- What’s the Bitcoin Halving?

- Why is the Bitcoin Halving Significant?

- How Many Bitcoin Halvings are there?

- How many bitcoins are there?

- When is the Subsequent Bitcoin Halving in 2024?

- Why Halve Bitcoin?

- Bitcoin Scarcity: A Composed Balance

- How Will the Halving Have an note on Bitcoin’s Label?

- Closing Thoughts: Will Bitcoin’s Label High-tail Up After the Halving?

The Bitcoin Halvening (or halving) is a big moment in Bitcoin’s history; this pre-programmed match protects Bitcoin from inflation and helps build obvious a level of scarcity for the digital asset.

Earlier than we ranking into the thick of the Bitcoin Halvening discussion, let’s clutch two minutes to drag over some lickety-split Halvening questions. Then, we can ranking into the juicy stuff.

The Bitcoin Halving is an match pre-optimistic by Bitcoin’s programming the establish mining rewards are carve in half. In most cases, the amount of BTC miners can fabricate as a reward for validating the subsequent Bitcoin block is carve in half.

Within the 2020 halvening, the mining subsidy is going to be ruin up from 12.5 BTC to 6.25 BTC.

Why is the Bitcoin Halving Significant?

Bitcoin’s many Halving occasions gaze to present the asset a part of “scarcity” to present protection to its long-term rate. Bitcoin would change into practically as scarce as gold.

This Bitcoin Halving match will cause the asset’s inflation rate to tumble to 1.8%, making it lower than the inflation rate of the U.S. Buck. Here is terribly important in 2020, because the United States has been printing trillions of greenbacks in financial stimulus applications to style out the economical chaos prompted by the COVID pandemic.

“The Halving is a extraordinarily vital match for Bitcoin, however it’s comely one part in the supreme storm that BTC is playing in the intervening time,” comments Alex Mashinsky, CEO of Celsius Network. “Governments around the sector are imposing unprecedented fiscal stimulus, which risks inflicting high inflation across fiat currencies, which boosts Bitcoin’s rate proposition as a deflationary asset. As a end result, many first time retail merchants are flocking to BTC as a manner to present protection to their wealth.”

Every future Halving will build Bitcoin extra scarce. Since we basically note BTC’s rate as a relation to USD, now we enjoy two diametrically adverse forces that recount the next Bitcoin rate.

Halving occasions have a tendency to reach with a flood of trade rate hypothesis, which mostly assumes the Halving match will cause a surge in Bitcoin’s rate.

How Many Bitcoin Halvings are there?

Halvings occur each 210,000 blocks except the block mining subsidy reaches 1 satoshi, the smallest unit of bitcoin (0.00000001 BTC). Once the finest Halving match occurs, the subsequent block subsidy drops to zero, and miners will now not be awarded block mining subsidies but can aloof gain transaction prices.

The finest Bitcoin halving is anticipated to be in 2140. Originate obvious to read our article about it then– don’t neglect!

How many bitcoins are there?

There are about 19,557,337 BTC in circulation ethical now. That’s about 93.13% of the final present.

When is the Subsequent Bitcoin Halving in 2024?

Bitcoin’s next Halving match is anticipated to occur in April 2024.

Bitcoin Halving Dates Historical past

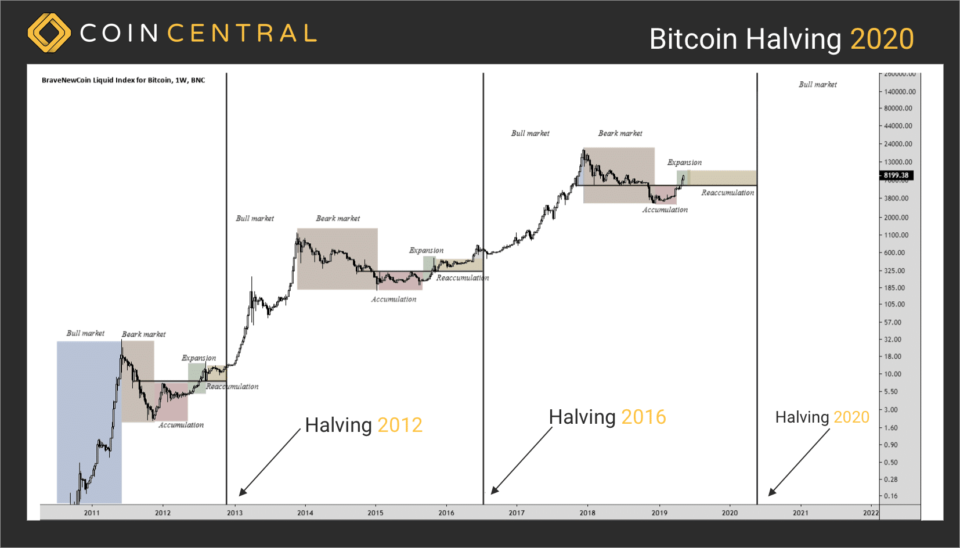

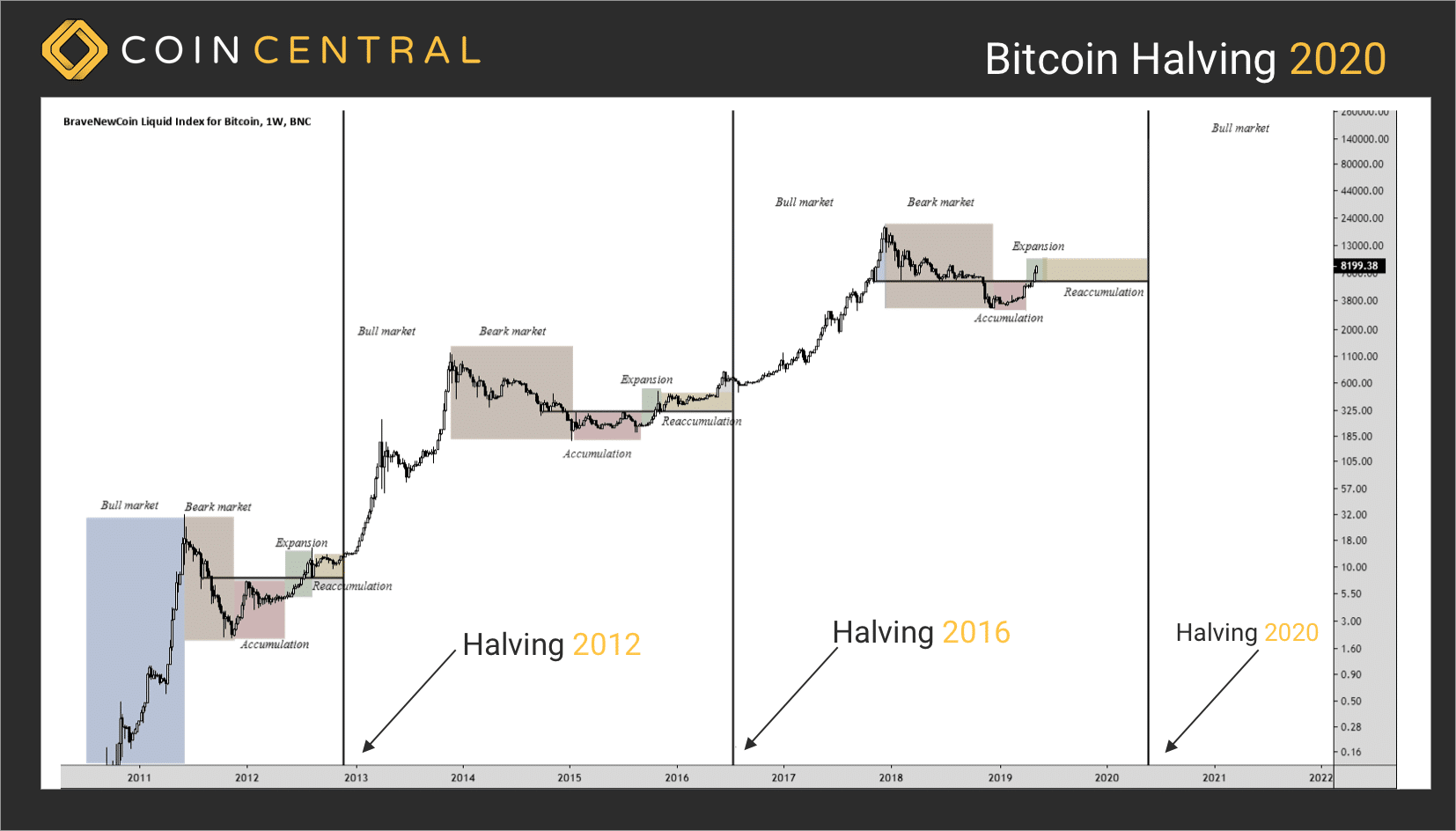

There enjoy been three Bitcoin Halvings– one in 2012, one in 2016, and one in 2020.

2012 Halving

The first Halving came about on November twenty eighth, 2012. The halving block was mined by SlushPool by a miner the utilization of a Radeon HD 5800 miner.

The BTC block reward dropped from 50 BTC per block to 25 BTC per block.

Bitcoin’s Label on 2012 Halving Day: $12.35

Bitcoin’s Label Label 150 Days Later: $127.00

Label establish: 928.34%

2016 Halving

The 2nd Halving occurred on July 9th, 2016.

The BTC block reward dropped from 25 BTC per block to 12.5 BTC per block.

Bitcoin’s Label on 2016 Halving Day: $650.63

Bitcoin’s Label 150 Days Later: $758.81

Label establish: 16%

- 2009 – Blocks 1-210,000 earned 50 BTC in rewards.

- 2012 – Blocks 210,001 – 420,000 earned 25 BTC in rewards.

- 2016 – Blocks 420,001 – 630,000 earned 12.5 BTC in rewards.

- 2020 – Blocks 630,001 – 740,000 will fabricate 6.25 BTC in rewards.

- 2024 – Blocks 740,001 onward will fabricate 3.125 BTC in rewards.

- ~2140 – all 21 million bitcoins will enjoy been mined; the reward will be 0.

It’s worth noting that comely since the BTC reward is lower doesn’t build mining any much less dazzling. Bitcoin’s rate has elevated all over time. Earning the block reward in 2016 was worth about $16,250, whereas the unusual block reward post-Halving 2020 could perchance well be worth about $53,125.

Why Halve Bitcoin?

A general query many enjoy is why not absorb the bitcoin reward the the same all over its existence? The acknowledge brings us to the idea of scarcity.

Bitcoin Scarcity: A Composed Balance

If Bitcoin enjoy been to absorb the reward consistent at 50 BTC, that will perchance well imply simplest 420,000 blocks would offer the reward except the 21 million BTC cap is hit, which would enjoy occurred at some level in 2016.

This could enjoy been extraordinarily detrimental to Bitcoin’s person adoption since the abilities was aloof reasonably unusual and simplest a diminutive minority of the inhabitants would absorb the mighty majority of the Bitcoin.

Firstly, an early lower in accessibility could perchance well build Bitcoin appear to be extra precious, but in some way, this would repel many early-stage customers. If there are fewer of us able to the utilization of it, then the digital asset would in truth be trapped in a gilded cage of low liquidity.

Following alongside the trail of occasions, low liquidity would develop the threat of keeping the asset, chipping away at its inherent rate.

The provision and inquire among the many diminutive community of Bitcoin hoarders would resolve the worth.

The worth of BTC could perchance well be artificially inflated and keeping (hoarding BTC) becomes a sport of sizzling potato. Any individual whale with huge holdings could perchance well tank the worth at any moment, extra increasing the volatility threat of the asset.

One in all the core drivers of Bitcoin’s rate is person adoption, and by inserting such unreasonable hurdles on unusual customers (high volatility and high charges to enter the Bitcoin ecosystem), few learners would endeavor into reasonably queer cryptocurrency territory.

With so many similar digital belongings akin to Litecoin, person adoption would not bode successfully for Bitcoin.

On the opposite facet of the scarcity extremities, lets clutch away the 21 million cap to admire Bitcoin’s mechanics.

If Bitcoin enjoy been to absorb the reward at 50 BTC but eradicated the 21 million cap, there could perchance well be a theoretical infinity of BTC available on market over a long ample timeframe. This could flood the markets in the long-term, creating an in truth worthless digital asset. Every unusual year would theoretically moderately devalue the asset. Whenever you’d adore any right-world evidence, comely clutch a stare upon the Venezuela cryptocurrency say and why so many Venezuelans enjoy embraced Bitcoin.

The 21 million cap and the periodic halving occasions serve to build obvious that Bitcoin offers customers the upper of each rate retention and worth.

How Will the Halving Have an note on Bitcoin’s Label?

Whenever you’ve been reading CoinCentral for a whereas, you’ll know we don’t speculate on asset prices. We’ll leave that to the Twitter day merchants who soundlessly delete their tweet predictions when depraved. Trixy hobbitses.

Nonetheless, a few logical arguments will likely be made for Bitcoin’s rate transferring in either direction. Bitcoin’s rate did develop after the major two halvings, however it’s engaging to recount whether right here’s merely correlation or causation.

That being said, many influential and first rate figures in the situation enjoy made rate predictions, plenty of which could perchance well be predicated on Bitcoin being a scarce asset.

Billionaire endeavor capitalist Tim Draper, to illustrate, predicted a $250,000 Bitcoin by 2022.

Ex-Goldman Sachs hedge-fund supervisor Raoul Friend, lately claimed Bitcoin’s rate could perchance well hit $1 million sooner than the subsequent halving match in 2024.

But clutch any prediction on the Web with a spoonful of salt. John McAfee, to illustrate, made plenty of noise with a $1,000,000 Bitcoin prediction but soon backed out once confirmed depraved by the test of time.

In a pure vacuum the establish simplest general market forces and arithmetic prevailed, Bitcoin’s rate would drag up after a halving ensuing from scarcity, however in truth a long way extra complex than that. In lieu of us jumping correct into a rabbit hole right here, truly feel free to shoot us an electronic mail in case you’d adore us to enter bigger detail in one more article.

Closing Thoughts: Will Bitcoin’s Label High-tail Up After the Halving?

No topic its impression on rate, the Bitcoin halving is a unusual share of digital asset history. By sheer resilience, Bitcoin has confirmed countless doubters and antagonists depraved. Every a success milestone of its programming retains Bitcoin on its path to being a resilient, decentralized, and world manner of change and store of rate.

Whether or not Bitcoin’s rate goes up will be optimistic by history, as markets will likely be fickle– prior efficiency does not predict future results.

The halving doesn’t require grand, or any action, to your segment. Whenever you absorb the digital asset, it’s worth your whereas to impression a extra intimate determining of the method in which it truly works. Finding out this unlocks the flood gates to better determining world monetary protection in an extra and extra extra tech-enabled, a extraordinarily vital lesson given the most up-to-date financial conditions.

“While we don’t know the method the upcoming halving will enjoy an impression on the worth of bitcoin, we establish know that investments are pouring into the institutional market and extra people are investing in bitcoin than ever sooner than,” comments Ledger CEO Pascal Gauthier. No topic exterior rigidity on the inventory market, we’ve had our excellent April ever. The crypto market continues to climb, in a pattern very the same to what we saw pre-halving in 2016. There’s a long-term different for ticket unusual adopters that begins with training and emphasizes the significance of bitcoin being accessible to the of us, because it was designed to be.”

To ranking the next determining of Bitcoin, read our Bitcoin manual or Bitcoin for dummies manual.

Never High-tail over One more Opportunity! Bag hand selected files & data from our Crypto Consultants so that that you just must perchance well well build trained, educated selections that at once enjoy an impression to your crypto earnings. Subscribe to CoinCentral free e-newsletter now.