Solana is a permissionless and ravishing contract-capable blockchain platform designed with the blueprint of optimum efficiency, high transaction throughput, and mercurial transaction stride; powered by its native taken SOL, Solana rivals layer-1s much like Ethereum (ETH) and Avalanche (AVAX).

On this Solana fundamentals manual, you’ll discover how the protocol works by reviewing its predominant formulation and other indispensable parts, much like the most effective DApps on the ecosystem, tokenomics, and the scheme it compares to Ethereum.

What’s Solana?

Solana is a layer-1 blockchain, which approach it’s miles the contaminated layer infrastructure, versus layer-2s and sidechains, that are parallel chains linked to layer-1.

Solana uses two consensus algorithms: Proof-of-Stake and Proof-of-History.

Proof of History (PoH) is Solana’s spine—it timestamps all transactions on the blockchain to point out they took remark at a given time. It’s truly a cryptographic clock that confirms those transactions in sequential say. PoH maintains the safety of the Solana community by proving the legitimacy of all transactions taking remark in actual time.

In Proof-of-Stake (PoS), community contributors must stake a obvious amount of SOL tokens to change into validators and test transactions. The PoS algorithm brings a community of validators to confirm the timestamps and make sure the transactions.

The perfect approach to Stake Solana (SOL): Change into a Solana Validator

Users who’re seeking to bustle a validator node must meet the computational requirements (CPU with 12 cores, 2.8GHz, and RAM 128GM, for instance) and stake SOL. There isn’t a minimal amount of SOL to change into a validator, however taking fragment in consensus requires a “Vote Story,” which has a rent-exempt reserve of approximately 0.026 SOL.

Validators must vote on every block they salvage; the vote casting charge is 1.1 SOL per day. This approach a validator must stake ample SOL to fetch earnings and no longer drain their wallets on vote casting charges. The different possibility is to plot ample users to stake for your validator node.

Users can stake SOL to manufacture rewards and support score the community, which is ready to be allotted to one or a couple of validators.

Solana staking rewards depend on:

- The preliminary inflation rate, which is 8%. This pick is diminished by 15% yearly till it reaches a mounted rate of 1.5% yearly.

- The complete number of staked SOL.

- Validators’ uptime and commissions.

Solana: History & Founder

Anatoly Yakovenko, a former engineer at multinational Qualcomm, based Solana in 2017, publishing the whitepaper the identical one year. His blueprint used to be to create an infrastructure that could presumably presumably overtake proof-of-work and proof-stake networks.

Greg Fitzgerald and Eric Williams joined Yakovenko in developing the Solana testnet and growing Solana Labs, headquartered in San Francisco, California. Yakovenko launched the creation of the Solana Foundation in 2020, a Swiss nonprofit that helps and promotes Solana’s increase.

The SOL Token: Tokenomics and The effect to Spend

SOL is Solana’s utility token historical to pay charges for running ravishing contracts on transactions on the community. The different exercise case is staking and vote casting on authorities proposals.

Own of it as Ethereum’s ETH.

SOL’s complete supply is capped at 511,616,946 tokens. As of September 1st, 2022, there are 349,510,121 SOL tokens in circulation, roughly 66.2%. The distribution segment started in 2019 through an Initial Coin Offering, divided into 5 funding rounds, of which four had been inside most gross sales.

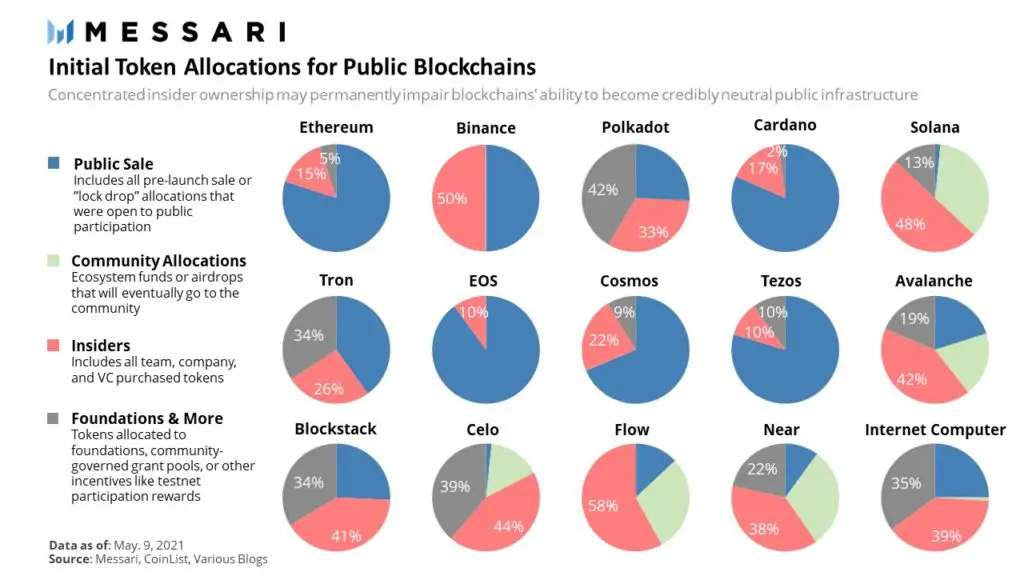

The preliminary distribution is as follows:

- 38% to the Neighborhood Reserve Fund (managed by the Solana Foundation)

- 15.86% to Seed Round traders

- 12.5% to the Solana Foundation

- 12.5% to crew contributors

- 5.07% to Validator Sale traders

- 1.84% to Strategic Sale traders

- 1.6% to Public Public sale Sale traders.

SOL’s highest value used to be $258.93 on November sixth, 2021. SOL is a regular crypto, so chances are high you’ll get it listed on most cryptocurrency exchanges, including Binance, Kraken, Coinbase, and so forth.

Solana’s Biggest Patrons

Solana is backed by somewhat a very good deal of crypto VC companies and digital assets institutions worldwide, including Alameda Analysis, CMS Holdings, BlockTower Capital, and Andreessen Horowitz (a16z).

Solana has raised a full of $335.8 million in 9 rounds from on the least 37 traders. The final spherical took remark on August 19th, 2021. Solana Ventures is the blockchain’s investment arm and has invested in on the least 16 projects across GameFi, NFTs, and DeFi.

Solana Vs. Ethereum: How Map They Differ?

Every blockchain has its advantages and downsides. All of it comes correct down to what fits easiest for you or your project. Ethereum transiotioned from PoW to PoS in September. Since both blockchains are technically running on the PoS algorithm, all of it boils correct down to their a couple of designs and the scheme they implement security, so right here’s a short rundown on both:

Solana’s Scalability and Transaction Jog

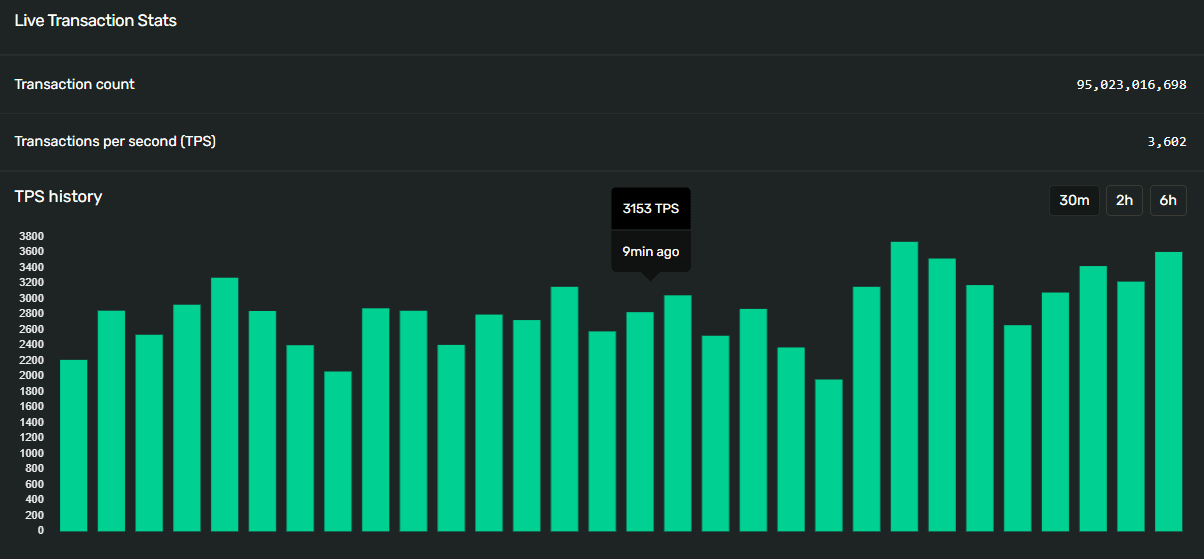

Metrics show Solana can process spherical 3,500 to 4,000 transactions/2nd, whereas Ethereum can deal with 10 to 15 TPS. Solana claims the community can attain many of of hundreds of TPS, however this claim has never been proved.

Solana’s Different of DApps

Whereas it experienced gargantuan increase throughout time, Solana nowhere edges the amount of work that Ethereum deals with day to day. The number of decentralized applications (DApps) on Solana is challenging to note as more projects are being constructed day to day, however DappRadar estimates more than 350 projects.

Likely the most end DApps on Solana are:

- Magic Eden: the most effective NFTs marketplace within the Solana ecosystem.

- Solend: Solana’s main decentralized lending protocol the effect users can leverage long and short, borrow, and manufacture passion on their crypto funds.

- Saber: a decentralized swap (DEX) providing inferior-chain interoperability between Ethereum, Binance Neat Chain (BSC), Polygon, and more.

On the different hand, Ethereum hosts roughly 2,500 to 3000 DApps, including Polygon PoS Bridge, Uniswap V3, Curve, Compound, and Arbitrum. These projects arise Ethereum’s over $50 billion in Total Cost Locked (TVL), whereas Solana has $1.40 billion, as per info from DeFi Llama, making it the fourth most sharp ecosystem.

Safety Aspects

Whether one blockchain plan is more score than but every other is continuously arguable. Neither Solana nor Ethereum has the right infrastructure, so it’s greater to stability the pros and cons of every platform.

On the one hand, Ethereum is older than Solana — launched in mid-2015— so it has undergone more audits and security overview. Ensuing from this fact its flaws and vulnerabilities are greater identified to the public. Proof of Work blockchains are device to be less inclined to attacks than PoS protocols however hang decrease throughput and are highly energy titillating.

Solana used to be launched in 2020, coming into the swap with a rather more complex architecture than Ethereum. The protocol champions stride and throughput. Nevertheless it also has a small income over classical PoS techniques since it uses a combination of PoS and its mechanism, PoH, which orders transactions looking out on the execution time as an different of transaction charges, conserving the community from entrance-running attacks.

Closing Tips: Solana and the Centralization Dilemma

Solana emerged within the early 2020s as the different possibility for users hunting for a scalable and value-environment friendly blockchain. It has established itself as one of many end networks for original users and blockchain builders.

Solana is within the “Ethereum killers” membership; layer-1 protocols offer the same aspects to Ethereum however hang improved traits.

Nevertheless —cherish every other protocol— obvious parts of it hang drawn criticism. Critics basically spotlight Solana’s centralized ecosystem. Half of of SOL tokens are owned by VC companies and insiders, and roughly 20 of over 1,100 validators on Solana management over 35% of the overall stake.

Nevertheless, issues are taking a sharp flip for Solana. The post-merge occasion has raised criticisms for Ethereum since more than 40% of community blocks had been added by two entities: Coinbase and Lido.

high 7 entities controlling >2/3 of the stake is gorgeous disappointing to seem tbh pic.twitter.com/VBipyFUM7g

— Martin Köppelmann 🇺🇦 (@koeppelmann) September 15, 2022

Typically Requested Questions

How many transactions can Solana abet per 2nd?: Solana offers 3,500 to 4,000 transactions per 2nd and could presumably presumably theoretically scale to 65,000 TPS.

Has Solana been hacked earlier than?: Solana’s core code hasn’t been attacked since the protocol launched, however cherish most ecosystems, a couple of projects inside Solana hang been victims of exploits, hacks, and other attacks. In early August, hackers drained over $5 million out of Solana wallets, which used to be attributed to a inside most key exploit tied to cell hot wallet Slope. In February, Wormhole, Solana’s most sharp inferior-chain bridge, suffered a gargantuan-scale assault, shedding $320 million.

How famous are transaction charges on Solana?: Solana’s contaminated transaction charge is $0,00025.

Does Solana Enhance NFTs?: Solana is home to somewhat a very good deal of NFT projects and marketplaces, Magic Eden being the most traditional for procuring and selling NFTs.

By no approach Omit One other Different! Rating hand chosen news & info from our Crypto Consultants so that it’s doubtless you’ll presumably presumably presumably fetch educated, urged decisions that without lengthen hang an affect for your crypto earnings. Subscribe to CoinCentral free e-newsletter now.