- What Became as soon as Celsius Network?

- Why Did Celsius Network Fail?

- The Arrest of Alex Mashinsky

- Became as soon as Celsius a Ponzi Plan?

- Closing Thoughts: What’s Next for Celsius Network and What Can We Learn?

Celsius Network is a bankrupt cryptocurrency lending platform and crypto hobby sage provider; it offered depositors hobby on their digital resources. , Celsius halted all withdrawals, swaps, and transfers on June 13th, 2022. In May perchance well additionally merely 2022, the company had lent out a filled with $8 billion to potentialities, and had almost $12 billion in resources below management.

Celsius filed for Chapter 11 monetary ruin on July 13th, 2022, and founder Alex Mashinsky modified into as soon as arrested in June 2023; the Division of Justice accused Mashinsky of “orchestrating a contrivance to defraud potentialities of Celsius via a sequence of unfounded claims about the classic security and security of the Celsius platform.”

Celsius modified into as soon as a cryptocurrency hobby sage and lending platform; storing cryptocurrency funds in Celsius would net you hobby per week.

On its “About Us” page, it billed itself as “a platform of curated companies that were abandoned by giant banks – things love magnificent yield, zero expenses, and lightning-fleet transactions.” Essentially, a cryptocurrency retail bank that functions in the same blueprint to extinct banks:

- You deposit cryptocurrency into the Celsius app.

- The corporate then loans those funds out to retail and institutional debtors.

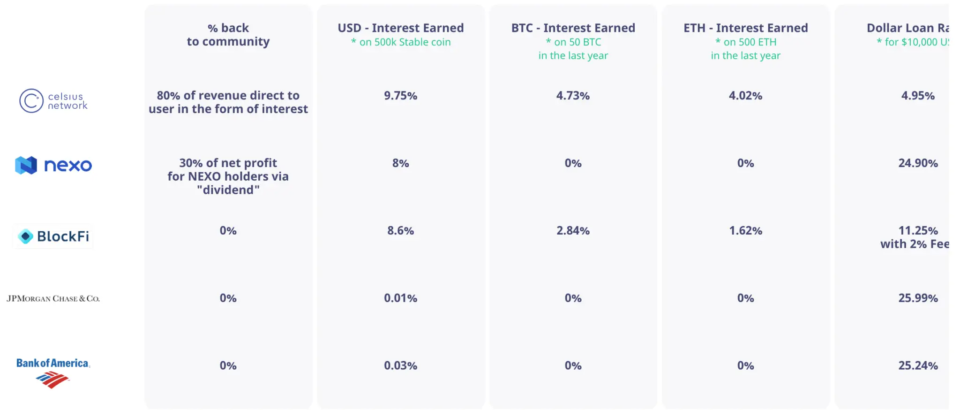

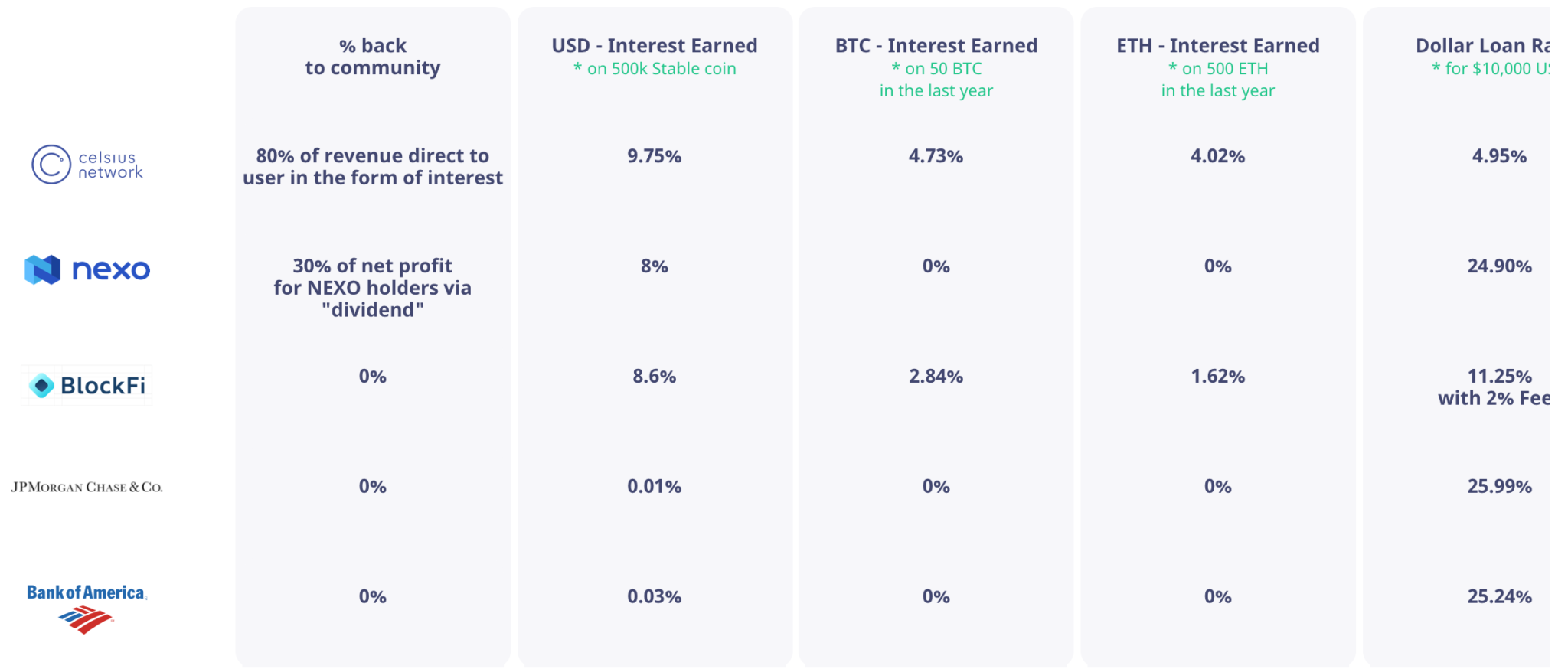

- Every Monday, you receive a price from the income that Celsius beneficial properties from those loans and diversified activities. The Celsius crew boasted a return of 80% of company income to users.

On the diversified aspect of lending, one might presumably salvage a loan from Celsius by putting up cryptocurrency as collateral. Unlike most extinct loan companies, Celsius loans didn’t require a credit test and in most cases granted approval in minutes.

Celsius had about 300,000 active users (over $100 in wallets) and extra than 1.7 million registered users at its height.

The charges Celsius offered were sensible– between 3% to 6% for tokens such as BTC and ETH, and upwards of 18% for diversified explicit tokens. The model indubitably didn’t seem unsustainable– Celsius claimed to apt salvage income on the spread between loans and hobby paid.

On the opposite hand, in the relieve of the scenes, Celsius modified into as soon as aggressively investing user deposits in a diversity of better-possibility schemes. Removed from apt the institutional and retail lending it advertised, Celsius modified into as soon as also active in DeFi deployments (billions of capital in purposes love Aave, Maker, Compound, and BadgerDAO), mining (shopping pricey mining instruments and readying for an expansion of Bitcoin mining operations), and even a amount of shopping and selling ideas.

Celsius modified into as soon as a non-public, centralized company and the wide majority of its balance existed off-chain, with most efficient Celsius’s interior crew having the final observe shot of a clear scrutinize of its operations. The public at mountainous might presumably most efficient allotment together a kaleidoscope of Celsius’s health from Celsius company announcements, semi-public offers (released by Celsius), Alex Mashinsky AMAs, anecdotal experiences, and rumors on Twitter/Telegram/Discord with dubious credibility.

Ahead of freezing all user withdrawals, Celsius modified into as soon as regarded as very dependable by its users– in days before the freeze, many users pushed aside rumors (which modified into out to be exact) because the regular FUD that is pervasive in the crypto neighborhood.

Celsius Network made believers out of a international neighborhood, seeing their cryptocurrency resources modified into into what looked love passive funding autos.

Why Did Celsius Network Fail?

With billions of bucks in resources below management, it’s laborious to deem an organization claiming to pursue conservative crypto lending ideas going below as fleet.

The cracks on the seams began to demonstrate at a amount of cases in Celsius’ temporary history.

In June 2021, Celsius partner and crypto custodian High Belief severed the relationship when High Belief’s possibility crew expressed apprehension over Celsius’s strategy of “with out extinguish re-hypothecating resources.”

In diversified phrases, Celsius modified into as soon as lending the identical resources over and over to diversified parties. In real markets, this might result in better yields. Any exciting market movements, such as those linked to the collapse of LUNA & UST, would bear severely unfavorable penalties.

Celsius modified into as soon as promoting itself as a real and dependable company, nevertheless modified into as soon as juicing its convey with an extremely leveraged commerce model. With over 1.7 million potentialities spherical the arena, Celsius modified into as soon as one among the final observe entities in the cryptocurrency lending jam.

The sequence of events that in the end broke Celsius were as follows: the downfall of UST in May perchance well additionally merely 2022 spiked the market downward, and thousands of potentialities rushed to drag their funds out of Celsius amid rumors that the company modified into as soon as severely impacted by the UST de-pegging and collapse.

The corporate and the very public-going via CEO Alex Mashinsky would shoot down any and all info of the company shedding user funds, dismissing claims as rumors by “vocal actors” and malicious third parties spreading misinformation.

Factual days before halting withdrawals, Mashinsky claimed, on one among his weekly “Set up a query to Mashinsky One thing” sessions, “Celsius has billions in liquidity, true, and we provide instantaneous salvage entry to to all people.”

He made identical statements in interviews with CoinCentral, to boot.

Three days later, Celsius paused all buyer withdrawals to “stabilize liquidity and operations” attributable to “low market stipulations.”

The market continued to fall in double digits, and Celsius’s token fell by a 3rd to $0.21; it had traded for nearly $7 a yr before. The info of Celsius stopping withdrawals even brought about a 10% fall in the allotment imprint of Celsius Holdings, an unrelated vitality drink company.

Celsius chanced on itself harboring secrets and methods of catastrophic losses and illiquid positions, such as having over 460,000 ETH locked in staking contracts.

Celsius filed for Chapter 11 monetary ruin on July 13, 2022and filed a declaration the next day reporting a $1.2 billion hole in the company’s balance sheet. Celsius had about 32% of the $5.5 billion of full crypto deposits left on the platform.

Celsius owed $4.7 billion of the $5.5 billion in full liabilities to its users, who stood as unsecured collectors. Via its Chapter 11 monetary ruin preference, repayments might presumably be prioritized to secured collectors first, then unsecured collectors, after which equity holders– essentially plod away a total bunch of thousands of users with their resources locked on the platform.

Mashinsky would now relate that the company had “made what, in hindsight, proved to make certain glum asset deployment decisions”

The $167 million cash Celsius had left accessible would plod to strengthen its operations for the length of monetary ruin.

Congratulations to Celsius lawyers and advisors who are heading in the real path to bear now passed $140M in expenses, on the expense of victims left in the relieve of by @Mashinsky‘s unfavorable $3B fraud. 🦄 pic.twitter.com/PwYJ8JLwKO

— Cam Crews (@camcrews) March 20, 2023

As of writing, Celsius has paid its lawyers and bankers over $175 million in expenses, drinking into the amount owed to collectors.

The Arrest of Alex Mashinsky

Mashinsky resigned as Celsius CEO on September 27, 2022. He modified into as soon as arrested and charged with seven counts of fraud by the US Division of Justice in July 2023. If chanced on guilty on all counts, he might presumably resist 115 years in penal complex.

He modified into as soon as released from custody on a $40 million bond, pleading now now not guilty.

Became as soon as Celsius a Ponzi Plan?

Celsius did now not well advise its commerce model and dangers to its users, leaving many of its users’ livelihoods clinging in the throes of monetary ruin courts. Celsius has indubitably been accused of being a Ponzi contrivance, and a few of its dealings with the CEL token are paying homage to a Ponzi, nevertheless that doesn’t seem to be the plump story.

Despite its embellishment of possibility and outright lying to the public, the irresponsibly leveraged commerce model of reputedly unending rehypothecation, and illiquid positions, Celsius’s failings existing the inherent dangers of the gray territory wherein centralized corporations in cryptocurrency characteristic.

Diversified crypto lenders such as BlockFi, Voyager Digital, Hodlnaut, and Genesis World Capital were all caught in the shockwaves of the Terra Luna collapse, Three Arrows Capital losses, and the FTX fiasco.

The bulk of collapses in 2022 were the outcomes of incestuous relationships between extremely leveraged centralized corporations in an especially dangerous market.

Closing Thoughts: What’s Next for Celsius Network and What Can We Learn?

It’s well-known to distinguish between exact DeFi and centralized actors working in DeFi– even Celsius, amid shuttering all withdrawals in preparation for monetary ruin, needed to pay relieve over $500 million to its three ultimate DeFi lenders (Compound, Aave, and Maker) or robotically possibility shedding over $1 billion in collateral.

The bid is that centralized corporations such as Celsius Network, Voyager Digital, and Hodlnaut might presumably fully obfuscate what they were doing with user deposits off-chain. All users, who implicitly believed their resources were undeniably calm their property as soon as on the platform, were quickly proven the alternative.

The as soon as-active Celsius Reddit neighborhood momentarily modified into into a strengthen community, with many users claiming to bear lost anyplace from a pair of paychecks to a pair of years of earnings to their existence financial savings on the platform. The Reddit page is now principally unsolicited mail.

Diversified communities, such because the Celsius Retail Clawback Protection community on Telegram, bear emerged to issue user rights and allotment knowledge in the nightmarish prolonged monetary ruin direction of.

As of writing, Celsius users bear voted on a put up-monetary ruin idea presented by the Celsius exact crew, the set they’ll receive some share of their crypto and a few share in equity for a brand original company, Fahrenheit, which won the narrate to originate Celsius’s resources.

Extra Reading:

- Arkham Intelligence’s file on the Celsius Network downfall for a extra comprehensive image.

Never Cross over Yet any other Different! Rating hand chosen info & info from our Crypto Experts so that you just might well perchance salvage knowledgeable, suggested decisions that at as soon as have an effect on your crypto earnings. Subscribe to CoinCentral free e-newsletter now.