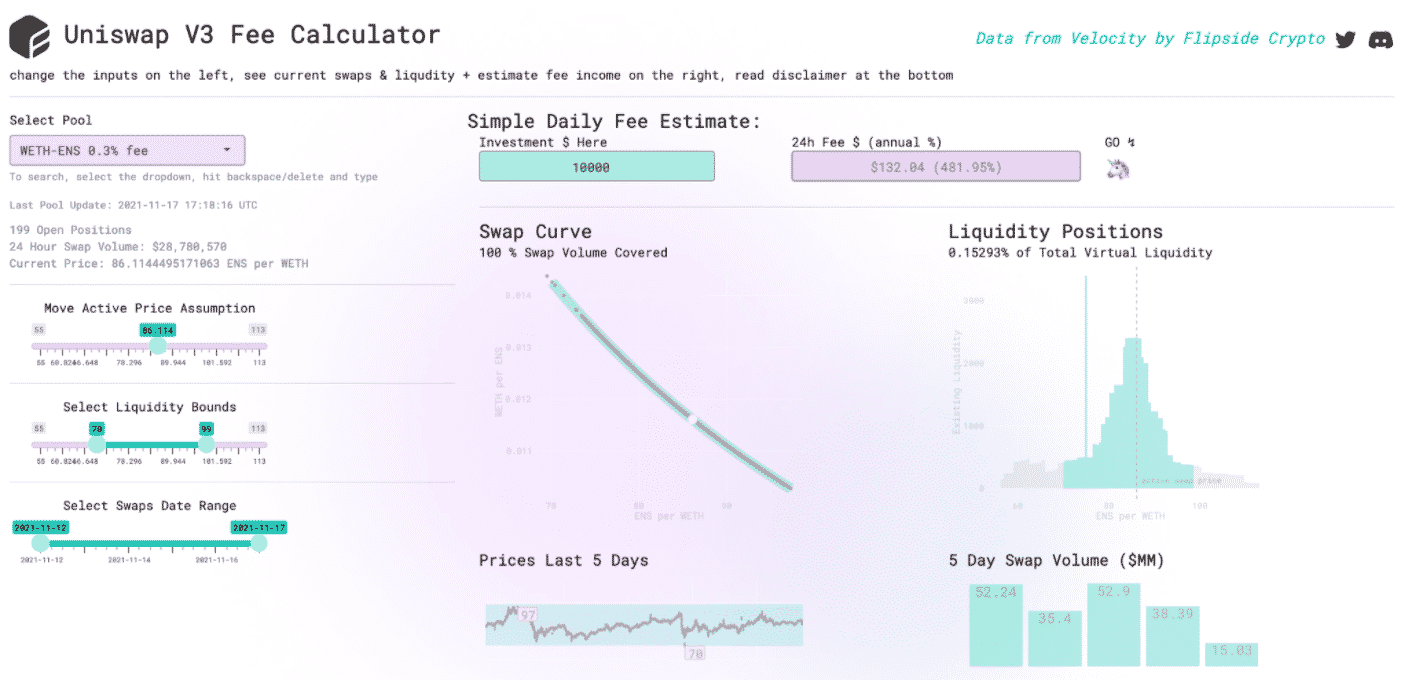

There are masses of neighborhood-led calculators that present a clearer estimate of charges and returns.

DeFi Liquidity Pool Instance #1: Liquidity Pools on Uniswap

For instance, striking $10,000 in a WETH-ENS Pool at a 0.3% price on Uniswap v3 is estimated to generate $132.04 per day in costs, at an estimated annual percentage of 481%.

Going to the particular Uniswap place, we glance that the ETH-ENS pool generated $72,320 previously 24 hours, that had been all disbursed proportionately to the liquidity suppliers.

The estimated LP returns on any DEX will all the time be in the train of flux, and a myriad of DeFi yield farming applications similar to aggregators exist to safe liquidity suppliers essentially the most intelligent charges.

Assist in mind that these liquidity pool costs earned are lawful for the pool itself, paid by Uniswap and generated by merchants of the platform.

As liquidity turns into a sought-after commodity, some protocols like taken it a step additional to compete for liquidity suppliers by providing liquidity pool token staking, which we’ll safe into below.

DeFi Liquidity Pool Instance #2: Liquidity Pools on ShapeShift Overview

ShapeShift is a centralized cryptocurrency company that modified into once founded in 2014, nonetheless elected to decentralize completely in July 2021. It airdropped FOX tokens to its employees, stakeholders, and customers, changing into a Decentralized Self sustaining Group (DAO.)

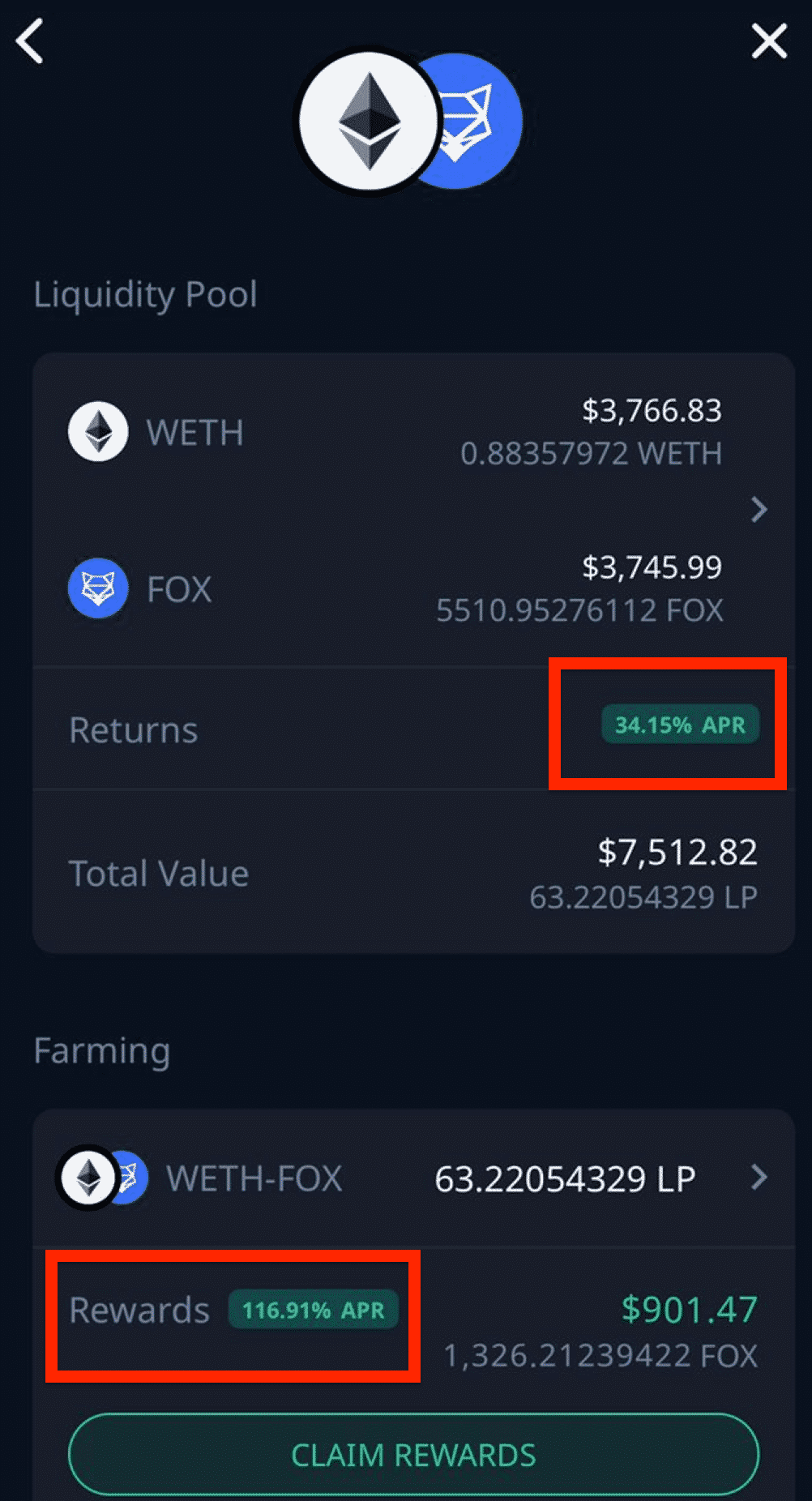

ShapeShift affords lawful one liquidity pool, WETH-FOX.

I can present an equal quantity of WETH (it’s normally lawful customary ETH, nonetheless “wrapped,” the distinction is insignificant for this dialogue) and FOX (the token that powers the ShapeShift ecosystem.)

I place in $3,750 of WETH and $3,750 of FOX for a whole of $7,500. In return, I receive WETH-FOX Liquidity Pool tokens.

I can then “Stake” these LP tokens for an estimated yearly reward of 116.91% APR.

Yes, you read that as it may per chance per chance well per chance even be– an APR of 116.91%. So, for the $7,500 WETH and FOX I place in, I have to soundless safe around $8,758 as income in one plump year, nonetheless this isn’t all the time the case.

Protocols on the complete denominate the APR in the quantity of tokens (on the complete the native token of the platform, treasure FOX) in place of a U.S. Greenback quantity. Your proper greenback APR may per chance per chance well even be more or much less counting on the price of the token.

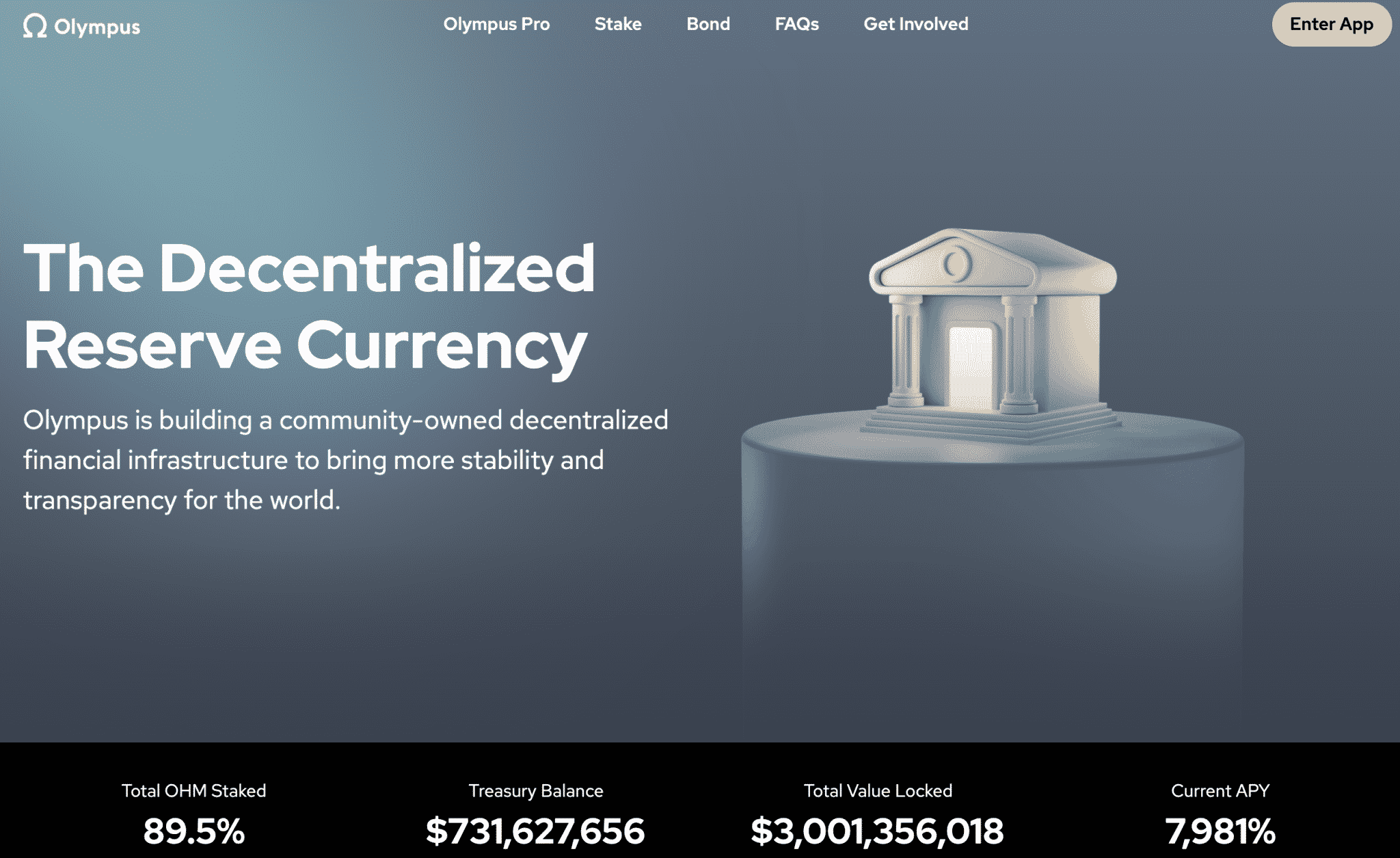

An APR treasure 110% APR, and even some as excessive as 90,000% or higher, isn’t an anomaly amongst other liquidity pools.

So, who’s paying these bonkers DeFi yields? There’s no reach they’re sustainable, proper?

What’s the Incompatibility Between Liquidity Pools and Liquidity Mining?

The distinction between liquidity pools and liquidity mining has to build with who will pay the yield and the contrivance in which.

Be conscious that the horny contracts written by protocol builders (similar to Uniswap) resolve how LP staking yields are paid, as a percentage of costs accumulated from the token swapping on the platform.

Some projects additionally give liquidity suppliers liquidity tokens, that can also very successfully be staked separately for yields paid in that native token. Right here’s a limited bit advanced, nonetheless the distinction is more than lawful semantics.

- The liquidity pool rewards are in accordance to the protocol costs, treasure 0.3% on Uniswap.

- The liquidity pool tokens, which are staked on a assorted protocol, can perform 100%+ APR, paid in whatever token that protocol is incentivizing you with (i.e., FOX.)

Again,

Liquidity suppliers bought a percentage of trading costs in a explicit pool. Liquidity pool rewards are inclined to diminish as more liquidity suppliers be part of, as per easy present and query.

AND,

Liquidity suppliers who stake their liquidity pool tokens may per chance per chance well safe paid in other tokens as an additional incentive to create liquidity there as towards one other platform. Are yields of 90,000% APR sustainable? Correctly, the protocol determines how a lot of its token it wants to print to shield the yield.

Right here’s the most foremost distinction between liquidity pools and liquidity providing, a distinction with blurred traces.

The note of in quest of out essentially the most intelligent yield in diverse DeFi protocols is named yield farming; it may per chance per chance well per chance safe ideal advanced, nonetheless it indubitably’s within glimpse for somebody searching to learn.

Final Tips: Are DeFi Liquidity Pools Legit and Value Your Time?

Whenever you’ve made it this a long way, congratulations– you’ve lawful learned about one in every of essentially the most intelligent parts of decentralized finance.

It’s easy to safe tripped up in the total funky protocol and token names. It’s well-known to keep in mind that DeFi is simplest a few years faded, so even as you’re learning this, you’re early.

And no, this isn’t going to total as some wild-eyed sales pitch where you, too, can automatically perform 90,000% yields with lawful a tiny investment. Our philosophize material isn’t investment recommendation– it’s all intended to be educational, and confidently, keen.

It’s no shock liquidity pools attract each speculation and skepticism of equal depth. As a nascent technology, liquidity pools like masses of roar alternatives and threat factors that desires to be belief to be. Providing liquidity is terribly perilous for reasons treasure a thing called impermanent loss, or even a whole lack of funds through horny contract failures or malicious rug pulls.

Liquidity is a extreme subject in a decentralized digital asset landscape, and builders like present you with some rather ingenious and creative alternatives. Instructing your self on DeFi liquidity pools and liquidity mining is treasure having a flashlight for your toolkit of exploring the following generation of finance.

By no reach Fling away out One other Opportunity! Get hand chosen news & info from our Crypto Specialists so that you just may per chance per chance well per chance per chance create expert, told decisions that straight impact your crypto profits. Subscribe to CoinCentral free e-newsletter now.