Polygon (previously acknowledged as Matic Community) is a layer two (L2) scaling solution for Ethereum-properly matched blockchain networks that enables rapid, cheap, and get off-chain transactions for funds and current interactions with off-chain tidy contracts.

Polygon became to birth with launched in 2017 below the name of Matic Community with the motive of rising a protocol and a framework for building and connecting Ethereum-properly matched blockchains utilizing a bunch of technical choices.

Polygon’s present flagship product is the Matic PoS Chain, an EVM-properly matched sidechain secured by a permissionless place of PoS validators with a theoretical throughput capability of 65,000 transactions/2d on a single Matic sidechain.

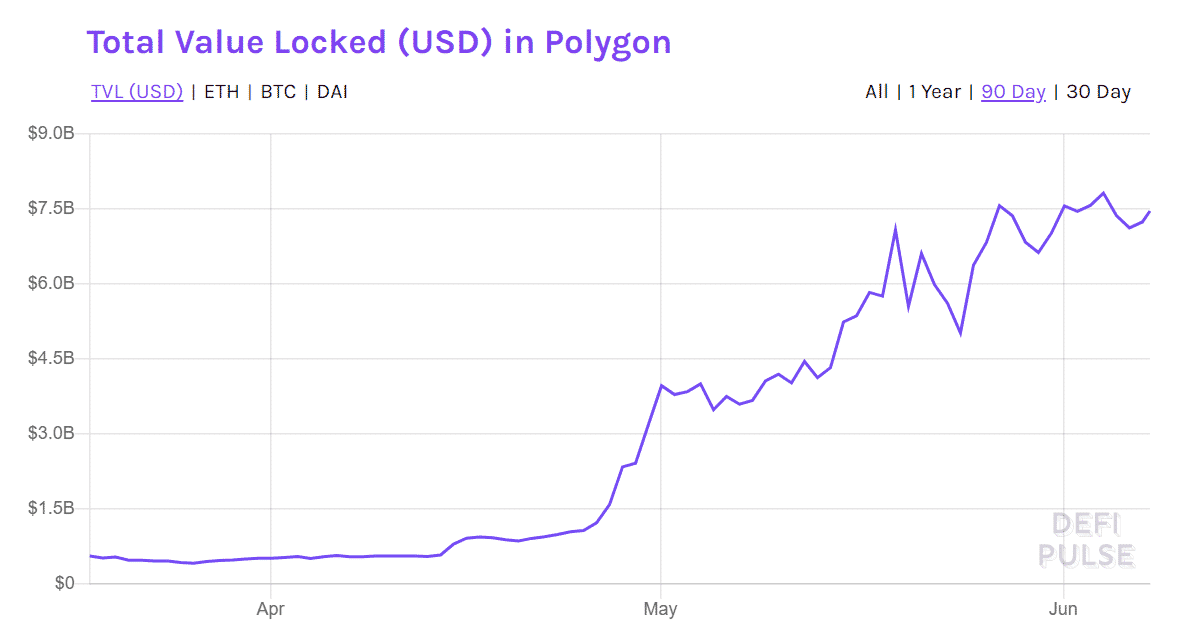

Price locked on Polygon, courtesy of DeFi Pulse

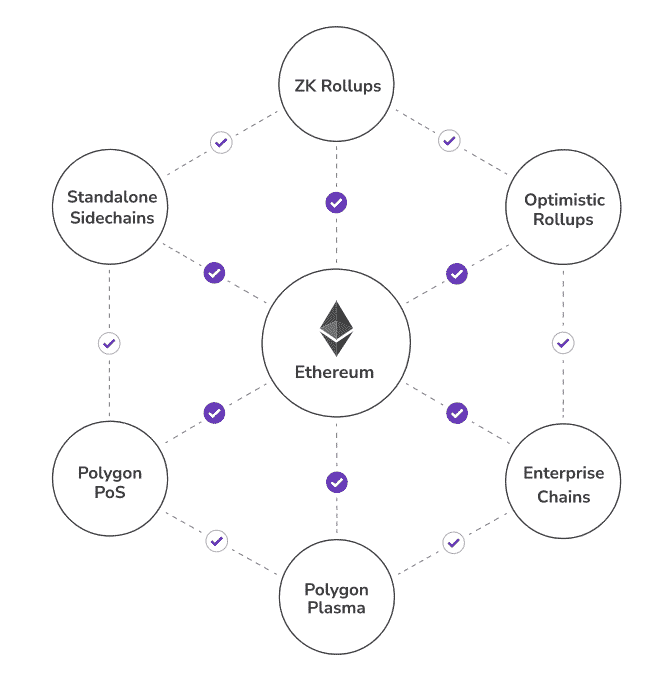

Price locked on Polygon, courtesy of DeFi PulsePolygon moreover constructed a modular and extensible framework for building Ethereum-properly matched blockchain networks, written in Golang, known as Polygon SDK, and is additional engaged on two extra L2 scaling choices, zk-Rollups and Optimistic rollups, per zero-records and fraud proofs respectively.

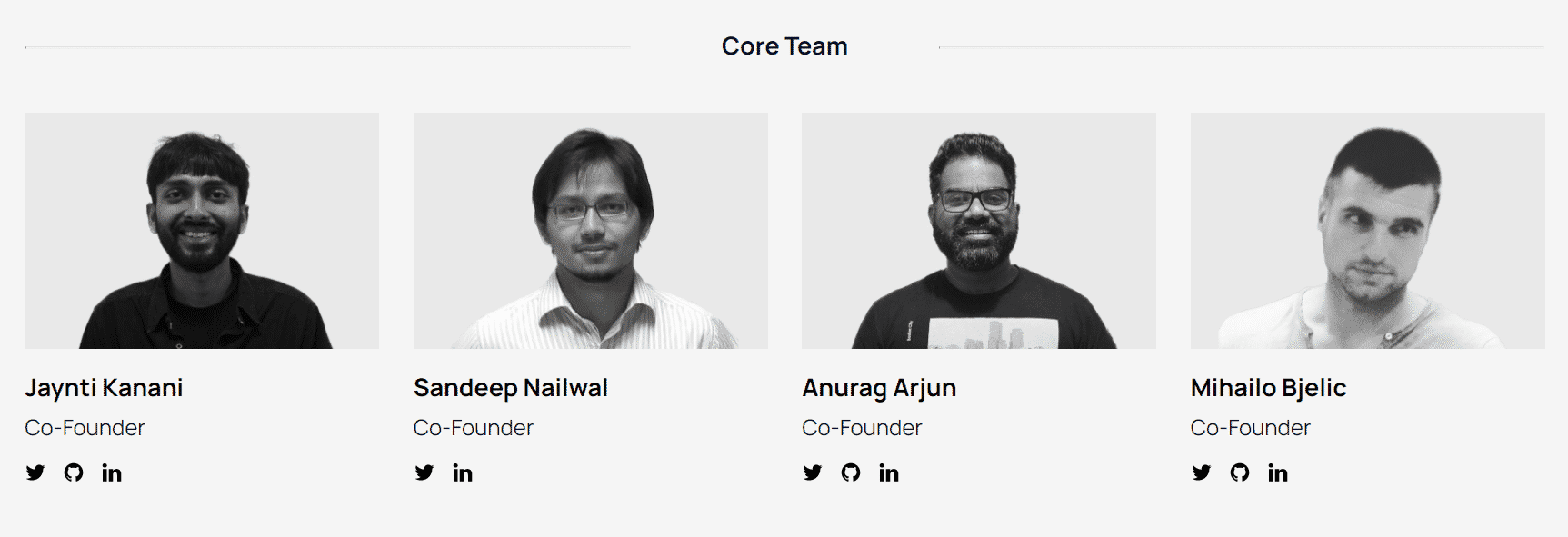

Who is Constructing Polygon?

The Polygon crew has thirteen workers, with four technical co-founders, six extra developers, a product supervisor, and two marketing and marketing experts. The core crew is moreover supported by a community of legit advisors, in conjunction with Hudson Jameson from the Ethereum Foundation, Ryan Sean Adams from Bankless, Anthony Sassano from EthHub & SetProtocol, Pete Kim from Coinbase, and John Lilic – ex ConsenSys.

The core co-founding and fashion crew consists of CEO Jaynti Kanani, COO Sandeep Nailwal, CPO Anurag Arjun, and VP of engineering Mihailo Bjelic.

Jaynti Kanani is a plump-stack developer and blockchain engineer who’s previously contributed to many notable projects, in conjunction with Web3, Plasma, and WalletConnect.

Sandeep Nailwal is a blockchain programmer, entrepreneur, and co-founder & CEO at ScopeWeaver, a agency that affords blockchain products and consulting products and companies.

Anurag Arjun is a product/challenge supervisor who previously labored for AVP, IRIS Industry, Cognizant Applied sciences, and SNL Financial.

Mihailo Bjelic joined the Matic crew as a co-founder and VP of engineering only now not too long ago, when the challenge rebranded to Polygon. Previous to becoming a member of Polygon, Bjelic labored on identical blockchain scaling choices as Matic.

What Field is Polygon (MATIC) Fixing?

Polygon is addressing Ethereum’s prime barriers: scaling or transaction throughput and black user expertise.

Somewhat than providing minute scaling choices cherish its predecessor Matic—which utilized a technology acknowledged as Plasma that enables for the introduction of customizable ‘baby’ blockchains to direction of transactions off-chain earlier than finalizing them on the essential Ethereum chain—Polygon is designed to be a entire protocol and framework for launching interoperable blockchains.

Scaling is Ethereum’s oldest and most hindering teach. Ethereum’s present transaction throughput capabilities are grossly insufficient to meet the rising requires of the community. DeFi is blowing up rapid, and with most of it being constructed on Ethereum, the protocol needs to scale the day gone by for the reason that present transaction prices are pricing out a huge majority of the customers.

In phrases of scaling, blockchains can typically procure two different paths:

- Scale the mainchain or the so-known as layer one of the protocol, where projects are typically compelled tо pick between different substitute-offs and assemble definite sacrifices in either decentralization, scalability, or security (aka the blockchain trilemma)

- Or, employ facet chains that operate on prime of the mainchain (layer two) to offload a few of the work and resulting from this truth ease the congestion on the essential chain.

In this regard, Ethereum’s plot is to procure both directions simultaneously — i.e., scale on layer one by enforcing sharding and transitioning to a proof-of-stake consensus mechanism (Ethereum 2.0), and moreover employ sidechain choices cherish the one Polygon is building to scale even more and sooner.

Thanks to the Matic sidechain, the Ethereum community can scale vastly and abolish it effectively without making any sacrifices when it involves decentralization. Sidechains provide cheap and practically instantaneous transactions which will most likely be in the end settled in batches on the mainchain, which manner that they leverage the sturdy security of the mainchain without making any compromises when it involves performance.

How Does Polygon (MATIC) Work?

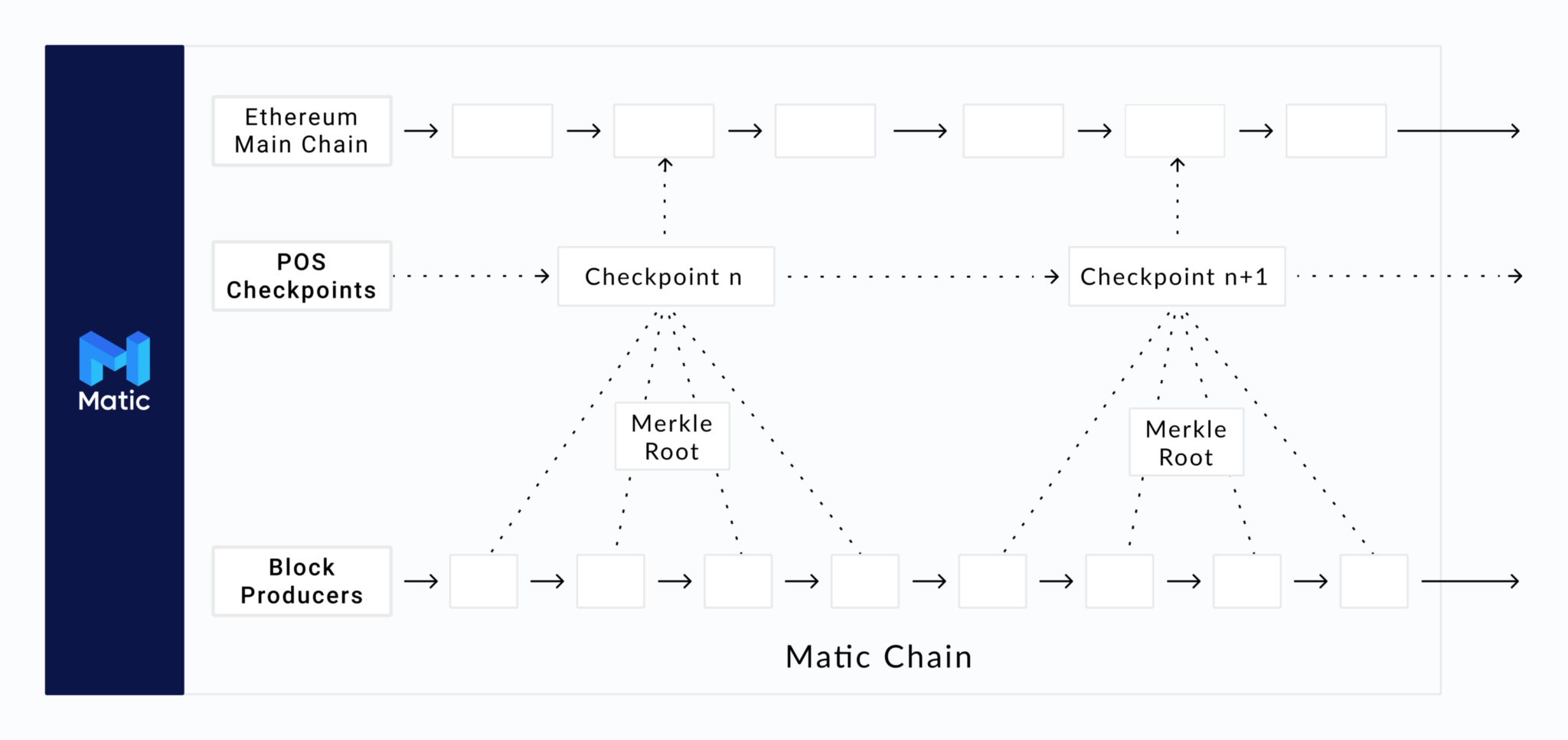

Polygon’s so-known as Matic Sidechain works cherish all other PoS-based blockchain, with its hang infrastructure, token, user nodes, validator nodes, native dapps, and tons others, other than the transactions are in the end batched and settled on the Ethereum mainchain (identical to how Bitcoin’s L2 scaling solution known as Lightning Community works.)

You might maybe be in a position to command the Matic sidechain as its hang petite interoperable ecosystem — piece of the broader universe of Ethereum — providing customers superior performance and user expertise. Every decentralized utility constructed on Ethereum or any other Ethereum-properly matched blockchain is vulnerable to be ported to the Matic Sidechain and operate there in a much more performance-optimized setting.

Customers who want to work alongside with decentralized choices which own migrated to the Matic Sidechain want to:

- Approve the so-known as Predicate Contract deployed on the Ethereum community, which locks the tokens to be deployed on the Matic Sidechain,

- Once the Predicate Contract has been current; the following step is to deposit the tokens on the Matic Sidechain, which is carried out considerably mechanically. In this direction of, a particular tidy contract known as RootChainManager triggers every other tidy contract known as ChildChainManager that mints the true amount of locked or deposited ERC20/ERC721/ERC1155 tokens on the Matic community.

- Once the user receives their tokens on the Matic Sidechain, they can switch them practically instantaneously and with negligible charges contained in the community. This implies that buying and selling or providing liquidity utilizing a decentralized alternate akin to SushiSwap on Matic will imprint the user cents as an different of $50-200, as is the case with utilizing the same protocol on the Ethereum mainchain.

- Withdrawing the tokens help to Ethereum is a two-step direction of: first, the tokens need to be burnt on the Matic sidechain, and then the proof of this burn transaction has to be submitted to the Ethereum mainchain. Once this direction of is carried out (takes about 20-30 minutes), the RootChainManager tidy contract will mechanically deposit help assets to the user’s handle (pockets) help on the Ethereum mainchain.

Polygon’s $MATIC Token?

The MATIC token (ticker: MATIC) serves a bunch of applications contained in the Polygon ecosystem, in conjunction with paying for transaction charges (identical to how ETH tokens are ancient to pay for gas charges on the Ethereum mainchain), contributing to security through staking, and taking half in the protocol’s decentralized governance by vote casting on Polygon Improvement Proposals (PIPs).

The present circulating present of the MATIC token is 6.3 billion, while the total token present (arduous cap) is 10 billion. Customers can moreover convert the MATIC token to other assets ported on the Matic Sidechain utilizing different token swap or alternate protocols on the community.

Where Can You Accept Polygon’s $MATIC Token?

Polygon is obtainable on in model cryptocurrency exchanges cherish Coinbase Pro, Binance, FTX, and Huobi Global.

Modest Overview of the Polygon Ecosystem

In current, the Polygon ecosystem consists of multiple actors, in conjunction with customers, developers, stakers, and block producers.

Polygon customers can employ the Matic Sidechain to transact and work alongside with varied Ethereum-based decentralized choices, excellent cherish they’d abolish on Ethereum or any other blockchain, other than Matic is a ways more cost effective and sooner.

On the different hand, the developers are expected to employ the Polygon Community and the Polygon SDK stack to assemble their very hang sidechains or scale their very hang dapps to compose their customers with a superior user expertise.

The stakers on Polygon effectively play the same feature as PoW miners on Ethereum. They want to stake (lock) MATIC tokens to participate in validating and verifying transactions on the Matic Sidechain. Furthermore, utilizing their staked tokens as vote casting energy, they can elect so-known as block producers (stakers that satisfy insist standards) to compose the blocks on the sidechain.

Block producers are chosen by the stakers to compose the blocks and in the end pick all transactions on the community. They want to stake a essential sum of MATIC tokens in give away to qualify and be elected.

Typically, the option of block producers shall be comparatively low because having fewer consensus creators permits for increased throughput and a ways sooner transaction settlements. For example, the typical block time on the Ethereum mainchain is ~20 seconds, while the Matic Sidechain mines or creates and settles a brand novel block each 2d.

Final Tips: Will Polygon “Fix” Ethereum?

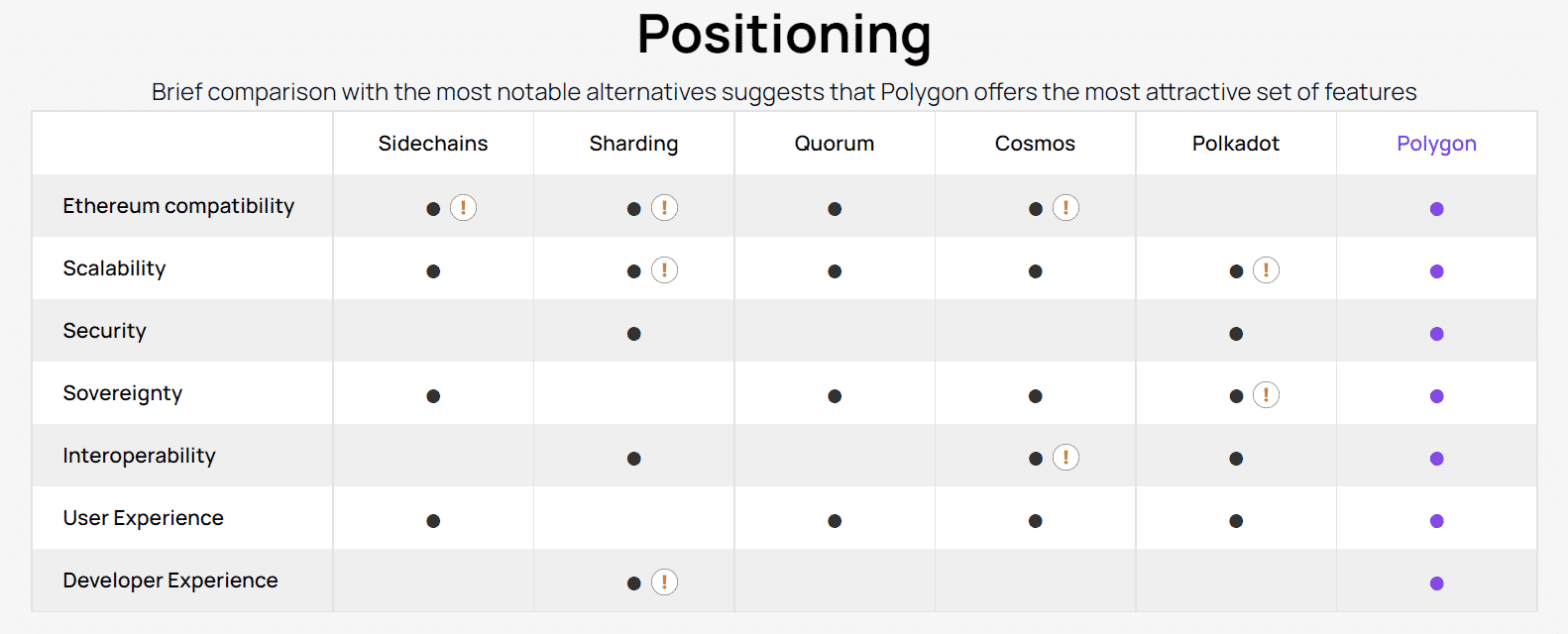

Presumably the paramount facet of Polygon’s value proposition is that it’s miles one among the easiest layer-two scaling choices constructed on Ethereum that has experienced lifelike to mass adoption.

Polygon helps to vastly enhance Ethereum’s transaction throughput and solve the high gas rate teach, however it moreover plays a essential feature in improving the broader teach of blockchain interoperability.