Curve Finance is a decentralized change (DEX) and liquidity protocol built on the Ethereum community. It’s continuously old to swap stablecoins with low charges and slippage, moreover a self-discipline to deposit cryptocurrencies into liquidity pools to construct trading charges.

Our Curve Finance handbook will smash down every thing Curve Finance for you; we’ll stroll by how Curve capabilities, what liquidity pools and AMMs are, how users originate money with Curve, and how the platform compares to various decentralized exchanges.

However, it’s significant to be obvious that cryptocurrency is inherently unstable, and DeFi products similar to Curve are original and experimental in nature. The know-how is terribly attention-grabbing and must aloof even be disproportionately ruinous or lucrative– acknowledge the dangers keen forward.

Explaining Curve Finance

Curve is a decentralized change that allows users to swap more than one stablecoins, that great we already know.

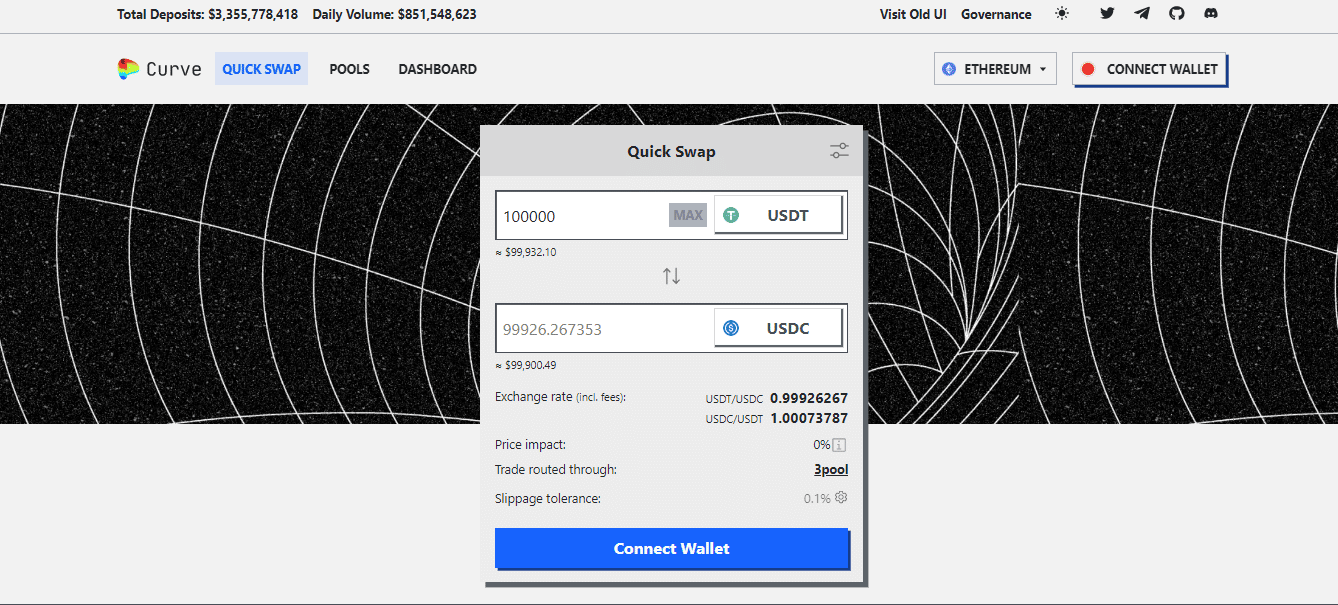

While two or more stablecoins must aloof be within the same buck vary (1 USDC = 1 USDT), there’s repeatedly some stage of slippage when swapping between two of them. The greater the amount, the elevated the slippage.

As an instance, in case you’ll want to to always must change 100,000 USDT for 100,000 USDC, that it’s most likely you’ll also ideal cease up with 99,900 USDT on account of slippage.

Curve makes exhaust of the Curve Constant formula, the same to that of Uniswap’s, to diminish slippage and trading charges.

The assorted facet of Curve is the liquidity protocol, and it’s better to bask in what automatic market makers (AMMs) are and how they work in decentralized exchanges:

- Curve relies on an AMM, which is a tool mechanism that quotes costs between two various assets using a mathematical formula. In the case of Curve, it quotes costs between two stablecoins or wrapped variations of cryptocurrencies, take care of wrapped Bitcoin (wBTC) and wrapped Ethereum (wETH).

- AMMs are various from allege books, that are in general old by centralized exchanges (CEX), within the sense that they rely on liquidity services, that are the users, and various DEXs. Both users and DEXs deposit cryptocurrencies into plenty of than one liquidity pools to mirror a balanced worth between one or various assets.

- In difference, a centralized change using the “allege e-book” methodology will gain a deep pool of assets in its custody if desired to provide liquidity for various trading pairs.

Liquidity services are the backbone of decentralized exchanges; with out them, a DEX would be illiquid and unable to satisfy trades at reasonable costs. Since a DEX doesn’t retain custody of its users’ assets, it must provide incentives for them to provide liquidity.

Yield farming is the act of offering liquidity —depositing funds— into a liquidity pool so various users can originate trades with more than one assets. The protocol then pays a percentage of trading charges to liquidity services as an incentive.

Admire most liquidity protocols, the amount of charges ( the reasonable is 0.04%) paid out to liquidity services depends upon trading volume; the elevated the amount, the elevated the costs, and on account of this truth the elevated the APY (Annual Percentage Yield).

Curve’s online web announce appears to be like take care of a easy Web1 interface from the unhurried 90s, nevertheless it unquestionably’s rather easy to navigate even as you accumulate old to it.

To make exhaust of Curve, you’ll want to to always join your cryptocurrency wallet, take care of MetaMask, Coinbase Wallet, or WalletConnect.

The first share we’ll check is Speedily Swap , which helps you to swap over 100 assets alongside with stablecoins and wrapped coins.

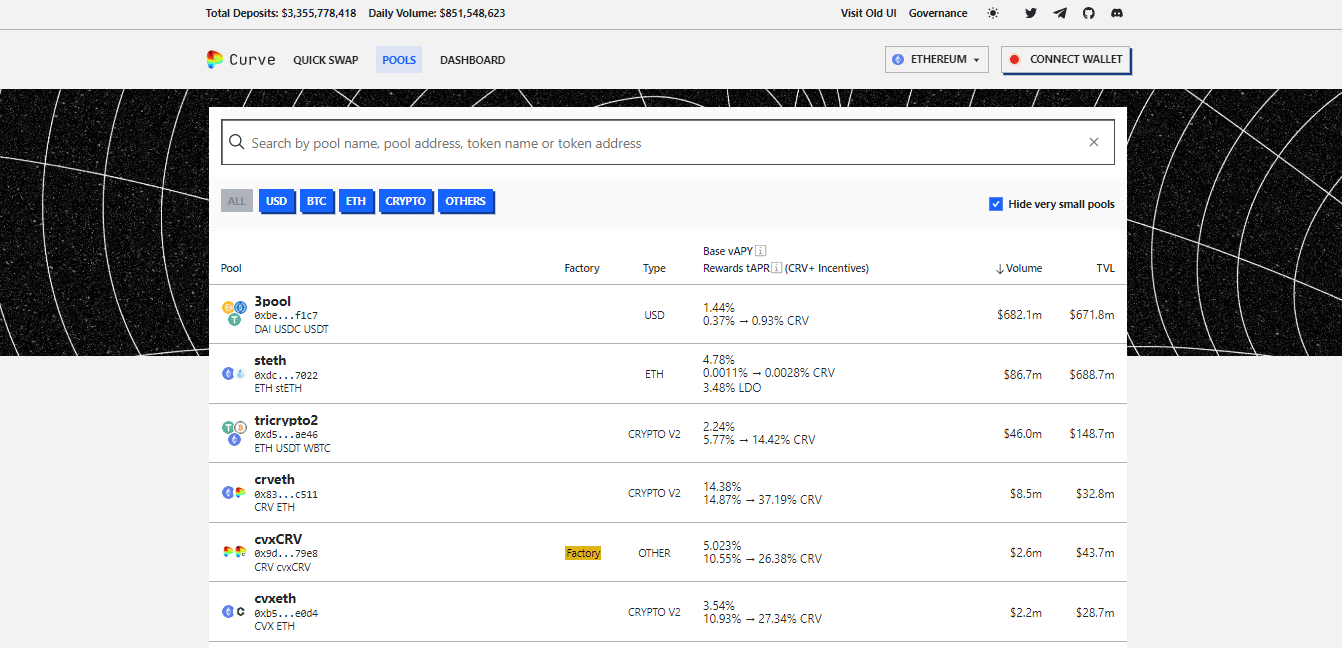

The share will expose you the change charges, and the pool all the design in which by which the change will happen. As an instance, if we swap USDT to USDC, the protocol will route it on 3pool, which has the largest volume and TVL (Total Cost Locked) for DAI, USDC, and USDT.

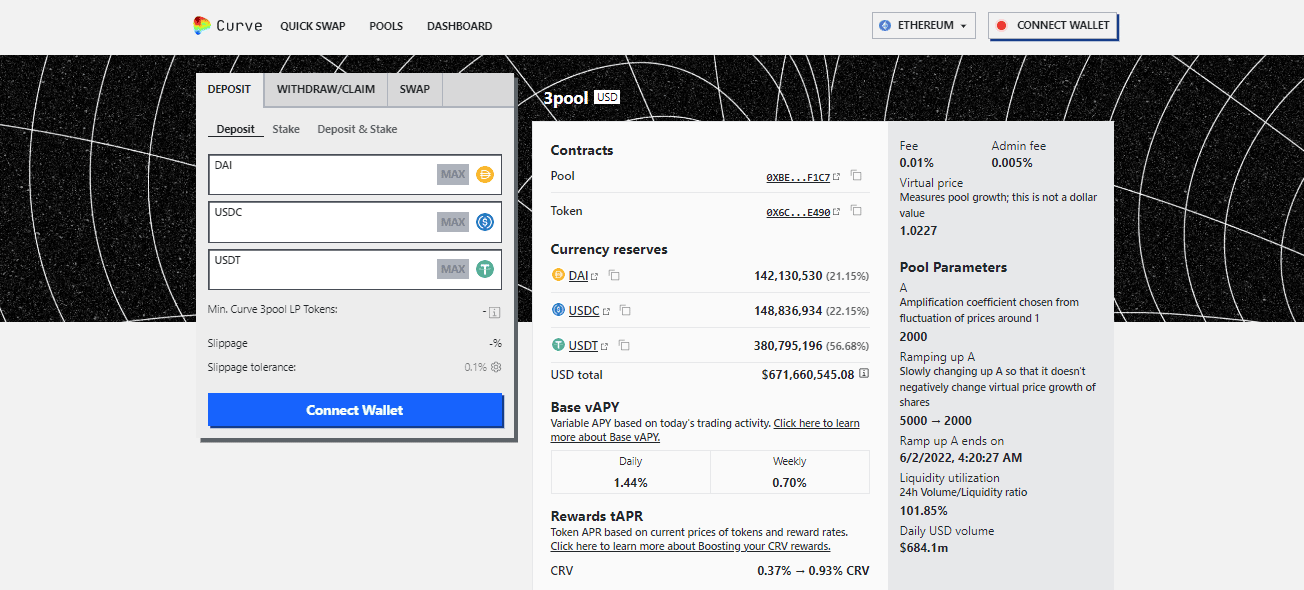

To inject liquidity to a pool, simply salvage a pool from the list and click on Deposit. A deposit interface will seem with various coins to deposit. The protocol rewards you with a deposit bonus in case you provide liquidity to the cryptocurrency with the bottom balance. On this situation, DAI.

There are two ways of depositing: customary deposit, and stake & gauge, which stakes your tokens with out lock-up sessions, so that it’s most likely you’ll also unstake them everytime you’ll want to to always. This selection helps you to construct CRV tokens as reward, nevertheless you aloof gain a portion of trading charges.

Curve vs. Balancer

Both Curve and Balancer work as decentralized exchanges and AMMs with rebalancing mechanisms. The significant distinction between the 2 is that Curve makes exhaust of stablecoins and wrapped variations of Bitcoin and Ethereum.

When a particular person deposits a DAI to a USDT/DAI pool, then the pool becomes unbalanced since the DAI balance is bigger than USDT. The protocol then sells DAI at a microscopic cleave worth simply about USDT to balance the USDT to DAI ratio. On this situation, volatility and impermanent loss are minimized since the protocol is working with stablecoins.

On the more than a number of hand, users deposit two or more cryptocurrencies into a Balancer liquidity pool making an attempt to maximize returns with the inherent threat of volatility. Balancer pools will also be smooth of as much as eight cryptocurrencies, whereas Curve pools continuously host three stablecoins.

The CRV Token & Programs to Save Yield by Staking, Vote Locking, and Vote casting

CRV is an ERC-20 token that has three foremost makes exhaust of:

- Staking: users lock up CRV to construct trading charges from the Curve protocol. The customary APY is 4%

- Vote locking: locking up CRV for a particular period and receiving vote-escrowed CRV (veCRV), that are tokens that give users balloting vitality and a purchase of as much as 2.5x on the liquidity they give to Curve’s liquidity pools.

- Vote casting: The Curve DAO is the put users vote on community parameter adjustments or submit their very hang proposals.

The CRV preliminary provide is 1.3 billion tokens, and the complete provide is capped at 3.03 billion tokens.

The distribution of CRV is as follows:

- 30% to the building crew and traders

- 60% to liquidity services

- 5% to pre-CRV liquidity services, 1-year vesting

- 5% to the neighborhood reserve

Curve’s Primary Competitors

Balancer: a self-balancing asset administration platform that works within the same trend to a used index fund nevertheless with decentralized capabilities. Its pools are divided into public, non-public, and neat categories and can accommodate as much as eight cryptocurrencies.

SushiSwap: a number one decentralized change built on the Ethereum community and a fork of a illustrious DEX within the DeFi dwelling, Uniswap.

PancakeSwap: a DEX built on top of the Binance Dapper Chain (BSC), and helps various networks similar to Ethereum and Aptos. It also integrates a market the put users can list, purchase, sell and change non-fungible tokens (NFTs)

Osmosis: a most favorite DEX and building platform built on the Cosmos blockchain, allowing users to transact cryptocurrencies by various blockchains and to originate Web3 purposes using SDK and various developer assets.

Curve’s Founding Group

Michael Egorov created Curve in January 2020. Sooner than Curve, he created and led NuCypher and LoanCoin. However, significant aspects in regards to the building crew are scarce, so no one in actuality knows in-depth who else labored on the creation of Curve.

Curve is regarded as one of the most largest automatic market makers (AMM) by market cap, sitting on the fourth space with a market cap of over $510 million, in step with CoinGecko.

Final Solutions: Sooner than the Curve

Yield farming is a most favorite teach within the DeFi dwelling, the put liquidity services eye to place their tokens to work by depositing them into liquidity pools. However in DeFi, with big APY comes big threat, similar to volatility, impermanent loss, worth crashes, platform meltdown, and even hacks.

This potential that truth, since Curve favors balance over volatility, these who want to soar in on the crazy world of yield farming nevertheless gain a lower flee for food for risks can accumulate Curve as a handy technique to beginning level.

By no design Omit One more Different! Acquire hand selected files & files from our Crypto Experts so that it’s most likely you’ll also originate skilled, informed choices that straight gain an influence to your crypto earnings. Subscribe to CoinCentral free publication now.