Introduction

The enviornment is reorganizing. Folks strive to devour the implications of present events at some level of a range of dimensions: politically, geopolitically, economically, financially and socially. A feeling of uncertainty has eclipsed global affairs and folk are rising an increased reliance on the solutions of these dauntless sufficient to strive comprehension. Experts are in every single establish apart the placement, but the educated is nowhere.

I’m no longer claiming to be an educated on one thing, both. I read, write and build my highest to fragment collectively an figuring out of imprecise and subtle concepts. I’ve spent some time studying and thinking by comparatively just a few concepts and specialize in we’re witnessing an inflection level of global have confidence.

My aim is to present an clarification for the framework that led me to this conclusion. I’ll on the total relief away from discussing geopolitics and specialize in the monetary and monetary implications of this shift we’re witnessing. The glorious situation to starting up is figuring out have confidence.

The World Runs On Belief

We’re witnessing a shift in global have confidence, environment the desk for a brand unusual global monetary present. Consume into consideration Antal Fekete’s introduction from his seminal work Whither Gold?:

“The one year 1971 turned into a milestone in the history of cash and credit. Beforehand, in the field’s most developed nations, money (and due to the this truth credit) turned into tied to a obvious cost: the cost of a effectively-defined quantity of a real of effectively-defined quality. In 1971 this tie turned into prick help. Ever since, money has been tied no longer to obvious but to harmful values — the cost of debt instruments.”

Debt instruments (credit) are constructed on have confidence — the most classic invent of organization. Organization allowed humanity to genetically eclipse its ancestors. Relationships, whether between folk or teams, hinge on have confidence. Societies developed applied sciences and social constructions to prick help the need for have confidence by reputations, security and money.

Reputations prick help the have to have confidence ensuing from they symbolize an person’s pattern of habits: You have confidence some of us more than others thanks to how they’ve acted previously.

Security reduces the have to have confidence that others will no longer damage you in some invent. You construct a fence ensuing from you don’t have confidence your neighbors. You lock your automobile ensuing from you don’t have confidence your community. Your authorities has a defense pressure ensuing from it doesn’t have confidence comparatively just a few governments. Security is the price you pay to relief away from the costs of vulnerability.

Cash reduces the have to have confidence that an person will return a favor to you at some point soon. Must you present an person a real or provider, in preference to trusting that they’ll return it to you at some point soon, they’ll straight trade money to you, doing away with the have to have confidence. Talked about otherwise, money reduces the have to have confidence that obvious outcomes will happen while reputations and security reduces the have to have confidence that harmful outcomes won’t happen. When money turned into entirely unanchored from gold in 1971, the cost of cash turned into a fair of reputations and security, requiring have confidence. Sooner than then, money turned into tied to the commodity gold, which maintained cost by its effectively-defined quality and effectively-defined quantity and due to the this truth didn’t require have confidence.

Belief at a world stage appears to be like to be provocative at some level of reputations and security, and thus credit money:

- Reputations — nations are trusting every comparatively just a few’s reputations much less. The U.S. authorities’s recognition at some level of present history has been a world pillar of political balance and fashioned of economic and economic prudency. Right here’s altering. The upward thrust of U.S. populism has hindered its recognition as a politically proper nation that allies rely on and competitors anguish. Unparalleled economic and monetary policy measures (e.g., bailouts, deficit spending, monetary inflation, debt issuance, etc.) are inflicting world powers to predict the soundness of the U.S. monetary system. A hindrance to the recognition of the U.S. is a hindrance on the cost of its money, to be discussed below.

- Security — nations are witnessing a contraction in global defense pressure present. The U.S. has been cutting back its defense pressure presence and the field is provocative from a unipolar to a multipolar building of present. The U.S.’ withdrawal of its defense pressure presence in another nation has reduced its fair as the show screen of world present and given upward thrust to the defense pressure presence of rival nations. Lowering the assurance of its defense pressure presence internationally reduces the cost of the buck.

- Cash — nations are shedding have confidence in the realm monetary present. Cash has existed as both a commodity or credit (debt). Commodity money is no longer area to have confidence by the reputations and security of governments while credit money is. Our recent system is entirely credit-basically based mostly mostly and the credit of the U.S. is the pillar upon which it exists. If the worldwide reserve currency relies totally on credit, then the recognition and security of the U.S. is paramount to putting forward world monetary present. Belief in political and monetary balance impacts the cost of the buck as does its holders’ inquire for liquidity and balance. Nevertheless, it’s no longer factual U.S. credit money that is shedding have confidence; it’s all credit money. As political and monetary balance decline, we’re witnessing a shift away from credit money entirely, incentivizing the adoption of commodity money.

U.S. Debt Is No longer Likelihood Free

Most no longer too lengthy previously, the recognition of U.S. credit has declined in an unprecedented manner. Foreign governments historically depended on that the U.S. authorities’s debt is possibility free. When monetary sanctions iced up Russia’s foreign alternate reserves, the U.S. undermined this possibility-free recognition, as even reserves for the time being are area to confiscation. The power to freeze the reserve property of another nation removed a foreign authorities’s real to both repay its money owed or use these property. Now, world observers are realizing that these money owed will no longer be possibility free. As the debt of the U.S. authorities is what backs its currency, here’s a important establish apart off for wretchedness.

When the U.S. authorities components debt, and inquire from home and foreign merchants of it isn’t proper sufficient, the Federal Reserve prints money to advise it in the originate market and generate inquire. Thus, the more U.S. debt nations are intelligent to do away with, the stronger the U.S. buck becomes — requiring much less money printing by the Fed to circuitously enable authorities spending. Belief in the U.S. authorities’s credit has now been damaged, and thus so has the credit of the buck. Extra, have confidence in credit is declining most steadily, leaving commodity money as the more trustless possibility.

First, I will search this shift in the U.S. which applies namely to its recognition and security, and then focus on about the shifts in global credit (money).

U.S. Dollar Dominance

Will foreign governments strive to de-dollarize? This predict is advanced because it no longer easiest requires an figuring out of the worldwide banking and price programs but also maintains a geopolitical background. Countries at some level of the field, both allies and competitors, like proper incentives to conclude global buck hegemony. By the usage of the buck a nation is area to the purview of the U.S. authorities and its monetary establishments and infrastructure. To higher understand this, let’s starting up by defining money:

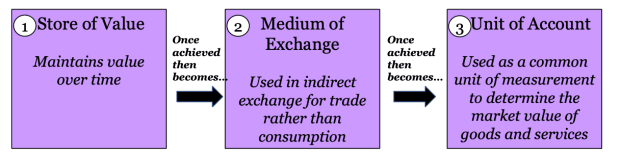

The above figure from my e book reveals the three functions of cash as a retailer of cost, medium of alternate and unit of account, to boot to the supporting monetary properties of every below them. Each fair plays a fair in world monetary markets:

- Retailer of Cost — gratifying this fair drives reserve currency establish apart of living. U.S. currency and debt is ~60% of global foreign reserves. A nation will denominate its foreign alternate reserve property in the most creditworthy property — defined by their balance and liquidity.

- Medium of Switch — this fair is closely tied to being a unit of account. The buck is the dominant invoicing currency in world trade and the euro is a end 2nd, both of which fluctuate spherical ~40% of whole. The buck is also 64% of foreign currency debt issuance, that methodology nations mostly denominate their debt in greenbacks. This creates inquire for the buck and is crucial. For the rationale that U.S. components more debt than home and foreign merchants are naturally intelligent to do away with, they must print greenbacks to do away with it in the market, which is inflationary (all else equal). The more foreign inquire they’ll invent for these newly printed greenbacks, the decrease the inflationary impact from printing unusual greenbacks. This foreign inquire becomes entrenched as nations denominate their contracts in the buck, permitting the U.S. to monetize their debt.

- Unit of Legend — Oil and comparatively just a few commodity contracts are most steadily denominated in U.S. greenbacks (e.g., the petrodollar system). This creates man made inquire for the buck, supporting its cost while the U.S. authorities repeatedly components debt beyond quantities home and foreign merchants may perchance per chance be intelligent to advise without the Fed rising inquire for it. The petrodollar system turned into created by Nixon basically based mostly totally on a multi-one year depreciation of the buck after its mounted convertibility into gold turned into removed in 1971. In 1973, Nixon struck a tackle Saudi Arabia in which each and each barrel of oil bought from the Saudis may perchance per chance be denominated in the U.S. buck and in alternate, the U.S. would provide them defense pressure protection. By 1975, all OPEC nations agreed to cost their like oil offers in greenbacks in alternate for defense pressure protection. This approach spurred man made inquire for the buck and its cost turned into now tied to inquire for energy (oil). This effectively entrenched the U.S. buck as a world unit of account, permitting it more leeway in its practices of cash printing to generate inquire for its debt. As an instance, it is doubtless you’ll perchance per chance perchance moreover no longer like that the U.S. is repeatedly rising its deficit spending (hindering its retailer of cost fair), but your trade contracts require you to use the buck (supporting its medium of alternate and unit of account fair), so or no longer it is essential to use greenbacks anyway. Put simply, if foreign governments won’t do away with U.S. debt, then the U.S. authorities will print money to do away with it from itself and contracts require foreign governments to use that newly printed money. In this sense, when the U.S. authorities’s creditworthiness (recognition) falls speedy, its defense pressure capabilities (security) like find yourself the slack. The U.S. trades defense pressure protection for increased foreign buck inquire, enabling it to repeatedly bustle a deficit.

Let’s summarize. Since its institution, the buck has served the functions of cash highest at a world stage ensuing from it may per chance perchance per chance moreover moreover be easily traded in global markets (i.e., it’s liquid), and contracts are denominated in it (e.g., trade and debt contracts). As U.S. capital markets are the broadest, most liquid and relief a be aware file of proper property rights (i.e., proper recognition), it makes sense that nations would net the most of it ensuing from there may be a comparatively decrease possibility of important upheaval in U.S. capital markets. Distinction this concept with the Chinese renminbi which has struggled to net dominance as a world retailer of cost, medium of alternate and unit of account due to the the political uncertainty of its authorities (i.e., sad recognition) which maintains capital controls on foreign alternate markets and steadily intervenes to manipulate its heed. U.S. foreign intervention is uncommon. Extra, having a proper defense pressure presence enforces buck inquire for commodity trade per agreements with foreign nations. Countries that denominate contracts in greenbacks would favor to be ecstatic trading away defense pressure security from the U.S. to buck this vogue. With belligerent Jap leaders rising their expanse, this security need is appreciable.

Let’s explore at how the functions of cash are enabled by a nation’s recognition and security:

- Recognition: basically permits the retailer of cost fair of its currency. Namely, nations that relief political and economic balance, and comparatively free capital markets, construct a recognition for security that backs their currency. This security may perchance per chance also be regarded as creditworthiness.

- Security: basically permits the medium of alternate and unit of account functions of its currency. Standard contract denomination and deep liquidity of a currency entrench its inquire in global markets. Army energy is what entrenches this inquire in the significant situation.

If the recognition of the U.S. declines and its defense pressure energy withdraws, inquire for its currency decreases as effectively. With the shifts in these two variables in entrance of mind, let’s consider how inquire for the buck will seemingly be affected.

Overview Of The Global Monetary System

Global liquidity and contract denomination may perchance per chance moreover moreover be measured by analyzing foreign reserves, foreign debt issuance, and foreign transactions/quantity. Dollar foreign alternate reserves step by step declined from 71% to 60% for the rationale that one year 2000. Three percent of the decline is accounted for in the euro, 2% from the pound, 2% from the renminbi and the excellent 4% from comparatively just a few currencies.

Higher than half of the 11 share level decline has come from China and comparatively just a few economies (e.g., Australian greenbacks, Canadian greenbacks, Swiss francs, et al.). While the U.S. buck decline in dominance is materials, it clearly stays dominant. The significant takeaway is that a lot of the decline in buck dominance is being captured by smaller currencies, indicating that global reserves are step by step changing into more dispersed. Display veil that this data must be interpreted with warning as the autumn in buck dominance since 2016 took place when old non-reporting nations (e.g., China) began step by step revealing their FX reserves to the IMF. Extra, governments don’t favor to be real about the numbers they file — the politically restful nature of this recordsdata makes it ripe for manipulation.

Supply: IMF

Foreign debt issuance in USD (comparatively just a few nations borrowing in contracts denominated in greenbacks) has also step by step declined by ~9% since 2000, while the euro has won ~10%. Debt issuance of the excellent economies turned into comparatively flat over this era so a lot of the trade in buck debt issued may perchance per chance moreover moreover be attributed to the euro.

The currency composition of foreign transactions is intelligent. Historically, globalization has increased the inquire for cross-border payments basically due to the:

- Producers rising provide chains at some level of borders.

- Scandalous-border asset administration.

- World trade.

- World remittances (e.g., migrants sending money home).

This poses an wretchedness for smaller economies: the more intermediaries which are angry by cross-border transactions, the slower and dearer these payments change into. Excessive-quantity currencies, much just like the buck, like a shorter chain of intermediaries while decrease-quantity currencies (e.g., emerging markets) like a longer chain of intermediaries. Right here’s necessary ensuing from it is these emerging markets that stand to lose the most from world payments and this is why various programs are lovely to them.

If we explore at the vogue in composition of foreign payments it’s evident that the buck’s fragment of invoicing is materially bigger than its fragment of exports, illuminating its outsized fair of invoicing in share to trade. The euro has been competing with the buck in phrases of invoicing fragment, but here is driven by its usage for export trade among EU nations. For the remainder of the field, export fragment has been, on realistic, bigger than 50% while invoicing fragment has remained lower than 20% on realistic.

Lastly, let’s focus on about the amount of trade. A currency with high quantity of trade methodology that it is comparatively more liquid and thus, more lovely as a trade automobile. The chart below reveals the proportions of quantity traded by currency. The buck has remained dominant and incessant since 2000, expressing its desirability as a liquid global currency. What’s necessary is that the amount of all significant global reserve currencies like declined a shrimp bit while the amount of “comparatively just a few” smaller world currencies has increased from 15% to 22% in share.

Supply: BIS Triennial Survey; (Display veil: in overall these numbers are proven on a 200% scale — e.g., for 2019 USD may perchance per chance be 88.4% out of 200% — ensuing from there are two legs to every foreign alternate trade. I’ve condensed this to a 100% scale for ease of interpretation of the proportions).

The buck is dominant at some level of every metric, even supposing it has been step by step declining. Most particularly, economies which will no longer be significant world reserves are:

- Gaining dominance as reserves and thus world FX reserves are changing into more dispersed.

- Utilizing the buck for foreign transactions in tremendously bigger proportions than their exports and restricted by a lengthy chain of intermediaries when making an strive to use their home currencies.

- Effort the most by lengthy chains of global intermediaries for their transactions and thus stand to net the most from various programs.

- Rising their fragment of foreign alternate quantity (liquidity) while the full significant reserve currencies are declining.

There exists a vogue whereby the smaller and much less dominant currencies of the field are rising but are peaceable restricted by buck dominance. Pair this vogue with the worldwide political fragmentation occurring and their persevered growth becomes more plausible. As the U.S. withdraws its defense pressure energy globally, which backs the buck’s functions as a medium of alternate and unit of account, it decreases inquire for its currency to wait on these functions. Extra, the buck’s creditworthiness has declined since implementing the Russian sanctions. The trends of declining U.S. defense pressure presence and creditworthiness, to boot to increased global fragmentation, point out that the worldwide monetary regime may perchance per chance moreover expertise drastic trade after all to term.

The Global Monetary System Is Shifting

Russia invaded Ukraine on Feb. 24, 2022, and the U.S. due to the this truth implemented a swath of economic and monetary sanctions. I specialize in history will explore help on this tournament as the initial catalyst of trade in direction of a brand unusual generation of global monetary present. Three global realizations due to the this truth took place:

Realization #1: Economic sanctions positioned on Russia signaled to the field that US sovereign property will no longer be possibility free. U.S. regulate over the worldwide monetary system topics all taking part nations to the authority of the U.S.

Effectively, ~$300 billion of Russia’s ~$640 billion in foreign alternate reserves were “frozen” (now no longer spendable) and it turned into in part banned (energy peaceable allowed) from the SWIFT world payments system. Nevertheless, Russia had been de-dollarizing and lift various reserves as protection from sanctions at some level of old years.

Now Russia is seeking decisions, China being the evident partner, but India, Brazil and Argentina are also discussing cooperation. Economic sanctions of this magnitude by the West are unprecedented. This has signaled to nations at some level of the field the chance they bustle by dependence on the buck. This doesn’t mean that these nations will starting up cooperating as they’re all area to constraints below a world spiderweb of trade and monetary relationships.

As an instance, Marko Papic explains in “Geopolitical Alpha” how China is closely constrained by the delight of its rising heart class (the bulk of its inhabitants) and scared that they may perchance per chance per chance moreover tumble into the center-earnings entice (GDP per capita stalling at some level of the $1,000-12,000 fluctuate). Their debt cycle has peaked and economically they’re in a inclined establish apart of living. Chinese leaders consider that the center-earnings entice has historically introduced the dying of communist regimes. Right here’s the establish apart the U.S. has leverage over China. Economic and monetary sanctions focusing on this demographic can prevent development in productivity and that’s what China is most fearful of. Merely ensuing from China desires to partner with Russia and construct “world domination” does no longer mean that they’ll attain so since they’re area to constraints.

A very worthy aspect of this realization is that U.S. buck property will no longer be possibility free: they relief a possibility of appropriation by the U.S. authorities. Countries with plans to act out of accordance with U.S. pursuits will seemingly starting up de-dollarizing before doing so. Nevertheless, as powerful as nations would clutch to make your mind up out of this buck dependency, they’re constrained in doing so as effectively.

Realization #2: It’s no longer factual the U.S. that has economic energy over reserves, it’s fiat reserve nations most steadily. Proudly owning fiat currencies and property in reserves creates dangerous political risks, rising the desirability of commodities as reserve property.

Let’s focus on about commodity money vs. debt (fiat) money. In his present paper, Zoltan Pozsar describes how the dying of the buck system has arrived. Russia is a important global commodity exporter and the sanctions like bifurcated the cost of their commodities. Equivalent to subprime mortgages in the 2008 monetary disaster, Russian commodities like change into “subprime” commodities. They’ve due to the this truth declined materially in cost as powerful of the field is now no longer seeking them. Non-Russian commodities are rising in cost as anti-Russia nations for the time being are all shopping them while the worldwide provide has contracted materially. This has created volatility in commodity markets, markets that like been (it sounds as if) disregarded by monetary system possibility monitors. Commodity merchants most steadily borrow money from exchanges to situation their trades, with the underlying commodities as collateral. If the price of the underlying commodity strikes too powerful in the cross direction, the exchanges present them that they favor to pay more collateral to relief their borrowed money (dealer net margin-called). Now, merchants favor both sides in these markets (they wager the price will trudge up or that this may per chance perchance per chance trudge down) and due to the this truth, no topic which direction the price strikes, any individual is getting margin-called. This methodology that as heed volatility is supplied to the system, merchants favor to pay more cash to the alternate as collateral. What if the merchants don’t like more cash to present as collateral? Then the alternate has to quilt it. What if the exchanges can’t quilt it? Then we have got a important credit contraction in the commodity markets on our fingers as of us starting up pulling money out of the system. This would perchance per chance per chance moreover result in super bankruptcies within a core segment of the worldwide monetary system.

In the fiat world, credit contractions are always backstopped — much just like the Fed printing money to bail out the monetary system in 2008. What’s irregular to this wretchedness is that the “subprime” collateral of Russian commodities is what Western central banks would favor to step in and do away with — but they’ll’t ensuing from their governments are the ones who averted seeking it in the significant situation. So, who is going to do away with it? China.

China may perchance per chance moreover print money and effectively bail out the Russian commodity market. If that is so, China would strengthen its balance sheet with commodities which may perchance per chance per chance strengthen its monetary establish apart of living as a retailer of cost, all else equal. The Chinese renminbi (also acknowledged as the “yuan”) would also starting up spreading more widely as a world medium of alternate as nations that desire to favor part on this discounted commodity trade net the a lot of the yuan in doing so. Folks are referring to this as the growth of the “petroyuan” or “euroyuan” (just like the petrodollar and eurodollar, factual the yuan). China is also in discussions with Saudi Arabia to denominate oil gross sales in the yuan. As China is the greatest importer of Saudi oil, it makes sense that the Saudis would consider denominating trade in its currency. Extra, the lack of U.S. defense pressure toughen for the Saudis in Yemen is the full more reason to vary to buck decisions. Nevertheless, the more the Saudis denominate oil in contracts comparatively just a few than the buck, the more they possibility shedding U.S. defense pressure protection and would seemingly change into area to the defense pressure affect of China. If the yuan spreads wide sufficient, it may per chance perchance per chance moreover grow as a unit of account, as trade contracts change into denominated in it. This building of incentives implies two expectations:

- Probably decisions to the U.S. global monetary system will strengthen.

- Inquire for commodity money will strengthen relative to debt-basically based mostly mostly fiat money.

Nevertheless, the renminbi is easiest 2.4% of global reserves and has a lengthy manner to switch in direction of world monetary dominance. Countries are powerful much less ecstatic the usage of the yuan over the buck for trade due to the its political uncertainty risks, regulate over the capital account and the chance of dependence on Chinese defense pressure security.

A overall expectation is that both the West or the East is going to be dominant once the dust settles. What’s more seemingly is that the system will continue splitting and we’ll like just a few monetary programs emerge at some level of the globe as nations strive to de-dollarize — most steadily known as a multipolar system. Multipolarity will seemingly be driven by political and economic self-hobby among nations and the elimination of have confidence from the system. The level about have confidence is necessary. As nations have confidence fiat money much less, they’ll favor commodity-basically based mostly mostly money that requires much less have confidence in an institution to measure its possibility. Whether or no longer China becomes the shopper of closing resort for Russian commodities, global leaders are realizing the cost of commodities as reserve property. Commodities are staunch and credit is have confidence.

Bitcoin is commodity-like money, the scarcest in the field that resides on trustless and disintermediated price infrastructure. Sooner than the invasion of Ukraine, Russia had restricted crypto property within its economic system. Since then, Russia’s establish apart of living has changed tremendously. In 2020, Russia gave crypto property correct establish apart of living but banned their use for payments. As no longer too lengthy previously as January 2022, Russia’s central monetary institution proposed banning the use and mining of crypto property, citing threats to monetary balance and fiscal sovereignty. This turned into no longer like Russia’s ministry of finance, which had proposed regulating it in preference to outright banning it. By February, Russia chose to manage crypto property, due to the the phobia that it may per chance perchance per chance per chance emerge as a sad market regardless. By March, a Russian authorities reliable supplied it may per chance perchance per chance per chance consider accepting bitcoin for energy exports. Russia’s trade of coronary heart may perchance per chance moreover moreover be attributed to the need for commodity money to boot to the disintermediated price infrastructure that Bitcoin may perchance per chance moreover moreover be transferred upon — ensuing in the third realization.

Realization #3: Crypto asset infrastructure is more ambiance friendly than former monetary infrastructure. Because it is disintermediated, it presents a technique of possession and switch of property that is completely no longer doubtless with intermediated former monetary infrastructure.

Donations in toughen of Ukraine by crypto property (amounting to almost $100 million as of this writing) demonstrated to the field the rapidness and effectivity of transferring cost by factual an net connection, without relying on monetary establishments. It additional demonstrated the ability to relief possession of property without reliance on monetary establishments. These are crucial aspects to like as a battle refugee. Rising economies are paying consideration as here is in particular precious to them.

Bitcoin has been worn to donate roughly $30 million to Ukraine for the rationale that starting up of the battle. Subsequently, a Russian reliable acknowledged that this may per chance perchance per chance consider accepting bitcoin, which I specialize in is ensuing from they’re acutely aware that bitcoin is the highest digital asset that may moreover be worn in a purely trustless manner. Bitcoin’s fair on both sides of the battle demonstrated that it is apolitical while the freezing of fiat reserves demonstrated that their cost is highly political.

Let’s tie this all collectively. Factual now, nations are rethinking the invent of cash they’re the usage of and the cost programs they’re transferring it on. They’re going to change into more avoidant of fiat money (credit), because it is easily frozen, and they also’re realizing the disintermediated nature of digital price infrastructure. Consume into consideration these motivations alongside the vogue of an increasingly more fragmented system of global currencies. We’re witnessing a shift in direction of commodity money among a more fragmented system of currencies provocative at some level of disintermediated price infrastructure. Rising economies, in particular these faraway from global politics, are postured as the significant movers in direction of this shift.

While I don’t establish apart an tell to that the buck will lose primacy anytime soon, its creditworthiness and navy backing is being called into predict. In consequence, the growth and fragmentation of non-buck reserves and denominations opens the market of foreign alternate to consider decisions. For their reserves, nations will have confidence fiat much less and commodities more. There may be a shift emerging in direction of trustless money and desire for trustless price programs.

Probably decisions To The Global Monetary System

We’re witnessing a decline in global have confidence with the conclusion that the age of digital money is upon us. Realize that I’m referring to incremental adoption of digital money and never corpulent-scale dominance — incremental adoption is frequently the path of least resistance. I establish apart an tell to nations to increasingly more undertake trustless commodity property on disintermediated price infrastructure, which is what Bitcoin presents. The significant limiting part to this adoption of bitcoin will seemingly be its balance and liquidity. As bitcoin matures into youth, I establish apart an tell to this development to amplify without note. Countries that desire a digital retailer of cost will clutch bitcoin for its sound monetary properties. The nations most enthusiastic and least restrained in adopting digital property will seemingly be among the fragmented rising world as they stand to net the most for the smallest quantity of political heed.

While these incremental shifts will seemingly be occurring in tandem, I establish apart an tell to the significant significant shift will seemingly be in direction of commodity reserves. Legitimate reserve managers prioritize security, liquidity and yield when selecting their reserve property. Gold is precious in these respects and may perchance per chance moreover play a dominant fair. Nevertheless, bitcoin’s trustless nature is perchance no longer lost sight of, and nations will consider it as a reserve no topic its tradeoffs with gold, to be discussed below.

Let’s lumber by what bitcoin adoption may perchance per chance moreover explore like:

Supply: World Gold Council; Evolved reserve economies contains the BIS, BOE, BOJ, ECB (and its national member banks), Federal Reserve, IMF and SNB.

Since 2000, gold as a share of whole reserves has been declining for developed economies and rising for China, Russia and the comparatively just a few smaller economies. So, the vogue in direction of commodity reserves is already in situation. Over this identical length gold reserves like fluctuated between 9 and 14% of whole reserves. On the present time, whole reserves (both gold and FX reserves) quantity to $16 trillion, 13% of which ($2.2 trillion) is gold reserves. We can behold in the below chart that gold as a share of reserves has been rising since 2015, the identical one year the U.S. iced up Iran’s reserves (this turned into ~$2 billion, an excellent smaller quantity than the Russia sanctions).

Reserves like been rising without note in China, Russia and smaller economies as a full. The chart below reveals that non-developed economies like increased their whole reserves by 9.4x and gold reserves by 10x, while developed economies like increased whole reserves by easiest 4x. China, Russia and the smaller economies uncover $12.5 trillion in whole reserves and $700 billion of these are in gold.

The growth and dimension of smaller economic system reserves is crucial when brooding about bitcoin adoption among them as a reserve asset. Smaller nations will ideally desire an asset that is liquid, proper, grows in cost, disintermediated and trustless. The below illustrative comparability stack ranks huge reserve asset lessons by these qualities on a scale of 1-5 (clearly, here is no longer a science but an illustrative visualization to facilitate dialogue):

Countries undertake comparatively just a few reserve property for various reasons, which is why they diversify their holdings. This overview specializes in the pursuits of emerging economies for bitcoin adoption concerns.

Bitcoin is liquid, even supposing no longer nearly as liquid as fiat property and gold. Bitcoin isn’t proper. Commonplace reserve property, alongside side gold, are intention more proper. Bitcoin will seemingly provide an excellent bigger capital appreciation than fiat property and gold over the future. Bitcoin is the most disintermediated because it has a in actuality trustless community — here is its main cost proposition. Storing bitcoin doesn’t require depended on intermediaries and thus may perchance per chance moreover moreover be stored without the chance of appropriation — a possibility for fiat property. This level is crucial ensuing from gold does no longer relief this quality because it is dear to switch, retailer and test. Thus, bitcoin’s main advantage over gold is its disintermediated infrastructure which permits for trustless lag and storage.

With these concerns in mind, I specialize in the smaller emerging economies which are largely faraway from political affect will spearhead the adoption of bitcoin as a reserve asset step by step. The enviornment is rising increasingly more multipolar. As the U.S. withdraws its world security and fiat continues to lose creditworthiness, emerging economies will seemingly be brooding about bitcoin adoption. While the recognition of the U.S. is in decline, China’s recognition is powerful worse. This line of reasoning will net bitcoin lovely. Its main cost-add will seemingly be its disintermediated infrastructure which permits trustless payments and storage. As bitcoin continues to used, its beauty will continue to amplify.

Whenever you specialize in the sovereign anguish of limiting its home monetary regulate is a proper incentive to stop bitcoin adoption, consider what came about in Russia.

While Russia’s central monetary institution wished to ban bitcoin, the finance ministry opted to manage it. After Russia turned into sanctioned, it has been brooding about accepting bitcoin for energy exports. I feel Russia’s habits reveals that even totalitarian regimes will enable bitcoin adoption for the sake of world sovereignty. Countries that inquire much less regulate over their economies will seemingly be even more intelligent to easily accumulate this tradeoff. There are a gigantic assortment of reasons that nations would desire to stop bitcoin adoption, but on salvage the ghastly incentives of its adoption are proper sufficient to outweigh the harmful.

Let’s apply this to the shifts in global reputations and security:

- Reputations: political and economic balance is changing into increasingly more riskier for fiat, credit-basically based mostly mostly property. Bitcoin is a proper haven from these risks, because it is basically apolitical. Bitcoin’s recognition is indubitably one of high balance, due to the its immutability, which is insulated from global politics. It does no longer topic what occurs, Bitcoin will relief producing blocks and its provide time desk stays the identical. Bitcoin is a commodity that requires no have confidence in the credit of an institution.

- Security: ensuing from Bitcoin can’t trade defense pressure toughen for its usage, this is frequently hindered as a world medium of alternate for some time. Its lack of heed balance additional limits this invent of adoption. Networks much just like the Lightning Community enable transactions in fiat property, just like the buck, over Bitcoin’s community. Though the Lightning Community is peaceable in its infancy, I await this may per chance perchance per chance plan increased inquire to Bitcoin as a settlement community — rising the retailer of cost fair of its native currency. It’s essential to hang that fiat property will seemingly be worn as a medium of alternate for some time due to the their balance and liquidity, however the cost infrastructure of bitcoin can bridge the gap on this adoption. Hopefully, as more nations undertake the Bitcoin fashioned the need for defense pressure security will decline. Until then, a multipolar world of fiat property will seemingly be utilized in alternate for defense pressure security, with a preference for disintermediated price infrastructure.

Conclusion

Belief is diminishing among global reputations as nations put into effect economic and geopolitical war, inflicting a reduction in globalization and shift in direction of a multipolar monetary system. U.S. defense pressure withdrawal and economic sanctions like illuminated the lack of security within credit-basically based mostly mostly fiat money, which incentivizes a shift in direction of commodity money. Moreover, economic sanctions are forcing some nations, and signaling to others, that various monetary infrastructure to the U.S. buck system is crucial. These shifts in the worldwide zeitgeist are demonstrating to the field the cost of commodity money on a disintermediated settlement community. Bitcoin is postured as the significant reserve asset for adoption on this class. I establish apart an tell to bitcoin to benefit in a material manner from this global contraction in have confidence.

Nevertheless, there are proper limitations to corpulent-scale adoption of one of these system. The buck isn’t going away anytime soon, and crucial development and infrastructure is required for emerging economies to net the most of bitcoin at scale. Adoption will seemingly be slack, and that is a real thing. Impart in fiat property over Bitcoin settlement infrastructure will profit bitcoin. Enabling a permissionless money with the strongest monetary properties will spawn an generation of interior most freedom and wealth creation for folks, in preference to the incumbent establishments. Irrespective of the declare of the field, I’m angry for the future.

Whither Bitcoin?

A particular thanks to Ryan Deedy for the dialogue and review of this essay.

Right here’s a guest publish by Eric Yakes. Opinions expressed are entirely their like and build no longer basically replicate these of BTC Inc or Bitcoin Journal.